The hedge fund industry is in the midst of a period of significant change driven by the pressure of both regulators and investors. Regulators are now requiring hedge funds to provide more transparency into their risk and control function by asking them to demonstrate if they could provide valuation services in-house, in case the fund administrator went bust. Investors are also becoming sophisticated, demanding more information on the valuation, liquidity and exposures of the hedge funds in order to assess potential risk factors.

To generate alpha, long/short equity strategies are no longer adequate and hedge funds are now relying on multi-asset strategies, which require them to operate at the highest level in terms of people, process and technology. Technology is not only an enabler for driving performance, but a critical factor for operating a multi-asset hedge fund. Technology by itself is no longer a differentiator; if it’s not there it simply will be impossible to run the business successfully. In its place it is vital to have the appropriate systems so hedge fund managers can remain in control of the diverse risks undertaken and demonstrate that they can react to the poorest situations.

To fully understand the state of software use within hedge funds, Dr Sven Kuenzel and Anika Schlien at the University of Greenwich Business School, in collaboration with Copia Digital, conducted a study to assess current and future trends. Questionnaires were forwarded to 556 hedge fund executives and the study analyses the following key issues in order to create a comprehensive understanding of the industry’s decision making when it comes to technology:

- Data reporting and management

- Software needs and trends

- Software preferences

Data management and reporting – reporting online, managing offline

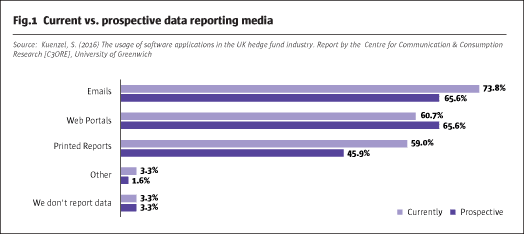

Given the regulatory pressure on transparency, data protection and security, hedge funds need to re-think their approach to data management and reporting. At the moment, 73.8% of the respondents stated that they are using emails to report their data. However, there is a decline of 8.2% when asked for future data reporting tools. In contrast, the usage of web portals for data reporting is expected to increase by 4.9% from currently 60.7% of the participating companies using this medium to 65.6%. Reasons for this increase could be the possibility of customizing the portals to the individual requirements of the companies and clients. Furthermore, analytic tools and dashboards can be implemented. To improve data flows, portals also allow the possibility to integrate the trading platform and expert data directly after the trade into the portal which allows the review of live data by the client. With 13.1% the usage of printed reports to communicate data will hit the most significant decrease. As mentioned above, the advantages of technology for data reporting will outweigh the advantages of using printed reports which always lead to a delay in reporting due to processing, printing and distribution. Given the possibilities of web portals to manage data it appears that other media are not perceived as important in the near future.

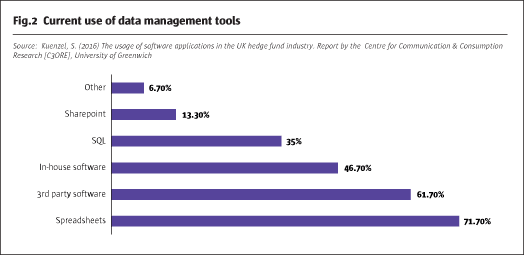

Though hedge funds are moving to online tools when it comes to reporting, the preferred choice for managing data is clearly the use of spreadsheets as confirmed by 71.7% of the respondents. Using hundreds of spreadsheets across the organization could lead to fragmentation of data and silos of knowledge which would require very substantial business and process optimization.

Despite the preference of hedge funds to develop technology solutions in-house due to security concerns and IP protection, 3rd party software is used by 61.7% of the respondents as compared to 46.7% using in-house software. SQL is used by 35% and Sharepoint by 13.3% of the respondents for data management.

A vast array of staff is involved when developing and preparing reports. 69.5% of the respondents stated that marketing staff are involved, which underpins that data reporting is understood by most of the companies as an importantpart of client relationship management. Just over half of the companies involve compliance experts (55.9%) in the data reporting process which is surprising considering regulatory pressures on the hedge fund industry. Interestingly, only in 35.6% of all participating companies say database experts are involved which indicates that the data reporting tools appear to be user-friendly as non-database expert staff are able to pull out the required data from whichever system is employed within the company. External fund managers are involved in 39% and investment team members in 16% of the respondents’ companies. English is the predominant language in the financial sector; hence, translators are involved in only 11% of the respondents’ companies when it comes to data reporting. Only 16.9% of the companies involve other staff members such as administrative, finance and risk staff.

Software needs and trends

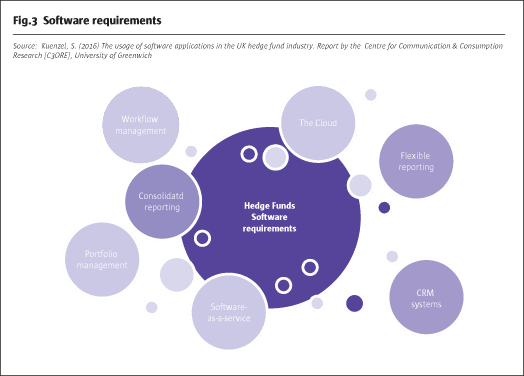

The respondents were asked to highlight specific gaps within their current operating environment which were not fulfilled by the deployed solutions. A variety of answers were provided which have been clustered into themes as seen within the cluster map, see Fig.3.

Consolidated reporting: Most hedge funds currently operate in a silo-fashion. This means that the trade, risk, client, finance and portfolio management information is stored across different systems within their organization. As regulatory pressure for providing more transparency is increasing, hedge funds are increasingly consolidating the information from different data sources to provide unified views of client, trade, risk and portfolio management. This approach towards consolidation is being further accelerated due to most market making activity being done using electronic trading.

Flexible reporting: Flexible reporting is required to serve increasingly sophisticated clients and stringent regulatory requirements. Data should be easily extracted from data management systems and support creation of compliance and regulatory reports. Also, internally CIOs can use data management tools to support their decision making in terms of extracting best value from traders, portfolio managers and asset allocation. This can give clients increased confidence that they are getting value for their money.

CRM systems: Participants raised their need for an efficient customer relationship management system that goes beyond existing contact databases. That means these advanced systems will not only incorporate client data, but also data from trading, risk and portfolio management. Ideally these systems should build-up on their existing contacts system so no information regarding client history and data will get lost in the process of transition. The need for an advanced CRM system is based on the requirement to generate reports from a single source to enhance simplicity and transparency as demands from investors as well as from regulators increase.

Software-as-a-service and the Cloud: With the volumes of equity dropping, most hedge funds have become cost conscious. This requires them to have scaleable operating platforms and increasingly hedge funds are moving to a software-as-a-service model. The change in approach is being matched by a change in the revenue model. Infrastructure firms are moving to provide fixed term contracts for their services rather than one-off license fees. Cloud technology provides the platform for deploying services and software globally without having to build and host the infrastructure in-house. However, security issues need to be addressed and are a main priority for decision making.

Portfolio management: Due to the drop in investment opportunities worldwide, most hedge funds are turning to multi-asset strategies. This requires hedge funds to be able toclearly see how assets of a fund are invested across different asset classes to determine where they are getting an alpha in terms of return. Portfolio Management Systems therefore need to be cross-asset and integrated with the trading and execution systems to capture this information and represent it in a unified form to the portfolio manager to be able to accurately determine risk and return.

Workflow management: With the increased regulation new checks and controls are being put in place across the trade lifecycle. It is therefore important for workflows management tools to be integrated and to have hooks into the relevant front, middle and back office systems to quickly provide a scaleable, configurable and transparent process flow.

Critical factors for software buy vs. make decisions

Overall, the study revealed that the hedge fund industry is reacting to changing market trends with technology being a main transformation factor to meet regulatory and client requirements. However, their internal decision making is driven by a variety of factors which the survey exposed as shown below:

- Keeping data in-house

- Security and confidentiality

- Data/application security

- Cutting edge features

- Integration

- Vendor reputation

- Web reporting

- Scaleablity

- Costs

For hedge funds, their trading strategies and client data is of key importance and the basis of their competitive advantage. There is a high degree of keenness to build vs. buy when it comes to infrastructure services hence the respondents stated a clear preference to keeping data in-house.

Security and confidentiality are paramount for hedge funds and will therefore play an important part in acquiring new software and services. Not only is security an important consideration when purchasing new software, the data/application security as well as the provision of audit trails has been rated by the participants as very important. With increased regulation around transparency on trading activities it is becoming more important for hedge funds to be able to demonstrate a clear log of investment decisions and trading decisions. In particular large hedge funds with AUM over $5 billion rate this feature as pertinent to their software purchase decision-making. As hedge fund strategies become increasingly sophisticated and regulatory requirements become more demanding, software solutions now need to cater for a host of variables. The data requirements to implement strategies requires software architectures to be scaleable and of high performance in terms of speed. To meet regulatory requirements the workflows within the software systems should allow for new controls and transparency.

Despite the growing interest for Cloud-based services, the respondents stated that it is currently not a necessity to receive services from the Cloud. This may be due to the fact that the technology is still in its early adoption phase and security concerns are dominating the decision making for implementing Cloud-based software. It seems likely that hedge funds at the beginning remain extremely cost sensitive and are more inclined to go for Cloud based services, nonetheless as the size of the fund becomes larger, there seems to be a tendency to insource the services to get more control back into the organisation.

Hedge funds spend a very small portion of their assets under management on IT and they are not extracted from their management fees. This causes them to be particularly cost sensitive when purchasing new software. While cost concerns are a consideration, hedge funds prefer to deal with reputable software providers who have been in the market for a long time and have a number of clients. Most hedge funds build software in-house and therefore require significant reengineering when deploying new vendor software. One obstacle to buying off-the-shelf software is the substantial costs of integrationwhich frequently results in businesses remaining with in-house sub-optimal systems and processes despite being aware of external vendor systems which could drastically reduce total cost of ownership. This challenges suppliers in coming up with appropriate price-value-propositions.

Overall, cutting edge features are of importance for the hedge fund industry. However, most hedge funds are driving technology with their sophisticated and time-sensitive investment strategies. Therefore, it is very difficult for vendors to react to changing market conditions and incorporate these specialized features. Building up close client relationships and intense market research is absolutely key to serving the complex needs of hedge funds given the dynamic environment they operate in.

Authors

Dr. Sven Kuenzel Reader, University of Greenwich Business School, London and Anika Schlien, Visiting Lecturer and PhD Researcher, University of Greenwich Business School, London.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 123

Managing Complexity With Technology

Technology trends within the UK hedge fund industry

DR. SVEN KUENZEL AND ANIKA SCHLIEN, UNIVERSITY OF GREENWICH BUSINESS SCHOOL, LONDON

Originally published in the June 2017 issue