During 2015, the hedge fund industry continued its evolution, where common goals are not only maintaining, but growing market share in the face of a number of different challenges. Growth ambitions are certainly nothing new; however, we are finding that managers increasingly view growth as a necessity to counter many headwinds that are disrupting their traditional business model. The level of AUM necessary to thrive is not only higher than what would have been necessary in the past, but the timeline to achieve these critical thresholds is shorter than ever. Additionally, the need to attract and retain top talent is paramount to success. The good news is that asset flows to the industry remain healthy; however, competition for these assets is stronger than ever as managers compete to satisfy investor expectations for products, exposures and outcome-based solutions.

Strategic priorities of an evolving industry

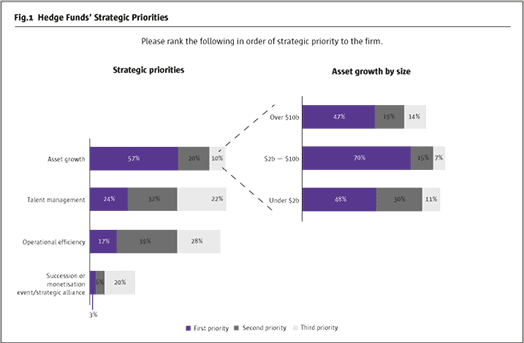

A majority of managers remain focused on asset growth as a strategic priority; however, those citing it as the top priority dropped significantly compared to 2013 when three out of four managers reported asset growth as the top priority. This reduction is partially driven by the success of the largest managers having implemented their growth strategies, whereas those mid-size managers with $2 billion to $10 billion of assets under management are still playing catch-up. Achieving growth remains a complicated proposition on account of increased competition, evolving investor demands and operating model constraints/margin considerations.

With their asset growth goals within reach, a higher proportion of the largest managers — one in three — noted that talent management is their new top strategic priority. They are seeking ways to attract and retain the best talent, not only in the front office where the pursuit of top investment talent remains paramount, but also in the back and middle office functions. This trend mirrors other industries (i.e., technology) where major firms differentiate themselves in their ability to identify, train and maintain top talent.

Divergence in approaches to achieving growth

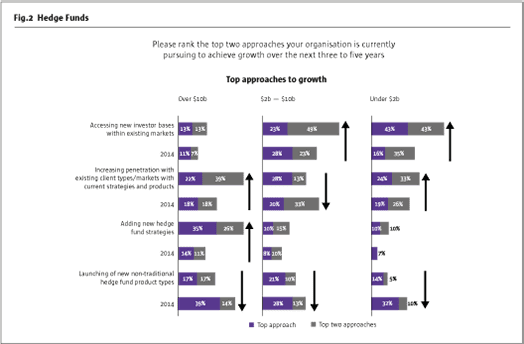

Growth can be achieved in a variety of fashions, and we find that managers tend to take different approaches based on their current size and point in their life cycle.

The smallest and mid-size managers are increasing their focus on accessing new investor bases. They are looking to expand their appeal beyond their core traditional hedge fund investors who generally have supported them from their launch date.

The largest managers, already having established a large clientele and brand in the market, are now focused on cross-selling products and becoming a “one stop shop” for investor needs. In prior years, this meant launching non-traditional hedge fund products. It appears that there may be less of an appetite to offer these non-traditional products as all participants highlighted a significant drop in new product launches. The largest managers are shifting their focus to offering new strategies. To execute this plan, they are not only hiring top talent to focus on offering new strategies, they are also driving consolidation of smaller managers.

Investor appetite for alternative products exists; however, traditional hedge fund managers are challenged by other market participants

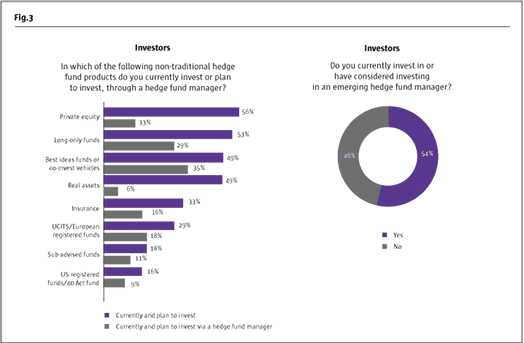

In past years, managers identified new product development as the pathway to reaching new investors and growing AUM. Many hedge fund managers are finding challenges in this space as investors appear to use other asset managers to obtain these products.

Certain of the products investors are most keen in having exposure to are not traditionally offered by hedge fund managers (i.e., private equity, real assets). Managers need to determine whether they are willing and able to compete with these alternative managers by making the required investments, including acquiring talent and building their brand. Alternatively, managers can solely focus where investors have demand for hedge fund products.

Additionally, a majority of investors remain committed to emerging managers. These new managers continue to receive a healthy proportion of new capital as they are viewed as nimble and able to deliver alpha by focusing on a core strategy.

As investors become more focused on actively managing their portfolio risk, there will be increased demand for customised solutions.

Managers are at a crossroad and need to ask themselves whom they want to be. Should they choose to continue down this path, they will need to invest in people, infrastructure and brand. The investors will continue to evaluate whether managers can compete and meet their evolving requirements.

Product diversification helped managers commercialise, but it did not come without challenges

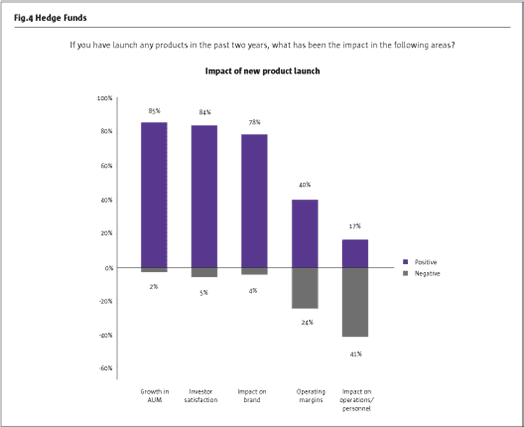

The largest managers were at the forefront of new product development. This has fueled their ability to transform from a standard hedge fund to a broader asset manager. However, they are now dealing with the ramifications of this expansion.

While offering new products was positive for investor interest and brand recognition, managers underestimated the bottom-line impact as there is a significant drop-off in margin satisfaction and an even heavier toll on the managers’ talent. This may be a reason for the decline in new product development.

Thus, managers need to find a balance when launching new products — they may be successful in increasing AUM, but have questionable financial implications and strain the team supporting the products. This conundrum is challenging managers to question their current operating model and the investments needed in key areas, such as technology, in order to have successful product launches.

New products are hardly the only area contributing to margin compression…

Management fees continue to be under pressure, particularly for the smallest managers

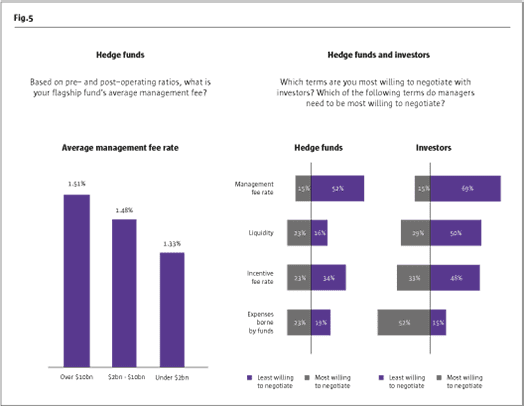

Management fees also continue to be squeezed. basis points lower than the historical 2% as respondents reported an average rate of 1.45% for their flagship vehicle. The smallest managers who often lack the negotiating leverage of the larger managers and must make fee concessions for initial capital reported a lower average rate of 1.33%.

At the heart of the issue is a more sophisticated investor base and the competition for capital being at an all-time high, which has forced managers to negotiate the terms of investment more than ever. Management fees are the most preferred area to negotiate among managers and investors, and 60% of managers say they have already offered reduced management fees for large mandates.

Though managers do not prefer to negotiate incentive fees, 70% report that they would entertain concessions to the incentive such as imposing minimum hurdle rates, tiering of incentive rates, reinvestment of incentives and/or crystallisation periods longer than a year.

Passing expenses through to the funds has reached its limit

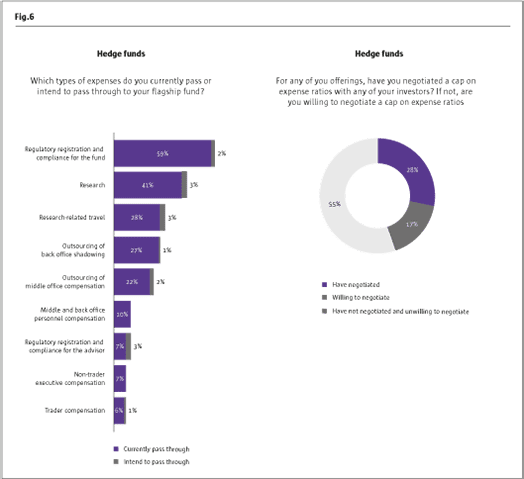

In the past, a lever managers could pull in response to increasing expenses was to pass through certain costs to the funds. However, few managers expect to pass through more expenses to the funds going forward. This is partially in response to regulatory scrutiny, but more directly related to the fact that investors have been laser focused on individual types of expenses they are bearing in addition to the overall expense ratios of their funds.

Not surprisingly, the smallest managers have fewer pass-through options and in almost all categories were bearing a substantially greater portion of the expenses as compared to their mid-size and larger peers. This cycle exacerbates the struggles that new managers have in successfully launching their businesses.

As further evidence of how far this dynamic has swung, nearly 30% of managers have negotiated caps on expense ratios and a further 17% say they would be willing to. This negotiation allows investors to fix the amount of expenses they will incur at an acceptable threshold while forcing the managers to further focus on managing their costs.

While the costs highlighted here are certainly not new, or surprising, for any manager or investor, the regulatory environment continues to prompt a number of new direct and indirect costs to the industry.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical