Millburn Ridgefield Corporation (Millburn) is one of the world’s most experienced systematic CTA managers, and as managed futures funds see a resurgence of performance in 2014, it’s perhaps not unexpected to see Millburn amongst the top performers this year. But don’t stop reading there. The firm’s adaptive approach and iterative process is what may be providing real edge. Combined with the firm’s deep experience trading through periods of market stress and inflection (experience “baked in” to the firm’s institutional processes and knowledge base), Millburn believes it has the recipe for a truly sustainable approach – an approach it is now applying in innovative formats to meet investor needs.

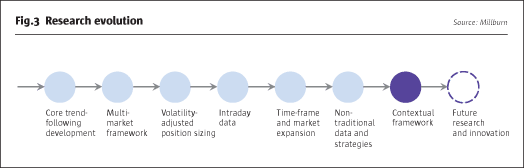

From the outset, the firm’s approach has always been purely systematic and quantitative but, says Millburn’s executive vice president and executive director of trading, Barry A. Goodman, “Our approach has evolved as the range of available markets has grown, and as technological and statistical advances enabled us to better process and interpret data.” He explains that Millburn aims to “integrate our significant experience into the process of innovation, but the focus remains squarely on efficient ways to use statistical inference to explain the structure of today’s markets, so that we can continuously improve our return forecasts.” The term straight-through processing (STP) commonly refers to back-office processes, but for Millburn STP defines their front office structured, multi-stage research process, whereby the firm “evaluates, develops, implements and executes.” This scientific ethos is “very much evidence-driven, iterative and self-critical,” Goodman states. “Our experience informs our approach, gives us humility, and helps us understand what processes work as opposed to just what strategies work. Experience is a crucial input that we believe should not be underestimated. But we’re certainly not resting on our experience alone.”

All of this is labour-intensive and nearly 40% of the 50-strong team have strong technological and quantitative backgrounds to power forward the research and development effort. Millburn’s main offices are in “hedge fund central”, Greenwich, Connecticut, and its affiliate The Millburn Corporation has its office in New York’s Midtown in the Rockefeller Centre. Millburn seeks candidates from all over the globe, although most have historically tended to be US-educated and based. Goodman believes the attractions are a “firm that gives team members a fruitful environment in which to work, grow and succeed.” Furthermore, Millburn has invested in experienced product specialists, hiring Craig Gilbert in early 2011 from Two Sigma to oversee global business development strategy, and cover North America and Asia, while ex-BlueCrest Shezad Syed handles Europe, the Middle East and Australia. These “hybrid” business development types, a strong investor relations team, as well as a solid operational core, enable the quants to concentrate on research.

Gregg Buckbinder, chief operating officer for Millburn, pursues efficiency as a means to maintain the ability to reinvest in the business. “We’ve been fortunate to hire, and keep, some really strong team members at all levels of the firm, and through a variety of market cycles,” he says. “We try to remain lean and nimble, which means we challenge our people by giving them a lot of responsibility right out of the gate. But it’s all within the framework of an experienced leadership team. We think this makes for a good combination. Still, this requires a very deliberate and data-driven hiring process.” In terms of quant talent specifically, Millburn has cast the net wide in its search, hiring researchers with academic backgrounds in bioscience, astrophysics, statistics and game theory, to name a few – as well as those with more conventional finance backgrounds. Goodman asserts, “Diversity is one of our cornerstones – not only in how we invest but also in how we hire. As a result, we are always trying to round out our array of skill sets. Students of different disciplines think differently and tend to be adept at employing different statistical techniques to solve complex problems.” The research process follows an open-plan format to promote idea sharing, rather than the siloed set-up favoured by some quant shops. For Goodman, “if you’re going to hire a diverse group of researchers it’s because you want them to learn from one another and foster collaboration. And also because you want the flexibility to allocate resources based on capabilities and skills. We think an open architecture model is the best way to achieve these goals.”

A consensus and team-driven approach is also taken by the executive committee, and investment committee, which approve all major decisions concerning the business and the investment strategies, respectively. The members of these committees are really manager-owners, who own most of the Millburn management company. All told, the current and former principals and employees of the firm, and their families, have substantial investments in Millburn’s funds: some 28% of the $1.4 billion, or just over $400 million, is proprietary capital. Goodman believes this helps keep the firm aligned with the interests of its investors.

An adaptive approach to the research process

The programmes that put this capital to work are still heavily invested in extracting value from momentum. In common with most CTAs, Millburn can cite plenty of research backing the case for trend following, with some of the most recent being behavioural finance studies that have now attained mainstream academic acceptance. Millburn are very much wedded to momentum, but they have also sought to become more resilient during headwinds for traditional trend following. Grant N. Smith, Millburn’s MIT-educated director of research, sets the agenda for the research team. “Markets do shift between different regimes and have done so over multiple decades,” reflects Smith, who adds that “We are trying to preserve our ability to participate during strong, sustained price moves in markets – but we also want to be able to navigate choppy, directionless periods when traditional trend-following approaches may do less well.”

One significant evolution in Millburn’s research was the addition of price-derivative and non-price inputs, research which started in the mid-2000s. The addition was driven, in Smith’s words, “by the belief that, while price captures the overwhelming majority of information in markets, there are other data that can have influence.” These “non-traditional” inputs seem to have a “quant macro” or “systematic macro” flavour, including things like (quantitative) seasonal, fundamental, supply-and-demand and market structure data. Millburn calculates that the simple addition of this “non-traditional” data reduced drawdowns and volatility significantly compared with their more pure trend-following approaches on a standalone basis. This helped during recent periods that were tough for trend.

Context matters

But what makes Millburn perhaps different from many systematic macro funds is that these non-traditional data types, or factors, are not viewed in isolation. Soon after adding the factors Millburn realized that they could add even more value when dealt with “simultaneously, contextually and adaptively,” recalls Goodman. Today, the emphasis is at pulling all the strands together to see how the factors interact. Millburn’s holistic philosophy means that the platform “takes all relevant inputs, factors that we’ve shown to have value, and looks at them individually, but also in the context of one another. The framework allows us to try to best explain the structure of a particular market, and as a result extract as much information as possible from the data,” explains Smith.

This means that factors can reinforce each other, strengthening a signal, but the factors can also offset or even cancel out each other. A contemporary example is that price momentum models have been clearly negative for heating oil, but seasonality factors could be positive due to historically higher consumption over the colder winter months. Taken together, sometimes seasonality will have no impact on the signal, but at certain times it could have a significant impact. But the signal won’t necessarily be a result of simple addition or subtraction, as the levels of influence of these factors can change. In Millburn’s “New Math,” 1+1 often equals 3. Says Smith, “The models would look back at history, using robust statistical techniques, to help determine how the factors in this example, price momentum and seasonality, interact… including when (and to what extent) we should believe one over the other.” And Smith stresses that “while this example highlights two factors, in reality we often use 10, 20 or more factors in a particular market.”

Despite the push and pull of different factors, it is in practice very rare for Millburn to have a zero or neutral stance in a market. Ultimately it depends on how the suite of models “interpret data in the present market context,” explains Goodman. Millburn finds all of this very healthy – “we actually do not expect all of the models to agree all of the time… when that happens we get a little bit suspicious,” admits Goodman. “We prefer an approach that combines many somewhat uncorrelated factors, statistical techniques and model constructs – this in our view is the path to a robust portfolio,” says Smith. Millburn has actively sought factors that add value in terms of informational content, which results in very “fine-grained signals for each market,”says Gilbert, “which can potentially help the portfolio avoid periods of over-extension, and which can facilitate responsiveness.”

Finding high-value, diversified factors has been made possible by accelerating the efficiency of the research process: the time window for deep evaluation and integration of a new factor has compressed down to weeks from the months it once took. This reflects the firm’s commitment to reinvestment. Over the decades, Millburn has continued to invest in R&D and personnel, to explore new iterations and obtain positional advantages. “Even when performance was choppy, this effort continued,” notes Buckbinder, and “continuous innovation” is one of the firm’s guiding stars.

Notwithstanding Millburn’s diversification into both price-derivative and non-price factors, the firm “remains anchored to the momentum thematic, with, on average, 50-60% of inputs in a typical market, sector and fund being price momentum-based,” stresses Goodman. “It’s really a case of what we think is a much more efficient way to use momentum.”

Resurgent performance

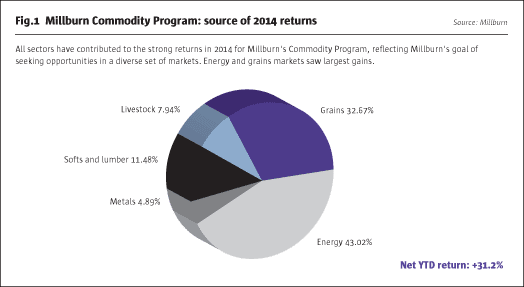

Millburn runs two different diversified long/short CTA strategies: the Diversified programme and the Multi-Markets programme. While these programmes differed when launched, today they are very similar in approach, having gradually absorbed the best of each other’s innovations over time. The Commodity programme is a unique long/short programme, as opposed to a simple “carve-out,” including strategies and markets distinct from those used in multi-markets or diversified.

While long-run average annual returns for the firm’s Diversified programme have exceeded 15%, beating world equities, Millburn has not been immune to the difficulties that other quant CTAs have experienced in recent years. However, 2014 performance numbers would seem to vindicate the ongoing research effort. Thus far in 2014, through November, the Diversified programme, which allocates risk fairly equally between equity, interest rate, commodity and currency sectors, is up just over 19% net, while the nearly 10-year-old sector-specific Commodity programme is up just over +31% net. The Commodity programme was also the top performer for the third quarter of 2014 in the Lipper Global Commodity Sector League Table. According to Millburn, the Diversified programme, which was added to the Newedge Trend Index in January 2014, is beating that index by more than 500 basis points through the end of November. Moreover, the path of returns has been reasonably consistent, another differentiating factor from some of Millburn’s peers.

“We are not just playing fat tail events; we are also trying to generate more frequent and smaller rate of return opportunities,” points out Goodman. His preferred baseball analogy is that “we are hitting singles and doubles, not just home runs.” To draw another analogy with Johnny Mercer’s 1940s song, Millburn seems to be adept at accentuating the positive and eliminating the negative. “We have captured our fair share of the upside in the Newedge trend index in 2014 with less of the downside. And importantly we performed very well in the first half of the year, when traditional trend following had difficulties. This is the profile we’re after,” says Gilbert.

Enhanced beta “adaptive long-only” strategy

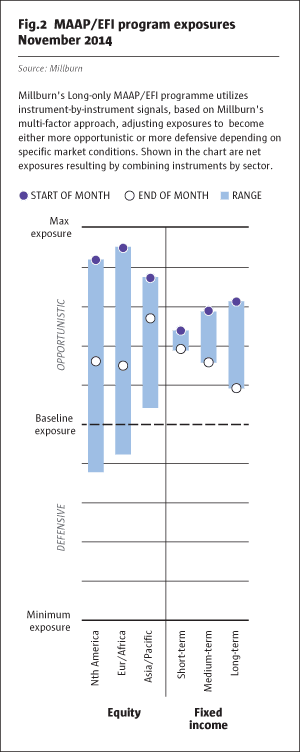

Thinking laterally, Millburn has started to apply its techniques to the long-only market in a range of asset classes, including equities, bonds and commodities, and combinations thereof. These adaptive long-only approaches are seen as “a natural extension of the innovations and evolutions we have gone through,” maintains Goodman. The first initiative, a roughly 60/40 balanced global equities/bonds portfolio called “Millburn Adaptive Allocation Program” was piloted with proprietary capital in September. The aim is “to replicate the positive characteristics of a long-only balanced stock/bond portfolio, which we know can do very well over the long haul and during benign periods, but mitigate losses during periods of stress,” he says. “We seek to capture upside beta but use our alpha engine to systematically take the edge off the exposures when there is a negative forecast.”

In opportunistic mode the allocations to each market can be increased above a baseline level, while in fully defensive mode allocations go down to a prescribed minimum. This offering does not go short but tactically varies long exposures depending on the signals seen in each market. “The real mantra of the strategy is ‘perform and protect’,” says Goodman. For instance, simulations suggest that the strategy would have systematically adjusted exposures to utilize relatively more fixed income risk in 2008 (and relatively less equity risk), while doing the opposite in a bull-run equity market like we saw in 2013. Additionally, the approach calibrates to individual markets, so it could in theory be overweight of Japanese equities and underweight of European equities, for example, to take advantage of dispersion between geographies or markets within an asset class.

In opportunistic mode the allocations to each market can be increased above a baseline level, while in fully defensive mode allocations go down to a prescribed minimum. This offering does not go short but tactically varies long exposures depending on the signals seen in each market. “The real mantra of the strategy is ‘perform and protect’,” says Goodman. For instance, simulations suggest that the strategy would have systematically adjusted exposures to utilize relatively more fixed income risk in 2008 (and relatively less equity risk), while doing the opposite in a bull-run equity market like we saw in 2013. Additionally, the approach calibrates to individual markets, so it could in theory be overweight of Japanese equities and underweight of European equities, for example, to take advantage of dispersion between geographies or markets within an asset class.

Millburn thinks that the adaptive nature of forecasts in the context of a long-only portfolio is the real differentiator here. The concept is not smart beta, because it is tactically varying allocations to mainstream indices and futures, rather than changing the composition of indices. And while it uses some risk parity concepts as a starting point, tactical return forecasts and resulting portfolio responsiveness are the key drivers of potential return improvements. So far, the balanced stock/bond iteration of the programme, which launched this September, is up 2.3% from 1 September 2014 to 30 November 2014, net of its proposed flat management fee, while a 60/40 blended portfolio of the MSCI Global Equity Index and the Citi Global Bond Index is down approximately -1.6% over the same time period. Improvements like this are likely to be attractive to a long-only investor who needs to participate in the market strategically over the longer term but is worried about getting caught flat-footed by short-term inflections.

A sustainable, systematic approach to commodities

It was institutional investors that sparked the Commodity programme launch in 2005, “during the heyday of commodity investing when there was huge interest amongst institutional investors seeking an inflation hedge and a way to participate in global growth,” Goodman surmises. Yet Millburn observes that this craze was partly based on extrapolating historical conditions that did not persist. “The rationale for commodity indices was partly based on a benign term structure with much lower cost of carry, so the backwardation meant you got paid to hold positions, particularly in energy,” recalls Goodman. Millburn did not pursue a long-only approach here, but rather enhanced existing long/short approaches and added new ones, specific to the commodity markets. The programme has continued to evolve, with “breakthroughs on forecasting and on specific strategies, so that the standalone programme has outperformed commodity indices as well as more active discretionary and other systematic programmes.” In particular, the programme has captured the downdraft in many commodities, including crude oil, copper and corn in 2014. Investors in the Diversified or Multi-Markets programmes get exposure to commodities, which is typically around 20% on a risk basis, but has recently beenas high as 26%. Millburn find that their assets of $1.4 billion allow them to make meaningful allocations to their preferred commodity markets, including some smaller ones, such as live cattle, and while capacity is a moving target, Millburn currently estimates significant capacity for their suite of absolute return strategies on the whole; long-only enhanced beta products touched on below are likely to be even more scalable.

Investment universe, factor and portfolio rebalancing

Millburn’s criteria for choosing the 130 or so markets they trade are partly based on liquidity data and diversification value. “We weigh the evidence and look at our optimization processes,” says Goodman, with new markets offering a better “risk-adjusted additive value” being more interesting. A longer-term perspective is also crucial for Millburn, with multi-decade look-back windows used to determine whether to add markets. In constructing the portfolio, Millburn is “striving for a stable cross-correlation matrix” and in this endeavour they find longer analysis periods more reliable. For Millburn, these more extensive histories are one safeguard against the quant pitfall of “overfitting”, whereby quants can identify relationships that turn out to be spurious, isolated or ephemeral cases rather than widely applicable and repeatable signals.

Another key area of focus for the firm is execution, although Millburn are not super-fast or high-frequency traders. Millburn uses high-frequency “tick” data for research but does not trade such time frames, with intra-day the shortest holding period. Even so transaction costs still need to be managed. “Part of the advantage of our research framework is that we’re able to feed expected return forecasts directly into the execution engine. We look at expected forecasts and signals, and balance these against expected costs, for every trade we do. If we can’t overcome costs over some time frame, we won’t take the trade, or at least we will treat it somewhat differently, to be most efficient,” Goodman points out. Trades are sized according to ratios of forecast magnitude and anticipated execution cost. Most of Millburn’s execution is now electronic. Millburn gets trade signals all hours and actions them at any time of day. Using multiple prime brokers helps Millburn’s broker-neutral execution algorithms to shop around for better prices, and this also diversifies counterparty risk. But most of the funds’ net asset value is not posted as margin with brokers or exchanges, with unencumbered cash typically near 80%, and sitting in US government securities – corporate credit risk is not seen as an incremental source of returns.

Sanguine outlook

After a challenging post-crisis period for many CTAs, Millburn is heartened by recent market action. “When markets are free to trade and adjust, you can get interesting long-term moves,” says Goodman. While neither Smith nor Goodman believe QE was the source of all ills, Goodman ventures that the paring down of central bank activity, as the Fed tapers its QE, “leaves markets freer to perform their natural function, which could potentially mean some significant price moves.” Naturally, Millburn “always wants to be able to capitalize on those types of environments, and expects to.” The recent drop in correlations between markets has also benefited Millburn as there is “less of a common thread and less artificial behaviour, meaning that prices are likely more indicative of markets,” Goodman judges. But as the markets continue to evolve we have no doubt that Millburn’s systems and processes will also continue adapting.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical