Top-line revenues remain under attack in the form of fee concessions and a permanent departure from the “2 and 20” industry model. Further, trade economics are being pinched in the form of increased financing costs, taking a further bite out of the revenues of a manager. Last, the costs of the business are certainly not declining, creating a dramatic squeeze on the margins that a manager yields.

This has caused the AUM break-even point to exponentially increase compared to earlier days in the hedge fund industry’s life cycle. In 2015, an asset base of $500 million is often a minimum amount required to support the costs to run an increasingly complex business. So what does it take to be successful and profitable?

Managers need to be more focused than ever on the financial considerations of running an effective business. That means understanding the implications of a lower revenue environment while being cognizant of ways in which the operating infrastructure can be optimised to gain efficiencies and also the impact that successful investments, particularly in technology, can have on the business.

Investments in technology can help integrate front to back office reporting capabilities, leading to more timely and less manually intensive exercises. Additionally, while back office outsourcing is near a saturation point, the middle office offerings from various participants have become quite robust and customised to the asset management community. Leveraging these solutions is a cost-effective alternative for managers who would rather have their personnel focusing on other core activities.

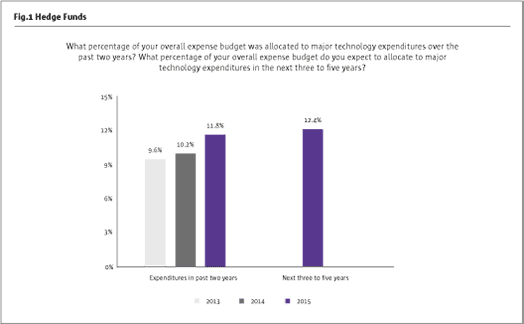

Technology investment expenditures continue to steadily rise

As a proportion of a manager’s overall expense budget, technology expenses have increased dramatically over the past several years. This trend is partly a function of many managers not properly investing historically and having to play catch-up. It is also fueled by the fact that today’s technology environment and the impact it has on the business is rapidly evolving.

In today’s environment, managers must scale their operations. This is challenging as the industry moves to more bespoke products and challenging regulatory demands.

The proposition of continued expansion of technology related costs is daunting; however, it is a reality of operating in a maturing industry. Whether it be driven by goals of developing tools that allow for more timely and customised investor necessitated reporting, regulatory reporting, risk management capabilities or being responsive to ever-present cybersecurity concerns, it is imperative that all organisations provide the appropriate attention to building out this area of the business.

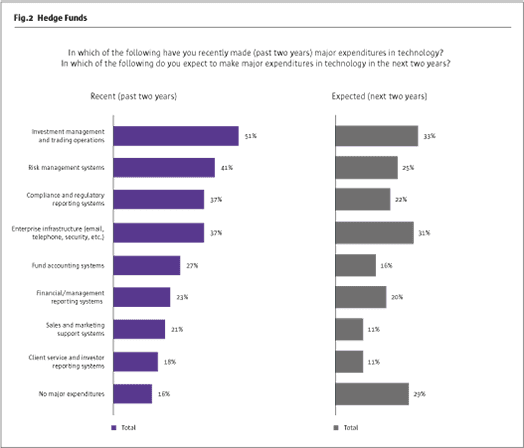

Managers are investing in technology to support a variety of business functions

Though the overall pace of investment in technology is anticipated to slow slightly in the future — 70% of managers expect to make major investments in the next two years, compared to over 80% who invested in the past two years — the magnitude of the spend is forecasted to increase. This is a result of greater business transformation projects, which result in larger front to back office efficiencies.

While there is diversity in the areas of investment, it is clear that managers broadly recognise the need to evolve their current capabilities and is noteworthy that only 16% have not made an investment in the past, and less than a third have no expectations for further expenditures.

Mid-size managers are outpacing both larger and smaller managers materially in expenditures in most business processes as they invest in infrastructure to support their growth ambitions.

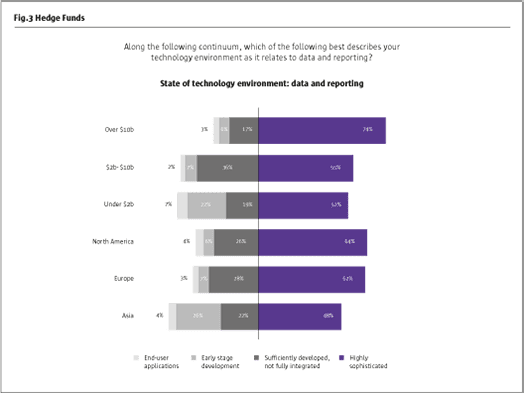

Data management and technology need to be advanced to provide seamless operations and to reduce reporting risk

Investment in data management and advanced reporting are vitally important for managers as they continue to grow. Data needs to flow seamlessly from manager to vendor and counterparties and back, to close any gaps between trading, risk and reporting.Given their recent investment, few managers would characterise their technology environment for data and reporting as in early stage development or leveraging end-user applications; over half of managers with less than $10 billion under management believe there is room for improvement. The most common issues these managers face is a lack of an integrated set of technologies in which data is easily managed.

As outsourcing becomes more prevalent and critical, an appropriate data and technology environment is a greater necessity.

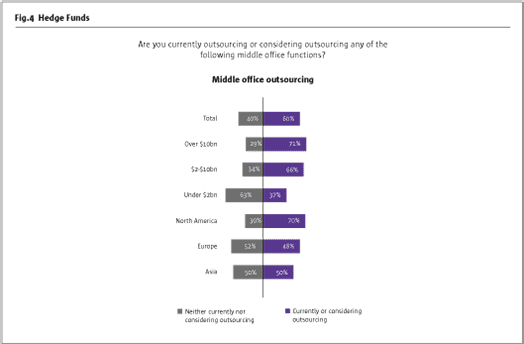

Middle office outsourcing is an additional tool to optimise the operating model

In the face of increased costs and demands as a result of managers’ ever-growing and complex businesses, middle office outsourcing remains an area that 6 in 10 managers have embraced.

Middle office outsourcing continues to evolve with service offerings from new entrants — spin-outs from managers, banks and technology companies — with offerings that have provided serious competition to incumbent providers that continue to invest in this space.

Though smaller managers are likely to have less complex needs, they should evaluate whether the available solutions offer much-needed cost efficiencies, thus reducing their break-even point. For the two-thirds of smaller managers who have not looked to outsource, this could be a tool that helps reduce the operational and cost burden so they can focus on core capabilities.

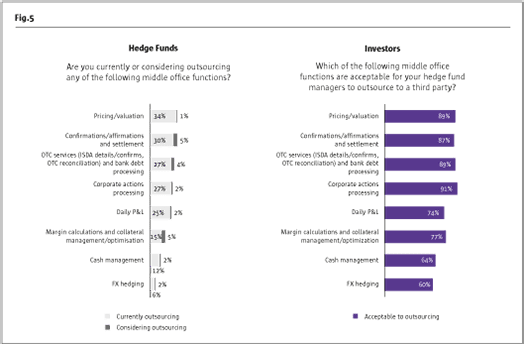

Investor comfort with outsourcing far outpaces manager willingness to relinquish control

While the previous results indicate that a majority of managers are comfortable outsourcing areas of the middle office, these results show a greater reluctance among specific types of activities. Part of this inconsistency can be attributed to current outsource providers choosing to focus on niche areas of expertise while lacking quality full-service middle office offerings. Managers who are considering outsourcing middle office functions would be wise to put a holistic transition strategy in place even if they expect to make the move in stages. The interdependencies between functions — and the front office — should not be underestimated.

Broadly speaking, investors are accepting of outsourcing all of these functions. They show the most resistance to cash management and hedging, but even those are supported by 60% of investors. Managers should not resist outsourcing on the mistaken belief that investors are not comfortable with it. Investors are satisfied with the benefits that managers have reaped from using third parties to perform a majority of back office functions and are now encouraging their managers to be opportunistic in expanding to utilise specialists in performing as much of the middle office as possible.

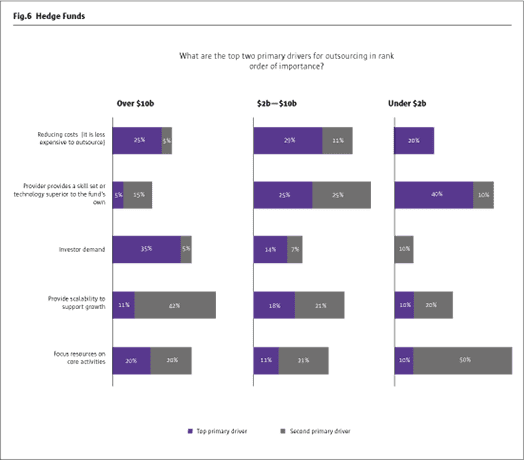

Cost savings is a key driver, but other factors are also providing impetus to outsource

All managers recognise the cost benefit associated with outsourcing as a key driver; however, it is interesting that other deciding factors tend to vary by size of the manager.

The largest managers point to investor demand and scalability as key drivers of outsourcing decisions. They likely recognise that investors are supportive of outsourcing as a means of separation of duties and independent oversight in addition to the size and scale of their business requiring external servicing. The technology solutions tend not to be a consideration for the large managers as these entities often have already made significant investment in their infrastructure and have the necessary tools to perform these functions.

Conversely, smaller and mid-size managers are motivated by the lure of skill sets and technology that is best in class. These managers need to move rapidly but have not yet built out their own systems or teams in these areas and can benefit from utilising the services of a provider who has the requisite expertise.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical