Metori’s Epsilon CTA strategy is one of Europe’s oldest, dating back to 1994, and has regularly received The Hedge Fund Journal’s UCITS Hedge award for best risk-adjusted performance in the trend following category, for various time periods. Metori was also an early mover in starting a Chinese CTA strategy in 2014, where its onshore presence has provided wider market access and the ability to go outright short of some financial futures markets that other investors can only short for hedging purposes.

Paris-based Metori became an independent French company in 2016, wholly owned by its five founding partners, amicably spinning out of Lyxor Asset Management. “We wanted to create a company around the investment strategy and not be a team within a larger organization,” says CEO, Nicolas Gaussel.

For the time being, Metori is one of a select handful of western CTAs with a presence in China.

Lyxor’s award-winning UCITS platform continues to host the UCITS version of Metori’s CTA strategy, which is one of the largest UCITS CTAs. Metori also runs AIFs, a US onshore vehicle and managed accounts for its flagship CTA strategies. Assets come mainly from European institutions, wealth managers, family offices and private banks though the firm also has a US representative registered with the NFA who is building out the US investor base. Metori’s China CTA strategies trade onshore Chinese markets for onshore Chinese investors.

Strategy differentiators

Metori’s entirely systematic approach to trend following is principally distinguished by its portfolio level perspective on estimating trends; by the time periods over which it estimates trends, volatility and correlation and by its variable risk and volatility targets.

Says founding partner, Laurent Le Saint: “It is natural for many trading systems to consider asset classes separately because traders who worked in banks were siloed into desks for agriculture, oil, energy and so on. We did not come from that culture and our unsupervised statistical approach lets the model identify trends in any groups of markets, without tagging them by asset class. We apply the same algorithm to extract trends from price and data series across all markets. Therefore, Australian equities will sometimes be clustered with other equity markets and at other times could be clustered with commodities or other factors. The optimization is geared to jointly estimating trends and inputs to find the portfolio with the best risk adjusted returns”.

35

Of the 35 futures traded by Metori's China strategy, two are bonds, three are stock indices, and 30 are commodities

Therefore, Metori’s models could pick up some changing patterns of correlation that might be overlooked by a rigidly regimented asset class approach, and the Covid pandemic in 2020 has upended some market behaviour within asset classes. Typically, in 2020 most equity markets exhibited high daily correlation. Yet, growth and technology stocks, such as the Nasdaq index displayed positive performances while the more cyclical and value-oriented equities, such as the Russell 2000 small caps index performed poorly. “In fact, the correlations have been above 80% and our models have been positioned in the same direction for most equity markets acknowledging some kind of ‘Covid factor’. In March 2020, Epsilon was only short of one or two of the 15 or so equity markets it traded. It is in practice unusual that the model generates opposing trend signals within global equity markets,” Gaussel clarifies.

This is partly because the signals derive from multi-month rather than daily price action. Metori’s style of trend following is based on lookback periods of 6-9 months, which straddles typical industry definitions of medium term and long term. Volatility and correlation are estimated over somewhat shorter, weighted average 1-2 month lookback periods, so as to be more responsive and adaptive while also staying statistically robust. “If the lookback period is too short there are not enough data points to have confidence in the robustness of the estimate, and we judge that at least one month of data is needed to avoid statistical noise or spurious, random signals,” says Le Saint.

Volatility is easier to forecast than returns and some CTAs target roughly constant performance volatility, but Metori is more opportunistic. “A fixed volatility target forces you to increase the size of low conviction positions when you have weak trends. Our model has a cap on maximum volatility, but we will also trade below the volatility budget under conditions of highly correlated, rangebound markets, when we have little confidence in trends,” says Gaussel. A good example was the second quarter of 2020, when Metori reduced margin to equity to 5%, less than half the long-term average of 11%. This was not very usual, but nor was it exceptional. Notwithstanding the flexibility around volatility targets, Metori’s UCITS has a long run average volatility target of 10%, while the Irish AIF has a higher volatility target.

Commodity exposure in different strategies

Investors who avoid commodities can opt for the UCITS, which has avoided commodity exposure since February 2014, or a managed account. The Irish AIF includes commodity exposure and Metori’s Chinese CTA strategies have a much higher proportion of commodity exposure because the majority of Chinese futures markets are currently commodities. Commodities have in recent years detracted from performance globally, but enhanced performance in Chinese markets. The AIF has underperformed the UCITS since 2012, but would have outperformed before then according to simulations. Since 2014, the Chinese strategies have outpaced the other two by a large margin, generating average annual returns of 20% with volatility around 20%. The MCTOP strategy made 49.2% in 2020, while the somewhat more leveraged onshore product run in collaboration with Hwabao WP fund management had made 72%. Assets in the China strategy at year end were $46.5 million.

Powerful momentum in China’s commodity markets

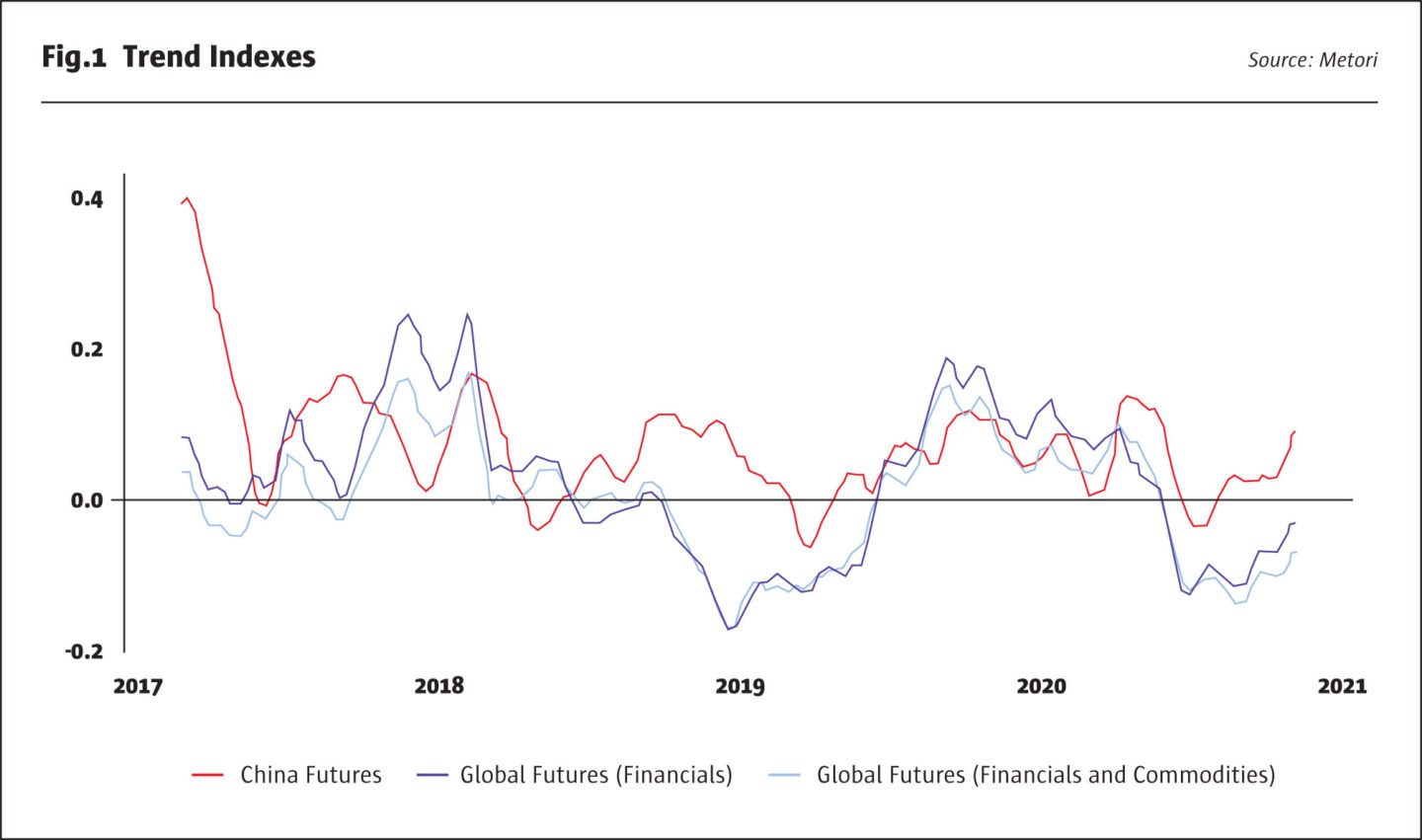

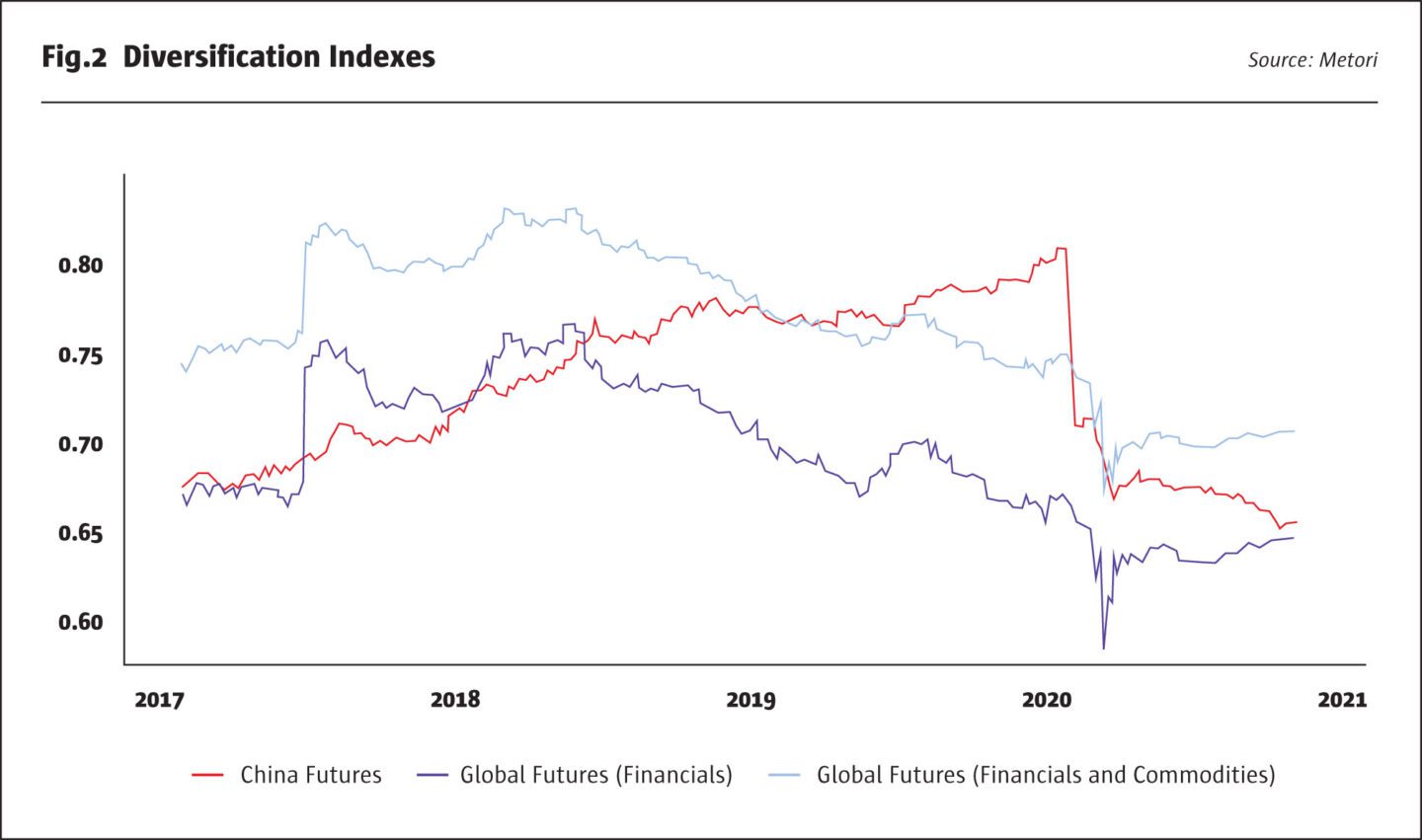

The reasons for the outperformance of the China strategy are easy to explain. Metori’s trend index measures the average strength of trends in a given investment universe. Over the past four years, the Chinese futures markets traded have, on average and most of the time, generated much stronger trends than have the global markets traded by the UCITS and AIF, as shown in Fig.1.

The stronger trends have been powerful enough to outweigh the fact that the Chinese portfolio has been less attractive from another perspective: it has, on average, had the lowest internal diversification. Cross market correlations have been highest within the Chinese markets and lowest within the AIF in recent years, as shown in Fig.2.

Chinese commodities versus exotic OTC markets

The drivers of outperformance for Metori’s Chinese CTA are similar to those CTAs trading exotic, OTC markets, insofar as both investment universes have generated better trends in recent years, but different in that lower correlations between the markets have also been an important determinant of higher risk adjusted returns for the exotic CTAs. Some of these CTAs are trading some Chinese markets, including OTC markets that Metori does not trade. Metori trades only liquid futures whereas exotic CTAs wholly or mainly trade non-futures OTC markets. Metori’s Chinese CTA strategy is therefore not a regional subset of the exotic markets CTA approach.

China’s large, liquid, institutionalized, and unique commodity futures markets

Of the 35 futures traded by Metori’s China strategy, two are bonds, three are stock indices, and 30 are commodities. Metori trades on four of China’s five futures exchanges: 10 contracts on Shanghai Futures Exchange, 11 contracts on Dalian Commodity Exchange, 9 contracts on Zhengzhou Commodity Exchange and 5 contracts on China Financial Futures Exchange.

Chinese commodities are appealing on account of their size, liquidity and relatively low transaction costs.

Metori’s strategy is mainly focused on the most liquid contracts, the date of which varies by market. “For crude oil and non-ferrous metals, the front month can be the most liquid but for agriculturals, the January, May and September contracts are generally most liquid. Our longest maturity is usually one year,” says portfolio manager, Coleen Kang, who joined Metori’s Chinese office in 2020 after working for one of the largest futures brokers in China for over 12 years. Metori picks the most liquid contracts for directional trading, and is not trading calendar spreads.

We will be one of the few ready to serve clients when the time comes.

Gilbert Tse, Metori China General Manager

This liquidity has helped to create competitive transactions costs. “Bid/offer spreads are very narrow, and commissions, which include clearing, broker and exchange fees are competitive. For instance, the commission on copper, soybean meal and other agriculturals is pretty similar to that on comparable Western contracts, though different brokers do offer different levels of commissions according to trading volume,” says Kang. “Exchange fees may be slightly lower in the US market but funds can access the benefits of discounts for exchange members via their brokers,” she clarifies.

In contrast to China’s retail-dominated equity markets, the futures markets are increasingly institutionalized. In 2011, 97% of active clients were retail investors. Now over 60% of outstanding margin and 50% of open interest comes from institutions, according to Mr Yang Guang, General Manager of the China Futures Market Monitoring Centre (CFMMC).

Perhaps most importantly, many Chinese commodities offer unique diversification benefits versus global futures. Some 14 of the markets that Metori trades are unique to China, including steel rebar, hot rolled steel, coking coal, thermal coal, PTA (purified terephthalic acid), PVC (polyvinyl chloride); PP (Polypropylene), LLDP (linear low-density polyethylene)and rapeseed oil, which are not traded on other international exchanges. Metori has not yet started trading some of the smaller unique Chinese futures markets such as apples and eggs, which do not meet their liquidity criteria. About 10 of the markets that Metori trades – base metals like copper, zinc, nickel and aluminium; precious metals like gold and silver, and agriculturals like soybean, palm oil, corn, sugar and cotton – are analogous to Western futures, and are becoming increasingly correlated with similar markets on western exchanges due to arbitrage, which is not a strategy that Metori pursues.

Going forward, Metori China General Manager, Gilbert Tse, is open minded about the possibility that greater capital inflows might eventually erode alpha from Chinese markets: “Our higher Sharpe ratio in China may be because capital markets are less mature. Now that the CSRC has announced QFII investors can invest in private funds and futures contracts, we would expect to see more inflows and the gap between Chinese and global markets should narrow over time. However, this may take a long time. QFII has been running for over 10 years yet global investors are still under-invested in China”.

Why go onshore?

For the time being, most foreign investors cannot directly access most of the investment universe for Metori’s Chinese CTA strategy. Only two of the markets that Metori trades – iron ore and PTA – are included in China’s six internationalized commodity futures as of December 2020.

And even where investors without a local entity can access some other Chinese futures, they might not be able to short them – for reasons other than hedging. China’s commodity futures markets have been particularly attractive to CTAs because they have allowed unfettered short selling, whereas for QFII investors equity index futures have only been used for hedging purposes and it is still not clear if the recent QFII/RQFII reforms will in practice open up the possibility for financial futures contracts to be eligible for shorting. “Futures exchanges need to submit each futures contract separately for authorization by the CSRC and so far, the China Financial Futures Exchange 30th Oct 2020 “Notice on Participation of QFII and RQFII in Equity Index Futures Trading” has not proposed allowing shorting of equity index futures beyond hedging. The other three exchanges have not yet issued any guidance,” explains Tse.

Investors such as Metori with a local entity can run the gamut of China’s futures markets – and should be able to short financial futures, absent any ad hoc bans.

6-9 months

Metori's style of trend following is based on lookback periods of 6-9 months, which straddles typical industry definitions of medium term and long term

Blazing a trail in Hengqin

Until 2020, Metori had availed of a regulatory grandfathering provision that allowed it to continue using the SG Fortune company’s regulatory authorization. Since 2016 the regulator has been exhorting companies to apply for their own licenses and had made this compulsory by the end of 2020, prompting Metori to set up its own company. Most PFMs are based in Shanghai, which as the major financial centre, is the obvious first choice but Metori has established Metori Investment Management (Zhuhai Hengqin) Co., Ltd., with a support office in Beijing. A PFM needs one registered headquarters and can have other offices.

“One attraction of Guangdong is the central government’s “Greater Bay” vision to integrate it with the SARs of Hong Kong and Macau and 9 cities as part of the “Greater Bay Area” (including Shenzhen, Guangzhou, Hong Kong, Macau and Zhuhai) aim to promote more collaboration among cities and more flows of people and money,” says Tse.

Hengqin Financial Services Bureau’s focus on quant strategies and innovation, and Hengqin New Area’s development plans, are helpful for a wide range of tax incentives and subsidies, such as free office space, assistance with streamlined corporate set up, and help with hiring talent locally or from other parts of the region. A Chinese law firm was also retained to assist with the documentation, with various parts in Mandarin and English. Other upcoming regional initiatives include plans for mutual recognition of wealth management products within the region.

Metori China is initially building a team of eight in China, with five in Hengqin where Tse and Kang will soon be joined by a quantitative research specialist, an analyst, and a business development professional. The Beijing office has already hired two staff: IT specialist Kevin Cheng, and legal and compliance specialist, Xinxing Ou, with an analyst due to join in early 2021.

For the time being, Metori is one of a select handful of western CTAs with a presence in China. For now, Metori China can only raise assets from Chinese investors and has done so mainly from institutional investors, including pension funds and insurance companies. Metori has launched three products: one catering for institutions and another targeting high net worth individuals. Longer term, the aim is also to give foreign investors access to these markets as and when regulations allow and Metori expects to reap an early mover advantage here: “We will be one of the few ready to serve clients when the time comes,” says Tse.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical