Managing Tail Risk With Options Products

Appetite remains for the moment

STUART FIELDHOUSE

Originally published in the March 2013 issue

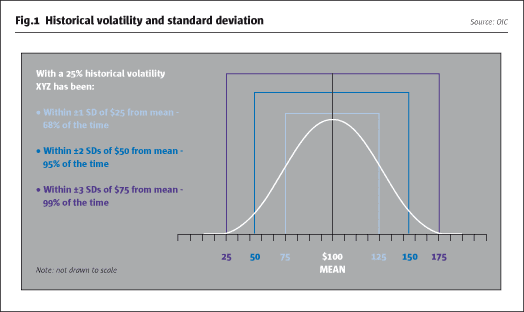

Tail risk is the unforeseen risk of a three standard deviation move, which has the magnitude to upset and reverse markets. Because of its infrequency it is difficult to predict. Typical tail risk events, like the 9/11 attacks or the Japanese tsunami are classic examples. Others, like the 1987 stock market crash or the spectacular collapse of Lehman Brothers, are slightly more predictable, but can still have catastrophic consequences for an investment portfolio. The recent brinkmanship in Congress over the US budget, the systemic dangers posed by the Eurozone crisis and concerns over growth and politics in Asia have re-focused investors on the need for some kind of tail risk insurance (see Fig.1).

Tail risk can be hard to insure against, particularly for passive investors who are already one step away from the market. While a hedge fund manager might already hear rumours that a major bank is in trouble, a pension fund with a portfolio of funds to oversee may not have immediate access to the same market-turning news. Nor, in many cases, do institutional investors have the requisite skills to implement a sophisticated hedging strategy. Consequently, there has arisen a need for funds that can sit in the same portfolio and act as de facto insurance policies, minimising the damage that an unforeseen market event might cause.

Research conducted by State Street Global Advisors and the Economist Intelligence Unit (EIU) in September 2012 discovered that almost three quarters of institutional investors felt that it was highly likely that a tail risk event would occur in the next 12 months, with most expecting some form of collapse in the Eurozone. However, it is rare that a broad consensus of allocators is able to predict precisely where and when the next big crisis will emerge from.

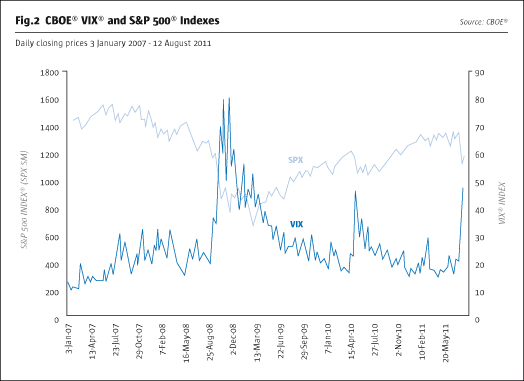

Investors told the EIU that they were not confident that they were adequately protected against the next tail risk event: diversification is one of the tools being used, followed by risk budgeting techniques and managed volatility strategies (see Fig.2).

It could be argued that all hedge funds, by definition, are meant to be able to minimise the impact of a sudden bear event. Historically, it was possible for fund managers like Paul Tudor Jones or John Paulson to capitalise from sudden downturns, but in their cases there was already a degree of evidence that something was not quite ‘right’ in the market, and they took a contrarian view. Also, you had to be invested specifically in their funds to benefit. Diversification of assets even via hedge fund allocation has not proven to always be diversification of risk. However, beyond this, a tail risk fund or strategy is designed to make considerable profit under such circumstances, as it is uncorrelated to a long only equity portfolio. The tail risk fund, by contrast, is a newer hedge fund animal that on an ordinary day will likely be losing money. It is only when things go disastrously wrong that it intends to make a considerable return.

Benefits of tail risk funds

A tail risk fund brings a number of benefits to the investment portfolio: firstly, it is designed to profit from a pronounced downturn in the market, say a 20% retracement or more. Secondly, it can – although this is not guaranteed – also provide the investor with a source of liquidity at a time when many other funds are locking assets in. Is this likely to happen again as it did when liquidity dried up for investors in 2008? It is hard to say, but many allocators don’t want to make the same mistake twice. Tail risk funds are therefore often expected to offer superior liquidity terms in bear market scenarios.

The favoured strategy pursued by tail risk funds uses long term put options, usually with some form of macro overlay. This will typically include both active and systematic processes (usually informed by economic criteria fed into a proprietary model) that will help to inform which options to use. The contracts can be dated out as far as five years or more. Long term put options are not as widely available as those with short term maturity, and they can become more expensive if market volatility increases.

Tail risk funds – and strategies – tend to be cheaper for investors (and a better investment) at the top of the market. Long term options tend to be at their cheapest near such a peak. Tail risk funds tend to be most expensive at the bottom of a market cycle, when most of the pain has already occurred.

There is a big difference between funds that offer tail risk opportunity or, alternatively, tail risk insurance. With funds offering tail risk opportunity the manager can make enough money from a macro bear event to cover all the losses the investor has sustained with the fund up to that point and some profit as well. In funds offering tail risk insurance, an investor will still be making a loss on the fund over, say, a 10 year time horizon.

Regulatory changes are starting to impact the market for long term options, particularly in the US, because banks and other writers of long term puts are being forced to shed some of their risk. Other market participants have also been taking option risk off the table,forcing prices for long term puts higher, thus it is also becoming more expensive to hedge portfolios. Experiences are mixed: some managers profess to still be able to obtain sufficient liquidity, but usually only if they are buyers of scale. Others welcome the migration of OTC options to exchanges, but are cautious about the possibility of artificial volatility that could occur as the result of regulatory changes.

Investors will generally be expecting to pay between 50 and 200 basis points for a tail risk strategy, although the price of the fund will vary widely depending where in the current market cycle the fund is positioned. Most investors expect and understand that a premium needs to be paid for a tail risk strategy.

Liquidity will be a primary consideration, hence many investors lean towards managed accounts as the preferred format for tail risk insurance in a portfolio. Allocators will expect daily or at least weekly liquidity, even during periods of crisis.

Constructing tail risk strategies

Some specialist providers of tail risk investment strategies already exist, and many larger hedge funds already use a degree of tail risk hedging within their existing funds. However, investor demand is causing many more established fund managers to consider specific tail risk products. For example, SYZ & CO launched a sub-fund product around tail risk in 2011, OYSTER Multi-Manager Tail & Trading, employing a managed accounts platform.

Tail & Trading combines decorrelated CTA funds with two funds that protect against tail risk events. SYZ & CO uses two managers – Capstone Convexity, which is an explicit long, systematic protection fund designed to generate high returns in severe market corrections, and LAMP Conquest, a more opportunistic strategy structurally (but not explicitly) built to outperform in difficult market conditions. In both cases, the emphasis is on liquidity and providing a level of insurance to investors concerned about tail risks.

“We launched the fund at a very difficult time in Europe,” explains Stephane Varin, a portfolio manager with SYZ Asset Management. “We felt the odds for a tail risk event in Europe had substantially increased but we underestimated the strength of the policy response.” However, he has seen more inflows in recent months, even as US markets have rallied.

The tail risk funds in Tail & Trading mostly use listed options based on equity indices, ETFs or the VIX®. The managers may also use some OTC products, but SYZ & CO exercises close control over the risk management of the funds, including risk budget and approval of specific products. This is partly because OYSTER Tail & Trading offers weekly liquidity. The use of options in the portfolio also means the strategies offer a high capacity.

Geographical constraints are imposed on the SYZ managers, with a minimum of 40% exposure to the US, for example. This reflects awareness that tail risk effects can be felt only on a very regional basis. Varin cites the example of the reactor accident at Fukushima. Here there was a strong potential for a tail risk scenario. However, a specific Asian tail risk strategy is hard to replicate, partly due to the volatility in the liquidity of options in Asia and the reliance on bank dealers selling capital protected products to the retail market.

By way of contrast, the more opportunistic LAMP Conquest strategy monitors credit and swap spreads in order to gauge market sentiment. It targets a 5% return in risk seeking markets and a 15% return in risk averse markets and invests in equity, government bonds, commodities and currency futures.

As with other tail risk proponents, Varin sees the tail risk strategy as an insurance policy for investors: the key is minimising losses in the majority of years where there are no tail risk events. He says it can be nigh on impossible to time a tail risk event – these are not funds you can get into cheaply once things have started to go wrong in the market.

In many respects, tail risk should be considered more as a form of risk management than a stand-alone strategy. While a hedge fund might be sold as a tail risk fund, it is really only there as a hedge against the next time the market faces a major crisis on the scale of Lehman Brothers. Exposure to a tail risk fund, and the losses and costs that this entails, should be regarded in the same light as paying a premium on portfolio insurance.

“We view a tail risk hedge, particularly in the current environment of monetary distortion and overvaluation, as more than protection but as a means for enhancing an investor’s long term equity returns,” says Mark Spitznagel, CIO of Universa, established in 2007 as a specialist in convex and tail hedging. Universa portfolios are positively-skewed, robust to extreme risk assumptions and non-linear to common risk factors (e.g. beta). Universa’s edge is derived from its ability to provide tail hedging and investing in a manner that they contend is more efficient than that offered through ‘naïve’ options strategies and other risk management strategies. Significant edge is also derived from acting as a liquidity provider, as well as from systematic options supply and demand imbalances, structural and behavioural biases and access to order flows.

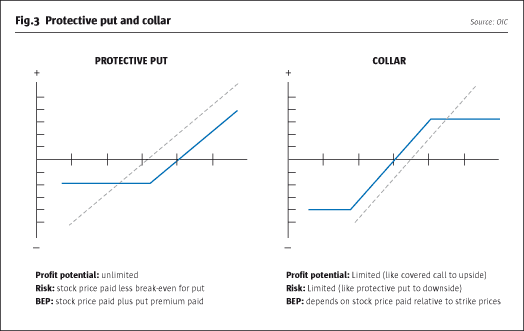

Tail risk managers will make use of a wide variety of put options: some have a bias towards OTC contracts because they want to isolate very specific investment opportunities. Others, due to liquidity issues, will lean towards exchange-traded instruments. There is a general consensus amongst the tail risk managers we spoke to for this article that the balance will be shifting towards exchange-traded options over the next few years, mainly due to regulatory requirements (see Fig.3).

Some larger hedge funds are building a tail risk component within their existing fund ranges, as they become more aware of the potential benefits and opportunities of this approach. However, for larger investors like major pension funds and insurance companies, there is more of a requirement for a tailored strategy that will suit their own investment requirements than a generic hedge fund shared with other investors. For example, some investors will seek to hedge exposures in emerging markets or in specific commodities markets against tail risks. Such highly tailored solutions can still be achieved via exchange-traded instruments, for example via puts on ETFs.

“We go out to 10 years in our long-dated options, with a weighted average expiry of between three and six years” says Anthony Limbrick, a principal and portfolio manager with 36 South. “We will run a rolling short-dated strategy in place of a long-dated strategy, but we prefer to be long-dated.”

36 South prefers to be well out-of-the-money in terms of strike prices. It is an active user of proxies, particularly during risk aversion periods where correlation is more obvious. “Every trade we put into the book has an element of tail-driven pay off, but because it is longer dated and typically out of the money, it starts off as a volatility trade…but becomes more of a directional trade as it becomes more profitable.”

36 South includes left and right tail events as part of its strategy, for example inflation or very strong bull market moves.

Conclusion

Tail risk funds have been increasing in popularity with investors, as fear in the market has continued. Those investors who have been forced to maintain active allocations have been seeking a means of insuring their exposure, particularly as the prospect of major systemic problemsin banking and government continue to dominate the headlines. Whether this appetite will continue once economic circumstances improve is an open question.

The expectation seems to be that tail risk funds will be making more use of exchange-traded options in the future, partly as the OTC options industry migrates over to more of an exchange-traded model. In addition, there are obvious concerns about counterparties in the OTC market, and how they might be affected in a tail event. As one manager points out – holding an option with Lehman Brothers as your counterparty would not have helped much in 2008.

The Options Industry Council (OIC) was formed in 1992 to educate investors and their financial advisors about the benefits and risks of exchange-traded equity options. Its members include BATS Options Exchange, BOX Options Exchange, C2 Options Exchange, Chicago Board Options Exchange, International Securities Exchange, MIAX Options Exchange, NASDAQ OMX PHLX, NASDAQ Options Market, NYSE Amex Options, NYSE Arca Options and OCC. Options industry professionals have created the content in our software, brochures and website. Appropriate compliance and legal staff ensure that all OIC-produced information includes a balance of the benefits and risks of options. Go to www.OptionsEducation.org

Sponsored by OIC. The views expressed are solely those of the author of the article, and do not necessarily reflect the views of OIC. The information presented is not intended to constitute investment advice or a recommendation to purchase, sell or hold securities of any company, but is intended to educate users concerning the use of options.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical