Natural gas prices around the world, from North America to Europe to Asia, are coming together after years of drifting apart. Before the natural gas production boom in the United States in 2007, prices in top consuming regions of the world were loosely connected. There was plenty of price-spread risk, even though the secular patterns were clearly linked. However, from 2008 to 2015, regional natural gas prices became delinked and danced to the tune of their own drummer. The reasons for this were varied. In North America, growing domestic supply was the real issue. In Asia, the challenge was the shutdown of Japan’s nuclear power industry after the devastating earthquake and tsunami. Europe faced tensions amid disruptions in Ukraine that escalated risks concerning gas supplies from Russia. Also, over the years, the practice of pricing natural gas in Europe and Asia benchmarked to Brent crude oil has been eroding to the point that the link is breaking as long-term contracts expire.

The collapse of crude oil prices in late 2014 was the catalyst for bringing regional natural gas prices loosely back in line with each other. But, over the decade of the price divergence, a lot had happened. The US created the capacity for liquefied natural gas (LNG) exports, and in September 2016 initial US cargos of ethanol started unloading in Scotland. New gas sources were developed in the Asia-Australia region to supply Japan. Russia inked a long-term natural gas deal to supply China. For these reasons, the question now is whether regional natural gas prices will stay engaged or if another bout of divergence is on the horizon. Interestingly, some clues may come from the evolution of electrical power generation. We turn first to the implications of the growing global role of natural gas in power generation. Then we provide some summary comments suggesting that prices staying connected is the more likely scenario than moving apart again.

Role of natural gas in electrical power generation

Countries around the world produce their electrical power in widely different ways. The trend though is for natural gas to take market share from other energy sources, regardless of the current composition of power generation.

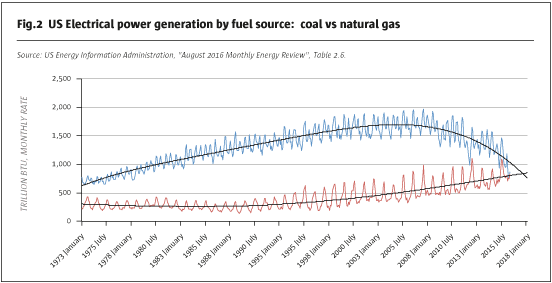

In the United States, the shift is from coal to gas. Indeed, natural gas will surpass coal as the dominant energy source for power generation in 2016. Coal remains cheaper on a BTU-per-dollar basis. However, the relative cleanliness of natural gas means that it is favored from a regulatory standpoint. That is, for environmental reasons, this trend toward using more natural gas and less coal for US power generation is not likely to change, even if natural gas prices were to rise relative to coal.

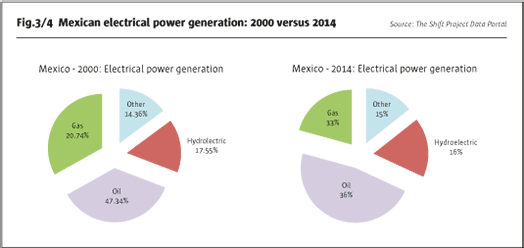

In Mexico, the dominant energy source for power generation had been diesel fuel refined from crude oil. Relatively inexpensive natural gas flowing into Mexico through pipelines from Texas changed the incentive structure, causing Mexico to start shifting to natural gas. Additionally, more pipelines are being built and the flow rate in existing pipelines is being enhanced. Therefore, the increased natural gas exports from the US to Mexico will likely accelerate the shift from diesel to natural gas as the preferred energy source for power generation.

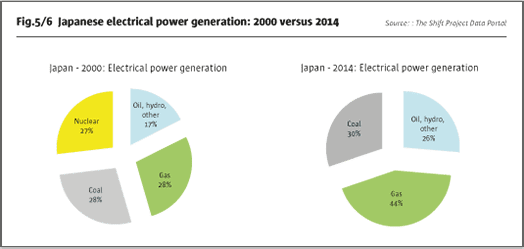

Japan’s story is quite different. The country, being committed to clean power, generated over 25% of its power from nuclear sources prior to the 2011 earthquake and tsunami that caused a nuclear disaster in Fukushima. In the aftermath of this catastrophe, the nation shut down its nuclear capacity and switched to natural gas, paying a steep price in the first few years of this emergency transition. Due to the high costs of obtaining adequate natural gas supplies in Japan, there was a divisive debate inside the country on whether to restart the nuclear power capacity. Political opinion runs heavily against restarting nuclear power generation even though the current Prime Minister, Shinzo Abe, has expressed some support. Given the drop in the price of imported natural gas in 2015-2016, the issue has faded, and restarting the nuclear capacity seems unlikely at this point.

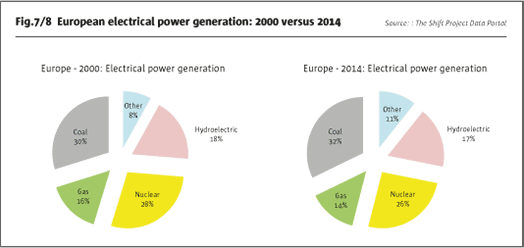

In Europe, the power generation mix is more complex. Interestingly, it has not changed much over the last 15 years, except for a small increase in the share of alternative energy sources (captured in the “Other” category). The lack of a shift in the power generation mix should not, however, be taken as a signal that change is not imminent (or at least on the horizon).

While nuclear power constitutes about one-quarter of European power generation, the nuclear plants are aging. The replacement process of these plants needs to get into high gear, given the time it takes to build a new plant. If not, nuclear power will start to lose market share over the next two decades as older plants are decommissioned. The choices surrounding nuclear power are seriously controversial and not easily generalised, even within Europe.

France will be the focal point. Far and away, France has the heaviest commitment to nuclear in the world, with over 70% of its electrical capacity generated from nuclear plants. The primary supplier of nuclear-generated electrical power is Électricité de France (EDF), which is 85% controlled by the French government. The debate in France on rebuilding its aging nuclear capacity is going to be especially intense as plans for a third generation of nuclear power plants have been plagued by delays and huge cost over-runs. The current government has considered phasing out up to 24 aging nuclear plants (out of nearly 60) by 2025. However, a new President will be elected in May 2017 and long-term power generation plans could change. Whatever France does, it is going to be expensive, and acting slowly or doing little is effectively a decision to shift away from nuclear power.

The UK built the first nuclear power generation plant in 1956. Like France, though, capacity is aging and decisions about the future need to be made. Also, like France, the building of new nuclear power plants has become very controversial. Scotland has banned them, while a new plant for England has just been approved and is to be built by France’s EDF.

Another controversial challenge in Europe is the role of coal – essentially the swing source of energy for power generation. Several decades ago, the thinking was that nuclear would replace coal. That is not happening. Also, natural gas is not growing its share, primarily because Europe does not want to become even more dependent on Russia as a primary source, given the instability of the EU-Russian relationship. For these reasons, Europe has aggressively pushed alternatives, mostly wind and solar, and they have made a lot of progress in terms of total capacity, but only limited progress in increasing the market share. Hence, coal looks to be the dominant energy source for power generation in Europe for decades to come. New pipelines lessening the dependence on Russian natural gas and new sources for LNG imports suggest, however, that as nuclear power generation slowly declines as aging plants are decommissioned and few new plants are built, natural gas will compete with coal and alternatives for market share.

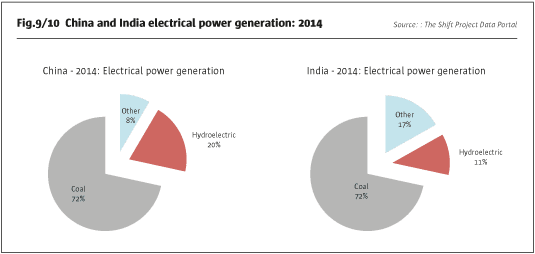

China and India are even more dependent than Europe on coal as their primary energy source for electrical power generation. China has signaled it wants to use more natural gas and possibly nuclear, as well. Additionally, China continues to build more dams for hydro-electric power generation. India is probably going to continue using coal for a long time, simply due to the cost calculus and budget limitations of changing the supply mix

Staying connected

While the pace with which natural gas increases its market share of power generation will vary considerably around the world, in every region, natural gas is picking up market share. For environmental reasons, natural gas is favored over coal. Costs and political controversy surround nuclear power generation, therefore increased market share from this source may only occur in China. Japan will likely keep its nuclear power capacity idle, and Europe will decommission more aging plants over the next decade than it builds new ones. Alternatives, such as wind and solar, are likely to gain market share, especially in Europe. However, the percentage gains are not very large. In short, when one takes a 10,000-foot perspective on the future of power generation around the world over the next decade, two conclusions stand out. First, coal will remain the primary source of power generation globally for a long time to come. And second, natural gas is the energy source that will gain the most market share as nuclear and coal lose their share.

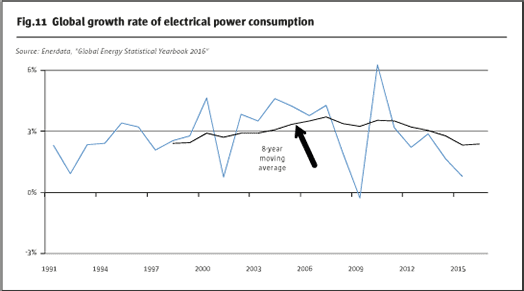

Thus, our base case scenario is for growing demand for natural gas as an energy source for electrical power generation. If global electricity consumption was to hold steady at around a 2-3% growth rate, global natural gas demand for power generation could grow at twice that rate or more.

One final caveat, while natural gas markets around the world are becoming more engaged with each other, they are still very much dominated by regional supply/demand factors, not to mention that the basis risk between the US, Europe, and Asia will remain exceedingly volatile. This basis risk in the price spreads is driven by (1) different supply environments, (2) different regional demand dynamics, and most importantly, (3) the material and variable costs of moving natural gas from one region to another. Pipelines can only go so far. Liquefying natural gas, putting it on very large LNG carriers, and moving it from the US to Asia or Europe is no small feat and not inexpensive. Certainly, more US LNG exports are on the horizon but it is just that the cost calculus today versus when they were planned is not quite so favorable. Thus, while our base case scenario assumes that longer-term global price trends in natural gas will be felt in every region, we are still talking about considerable potential for volatility in the price spreads between any two regions.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the authors and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 117

Natural Gas

Global markets converge after a decade apart

BLU PUTNAM, CHIEF ECONOMIST, CME GROUP & TINA MARIE REINE, MBA, CONSULTANT

Originally published in the October 2016 issue