As the hedge fund industry has grown to about $3 trillion in assets under management (AUM) in the first quarter of 2015 and represents a significant portion of institutional portfolios, academic and industry publications have provided valuable insights into certain aspects of portfolio management, particularly in the area of fund evaluation and portfolio construction. Yet there is an apparent lack of a robust and flexible methodology that is capable of evaluating whether those insights can benefit a specific institutional investor once implemented with real world constraints.

There are several important challenges that need to be carefully dealt with.One – investors have their own objectives that vary substantially depending on the type of institution. For example, a family office or an asset management firm might seek to maximise Sharpe ratio, a university endowment attempts to target returns that exceed the university’s spending rate over a market cycle, and a pension fund pursues maximisation of risk-adjusted return within an asset-liability framework.

Two – sophisticated investors often impose rigorous filtering criteria or show stoppers such as the length of a track record and level of AUM. Most academic studies either completely ignore these show stoppers or selectively incorporate some of them with the purpose of accounting for certain biases such as small fund bias or incubation bias.

While accounting for biases is important, an institutional investor ultimately wants to know whether he will be able to benefit from a portfolio management technique given his own set of preferences and constraints. Three – most academic papers often compare portfolios that include hundreds of funds, which might be irrelevant to an investor who plans to hire three to five hedge funds. By contrast, such investor would be interested in knowing the impact of his manager selection and portfolio construction decisions on the outcome distribution.

Generating out-of-sample results for multiple subsets of five manager portfolios within in a simulation framework gives that information. Four – the investor cares about the marginal impact of the hedge fund investment on his existing portfolio but that is often ignored. Finally, hedge fund databases provide returns with a delay of about one month that is ignored in academic papers, as reported in Molyboga, Baek and Bilson (2015), creating a significant barrier to implementing results of most studies.

In our research paper, “A simulation-based methodology for evaluating hedge fund investments,” we introduce a methodology that is designed to evaluate hedge funds’ investments subject to the realistic constraints of institutional investors. The methodology is customisable to the real-life preferences and constraints of investors, including investment objectives, performance benchmarks, desired number of funds in a portfolio, and rebalancing frequency.

We illustrate the methodology by imposing the framework on a dataset of Commodity Trading Advisors with 604 active and 1,323 defunct funds over the period 1993-2014. We then measure the out-of-sample performance of three hypothetical risk-parity portfolios and two hypothetical minimum risk portfolios and their marginal contributions to a typical 60-40 portfolio of stocks and bonds.

We find that an investment in CTAs improves performance regardless of the choice of the portfolio construction approach. For the out-of-sample period between January 1999 and December 2014, a 10% allocation to managed futures improves the Sharpe ratio of the original 60-40 portfolio of stocks and bonds from 0.376 to 0.399-0.416 on average, depending on the portfolio construction methodology. Blended portfolios have higher Sharpe ratios in at least 89% of simulations and higher Calmar ratios in at least 89.5% of simulations. Minimum risk portfolios perform the worst for all performance metrics.

For example, their average Sharpe ratios are between 0.299 and 0.304, significantly lower than the 0.319 average Sharpe ratio of the random portfolios from both an economic and statistical perspective. By contrast, equal risk methodologies deliver superior average Sharpe ratios of 0.342 to 0.362.

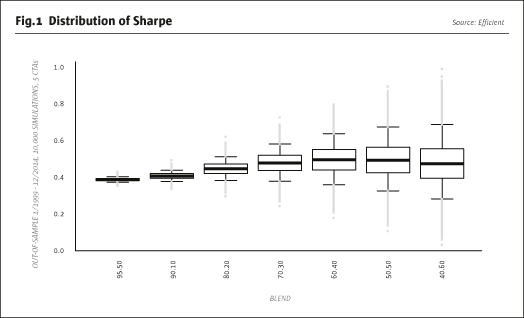

We repeat marginal contribution analysis for the range of CTA allocations between 5% and 60%. Fig.1 shows that the average Sharpe ratio of blended portfolio reaches its highest value of 0.507 at 40% allocation to equally weighted portfoliosof five CTAs, which is substantially higher than 0.376, the Sharpe ratio of the original 60-40 portfolio of stocks and bonds.

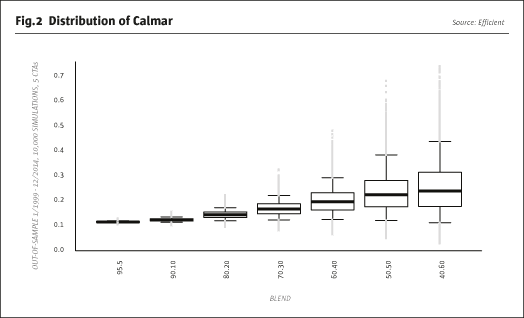

Fig.2 shows that the average Calmar ratio of blended portfolio reaches its highest value of 0.24 at 60% allocation to equally weighted portfolios of five CTAs, which is substantially higher than 0.092, the Calmar ratio of the original 60-40 portfolio of stocks and bonds.

While the empirical findings can immediately benefit institutional investors who evaluate the diversification benefits of managed futures, this analysis is merely an illustration of a methodology that can be applied broadly. We introduce a quantitative large-scale simulation framework for the robust and reliable evaluation of hedge fund investments by institutional investors. The framework is customisable to the preferences and constraints of individual investors, investment objectives, rebalancing periods and the desired number of funds in a portfolio and can include a large number of portfolio construction approaches. Thus, the methodology can benefit portfolio managers, investment officers, board members and consultants who make hedge fund investment decisions. A full version of the paper is available for download on SSRN.

Marat Molyboga, CFA is the Head of Research and Chief Risk Officer at Efficient Capital Management, and an Adjunct Professor of Finance at Stuart School of Business. Christophe L’Ahelec, CFA is an Assistant Portfolio Manager at Ontario Teachers’ Pension Plan.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical