Governments and central banks around the world are backing into Modern Monetary Theory (MMT), not by embracing a new theory of economic policy but by the sheer necessity of swiftly repairing the economic damage from the Covid-19 pandemic. At its heart, MMT is about the fusion of fiscal and monetary policy. It does not worry about fiscal budget deficits, but cares about how the government spends money. It links fiscal to monetary policy by using the central bank to buy the debt the Government issues via Treasury securities when it chooses not to use tax revenues to fund new spending. The limits of fiscal spending and central bank debt purchases are guided mainly by whether too much inflation is created.

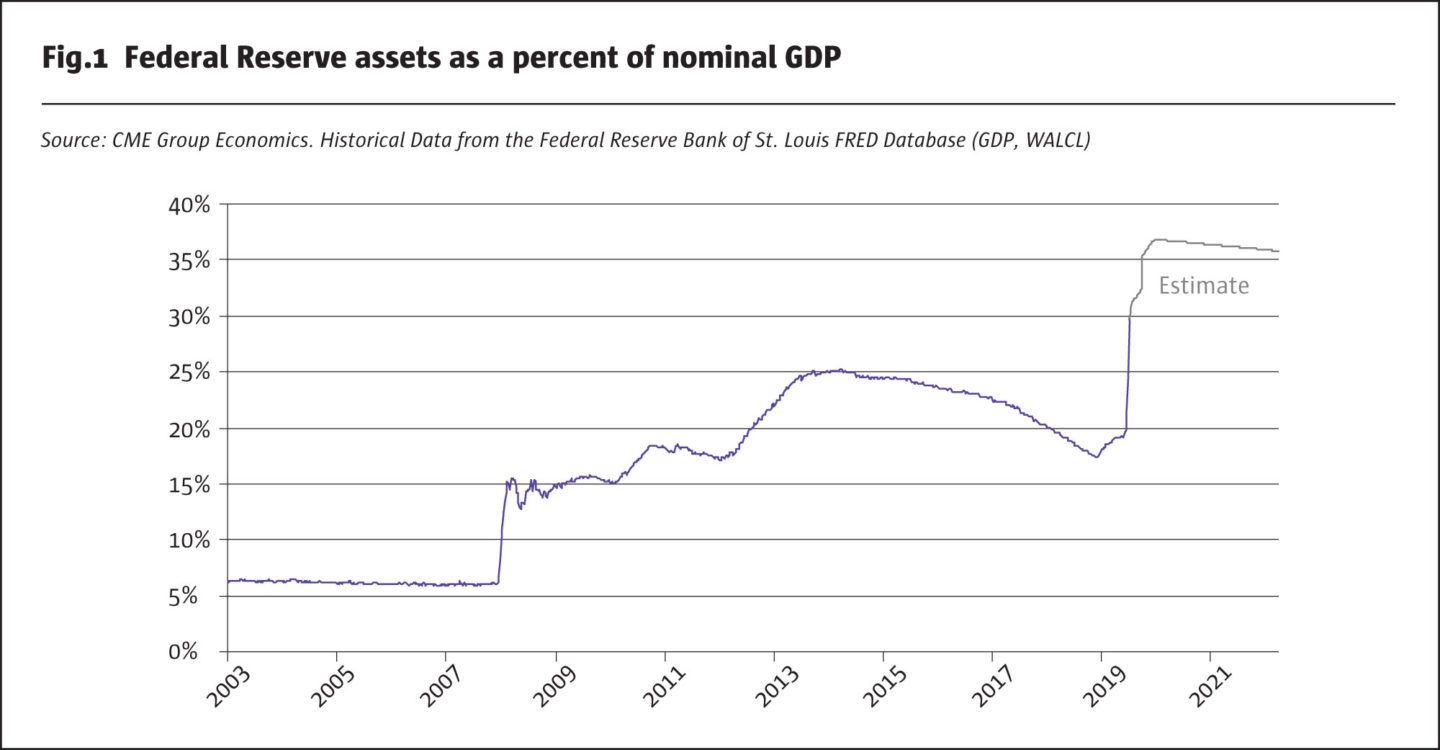

The economic crisis stemming from the global pandemic of 2020 quickly exposed the limits of traditional monetary policy acting in isolation from fiscal policy. Lowering short-term interest rates to near zero would clearly not be enough to limit the economic damage from a cascading collapse of the economic network, akin to a disequilibrium phase transition in physics1. Central bank purchases of government bonds (i.e. Quantitative Easing or QE) was unlikely to help much either, given that this approach had failed to generate additional economic growth or inflation when tried in an aggressive fashion by the central banks in US and Europe during the economic expansion of 2010-2019. Arguably the Bank of Japan’s (BoJ’s) even more extreme version of QE, which took its balance sheet to over 100% of GDP and, unlike Europe or the US, also included buying large quantities of corporate debt and even equities via exchange traded funds, provided a very slight boost to Japanese inflation through the transmission mechanism of depreciating the yen in 2013 and 2014. Once the yen depreciation was capped and then reversed, though, the BoJ’s aggressive QE had no further impact on growth or inflation.

In addition to monetary policy, many countries around the world, especially the US, Europe and Japan, embraced the idea that massive fiscal stimulus would be required to deal with the cascading collapse of the economic network. Many central banks responded to the fiscal stimulus by committing to expand their asset purchases in new directions, including corporate and local government debt.2 Voilà, the active collaboration of fiscal and monetary policy by way of MMT was implemented, not by choice, but by necessity.

In this research, we hope to frame the ideas of Modern Monetary Theory in as apolitical a way as possible by clarifying the economic logic (without judgment) and to examine MMT’s potential (1) to arrest the economic damage of the pandemic and encourage a more rapid rebuilding of the economy, and (2) to assess the long-term implications for inflation.

Guiding principles of modern monetary theory

MMT has a rather straightforward set of guiding principles, which include the following:

- The focus is on achieving full employment and other societal objectives through government spending, asking the questions of what is the expected return on the investment and whether the spending helps achieve the stated goals?

- If the project meets long-term objectives and seems worth doing, then the secondary question is asked about how to finance it – tax revenues or debt issuance.

- If raising taxes is not politically feasible, then MMT argues that high-value spending projects should be financed through debt, with no worries about the rising budget deficit.

- The central bank is expected to purchase enough quantities of the new debt to keep longer-term note and bond yields more or less inside established ranges.

- The limit on how much the government can spend and how much debt the central bank can buy is governed by whether inflation pressures develop.3

When thinking about MMT, there are some key points of interest to note. MMT takes a very different approach to analyzing potential new spending from traditional government policy approaches.

For example, the first question that traditionally gets asked when the government is thinking about a major new spending program is how are we going to pay for it? MMT takes a more corporate finance approach and wants to know the benefits of the spending, whether it helps achieve stated objectives and what is the return on the investment? If the potential spending passes various return-on-investment criteria, then MMT turns to the question of how to finance the spending.

MMT also takes a very different approach from traditional policy analysis. Budget deficits do not matter, at least to a point, which we will come back to later. If the government has the ability and willingness to raise tax revenue, then that is one option. Since raising taxes is not always politically feasible, however, MMT moves to financing the new spending with new debt issuance. The point of MMT is that new spending that meets various long term return-on-investment criteria should be undertaken; the financing question is secondary. If raising new tax revenue is not an option, then switch to debt finance, without worrying about the budget deficit implications.

The limits on deficit spending and central bank purchases of government debt are determined by inflation. If there is no meaningful inflation pressure in the economy, the presumption is that more spending that meets investment criteria is possible to be considered. Only if serious inflation develops does MMT suggest that government should put the brakes on new spending.

The point of MMT is that new spending that meets various long term return-on-investment criteria should be undertaken; the financing question is secondary.

Fiscal/monetary help to get individuals and consumers to the other side

For MMT advocates, it matters greatly what the new spending is intending to accomplish. When analyzing MMT as an economic theory it can be hard to separate the political agendas of the proponents from the economic theory, because MMT is typically associated with specific objectives, such as full employment, infra-structure rebuilding, or environmental objectives related to mitigating global warming. While environmental objectives can be extremely contentious and politically polarizing, the pandemic crisis brought about a much stronger political will to tackle unemployment.

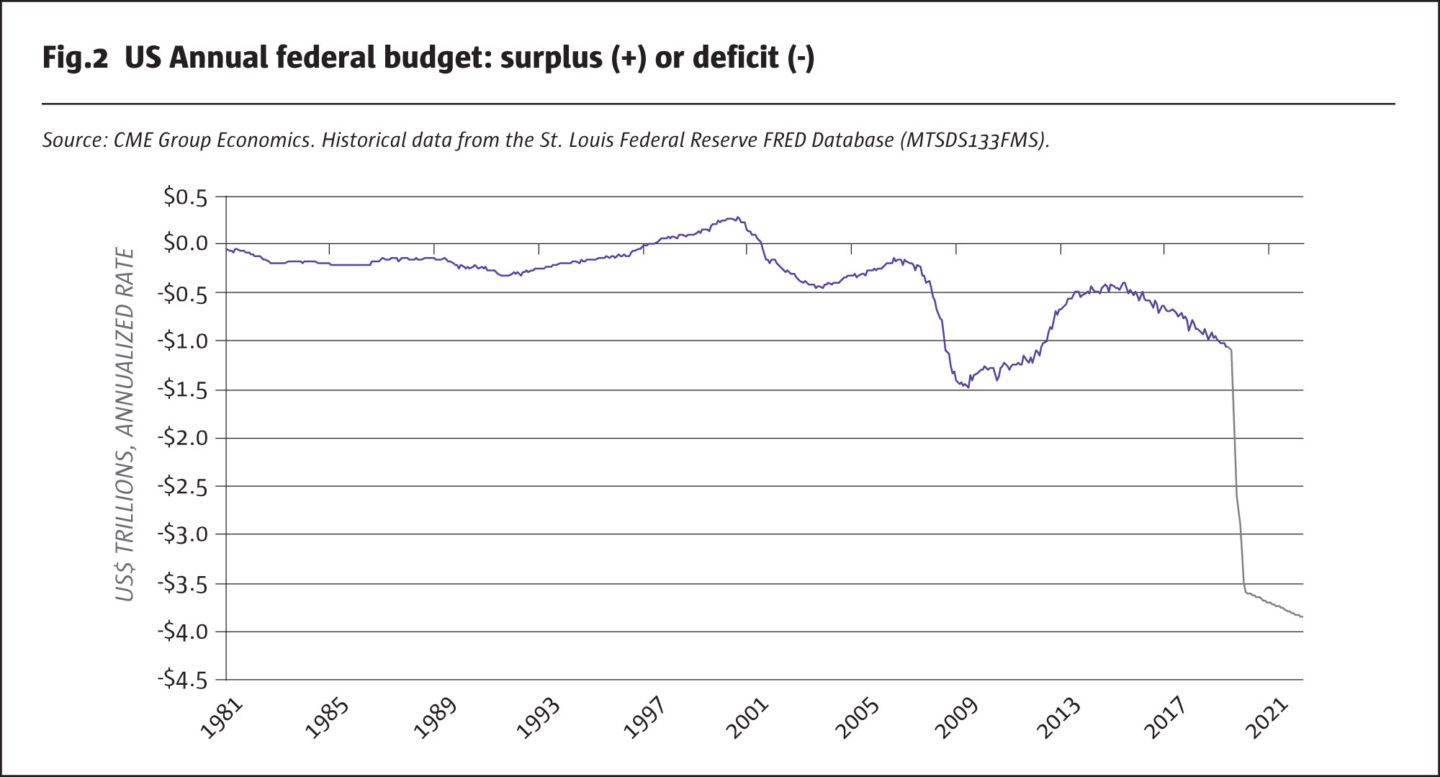

MMT has gained relevance in terms of tackling unemployment because it frees fiscal policy to run massive budget deficits as a percentage of GDP, and MMT frees the central bank to buy all kinds of debt in very large quantities, without regard to how large the balance sheet gets in terms of its ratio to GDP.

MMT also effectively recognizes asymmetries in policy effectiveness. That is, when economies are far from equilibrium, monetary policy may not be very useful in arresting the economic decline associated with a phase transition like the cascading network collapse caused by the pandemic. A catch phrase for this monetary policy asymmetry, often associated with John Maynard Keynes: “in times of high unemployment, monetary policy is like pushing on a string”.4 The solution in the 1930s in the US was to lean on fiscal policy and launch a wide variety of massive public works and other spending programs, known as the New Deal.

This time around in 2020 in the US, Europe, and Japan, there is a willingness by governments and central banks to intertwine fiscal and monetary policy to fight the huge abrupt increase in unemployment caused by the pandemic. Governments are trying to provide support for wage earners, and loans and grants to corporations. Central banks are not only expanding their loans to banks and buying more government bonds, they are going beyond their traditional limits and are now lending to corporations and local government authorities. These programs are largely aimed at getting individuals and businesses through the worst of the pandemic and to put a floor under the economy. New programs to address the pace at which the economy can rebuild are still being discussed, many will be controversial, but more spending is on the horizon.

The most likely public policy program, for example in the US, to accelerate the pace of economic rebuilding would be massive spending on infrastructure improvements, from roads to airports to schools and hospitals, etc. Such spending programs would involve even larger budget deficits and more asset purchases from the central bank, but the key to their being proposed and implemented would be that they would get the economy moving at a much more rapid pace. That is, the return on investment criteria approach of MMT would be front and center to the debate over these spending plans, rather than worrying too much about how they would be financed.

Inflation potential of modern monetary theory

When traditional economists, meaning most of the profession, analyze MMT, they worry about the breakdown of the independence of central banks and the possibility of a return to serious inflation pressure. With the central bank being joined at the hip with expansionary fiscal policy under MMT, were an inflationary spiral to develop, the central bank would not be able to “take the punch bowl away,” using the typical metaphor.5 This criticism takes as a given that the politicians in charge of fiscal policy will become addicted to spending and not worry about budget deficits, so they cannot be depended upon to rein in spending.

As economics Nobel Prize winner, Robert Shiller, observed though, MMT may well work up to a point.6 When the starting point for the rapid rise in government debt finance aided and abetted by the central bank is a low inflation environment, then it may take years or decades for the inflation to occur. Down the road, if inflation occurs when demand for goods and services far exceeds the available supply, such as often happens with war time military spending, then MMT has the potential to lead to inflation even in peace time, eventually.

When the starting point for MMT is in the middle of a massive economic dislocation with huge rises in unemployment, the immediate problem is going to be lack of demand, and the risk is outright deflation, not inflation pressure.

Indeed, by most measures, inflation has been extremely low in Europe and Japan for a long time. In the Eurozone, core inflation has not once exceeded the European Central Bank’s 2% limit since December 2002. In Japan, expanding the Bank of Japan’s balance sheet from 40% to over 100% of GDP and buying corporate bonds and equities in the process, did succeed in moving Japan from -1% inflation to barely positive inflation, averaging 0.4% or so for the past five years. Even in the US, where the Federal Reserve enjoyed more success than either the European Central Bank or the Bank of Japan in steering its economy clear of deflation, the Fed’s preferred measure of price increases, the core PCE deflator, has exceeded a 2% year-over-year growth rate on only a few occasions since 2008. That is, central banks have tried hard to create some inflationary pressure in goods and services, and neither low rates or government bond asset purchases achieved the stated objectives. So, the frustration of central bankers was manifesting itself in calls for less fiscal austerity and more government spending, even before the pandemic crisis hit.

From our perspective, the challenge is figuring out when the inflation might occur, and what to do about it when it arrives. When the starting point for MMT is in the middle of a massive economic dislocation with huge rises in unemployment, the immediate problem is going to be lack of demand, and the risk is outright deflation, not inflation pressure. A necessary yet not sufficient requirement for the inflation pressure to re-emerge is that the economy would have to get back on track and reduce unemployment back to the low and non-inflationary levels of 2019. And then, even more aggressive new spending, financed by debt bought by the central bank, would be needed to push the economy into an inflationary spiral. This whole process of “getting out of deflation” and “moving into spiraling inflation” could take a decade or more. When it comes, though, MMT has no exit plan – except depending on the fiscal authorities to curtail their spending.

A few examples of past inflationary episodes highlight some of the analytical challenges and criticisms of MMT. For example, to examine spiraling inflation in an economy built on government debt, well, one might go back to the 1920s in Germany to understand the economic ramifications of hyper-inflation. It is was not a pretty picture. There was also the descent into ever-expanding government spending in the UK in the 1960s and 1970s while the Bank of England kept a lid on interest rates. That episode led to IMF loans to the country, a depreciating currency, and double-digit inflation. The US had its own mini-version of MMT back in the late 1960s and 1970s, as President Johnson introduced “Great Society” spending programs while ramping up the war in Vietnam. President Nixon increased spending on the war effort after he won the Presidency in 1968, and he also appoint Professor Arthur Burns to chair the Federal Reserve Board (Fed). Aside from the being the first economist to chair the Fed, Burns actively promoted the re-election of President Nixon with a very easy money policy. And, with the help of OPEC and the oil price surge, the decade of the inflationary 1970s arrived in the US. There was no exit plan, but when the political pain of double-digit inflation became too much, then President Carter appointed Paul Volcker as chair of the Fed, and Volcker hit the brakes – hard, and Carter was not re-elected.

None of these illustrative cases was seen at the time as MMT, because the term Modern Monetary Theory had not been coined yet. Still, these cases do highlight one the key challenges when an aggressively expansionary fiscal policy is supported by an accommodative central bank. Namely, it takes a long time, years and years, to get inflation started, but once the spiral commences it is a vicious cycle of higher and higher inflation, the exit is extremely painful for the economy and to the politicians that oversee it. But like it or not, Modern Monetary Theory is here by virtue of the pandemic, and there will be plenty of time to debate whether the collaboration of fiscal and monetary policy can be orchestrated to avoid an inflation spiral down the road.

Footnotes

- See CME Group research report: “Policy Analysis through the Lens of Phase Transitions”, by Blu Putnam, March 2020.

- Federal Reserve Press Release, March 23, 2020. Federal Reserve announces extensive new measures to support the economy. The opening sentence said it all: “The Federal Reserve is committed to using its full range of tools to support households, businesses, and the U.S. economy overall in this challenging time.” Many analysts dubbed this “open-ended QE or infinite QE”. Also see: Federal Reserve Press Release, April 9, 2020. Federal Reserve takes additional actions to provide up to $2.3 trillion in loans to support the economy.

- Stephanie Kelton, “Modern Monetary Theory Is Not a Recipe for Doom”, published by Bloomberg News (February 21, 2019). Also see: Stephanie Kelton. “How to Tell When Deficit Spending Crosses a Line.” Bloomberg, March 7, 2019.

- From Investopedia “While the phrase pushing on a string has been attributed to British economist John Maynard Keynes, there is no evidence he used it. However, this exact metaphor was used in a House Committee on Banking and Currency in 1935, when Federal Reserve Governor Marriner Eccles told Congress that there was very little, if anything, that the Fed might do to stimulate the economy and end the Great Depression. Governor Eccles: “Under present circumstances there is very little, if anything, that can be done.” Congressman T. Alan Goldsborough: “You mean you cannot push a string.” Governor Eccles: “That is a good way to put it, one cannot push a string. We are in the depths of a depression and…, beyond creating an easy money situation through reduction of discount rates and through the creation of excess reserves, there is very little, if anything that the reserve organization can do toward bringing about recovery.”

- William McChesney Martin, Jr. (October 19, 1955). “Address before the New York Group of the Investment Bankers Association of America”. The job of the Federal Reserve, he famously said, is “to take away the punch bowl jus§t as the party gets going,” that is, raise interest rates just when the economy reaches peak activity and inflation pressures are likely to emerge. [paraphrased from Wikipedia]. William McChesney Martin was chairman of the Federal Reserve Board from March 1951 through January 1970, serving under five US Presidents.

- Robert J. Shiller. March 29, 2019. “Modern Monetary Theory Makes Sense, Up to a Point” The New York Times.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 148

Modern Monetary Theory Makes Back-Door Entry Into Policies

Blu Putnam, Chief Economist and Erik Norland, Senior Economist, CME Group

Originally published in the April | May 2020 issue