For the first time in fifteen years, Oceanwood Capital’s Founder and CIO, Christopher Gate, sees the best opportunity set for his event driven strategy in liquid European equity and credit markets. Gate is therefore launching a Luxembourg-domiciled Article 8 UCITS in late September on the Alma Capital platform, with discounted fees for the founders’ share class.

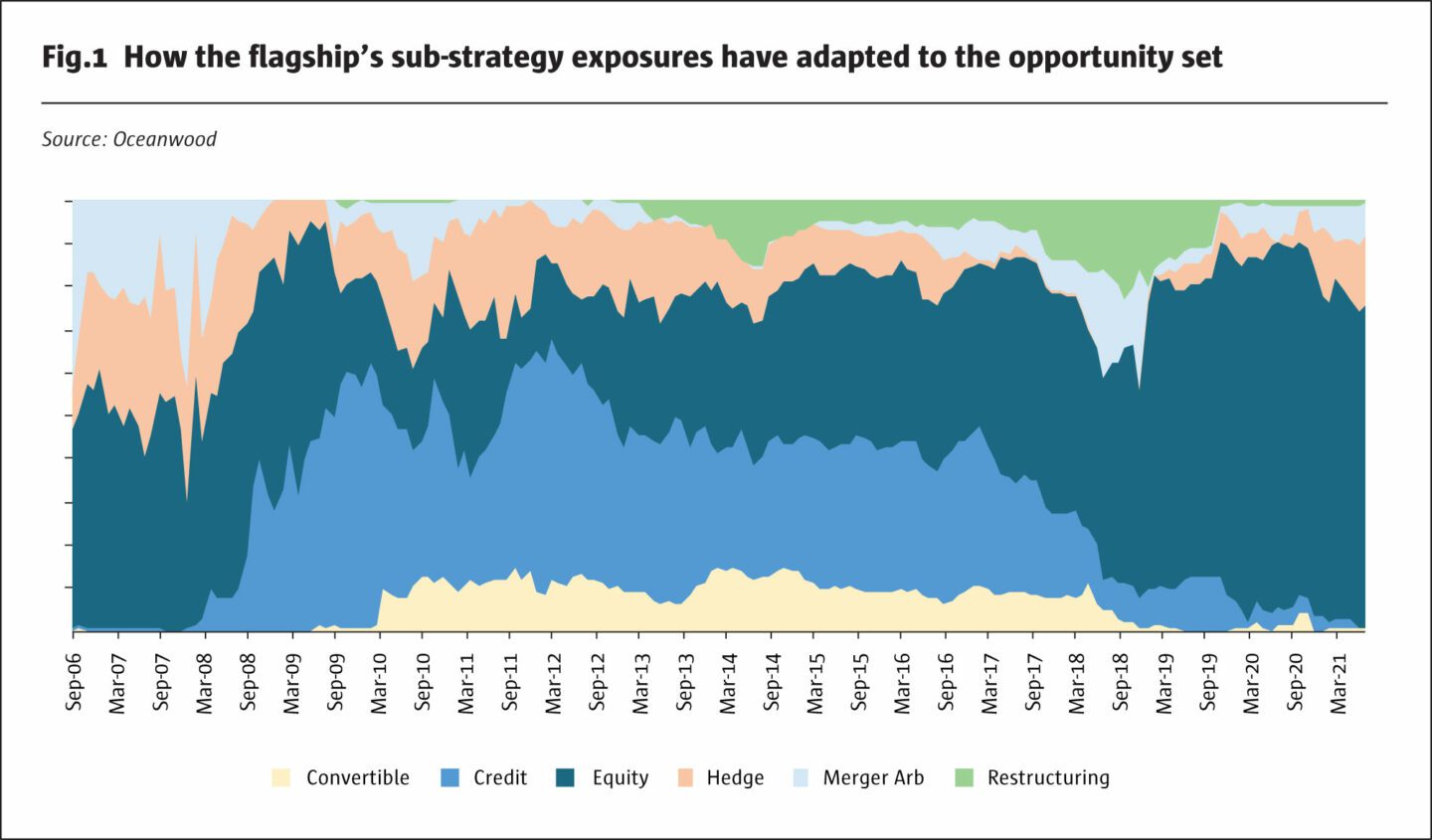

Since spinning out from Tudor Investment Corporation in 2006, with capital and support from Paul Tudor Jones, Oceanwood has found some of the best investments in sometimes less liquid situations: credit, bank debt, distressed debt, and small cap activist control positions. As one of the oldest event driven funds in Europe, Oceanwood has seen the book morph and turn over multiple times. However, a few consistent themes are evident. Firstly, Oceanwood has been very successful at compounding investor capital over the long term, thus providing investors with significant alpha above the European benchmark , and with lower volatility. This has been achieved through its focus on idiosyncratic situations which are often complex and going through change, and a concentrated book driven by conviction. Secondly, Oceanwood use moderate leverage so that they have dry powder to take advantage of dislocations and downturns. Thirdly, Oceanwood is generally long biased since the manager recognises that some event driven opportunities cannot be disentangled from the beta element.

Many European companies have more non-European revenues than some US companies and are becoming increasingly international in terms of their board and senior management.

Christopher Gate, Founder and CIO, Oceanwood Capital

The team, who currently manage around USD 1 billion, have broad experience spanning European equity and event driven investing. Before setting up Oceanwood, Gate managed event driven strategies at Tudor and earlier headed up equity proprietary trading at Barclays Capital, having started his career within investment banking and equity derivatives at Goldman Sachs. Deputy CIO, Julian Garcia-Woods, has applied his expertise in European banks to many profitable long and short trades at Oceanwood and previously worked for ORN Capital and JO Hambro in European event driven. David Vaamonde, previously at MainFirst, Fidentiis and J.P. Morgan, has extensive experience as a dedicated financials analyst, is a member of the board for one of the Spanish banks, and has also been active in many European bank situations. Andrew Dick formerly worked for event driven managers Gruss Capital Management and ORN Capital, having started his career in M&A. John Chiang, who leads credit, was earlier at DE Shaw and KKR. “We have the right balance on the team,” says Gate. These portfolio managers do not run their own books but are free to express differences of opinion. “There is never any negativity about that. We can always disagree for a reason, in a collaborative team culture,” says Gate. They contribute ideas to Oceanwood’s flagship and UCITS strategies, with total internal transparency on positioning and profitability.

At Oceanwood, the flagship strategy and newly launched UCITS fund will both be run by the same investment team. Both the flagship and UCITS are moving towards liquid opportunities, with the UCITS avoiding certain areas, including some control positions (with board seats or voting rights), and some less liquid areas of credit such as loans and unlisted assets. Like the flagship, the UCITS will be predominantly focused on hard events, with some exposure to soft events, soft activism, merger arbitrage, opportunistic liquid credit up to 25% (with up to 15% in AT1s), and alpha shorts. Currently, a differentiator between the two funds is that the UCITS fund is category 8 under SFDR and will integrate ESG risks and considerations into the entire investment process. Importantly, the UCITS diversification rules need not cramp Oceanwood’s style; the manager expects to run a high conviction book in which the top ten positions could comprise over 50% of the portfolio, investing in 20 to 30 longs and 0 to 10 shorts. The strategy will also take positions in indices and sector baskets for the purpose of hedging general market beta.

Covid and corporate catharsis

Oceanwood invested through the GFC and two European crises, achieving high double digit returns in 2009, 2012 and 2013 respectively. These crises provided deep value opportunities, especially in credit, including sovereign debt and bank debt after the more politically and macro-driven Southern European crisis, however they did not provoke the sort of corporate transformation now underway. “We have always felt that Europe was undervalued and needed to reform, but there had not been a strong catalyst until now. The Covid crisis has been a short, sharp shock, catalysing change for European companies, which are becoming much more global, shareholder friendly, forward-looking, and open to addressing conglomerate discounts. Europe is also leading on ESG and areas such as renewable technology,” says Gate.

Europe is home to global firms that generate most of their growth from more dynamic economies outside Europe: “Many European companies have more non-European revenues than some US companies and are becoming increasingly international in terms of their board and senior management, who are often multi-lingual and have lived and worked in three or four countries. This marks a big change in outlook and attitude. European autos such as BMW and Daimler or insurers such as Prudential offer plenty of Asian exposure and the miners offer global revenues and profits,” says Gate.

The pandemic has promoted positive change across multiple sectors: “Covid has triggered a long overdue cleaning of house for many firms on multiple levels. Retailers, who were initially threatened by Covid, have been digitising and moving their customer and payment relationships online. Banks, which had too many branches, have been reducing their physical footprint and going digital. We expect that mainstream banks will acquire Fintech. Pharma firms have been developing innovative new diagnostic tools using gene sequencing technology,” says Gate.

The US may lead in large and mega cap technology stocks and in software, but Europe can hold its own or even lead in several areas of technology: “Renewables is led by Europe, which has great embedded technology in generation, storage and distribution of electricity. Danish wind firms Orsted and Vestas have won big US projects. In Fintech payment processing, Europe is also a leader,” says Gate. Oceanwood itself has capitalised on these trends with a banner year in 2020, quickly recovering an early drawdown.

Event driven investors often have a bias towards value and distressed strategies, and Oceanwood has historically had a contrarian and value lean. In recent years, the firm has selectively invested in both growth stories, such as cell tower operators, and some disruptive growth firms that are harder to value. “Examples include last mile food delivery, as well as diagnostics and rapid gene sequencing, which could revolutionise health services,” says Gate.

2006

Oceanwood spun out from Tudor Investment Corporation in 2006, with capital and support from Paul Tudor Jones

European event driven investing

Corporate transformations are often associated with hard corporate events, such as mergers and acquisitions, spin offs, equity offerings, and restructurings; or soft events, including changes of management, balance sheet engineering, and some regulatory or legal factors. “The environment is now much better for broadly defined event driven investing, which includes not only merger arbitrage, but also the whole panoply of re-organisations, spin offs, break ups, balance sheet changes, and regulatory and tax changes. The market is not good at valuing these complex changes and events, such as a sudden shift in business model from fossil fuels to renewables, because most investors are focused on forecasting earnings and inflation. We concentrate on accounting and tax analysis, balance sheet structure, regulatory changes, and shareholder bases,” says Gate.

For instance, the valuation gap between European and US equities is historically high and could be partly explained by higher corporate tax rates in Europe. That may soon change as US and global initiatives harmonise corporate tax rates, leading to some convergence between the US and Europe.

Shareholder analysis can also be critically relevant to these special situations: “If a large shareholder is selling down a position, the overhang could weigh on share prices for weeks or months. Ten years ago we might have held onto such names, but now we would exit the whole position as soon as we recognize an overhang issue. It is a very common problem in Europe for non-economic activity to lead to mis-valuation. The key shareholders may well be based in the US. Most European countries have a bond-oriented investing culture, so the marginal drivers of share prices may be flows from US investors,” says Gate.

Mergers or demergers?

Oceanwood is currently more interested in demergers and corporate structure rationalization than mergers. The firm expects that the volume of M&A activity in Europe will continue at historically high levels, but also perceives merger arbitrage as a relatively crowded strategy with abundant capital chasing opportunities. “This makes it harder to obtain an information edge, and the risk reward is asymmetric; the spread could be 1.5% but losses could be 30% in a day. We have even had shorts in some deals with very tight spreads. Occasionally more complex deals such as cross-border transactions or those with regulatory issues, foreign regulatory reviews, or uncertainty around voting, could offer much wider spreads,” says Gate. Shire’s takeover by Takeda or Ingenico’s by Worldline were two examples of more compelling deals that piqued Oceanwood’s interest.

Gate expects that more complex corporate structures, such as dual listings and holding companies, will be simplified in response to increasing shareholder pressure. “The rationale for holding companies is usually control or taxation and both of these reasons could disappear.” The arguments for horizontal and vertical integration do not always stack up: “Bancassurance alliances, such as Sampo and Nordea, or Bankinter and Linea Directa Aseguradora, are now splitting up since cross-selling benefits can continue after a spin off without eating up too much capital and mainly large cap bank consolidation is only just starting,” says Gate.

Oceanwood was also investing around the April 2021 spin off of non-life insurer, Linea Directa Aseguradora, from Spanish bank conglomerate, Bankinter. The attractions of the demerger included freeing the insurer from ECB oversight and allowing for higher dividend payments. Oceanwood traded this tactically, selling Bankinter before the spin off after it reached a fair value target, and awaiting the flotation in anticipation of forced selling from some shareholders before building a position below the IPO price. Oceanwood sees scope for Linea Directa Aseguradora beating conservative earnings and dividend payout guidance as well as multiple expansion based on peer group valuations.

Another interesting conglomerate situation is Siemens which is breaking up into multiple pieces, including Gamesa, Health and Energy. This should throw into sharp relief the growth potential of some divisions. Siemens Energy, which was spun off from Siemens AG in September 2020, is a prime example of a European company on Oceanwood’s radar. Siemens Energy is exposed to significant long term growth drivers for example the transition from coal to gas and clean hydrogen, which could increase demand for its ground-breaking large scale PEM electrolyser plants and projects. Additionally, Siemens Energy owns 67% of Siemens Gamesa, which is the biggest manufacturer of offshore wind turbines. The event here for Siemens Energy would be the potential sale of the Gamesa stake. Along these lines, Oceanwood built a position in Siemens Energy on the thesis that, given the secular growth stories within Siemens Energy the Gamesa stake was ascribed virtually zero value. Held through 2021 until the start of July, the position was cut from the book on fears that supply chain issues would put pressure on Siemens Gamesa, fears that played out in mid-July when Gamesa and therefore Siemens Energy’s share prices fell 14% and 11% respectively. Long term, Oceanwood believes that the growth outlook for Siemens Energy is intact and may reinitiate the trade when more favourable conditions present themselves.

European SPACs could be one route to spin out such units, but Oceanwood has not yet invested in SPACs because Gate has concerns about the magnitude of the sponsor promotes and appropriate alignment with investors, but these terms seem to be changing and becoming more reasonable.

Renewables is led by Europe, which has great embedded technology in generation, storage and distribution of electricity.

Christopher Gate, Founder and CIO, Oceanwood Capital

ESG

ESG considerations and practices are deeply instilled at Oceanwood, which is a UN PRI signatory, supports the Carbon Disclosure Project and Say on Climate, and has ESG policies at the firm level including a commitment to having a negative carbon footprint, via offsets. Oceanwood has created a structured approach for applying ESG, with an ESG committee, framework, and engagement model to improve companies’ ESG performance.

ESG is integrated into the risk and investment process, not least because ESG trends often overlap with broader corporate transformations. Firms are spinning off both “green” units such as renewables and “brown” ones such as fossil fuels, allowing investors to access purer plays, which may command much higher valuations in the case of renewable utilities. Covid has highlighted European companies’ emphasis on worker protection. Meanwhile the G in ESG, governance, addressing issues such as complex structures and conglomerate discounts, was a focus for event driven investors long before ESG became fashionable. For Oceanwood, ‘G’ has been part of the firm’s DNA since day 1.

The firm’s philosophy is twofold. Firstly, Oceanwood believes that investment that considers ESG factors is intrinsically good. “We are aware of overconsumption and environmental abuse and believe that investing should not be net negative for future generations,” says Gate. Secondly, investors need portfolios that mitigate against ESG risks, as exposure to companies with poor ESG practices are likely to see financial implications, be they from regulatory and governmental fines or a higher cost of capital. The reverse of this is that companies with good ESG practices are likely to outperform, at least on a relative basis and in the medium term. “Younger generations are more aware of ESG and companies that are sensitive to this should grow their market shares. Corporate waste means that greener solutions can also reduce costs, creating a win-win situation. Some consumers will pay a premium for sustainable products,” says Gate.

Oceanwood has been exposed to a range of green technologies. “We have been active in renewables, hydrogen and fuel cells. We see a matrix of green solutions, because not all will work in all situations. There is no single winner,” says Gate. Overall, the transition to renewables might inform some long investment theses, but Gate is more enthusiastic about themes such as conglomerate breakups and a narrowing of the gap between European and US tax rates.

Oceanwood is launching its UCITS product, which will be category 8 or “light green” under SFDR. The UCITS fund will follow a set process when it comes to ESG, which will include hard sector exclusions, quantitative and qualitative screening processes, and mandatory engagement on ESG grounds with companies deemed to be investable but with minor ESG risks. “We would probably not launch an article 9 or ‘dark green’ strategy because it may not leave room for companies that are transitioning towards better ESG policies, often through spin offs or changes in business model. The taxonomy of sustainable activities is also too narrow, we do not want to over-bucket,” says Gate.

Though ESG concerns might also inform a short thesis, shorts are more likely to be based on financial reasons, such as balance sheet and debt issues or regulation. A firm with a high ESG score could be shorted if it was very overvalued or faced negative tax, regulatory or other events. Oceanwood has recently exited a relatively highly valued stock in the renewable space.

Discreet activism and voting

Europe’s corporate culture influences Oceanwood’s style of activism, which has historically been meaningful but discreet. “The European mentality in management teams does not like to be criticized or publicly humiliated. Culturally it is somewhere between the US, which can accept criticism, and Asia, where saving face is important. We might communicate our views on governance to management or the board, but will not be loud, brash, hectoring or inappropriately negative. Even when we know many board members agree with us, we sometimes send a letter to the board to alert other board members to different opinions,” says Gate.

Oceanwood has applied its activism to Norwegian holding company Schibsted in 2019 and its subsidiary Adevinta, which was spun off and floated. Most of Schibsted’s market value can be explained by its holding in Adevinta, which leaves little value for the news and innovation units. The value of the stub (Schibsted minus its Adevinta stake) has been quite volatile, and in 2020 dropped to a low single digit EBITDA multiple compared with a high teens historical average. Oceanwood proposed accretive buybacks, which were enacted, and M&A, which led to Schibsted subsidiary Adevinta merging with eBay classifieds, generating strong synergies and a share price rise for both firms. There could be more potential for both mergers and demergers. Schibsted is a leader in Nordic markets, is cross-selling and is increasingly acquiring local monopolies in Europe and Latin America. In its news media segment, the firm is transitioning from paper to digital as part of its ESG strategy. Oceanwood sees scope for other spin offs including a Latin American unit.

The UCITS can participate in activism in liquid positions, but will not be involved in longer term or active control positions. The form of activism that the UCITS will consistently implement is engagement on ESG grounds, particularly with companies that Oceanwood feels have sufficient upside potential despite a minor ESG risk profile, which could fundamentally be improved upon.

Oceanwood votes on nearly everything and is especially sensitive to firms seeking the right to issue equity without investor approval and to misaligned management compensation. “We have no issue with high compensation, but it needs to be aligned with investor interests. We do not want to see managers taking very large salaries or fees well above the norm, but we do like to see well defined upside participation. Independence of the board per se is not necessarily essential – alignment and global outlook matters more. British investors tend to focus too much on compensation and not enough on shareholder dilution,” says Gate.

Oceanwood has occasionally pursued activism with governments, writing a letter to the governments of the UK, France, the Netherlands and Belgium, arguing that trains should replace planes and ferries. Oceanwood has held a position in Channel Tunnel infrastructure owner Getlink.

Alpha shorts

Oceanwood selectively uses a variety of hedges at portfolio and position level, including indices, sectors, custom baskets and single shorts, and has also generated substantial alpha from single stock shorts, of which at least 27 have been above the EU disclosure threshold of 0.50% since 2013.

Deputy CIO Julian Garcia Woods was one of the first to spot problems at Dutch Bank, SNS Reall in 2013, and David Vaamonde led the initiation of the short position in Banco Popular, being acutely aware of how commercial and residential real estate issues would create problems for the Spanish bank in 2017, which saw its equity and tier one capital wiped out. “Having started in real estate and corporate finance at Goldman Sachs in the early 1990s, it was no surprise that bank restructurings were usually related to property exposure,” says Gate. Several Italian banks have also been shorts between 2016 and 2020.

Oceanwood was also one of the first managers to start investigating Wirecard, which became a substantial short, though most shorts are not frauds or bankruptcies. “We did not necessarily expect these to be terminal shorts at the start. Outright frauds are rare and the term is often overused. We have a forensic accounting approach seeking aggressive accounting, such as revenue recognition or asset/liability mismatches, or related party transactions, such as management borrowing from a company. We generally dislike too many notes to accounts. Frauds may start with firms being over optimistic about refinancing and then trying to cover up troubles,” points out Gate. Oceanwood tend to avoid binary shorts in areas such as biotech where they do not have an edge.

Firms facing structural competitive challenges can be more classic short candidates. A recent short idea has been the UK’s largest retail investor platform, Hargreaves Lansdown. It charges relatively high management fees and stockbroking commissions and faces growing competition from new entrants, such as Vanguard or Fineco, which charge lower fees, and some others, such as Revolut and Freetrade, which offer free stockbroking. The UK regulator is making it easier for customers to switch providers and has threatened price regulation if platforms do not take action on legacy share classes, yet the shares trade at a historically high valuation and at a premium over most competitors.

In a world where disruptive technology, Covid and ESG are upending some business models, Oceanwood’s European event driven investing approach is eyeing multiple facets of opportunity over a multi-year time frame. There is scope for valuation expansion; unlocking hidden value in conglomerates; a rich variety of potentially transformative corporate events, and a keen sensitivity to ESG and sustainability trends. European equities have been something of a Cinderella market since the great financial crisis, but there are neglected pockets of tremendous potential where the Covid crisis may now catalyse some rejuvenation.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical