The meeting of minds between Palisade Capital Management LLC CIO, Dennison ‘Dan’ T. Veru, and its US equity long/short portfolio manager, Paul K. Flather, was “akin to the ‘blink’ moment described in Malcolm Gladwell’s science of first impressions,” recalls Flather. The affinity was instant, as Veru, who knew Flather by reputation, saw how Flather “has a unique ability to spot value and to see trouble before others," says Veru. "I couldn’t wait to have him join Palisade because I’ve never met anyone who can consistently generate returns from his shorts in all markets.” Though Palisade was no stranger to hedged strategies (having run a convertible arbitrage portfolio since 2004), stock picking is Palisade’s DNA, so Veru “wanted a strategy that leveraged the firm’s intellectual capital from 21 portfolio managers and analysts.” Palisade acquired Flather’s firm, Hermes Advisors, LLC, in 2013 and got the hedge fund – renamed – up and running within the firm.

Flather’s early years

After a successful career in institutional sales, Flather set out to capitalise on differences between market perception and reality, which he found were greatest for the smaller and mid-size companies that tend to have less sell-side research coverage. Having started with just $700,000 Hermes’ assets grew to a peak of $414 million between 2000 and 2004 and produced solid positive returns despite the turmoil of the post-internet boom and the 9-11 attacks. In 2005, however, a personal family health issue came up requiring an increasing amount of Flather’s time that diverted his attention from his work. Though Flather continued to manage money for family and friends, he told his clients that he would not be doing company visits as before and clients naturally redeemed their investments. After family issues normalised, Flather resumed his total focus on the strategy in 2009, but realised that he was going to have to prove himself to the hedge fund community all over again. Flather recognised that Hermes did not offer the institutional-quality infrastructure, processes and compliance needed to be a success.

Flather has a time-tested fundamental stock picking process honed over 21 years that relies primarily on company visits, proprietary research and analysis to form his own opinion about company valuations and catalysts. While many hedge funds do not last three years, let alone 21, and Flather is clearly a ‘veteran’ hedge fund manager, Veru has coined a term for how he views Flather: a “re-emerging manager”.

Why Palisade?

Palisade provides the institutional infrastructure that Flather sought. The New Jersey firm, based in Fort Lee, claims antecedents back to the 1960s, has been SEC-registered since 1995, and employs 53 staff with nearly half being PMs or analysts. Palisade is independent and privately owned by its principals and their families. The firm manages around $3.4 billion and counts as clients four of the 25 largest US corporate retirement plans as well as US public pension plans, and has recently added a European pension plan.

Palisade’s 26 investment professionals, including senior portfolio managers, research analysts and traders, as well as an independent risk team, contribute to the process. Veru, who has been CIO of Palisade since 2007, has a 360-degree view of all PMs, long and short orders and positions with the firm. All analysts and PMs at Palisade make numerous company visits, attend conferences and document their research in a centralised repository for all investment professionals, including Paul Flather, to use as needed. Veru sees an important part of his role as oiling the wheels of communication to ensure “ideas are flowing to all places where they need to be”.

Absolute profits from shorts

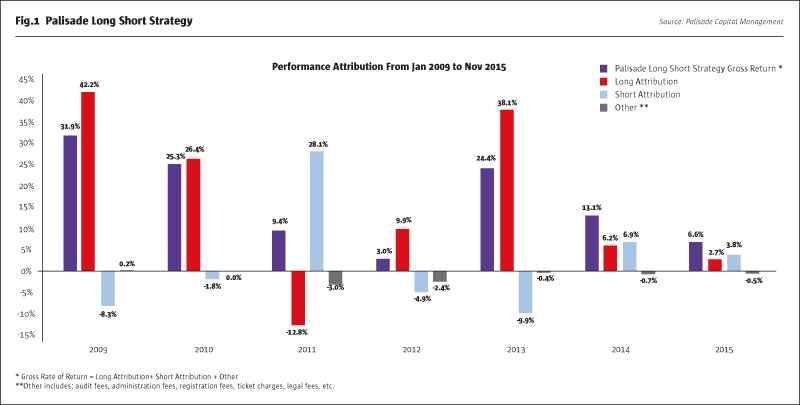

While many funds may only seek absolute positive alpha from their short book, or use shorts only as a hedge to dampen volatility, Flather has actually delivered alpha and absolute returns on both the long and short sides of his portfolio. He has profited on his short book in absolute terms since inception, and since 2009 over which period the S&P 500 has tripled. This is extraordinary when most money managers’ shorts have lost money (and sometimes destroyed alpha) over time. Attribution since 2009 appears in Fig.1.

CLICK IMAGE TO ENLARGE

Veru’s coordination role is just one of his many duties at the firm. Veru comments, "I view one of my duties as to be sure Paul has access to the entire research apparatus and to allow Paul to be Paul by keeping all distractions away from him”. He does not need to manage the analysts and PMs as Veru does that. Flather goes as far as saying that managing money and managing people are “mutually exclusive skillsets, as the first is cold headed while the second requires nurturing”. Nor does Flather need to spend time on operations, compliance, risk, or trade execution. The risk management function is handled by Chief Risk Officer, Frank Galdi, an industry veteran with over 20 years’ experience, who was previously Head of Investment Strategy and Risk Management at New York Life Insurance Company for their wealth management division. Flather greatly appreciates being able to use Palisade’s dedicated trading desk for executions. “At Hermes I had to do my own execution but I do not want to fret about 5 cents when I would rather be thinking about the next 5 or 50 dollars in the share price,” he explains. As a small and mid-cap US equity specialist since the 1990s, Palisade is adept at navigating the equity markets with multiple counterparties and venues and access to over 80 brokers and Alternative Trading Systems (ATSs).

Smaller caps equal large opportunity

Palisade’s big-picture view is that US small to mid-caps are in a sweet spot, for several reasons discussed in Veru’s thought leadership paper, “Rising Rates and the Strong Dollar: The Case for Small Cap Investing”. Smaller caps outperform large caps most of the time when the US dollar is strengthening, partly as they have a lower proportion of overseas earnings. Smaller US stocks also fare better when interest rates rise (and Palisade views higher rates as particularly beneficial to banks if it increases their net interest margins). “We want stocks with more US-centric demand exposure and that view is shared across the board,” says Veru.

Some stocks classified as ‘small caps’ in the US (e.g., $2 billion market cap) would easily be large caps in other markets such as Europe or Asia, but Flather will sometimes drill down well below this into real minnows in search of value and does not set a hard minimum in terms of market cap. “Real opportunities for outsized de-correlated return can be found in certain microcaps,” says Flather, who is well aware that these opportunities are not indefinitely scaleable. He seeks out overlooked situations that may be too small for some mega and multi-strat funds.

Darwinistic portfolio construction

These tiddlers can sometimes grow to become the biggest positions but they do not enter the book in large size, because Flather finds position sizing a key tool – more useful than stop losses – to manage risk in volatile markets. Portfolio construction and position sizing for Flather are partly a spontaneous consequence of how positions perform over his typical 12-36 month holding periods for longs. “Every year for the past several years, all of my performance has come from the top 10 contributors, but I do not know which 10 they will be,” Flather states. Consequently Flather does not have a ‘shadow book’ – he would rather get a toehold of positions so he has some ‘skin in the game’. And the top 10 names that might make up 25-35% of the portfolio have worked their way up from the base of the pyramid by virtue of their performance.

Flather has some broad macro and sector views, but likes to pick stocks one at a time. If there are clusters of certain sectors – such as domestic airlines and housing in late 2015 – these come from meeting individual companies. Visiting companies is crucial because “Regulation FD has changed behaviour but you cannot alter human nature, as people still send signals and my biggest asset is my baloney detector,” says Flather, who has physically visited 1,500 companies in order to kick the tyres, walk the store and walk the plant à la Peter Lynch. Though he recognises that many more investors are now visiting companies, Flather thinks it is important for more senior people to make visits in order to get “unfiltered information to have more confidence in decision making, as opposed to relying on filtered information from more junior people”. Flather seeks situations where the buyer perceives something different from the seller, which leads to skewed outcomes. Though Flather is seeking firms that can beat or miss consensus estimates, overall he finds it is “a qualitative not a quantitative process”.

Homebuilders and airlines

For Flather, the big-picture case for housing is that the US consumer is recovering after negative sentiment from the financial crisis, and the American dream is to own your own house. Housing starts have not returned to the bubble era levels of 2.5 million but they have normalised around 1.4 million and Flather thinks that is getting back to trendline levels. But it was one single company – LGI Homes in Houston – that inspired him to take this view, and LGI in turn led Flather to discover Century Communities in Colorado.

Airlines have historically been terrible investments, but Flather now thinks a paradigm shift is underway that goes beyond the cyclical benefits of lower energy prices. He enumerates: “Domestic US business travel is now a de facto oligopoly with four airlines controlling 85% of the market. It is run by rational, return-driven management. Structurally, higher oil prices forced airlines to be disciplined on idle capacity and take jets out of play.” Flather thinks that the cycle of increased profits leading to overcapacity is now over. But once again the investment thesis comes from meeting individual companies such as domestic US airlines, including Alaska Airlines and Virgin America, which “are both very well run with great hubs, fleets, streamlined labour relations, strong return on capital, dividends and buybacks, and low leverage,” he enthuses. In particular, Virgin America and Alaska Airlines have strong brand identity and good customer service. Flather thinks Virgin America was overly sold off on fuel hedge issues.

Air Lease is also misunderstood, according to Flather. It is perceived as a commoditised leasing company, but Flather sees it as “an asset manager with long-lived assets,” well diversified across 230 aircraft and 44 airlines. “Less than 10% of revenues come from China but the stock has been beaten down on China weakness,” he points out. Though the stock trades at a 20% premium to tangible book value, Flather thinks it is close to intrinsic value given the firm’s conservative depreciation policy. Investors are not giving Air Lease credit for the runway of growth that lies ahead: Air Lease is tripling its fleet without tapping the capital markets. Flather’s base case is that air traffic continues to grow, by 5% a year in Asia, though he does accept that a severe economic slowdown could cause air markets to implode.

Aside from these two sector clusters, Flather finds “the majority of names tend to be unique and one-off situations and are different from what our traditional competitors own”. For instance, a core long that arguably straddles two sectors is healthcare and technology play Vocera. Having been a ‘hot IPO’ the stock fell out of favour after the sequester slowed down hospital spending. Now Vocera has partnered with Apple and its offering can enhance productivity. Flather sees huge potential as microsales to individual nursing stations are moving towards integrated sales across whole hospitals or even chains of hospitals at the C-suite level. The firm has just won a big contract from the University of North Carolina, and the subscription model generates follow-on maintenance spending – meaning recurring revenues. Flather thinks the firm could soon become EBITDA positive. Potential investors can review many more case studies of profitable long investments Flather has made.

Portfolio risk management

While Flather has profited on his short book in absolute terms since inception, and since 2009 over which period the S&P 500 has tripled, he knows intimately the risks of shorting, so his shorts can start as small as 0.5% and will rarely be above 1% positions.

“There is a finite universe of crummy companies out there, and shorts now offer negative rebates and orchestrated short squeezes as too much capital is chasing the space,” he says. Flather reckons most investors use shorts just for defensive hedging or insurance purposes, but he never does that. Flather wants shorts to be a profit centre but he recognises it is harder to find stocks with a negative skew. Unusually, Flather states, “I let shorts come to me and do not go looking for them”. This is one way to control risk of shorting – he does not want to “dive into the groupthink and tries to avoid overcrowded and expensive shorts”. Sometimes Flather has used exchange-traded put options for shorting, though they are not always available. Another control on short book risk is simply the size of the book. Veru is distinguished in arguing that “gross exposure is a better measure of asymmetric short book risk than is net exposure”.

Patience might be one reason for Flather’s success at shorting. Some short sellers are looking for a ‘hit and run’ situation where they aim to book a quick profit, but Flather is exposed to shorts where he views “the odds of getting paid are better the longer it plays out”. In other words, Flather seeks investment shorts while others seek trading shorts, and his average holding period of six to 18 months is remarkably long for shorts. Flather has found some ‘terminal shorts’ and ridden them into bankruptcy, but he will often cover shorts below a market capitalisation of $50 million. He prefers not to publicly disclose short names as he says “some public shorters are pariahs at companies”. Investors do get detailed position-level performance attribution, however.

Flather is happy to discuss broad themes behind the short book. Shady stock promoters have been one in the past. Master Limited Partnerships (MLPs), which offer tax-efficient structures, have seen a huge growth post-crisis, as investors desperate for yield have subscribed to hundreds of billions of MLP offerings. But Flather dug deeper into their accounting and worked out that the yields could be unsustainable in some cases as some firms had high production costs and high costs of capital so “even at 100 dollar oil they had to keep tapping capital markets given their depleting resources”. The oil price crash has exposed the flaws in these business models, although in some cases aggressively accounted for hedges at oil prices of 85-90 USD are still shoring up their profitability – but not for long. “Once the hedges roll off next year some of these are on infinite multiples”.

In essence, Flather lives and breathes the equity markets and he loves the variety. “I wake up every day not knowing what is going to happen, which is a lot of fun as I have to adapt”. In particular Flather is pleased to have found the right partner in Palisade. Veru and Flather were both born in 1961. Veru is delighted that Palisade “has access to intellectual capital that could not be replicated very easily on its own, and Paul should be totally immersed in what he does best, teasing out nuances that are impossible to get from audit or research reports”.

Says Rasini Fairway’s head of hedge fund research, Linda Periti, “We at Rasini Fairway are very happy to provide such a differentiated offering to European investors”. Given Palisade Capital US Equity UCITS’s return profile, with the right format and partner in Europe, Palisade and Flather are confident that significant investor interest and assets flows are imminent.

Why Rasini Fairway?

Palisade has already had success at cross-selling its long/short strategy to existing, so far mainly US, clients and expects more of them will add it to their asset allocation. Palisade was interested to partner with Rasini Fairway Capital on a UCITS fund, partly to gain access to growing interest in US equities from allocators in Europe. “Palisade would never have access to Rasini’s network of allocators,” says Veru, who is excited and prepared to make as many trips to Europe as need be. The Luxembourg SICAV UCITS offers Euro, Swiss Franc and US Dollar share classes.

Rasini is of similar vintage to Palisade, having set up in 1992, and has 23 years’ experience in selecting and monitoring single-strategy hedge funds, with offices in London and Zurich. Unlike some platforms, which can be greatly restricted from co-investing by regulations such as the Volcker Rule, Rasini ‘eats its own cooking’ and has invested and procured at least $17.5 million into the Palisade Capital US Equity UCITS that launched in July 2015.

Another reason why Palisade partnered with Rasini is that “the regulatory regime is very different in Europe,” says Veru. Rasini had set up two other UCITS hedge funds before the Palisade one. Rasini put Palisade through a tough vetting and due diligence process, which included analysing Flather’s track record. Prior to aquiring Flather's firm, Palisade had engaged an independent accounting firm to review Flather's performance records back to 2000 and confirm that it had met the portability requirements under the CFA Institute's Global Investment Performance Standards (GIPS).

The UCITS risk rules are met through Palisade’s CRO working closely with Rasini and Lemanik Asset Management, S.A. Lemanik monitors compliance with UCITS rules on a daily basis and makes reports to the Luxembourg CSSF regulator. The aim is to run the UCITS pari passu with the existing fund and over time they do not expect big differentials. One example of a UCITS constraint that Flather finds it easy to comply with is the 5/10/40 concentration rule – his longs rarely exceed 5% of NAV.

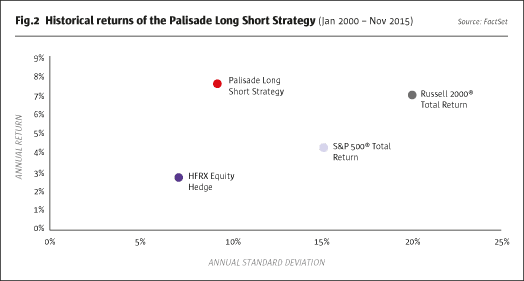

Having obtained attribution showing that the long and short books were generating not only double alpha but also absolute returns on both sides, the appeal of partnering with Palisade Capital was obvious. The strong risk-adjusted returns are shown in Fig.2. Gross exposure has rarely exceeded 120% and net exposure has seldom been above 60%, so alpha, and not beta nor leverage, is a key driver of returns. Since 2000, Flather has surpassed the Russell 2000 return with less than 100% net beta exposure.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical