Negative rates are a central banking idea based on a poorly conceived and constructed linear view of the efficacy of monetary policy. They do not work to encourage either economic growth or inflation. And, it is very likely that over the next six to 12 months, as evidence of their failure grows, bankers at the European Central Bank (ECB) and Bank of Japan (BoJ) may try to find graceful ways to back away from negative rates, and instead embrace a view of linking monetary policy to more stimulative fiscal policies to encourage economic growth and inflation.

Negative rate policies were first introduced in Switzerland and Sweden, aimed at keeping their currencies from rising relative to the euro since the eurozone was their key trading partner and the strength of their currencies was perceived as an impediment to their exports. Sweden and Switzerland are relatively small countries, and the negative rates, effectively a penalty on holding their currency instead of their trading partners’, had some limited success on the currency front, but had little to no impact on economic growth or inflation.

Negative rates were introduced into the eurozone by the ECB, designed to initially charge commercial banks holding deposits at the central bank a -10-basis-point interest penalty, which was expanded in March 2016 to a -40 basis point penalty. The BoJ followed the lead of the ECB in late January 2016, charging a -10-basis-point penalty on certain classes of deposits held at the central bank. The eurozone and Japan are very large economies and parallels with small economies do not apply, and the negative rate policies have not borne out as hoped to increase growth and inflation.

Negative rate policies in these two large economic regions did not help to weaken their currencies as expected by their central bankers. Since introducing negative rates, both the Japanese yen and euro have appreciated against the US dollar, not weakened, even as the US Federal Reserve (Fed) has restarted its debate over when to raise (not lower) its target interest rate.

Moreover, commercial banks in the eurozone and Japan have largely been unable to pass on the interest penalty to their clients. So their already highly-stressed profitability has come under even more pressure. When the banking sector struggles, credit markets do not function well, and economic growth is hindered.

So what’s wrong with the concept of negative rates? Basically, the impact of interest rate policy on an economy works in a highly non-linear manner, especially as nominal interest rates approach, and then go below, zero. Almost all economic developments in the real world (as opposed to the economics taught in the classroom) embody some significant non-linear properties. In this case, zero interest rates serve as boundary line, for several reasons, in explaining the asymmetric behavior of consumers, investors, and corporations to lower interest rates.

First, there are the lessons from behavioral finance. People react much more negatively to losses than they do positively to gains. As interest income shrinks, and then goes negative, the search for yield in alternative sources intensifies, pushing market participants into gold, equities, emerging markets, etc. where the risks may be much higher yet the returns are expected to be positive. If interest rates were eventually to rise, central banks may have a considerable amount of blood on their hands as investors quickly back away from their excessively risky exposures taken in their quest for yield.

Second, taxes are asymmetric at the zero-rate line. Gains and income are taxed. Loss-offsets to gains and income are severely limited, even if allowed to be carried forward in some modest form.

Third, very low rates and negative central bank policies are actually major wealth-redistribution policies by unelected officials. Wealth redistribution introduces a highly distortionary friction which works to reduce economic activity relative to what it might have been. The “losers” are retirees, a large and growing percentage of the population in Europe, Japan, and the United States. Retirees are hurt by low or negative rates as they typically carry lower-risk portfolios that have higher allocations in fixed income securities. As their interest income drops to zero, they need to consume less to guard their savings, and as a result this growing demographic becomes a drag on the economy.

By contrast, the “winners” in the low and negative rate policy environment have been corporations who have been able to increase debt and use the debt to buy back their stock. This may help the stock market, but it does absolutely nothing to encourage economic growth or inflation. And, it helps explain that central banks have been a big part of the reason for the widening gap between the wealthy (that own more stocks) and the lower and middle class.

Fourth, many retirees and future retirees also depend on institutionally-managed pension funds, whose return potential is damaged by the very low or negative rate policies. Indeed, when negative rate policies are combined with asset purchases by the central bank (i.e., quantitative easing or QE), the longer-term government bond yields also head toward zero. These long-term government bond yields play a key role in the accounting and measurement of long-term pension liabilities such that lower bond yields increase the liabilities. Increased liabilities mean that governments and corporations have to divert money from spending programs to shore up under-funded pension systems. The under-funded pensions in the US, as well as the financial burden of pension systems in Europe and Japan, have been adversely impacted by the low and negative rate policies.

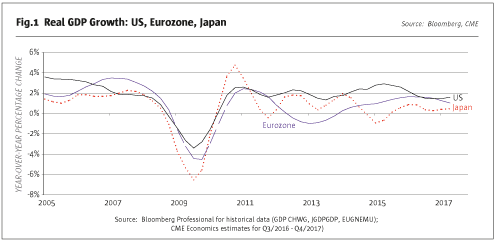

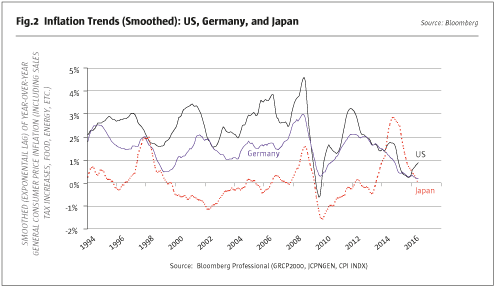

Central bankers in Europe and Japan went down the negative interest rate policy path because they were desperate. QE had totally failed to produce extra economic growth (Fig.1) or inflation (See Fig.2). And, QE had badly damaged the liquidity of certain government-bond markets. As noted earlier, when credit markets do not function well, economic growth is hindered. So the ECB and BoJ tried another form of unconventional monetary policy – negative rates. Not all central bankers, though, succumbed to either the pressure or the linear thinking. Notably, Governor Mark Carney of the Bank of England (BoE) has made it clear he opposes negative rate policies. And while the Fed never likes to close a policy door, Fed officials have said that they will study negative rates. But negative rates would be a last resort and probably never used.

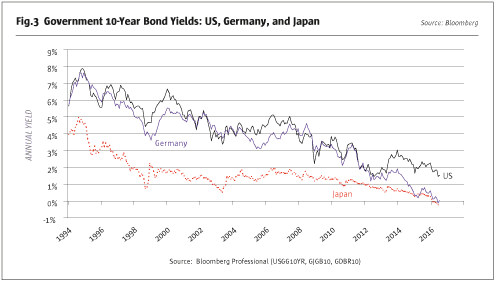

What comes next is likely a return of favor to stimulative fiscal policy, coupled with central bank asset purchases. When central banks buy securities that have already been issued and are outstanding in public markets, no additional government spending is associated with the QE. And, the only observable effects of QE have been to lower government bond yields (See Fig.3), reduce market liquidity, and damage the functioning of credit markets, to the overall detriment of the economies. Linking fiscal to monetary policy offers the possibility of breaking this cycle. The new government spending would be financed by new government bonds bought by the central bank. Since the securities are new, there is no damage to the existing situation in the credit markets and there is a direct link to new spending, which has been totally absent from non-conventional monetary policy so far to-date.

Of course, there are unintended consequences of success. If higher economic growth and some inflation emerges from more stimulative fiscal policy financed by central banks, then those in the “search for yield” game will find they need to cut their risks, but their run for the door may bring considerable downside potential to equities, gold, and emerging markets which have all been the refuge from low and negative rates. Needless to say, markets are in for some interesting times.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 116

Negative Rates

Not needed, not helpful

BLU PUTNAM, CHIEF ECONOMIST, CME GROUP

Originally published in the September 2016 issue