Lyxor’s award winning managed account platform has a good history of surviving and thriving through crises. It was born in 1998, the year of the Asian crisis; it met redemption requests in 2008, the year of the Great Financial Crisis; it on-boarded leading hedge fund managers through the European debt crisis of 2011-2012, and its managers have generated resilient performance in the first half of 2020, during the coronavirus crisis.

“We are pleased that alternative UCITS hedge funds have performed well in absolute terms, and that our funds have generally outperformed the industry,” says Chief Client Officer, Nathanael Benzaken. “Alternative UCITS have shown resilience and effective decorrelation of performance, confirming our belief that liquid alternatives provide positive diversification for clients. Hedge funds are here to stay and we are adamant that the industry will continue to grow.”

“Covid-19 is a test for the industry. After a ten-year bull market we had no clue what could have been the trigger for a correction. Who could have guessed it would be a virus? The only certainty now is that we are in the most uncertain environment ever. We have no reference point for the pandemic since the last one – the Spanish Flu of 1918 – which occurred more than 100 years ago. Since it is difficult to predict the future, our alternative UCITS business focuses on managers who can monetize volatility and dispersion. This is very complementary to our ETF business, which is all about beta,” says Benzaken.

Lyxor’s suite of ETFs is akin to a giant brasserie, with a long menu listing hundreds of specialties, whereas the UCITS offering as of July 2020 is more like a Parisian bistro specializing in a handful of tried and tested dishes. Over the years, Lyxor has hosted a huge variety of hedge fund strategies, but the UCITS hedge fund offering is currently comprised of nine carefully selected managers that have long track records and are focused mainly on alpha generation. “After 20 years of investing in hedge funds, we like strategies that are on average low beta with controlled volatility. This applies across asset classes to equities, bonds and credit,” says Benzaken.

Corporate credit

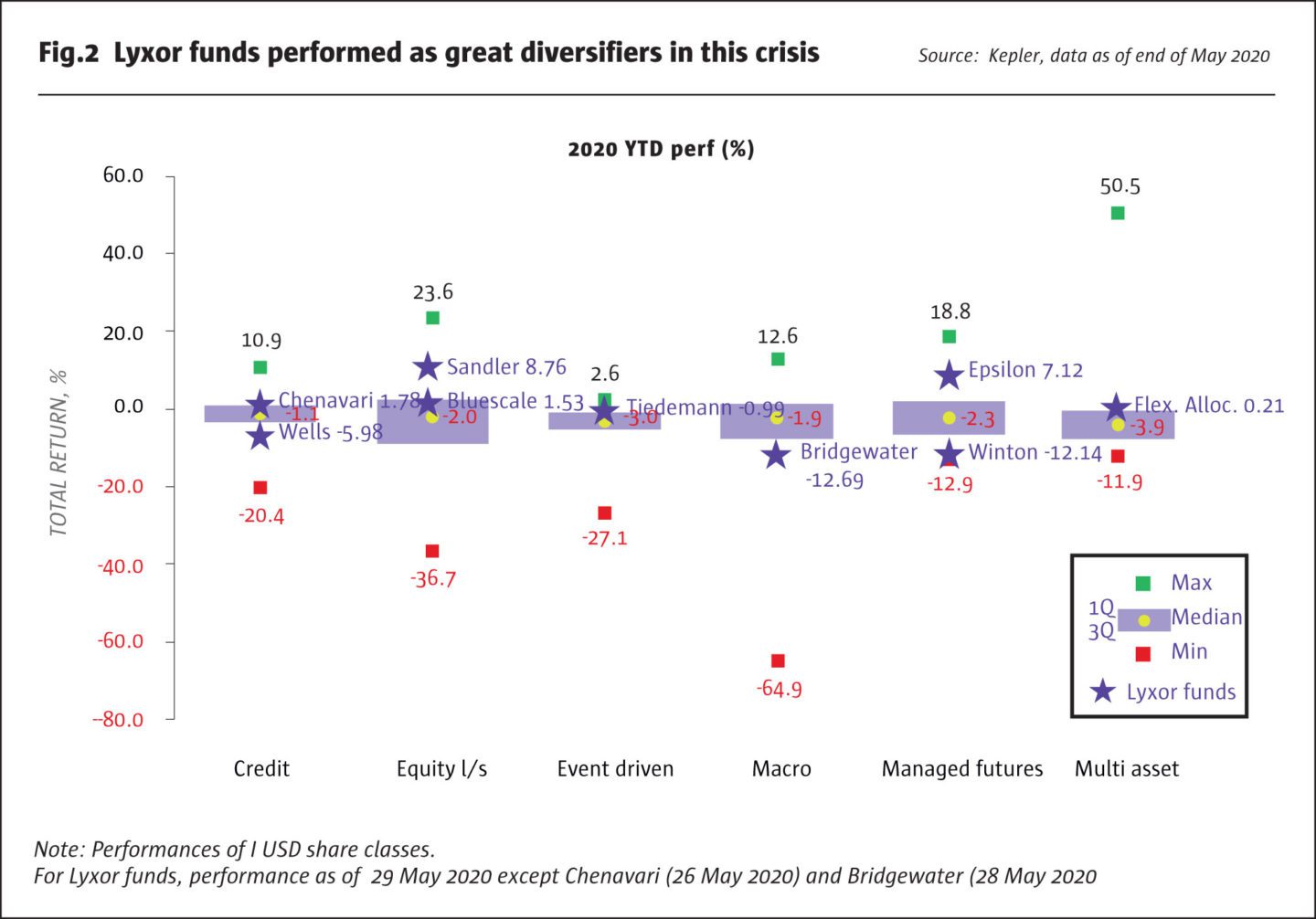

In the high yield space, the credit ratings agencies are now forecasting double digit default rates while recent recovery rates upon default have sometimes been in single digits. Yet credit spreads have made a very strong recovery, almost returning to pre-Covid 19 levels, partly due to central bank asset purchases. It is therefore not surprising that investors are seeking an active long/short approach. Kepler’s database shows wide performance dispersion in the alternative UCITS credit universe with performance ranging from +12.7% to -18.3% for the first half of 2020. The Lyxor/Chenavari Credit Fund made 3.07% over the first half and was distinguished by having profited in both the first quarter and the second quarter. “The mission of Chenavari is to collect a risk premium in the European markets. They did well because they had a cautious stance entering the year, with not much leverage nor directional exposure. They were able to capitalize on the dislocation in the heart of the crisis and acquired risk at discounted levels. Their performance is in line with the target for single digit returns with low volatility,” says Benzaken. This fund has been profiled in The Hedge Fund Journal, having received our UCITS Hedge award for best performing long/short credit strategy (Europe) over 2017 and 2018, and over 3 and 4 year periods ending in 2019. Chenavari has been running long/short credit strategies since its launch in 2008. The broadly market neutral Lyxor strategy has three sub-strategies: corporate long/short, financials and convexity.

Co-portfolio managers, Demian Brasil and Stéphane Parlebas, highlight strong opportunities for name selection in the financials sub-strategy: “The Covid-19 crisis will most likely mean that interest rates will remain low for much longer than anticipated, certainly beyond 2022 which will further depress banks’ profitability, especially for those institutions that are most reliant on maturity transformation and net interest income (i.e. mortgage banks). A new surge of NPLs, towards the end of 2020/H1 2021, may jeopardize solvency for some small regional players that have low equity buffers and weak profitability. These two factors could lead to an acceleration of M&A given dormant excess capital not being distributed to shareholders (dividend bans could be extended beyond October 2020) and ongoing IT investments towards digitalization that are not achievable by medium-sized banks. This trend will create interesting long/short opportunities between banks operating in same regions (as with the current takeover bid of Intesa by Ubi Banca in Italy). The positive factor however is that thanks to major reforms after the crisis of 2007-2009, European banks are much better capitalized to face asset quality deterioration and profitability headwinds coming from lower rates as well as lower business volumes (mortgages, consumer finance). However, selection will be key to capturing the excess return on peripheral names that have somewhat lagged the rebound initiated in March as well as to position on well diversified names that would likely benefit from an uplift in markets divisions in the second and third quarter, as suggested by strong FICC revenues in Q2 2020 recently posted by US banks (notably JPMorgan, Goldman Sachs and MS)”.

Covid-19 is a test for the industry. After a ten-year bull market we had no clue what could have been the trigger for a correction. Who could have guessed it would be a virus?

Nathanael Benzaken, Chief Client Officer, Lyxor

Equity long/short

The equity long/short UCITS universe has seen an even wider spread of returns, ranging between +31.8% and -33.6% in the first half of 2020. “Lyxor’s Sandler UCITS has returned 8.22% in 2020, without much leverage, beta or directionality. Sandler is a New York based boutique US equity long/short manager, which is close to market neutral varying exposure between slightly net long and net short. They have been long and short of the right sectors and stocks. This UCITS has now passed the USD 1 billion milestone for assets,” says Benzaken. The UCITS launched in 2016 but Lyxor’s relationship with Sandler Capital Management, on the managed account side, dates back to 2004. Sandler is one of the most well-established US equity long/short managers, having been an SEC registered investment adviser since 1988. The manager’s breadth of expertise is demonstrated by the fact that it also runs long/short credit and private equity strategies.

Lyxor’s latest launch on the long/short equity side, in December 2019, was Lyxor/Bluescale Global Equity Alpha fund. In common with Sandler, Bluescale has low net exposure, but whereas Sandler invests across multiple sectors, Bluescale is run by Boston-based 37 Capital, a TMT (technology, media and telecoms) specialist within the Putnam Investments Alternatives Group. The portfolio manager, Neil Desai, has been investing in the TMT industry since 1997, including some experience of private equity investing. The Bluescale strategy, which he has run since 2012, is well positioned to profit from sector dispersion and from disruptive technology trends, many of which have been accelerated by Covid-19. The strategy ended the first half up 2.76% with nearly no beta. Says Desai: “Less-crowded, mid-cap companies in the payments, cloud computing/SaaS, e-commerce, and video game sub-sectors are providing compelling bottom-up opportunities, differentiated from mega-tech names driving much of the current headlines. On the surface, tech benchmarks presented a solid “V-shaped” recovery during Q2, but this masked underlying volatility which provided our low-net approach with attractive entry points, resulting in both alpha generation and upside capture”.

Nathanael Benzaken, Chief Client Officer, Lyxor

Merger arbitrage

In the event driven space, merger arbitrage is a strategy that has demonstrated its potential for decorrelated returns in both 2008 and 2020. The Lyxor/Tiedemann Arbitrage Strategy Fund has been profiled in The Hedge Fund Journal, and has received our UCITS Hedge award for best performing merger arbitrage strategy over periods including four years ending in 2018. “We are immensely proud to have Tiedemann and manager Drew Figdor running our UCITS. He has navigated the crisis well in an uncertain environment. He has protected capital, and also capitalized on the extreme dislocation in March by adding risk at the trough of the crisis, and recouping losses. The ability to monetize with proper risk management is really quite impressive,” says Benzaken. The fund is roughly flat for the first half while the UCITS event driven space has seen a wide span of returns, between +5.5% and -24.4%, according to Kepler research. Going forward, Lyxor expects a pickup in corporate activity as pent up demand for M&A comes to the fore.

Says portfolio manager, Drew Figdor, who has been with TIG Advisors LLC since 1986: “The Covid-19 pandemic has been a challenge for all strategies. However, for us, the initial market sell-off in March provided a unique opportunity for our team to identify investment opportunities as some deal spreads expanded to 2008 levels. Coming out of Covid we could see a significant increase in opportunities; the difference between strong and weak balance sheets, and the number of industries that have seen extreme disruption, could create large prospects for opportunistic M&A. Continued volatility, however, has underlined the importance of a robust risk-management program which continues to underpin our ability to protect investor capital”.

Systematic macro

In the macro space, Lyxor’s rollout of Bridgewater Core Macro in 2019 received The Hedge Fund Journal’s UCITS Hedge award for largest asset raise by a new launch. The UCITS product has equal allocations to two Bridgewater strategies: its long only All Weather asset allocation strategy, and its long/short Pure Alpha Major Markets trading oriented strategy. “The strategy posted negative returns in March because All Weather is by construction long of market risk. Pure Alpha Major Markets also entered the crisis being quite positive on the economy, with a long equities, short bonds position. The loss in March is well within the range of expectations, and the strategy has profited in April, May and June, with low net exposure. Going forward in a climate of much government intervention, we expect that a large macro manager with huge data and talent resources should perform well,” says Benzaken. Connecticut-based Bridgewater was founded in 1975, and is the world’s largest hedge fund manager with assets of over $130 billion.

CTAs

Elsewhere in tactical trading, Lyxor has two trend following CTA programs in UCITS format. “It is worth having two CTAs due to the dispersion between them and the diversification benefit of allocating to both,” says Benzaken. One of the programs is run by Winton, and it now focuses only on their trend-following strategy, with no exposure to their other quantitative strategies such as single stock equities. “Winton’s performance has been at the low end of the range this year, but outperformed the industry in 2019,” observes Benzaken. Winton’s track record in trend following strategies dates back to 1997.

French CTA Epsilon’s managed futures strategy also started in 1997, though its UCITS was launched in 2011. The Epsilon team sat under the Lyxor umbrella before they spun out into Metori Asset Management in 2016. The Lyxor Epsilon Global Trend Fund has regularly received The Hedge Fund Journal’s UCITS Hedge award, most recently for best performing trend-following CTA over 5 and 7 year periods ending in 2019. It has also done well in 2020. CTA returns in the first half have ranged from -15.2% to +18.6%, while Epsilon finished the first half up 6.34%. “In 2020, they have done an excellent job of capturing market trends. Its assets have just passed EUR 500 million, with inflows accelerating in Q2, taking total assets up 40% compared to the beginning of the year,” says Benzaken.

Lyxor’s suite of ETFs is akin to a giant brasserie, with a long menu listing hundreds of specialties, whereas the UCITS offering as of July 2020 is more like a Parisian bistro specializing in a handful of tried and tested dishes.

Says Laurent Le Saint, Managing Partner and co-founder of the Metori Lyxor/Epsilon Global Trend Fund: “Our good performance in Q1, while volatility remained within budget and trading went normally, sheds light on some important properties of trend-following: convexity, high liquidity, low correlation to equities”.

Metori take some pride in their timely communication with investors: “In this period of high stress, our capacity to stay close to investors has been a key factor of success. We have been on client calls, or sending updates by email, almost every day from the very beginning of the sell-off until the end of March. Moreover, the general acceptance of video calls as a new convenient way to meet up, offers the opportunity to reach out to many investors in multiple locations. We believe that going forward, we’ll be able to continue with such video calls while limiting travelling to essential meetings,” adds Le Saint. His outlook is positive: “We see big opportunities, not only because our investment strategy has been successfully tested through the crisis, but also because we have the agility of a mid-size hedge fund manager. Communicating and staying as a team was not an issue during the lock-down. We have never stopped doing research, meeting new investors, pursuing our business development projects. We believe this agility will help us grow further in the future”.

Lyxor platform update

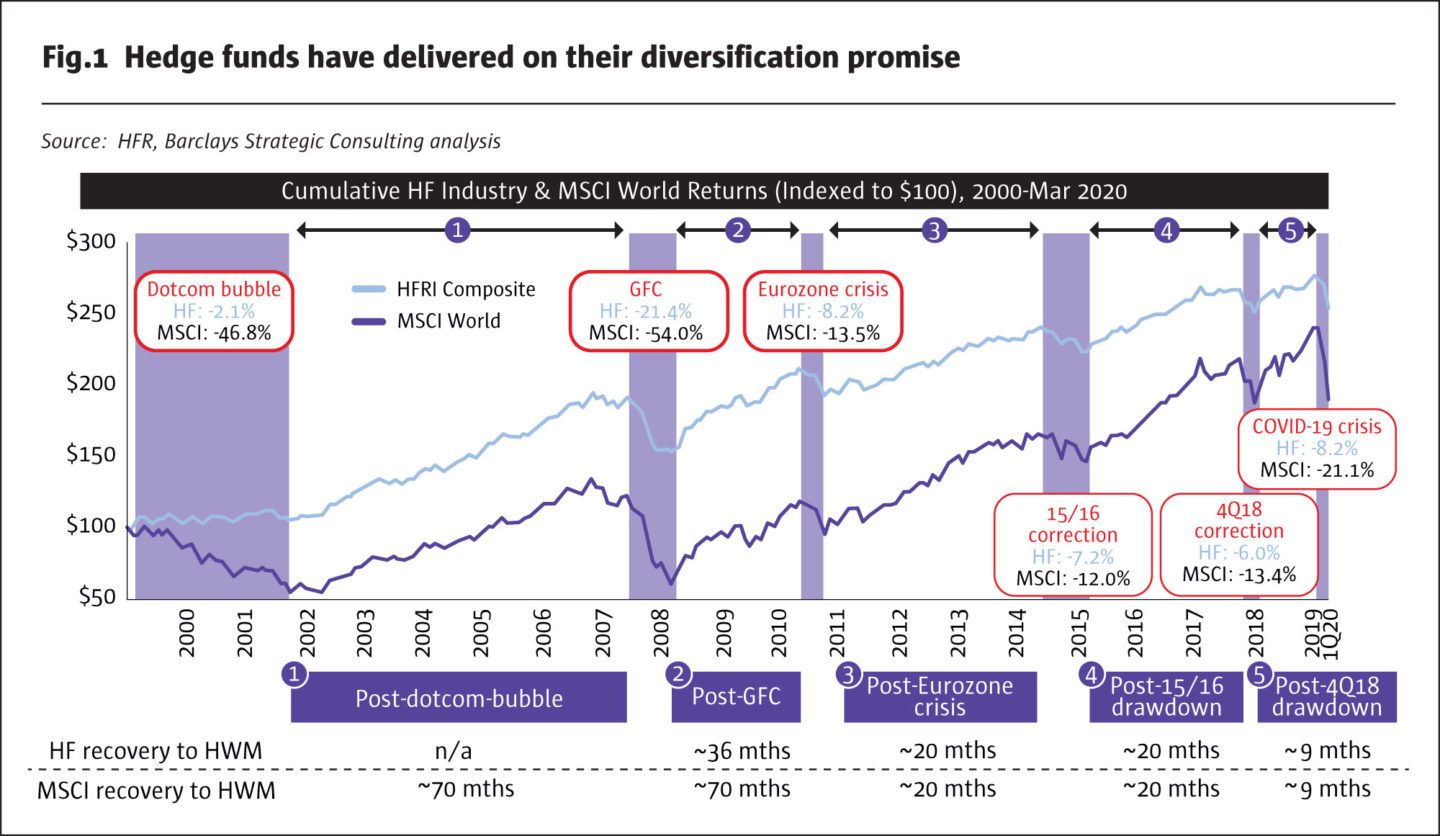

Lyxor’s platform has regularly received awards from The Hedge Fund Journal, both on the managed account side and the UCITS side, and its US based Head of Operational Due Diligence, Brynn Coursey Heegan, featured in The Hedge Fund Journal’s 2018 ‘50 Leading Women in Hedge Funds’ report, published in association with EY. Lyxor’s total hedge fund assets are circa USD 22 billion, its alternative UCITS assets have surpassed circa USD 6.3 billion, as of June 2020, and all strategies on the platform have raised assets. “Investors are looking for strategies to play a diversification role to protect portfolios. The Credit Suisse 2019 Hedge Fund Investor Survey found that investors’ number one priority is to add to hedge funds,” says Benzaken.

Lyxor distributes UCITS everywhere except the US. “We made a strategic decision to focus on UCITS in 2013, based on the premise that we can sell UCITS globally, except to US persons. This is very true in Asia (esp. in Singapore, South Korea, in Hong Kong and Japan) and also in Latin America,” says Benzaken.

For the US market, offshore dedicated managed accounts are offered, to cater for client preferences. Two of Lyxor’s UCITS hedge fund managers, Tiedemann and Sandler, also offer managed accounts, but the overlap is actually limited because manager selection is client driven, and not every hedge fund strategy fits into the UCITS framework.

Investors should watch this space for ESG launches. Lyxor has been an early mover in developing some innovative ESG oriented ETFs on the long only side, and although most hedge funds have been somewhat slower to adopt ESG, the trend is developing fast.

Diversification remains imperative for Benzaken: “We are continuing to build a platform where the primary objective is to offer a balanced solution. Some investors may argue that the market has bounced back too far for diversification to make sense. We would argue the contrary. It would make sense to exploit the rally since April 2020 and build a diversification portfolio at the highest possible level in the equity market. Given the most uncertain environment ever, investors not only need to protect from drawdowns and volatility, but also need to monetise volatility and dispersion”.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical