Many hedge funds went through major upheavals in their investor base in 2011. In some cases, firms lost substantial assets under management that had come from funds of hedge funds. For some single manager hedge funds it was catastrophic, damaging the economics of their businesses severely. For a few others, however, exiting fund of funds money was matched, and in some cases exceeded, by strong inflows from institutional investors, notably pension and sovereign wealth funds as well as endowments and insurers.

What was creeping institutionalisation of the hedge fund industry prior to 2008 is in 2012 an accepted fact of life. The ongoing march of institutionalisationis often blamed for pushing up barriers to entry and making it more expensive for hedge funds to get established. But it is also an opportunity for a large number of existing firms that have the scale, processes and risk/performance metrics to attract new capital, particularly from pension funds. For these hedge funds, the market environment may still be uncertain and returns tough to generate, but the viability of their businesses remains very strong.

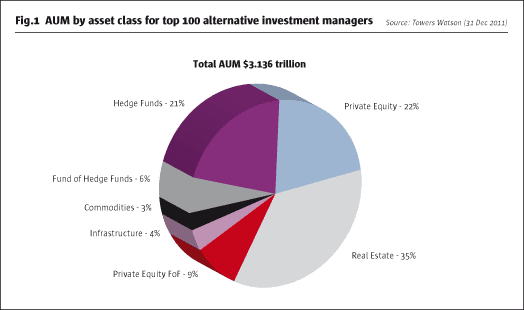

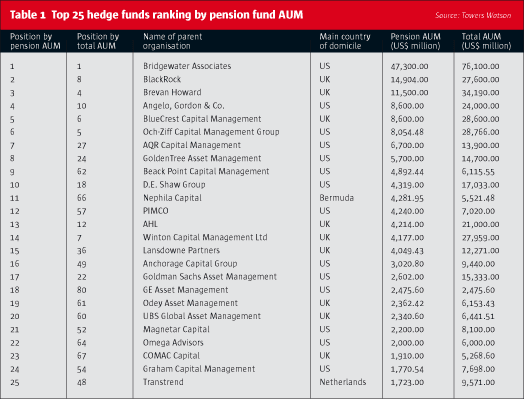

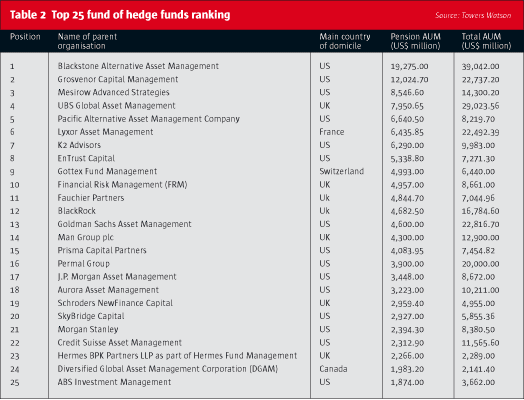

The 2012 Global Alternatives Survey from investment consultants Towers Watson shows that among the top 100 alternative investment managers, single manager hedge funds and funds of hedge funds account for 27% of total AUM of $3.136 trillion (See Fig.1). Significantly, the survey establishes assets from pension funds directly allocated to hedge funds for the first time. This shows the top 25 hedge funds received pension fund allocations of about $164 billion (See Table 1). Bridgewater Associates is the runaway leader with $47.3 billion from pension funds which constitutes nearly 62% of the $76.1 billion it runs in hedge fund strategies. In comparison, the top 25 fund of hedge funds received pension fund assets of about $132 billion (See Table 1).

“In 2003, according to prime brokerage surveys, direct institutional investment in hedge funds was about one fifth of assets under management; by the end of 2011 it was two-thirds,” says Damien Loveday, Global Head of Hedge Fund Research at Towers Watson. “This is a big shift. It shows funds of funds are a smaller part of the hedge fund market and institutions, particularly pension funds, are a much bigger part.”

So far, it is the big hedge fund firms that have attracted the overwhelming majority of interest from pension funds and other institutions. However, the impact of institutional money may be spreading to medium and smaller groups as standards and infrastructure across the industry improve. “We see more and more hedge funds regardless of their size making their proposition more institutional investor friendly,” says Loveday. “Consequently we think future surveys may show that hedge funds overall regardless of size will get more institutional inflows.”

In order to gauge what hedge funds are doing to attract pension fund allocations we interviewed a number of hedge funds, pension funds and consultants located in the US, the UK and Europe. We found a wide range of views about how hedge funds can serve pension funds and what managers must do to attract more allocations from this ultra-important investor group. Overall, it is clear pension fund investors are growing their allocation to alternative investments and that hedge funds are a prime beneficiary of this. But the behaviour of pension funds is more than just an opportunity for hedge funds.

A key political issue

“It relates to the issue at the centre of our political discourse,” says Matt Botein, Managing Director and Head of Blackrock Alternative Investors, which has over $100 billion in alternative investments spanning hedge funds and other strategies. “How are pension funds going to discharge their duty to provide pensions to retirees? US public pensions are driving it. The average plan has a return target of 7-8% and on that assumption they are 75% funded. If you remove the target and compare assets with liabilities, in that analysis it is less than 50%. Plans are not funded for the obligations they have taken.Private defined benefit plans are better funded but not adequately.”

From our survey of what pension funds are seeking in hedge funds three clear objectives emerged. One is return enhancement, a second is diversification and the third is downside protection. Botein says the biggest attraction of hedge funds for pension fund chief investment officers is their ability to enhance returns. He notes that the 2.9% annualised return and 16% volatility of the S&P 500 over the past decade fares poorly in comparison with the average hedge fund annual return of 5.9% with 6.5% volatility – a rate that is just one-third of S&P volatility. Moreover, a top quartile hedge fund manager, according to Botein, provides another 300 basis points of return per annum, giving a pension fund a 9% return with much less volatility.

To look at it another way, pension funds in Anglo Saxon countries a decade ago typically used an equity-bond-cash mixture of approximately 60:30:10. In European states, the fixed income element could be virtually the entire pension fund with only small equity and cash allocations. For pension providers following either portfolio weighting, the post-2007 environment has been fraught with difficulties. The bond market rally has put interest rates at all time lows and severely dampened yield. Equities, meanwhile, are still well below their bull market highs, while exhibiting frightening volatility. Adding to this unprecedented market environment is the fact that equity dividends far exceed sovereign bond yields, while country debt is being amassed at a rapid rate. This state of affairs poses tough investment problems for pension funds.

Change is underway

“I think UK institutional investors have been fairly cautious,” says Ian Naismith, Head of Market Development at pension provider and investment advisor Scottish Widows. “They have been more likely to invest in bonds rather than in alternative investments. Moving beyond conventional assets is much more of a US phenomenon than a UK one.” But Naismith acknowledges that change is happening and that there are a number of situations where pension funds might use an alternative investment fund. “As part of our risk management a pension fund manager will very often use a hedge fund alongside other investments,” he says. The chief aim would be to protect against downside risk. Hedge funds, according to Naismith, are most likely to be used by defined benefit pension schemes rather than defined contribution schemes. “Five years ago Scottish Widows might have allowed real estate investments in a pension plan, but things have moved on,” he says. “Now hedge funds and alternatives have become more mainstream in terms of it being a facility that is available.” In Denmark it is common for pension funds to use hedge funds to get extra return and Naismith notes that this could begin to occur more in the UK as a result of the government pushing for the adoption of defined ambition pension schemes. These schemes sit half way between defined benefit schemes where the risk is completely with the employer and defined contribution where the risk is with the employee.

Evolving investor base

One hedge fund vehicle that has seen its investor base change, but over several years, is BH Macro Ltd, a $2 billion closed-end fund listed on the London Stock Exchange which allocates to the $26 billion Brevan Howard Master Fund. BH Macro has attracted insurers, endowments, charitable funds and pension funds since being launched in March 2007.

“Our clear impression with BH Macro is that at least initially the shares were picked up by a variety of traders and bank prop desks,” says Ian Plenderleith, Chairman of the fund. “But this has shifted over the years as our returns have developed with pension funds and family offices becoming long-term committed holders, attracted by our liquidity and motivated by a desire to diversify their returns.”

Being a publically listed company means that BH Macro has a comprehensive disclosure regime and is required to treat all shareholders alike. It publishes a monthly news letter that is an investor letter in all but name as well as a monthly risk report and updates the fund’s net asset value weekly. Brevan Howard Asset Management handles investor relations, doing periodic road shows to speak to investors and brokers making the market in BH Macro shares, while Plenderleith also speaks to key audiences regularly.

“The message we try to get across to risk-averse investors is that we believe we are offering a pretty safe investment in the sense that the Brevan Howard investment strategy is based on three pillars,” says Plenderleith. “One is analytical capability which features an in-depth analysis of where the major economies are going and where interest rates, the bond yield curve and exchange rates should be. The second pillar when markets are mispricing events is Brevan Howard’s very strong capability to structure trades to take advantage when the market comes back into line. The third pillar is tight risk control with losses taken to avoid big drawdowns and profits taken to book gains. It means it is a very tightly controlled structure. That is the message you need to get across to long-term investors. It is a tightly controlled operation with a very coherent investment strategy.”

Moving into hedge funds

The bear market following the dot.com boom saw hedge funds gain attention for their strong outperformance. In the middle of the last decade, North American pension funds emerged as big allocators, following earlier moves to invest in hedge funds by some Japanese and European pension funds. The 2008 market cataclysm hurt pension funds badly. It occurred during a decade when equities underperformed and were subject to high volatility. With bonds the problem of particularly low interest rates has meant that pension funds have an appetite for yield. The target return of 7-8% per year has become increasingly hard to obtain.

“What we see is that a lot of pension funds are following an investment philosophy that is a bit outdated,” says Ferenc Sanderson, Chief Operating Officer of Cranwood Capital, a futures hedge fund specialising in US Treasuries ‘butterfly’ trades that is up over 13% in the 12 months to July 2012. “They are fighting against their natural instinct to have big fixed income allocations but with substantial equity holdings and therefore the volatility that equities generate. Traditional asset allocation is being revamped. Hedge funds are being used by some pension fund investors to fill part of their equity bucket.”

Some years ago pension funds would most likely have used a fund of funds to get hedge fund exposure. But in mid-decade that began to change when a new breed of firms, like Bluecrest Capital Management and Brevan Howard, with highly developed risk infrastructure, began targeting institutional investors directly. When in 2008 many funds of funds suddenly had heavy losses and correlation rose some investors began to question the added cost of fund of funds fees. The response has been for many more pension funds to invest with single manager hedge funds, either directly or through a platform, or use an investible index.

Concentration grows

This has led to a few big hedge funds getting even bigger. The Europe50 Survey of the leading hedge funds ranked by assets under management has recorded how the top five players grew combined assets 53% to $165 billion over the two years to 30 June, 2012. But some investors have noted that a number of big funds in both Europe and the US have underperformed or even lost money in 2012.

“As the industry hasgotten concentrated in terms of AUM, performance has suffered,” says Sanderson. “Some of the more forward-thinking pension funds are kicking out underperformers and looking at new strategies. The single biggest problem is having capacity available with high-quality managers.”

Indeed, for pension funds a major issue is finding managers that have an attractive strategy, but have enough scale to take a $200 million ticket allocated over a couple of years. Incubating a fund is one alternative. More likely is the use of an emerging manager platform with a pension fund devoting a 2-3% share of assets to it. With US pension funds, managers in this bucket could be there for diversity or social reasons.

Though approaches to hedge fund investing vary, virtually any big institutional investor like a pension fund will use a consultant. Most likely, they will have a fiduciary duty to do so. This means the timeline of securing an allocation will be long. What’s more, extensive data will be requested and there will be a general inspection of the entire portfolio along with thorough investigations into the backgrounds of key personnel and a full check on the main service providers to ensure there are no issues with them. Often a big pension fund will want to control the assets through a managed account.

A growing alternatives specialism

A traditional manager with a big and growing alternatives investment specialism, including $16 billion across hedge fund and distressed credit strategies, is Pacific Investment Management Company (PIMCO). Jennifer Bridwell, Head of Alternative Products, says that pension funds allocating to hedge funds coalesce into two broad groups. One is made up of pension funds that have used alternatives for some time as investors in funds of funds and that are now more willing to invest directly with established managers. The other is composed of pension funds with a lot of experience in hedge fund investing. “These pension funds are looking to enhance returns with managers that are performing and they are looking for mangers with less beta,” says Bridwell. “They are taking their portfolios from being overly diversified to focusing on a fewer number of managers with less duplication among strategies.” Instead of, say, allocating to three multi-strategy funds, which are likely to be closely correlated, pension funds are seeking to use the alternatives portfolio more thoughtfully and select the best managers who compliment their existing portfolio exposures and who lower correlation. This is aimed at removing underperforming managers rather than lessening diversification.

“Pension funds are looking for managers with a significant focus on downside risk and who have a solid risk management framework,” says Bridwell. “When it comes to portfolio management there have been few changes in what our pension fund clients are looking for. At PIMCO we have always incorporated our global macro view into our portfolio management, which is focused on managing downside risk, while producing returns with low correlated sources of alpha.”

Neal Reiner, an Executive Vice President with responsibility for credit alternative strategies at PIMCO, explains that pension funds want simplified reporting and more interaction with alternative fund managers. “Large clients want to talk to you more frequently,” he says. “We are very transparent and discuss where the risk is in the portfolio. This is especially true as large clients have become sophisticated allocators.”

Client outreach

PIMCO provides a whole support structure to service and inform investors regularly. The PIMCO Institute is just one example of this, Reiner says, adding that it is about reporting, dialogue and access on a daily basis. “We spend a tremendous amount of time educating our clients,”he says. “We speak to trustees and boards. We discuss a wide range of macro issues, asset class views and strategies. Clients depend on PIMCO for macro expertise and economic forecasts. By virtue of our dialogue we are trying to help them with understanding where alpha is coming from and where returns are.”

PIMCO may be best-known as the world’s top bond shop by AUM – it runs over $1.8 trillion in total assets – but the alternatives arm run by Bridwell has expanded steadily. For pension funds and other institutional investors looking to generate returns the message is simple. “In alternatives, it’s a target-rich relatively high return world given the global reallocation of credit and deleveraging of major banks,” says Bridwell. “In fact, it’s the most target rich investment environment of our lifetimes. The simple reason is the global reallocation of credit. It is hedge funds doing what the banks have traditionally been doing. Investors have significantly increased their pursuit of non-traditional strategies. They have grown allocations for hedge fund returns. They are looking for returns and the managers who can generate them, while protecting liquidity. The Volcker rule has created an alpha transfer from the banks to the alternatives portfolios. Pension funds want to hire managers to do that. Most pension funds haven’t taken their liability rate down. That is why they are aggressively looking for new sources of return.”

Embracing alternative strategies

One of the more innovative and active UK pension funds in terms of hedge fund investing is the Universities Superannuation Scheme (USS). From early 2007 after Mike Powell joined USS as head of alternative investments the pension fund began allocating to a range of alternatives managers. The aim was to allocate 20% of the £27 billion pension fund to alternatives. Within this about £1.3 billion was earmarked for hedge funds with allocating beginning in earnest in 2009. The pension fund has made a number of hedge fund allocations but still remains below the level of planned hedge fund investment.

“We are about two-thirds into the implementation plan for hedge funds which is slightly below where we expected to be at this point,” Powell says. “The main reason we are slightly behind plan is that the ‘tactical’ elements of our programme, where we identify strategies that will do particularly well in the macro and market environment, has been slow to invest. This is due to the ‘risk on, risk off’ nature of markets over the past 18 months driven by extraordinary government and central bank intervention leading to disconnects between the macro environment and asset prices. The latter is a positive for identifying opportunities, but the duration of the disconnect has been insufficient to really exploit it via allocating to hedge fund strategies. We regularly review the strategic asset allocation of the scheme including the allocation to hedge funds but there are no current plans to alter the allocation.”

USS has a primary performance target of LIBOR +3% for its hedge fund programme which Powell notes has been exceeded since inception. It also looks for a particular pattern of return. The programme is designed to produce a long volatility profile and do well when risk assets do poorly, acting as a true ‘hedge’ to the pension fund’s assets. “This has been a particularly successful aspect of the programme,” says Powell.

USS is flexible in how hedge funds show transparency. Powell accepts that the level of transparency that is deemed acceptable will vary from manager to manager. “It varies from what we deem full transparency – full position level data, counterparty exposures and comprehensive risk analysis – to, at an absolute minimum, the provision of position data to a risk aggregator and counterparty exposure, and pricing reports provided regularly and independently by the fund’s administrator,” he says. “The majority of what USS invests in today is managed accounts where, by default, we get full transparency, and we have found managers much more willing to offer managed accounts. However, transparency is not just about position data, it’s also about access to the manager, the key employees and their willingness to talk about their positions and their processes. Managers are now much more open about what they do with our money.”

USS has worked successfully with hedge fund managers to improve governance procedures. They have got funds to introduce independent board directors, change incumbent directors and even alter their fund structures to provide more governance rights. “We have found hedge funds to be very open to our views on governance as it’s an area where there is an obvious ‘win-win’ for manager and investor,” says Powell. “Alongside the minimum requirements of transparency, good governance is also non-negotiable from our perspective and we will not expose USS to a fund that doesn’t meet a fairly exigent minimum standard.”

In some cases, the minimum standard required by USS has required hedge funds and some service providers to make adjustments. One requirement is that all funds in which USS invests must permit the fund’s administrator to send all underlying portfolio positions to a risk aggregator.

“The requirement for the administrator to report counterparty exposures and pricing sources, as well as AUM independently to USS, were at first novel ideas and these processes had to be developed by administrators,” says Powell. “Today, most managers are willing to have the fund’s administrator provide the data and reporting we require and they are willing to provide it for all investors, and that’s been very satisfying. Without getting into specifics or naming funds we have had numerous managers provide enhanced regular reporting or ad hoc reporting when we’ve asked for it.”

Attracting pension fund assets

One of the more successful hedge funds in terms of attracting pension fund assets is BlueCrest Capital Management. It has received $8.6 billion from pension funds (See Table 1), putting it tied for fourth position with Angelo, Gordon & Co. for pension fund assets invested in single manager firms. BlueCrest combines systematic and discretionary strategies under the direction respectively of Leda Braga and Mike Platt.

To help bridge the information gap between portfolio managers and investors, BlueCrest set up a new three person group to aggregate the data and information of the trading floor and deliver it to client-facing employees in a format they can then digest and communicate to investors. One member of the group was a key and original member of the firm’s Systematic team, which launched and manages BlueTrend. Another was a fund of funds analyst for over a decade, while the third person is a quant who came from the firm’s product control group. “You need to take complicated concepts and make them accessible,” says Bob Shea, Head of Investor Relations at BlueCrest. “Boil it down and make it clear.”

A big change, Shea says, is that consultants like Mercers, Hewitt and Towers Watson, for example, have moved into the space aggressively. “That is opening up access to a vast number of pension funds.” he says. “It means that the sales and client service team members need to provide sophisticated information to multiple and diverse layers of people with varying degrees of specialisation – pension fund managers, analysts, trustees, consultants and boards – in a reliable and timely manner. With other institutional investors like sovereign wealth funds, insurers and endowments, the rationale for hedgefund investing may be different but the service requirements remain the same.”

The demands of institutional investors mean that managers must be prepared for heavy initial and ongoing due diligence. At BlueCrest, their due diligence questionnaires are substantive and comprehensive with emphasis on both the investment process and back office. “The hedge fund industry has a reputation for being non-transparent,” says Shea. “But the unwillingness to reveal detailed information is not due to recalcitrance. It’s often due to the inability to provide it consistently and accurately. It’s a structural and resource challenge unsurprising in a young industry. Many hedge fund marketing departments operate on the belief that as long as the P&L is strong the investors will come in. But in the institutional world that’s a fallacy.”

In addition to the P&L, Shea says, it is vital to have the appropriate robust organisational structure. “Single manager hedge funds have to accept the reality of the world they live in; to institutional investors it is about more than the portfolio manager,” he says. “The manager is very important, to be sure, but they are also looking for a big pyramid of support behind them. If you are to be considered amongst the best, you must be excellent across all departments – just like any other business – and be able to communicate that strength convincingly to your investors. This is what pension funds demand. Satisfy that demand and you will find yourself on the receiving end of a lot of interest.”

Experienced hedge fund advice

A bit more than a decade ago hedge funds still got most of their capital from high net worth individuals, family offices and funds of hedge funds. Hedge fund performance in 2000-2001 dot.com crash served to pique the interest of institutional investors. Invariably, pension funds and others turned to funds of funds to get capacity with the leading managers as well as to receive guidance in what was still a relatively uncharted investment territory. Pacific Alternative Asset Management Company (PAAMCO) set up in 2000 with a direct focus on institutional investors. From the outset, the business plan at PAAMCO was to provide the kind of hedge fund investment service that would appeal to institutional investors, notably pension funds. The result is that it ranks fifth overall among funds of funds in attracting pension fund assets (See Table 2).

“There was a time when hedge fund managers didn’t understand how institutional investors operated,” says Stephen Oxley, PAAMCO’s senior partner in Europe. “Institutional investors have very specific needs and expect managers to understand how they operate and what their needs and requirements are.” Among those requirements are high standards of operational infrastructure and compliance as well as clear governance and control, risk management and transparency.

“Our clients like us to report in a straightforward and detailed way about what their portfolio is doing and that comes from understanding what the managers are up to,” says Oxley. “They want the type of report that they can integrate into their broader portfolio. We expect more integration of reporting in the future.”

Since PAAMCO began offering hedge fund investing solutions, pension funds have significantly diversified the exposure in their portfolios. Hedge funds are just one part of that. But it remains the case that pension funds, especially with such low yields in fixed income, still need growth to meet their liabilities. If they can increase returns through the growth areas of their portfolio, pension funds have the opportunity to reduce their future funding costs. “Hedge funds can offer an equity-like return but with lower correlation, alpha and better risk management,” says Oxley. “Alpha is also the best source of diversifying returns available.”

Uncertain outlook

In mid-2012, the uncertainties in the world economy remain high. The financial crisis may be most focused on Europe rather than on the US as it was in the 1930s. Yet with a presidential election due in two months, events in the US may still have the capacity to roil markets. For pension funds and other institutional investors, it has become increasingly difficult to make the inflation plus 5-7% return target needed to fund their liabilities.

“There is no way pension funds can put a portfolio together to achieve it unless they build a way from the traditional long only structure using bonds and equities,” says Nathanael Benzaken, Head of Managed Account Development with Lyxor Asset Management. “If return expectations for hedge funds are similar to traditional assets, it comes with lower volatility, less correlation and, equally important, less market directionality. You increase the chance of meeting the return target, while reducing risk at the global portfolio level. This is why pension funds are increasing allocations to hedge funds to the 7-10% level and up to 20% in some cases, compared with 3-5% pre crisis. This pattern is moving out from the US to Europe and Asia.”

If there is one thing that pension funds absolutely want to avoid in any allocation to a hedge fund it is a ‘head line’ risk. Here the key things pension funds want to evade are fraud (think Madoff) and unconstrained risk (think Amaranth or Peloton). For pension funds, such as USS, which have been scaling up hedge fund allocations, using a managed account provides a secure structure to avoid these risks.

With pension funds allocating more to hedge funds Lyxor’s Benzaken says managed account inflows could grow strongly. But two things must happen. First, hedge fund performance needs to bounce back and perform more in line with their long-term average returns. The second thing is the resolution of the final details on the Level II rules of the Alternative Investment Fund Managers Directive which are due to come into effect in July 2013.

Benzaken sees several additional areas where pension funds will be putting pressure on hedge fund managers. Most important is the need pension funds have for higher levels of transparency. This may require hedge funds supplying daily position-level transparency and giving investors qualitative detail about performance and risk more quickly. Quantitative funds, meanwhile, may be asked to supply more detail about their investment process and risk budgeting.

Socially responsible investment is another area where pension funds are increasing demands on managers. This can affect whether a manager can invest in particular countries or industries. Finally, managers may need to offer the best possible liquidity terms that are appropriate to the strategy rather than what the manager finds comfortable. For CTAs and liquid strategies in general, this could mean more frequent redemption terms than the monthly/quarterly terms still used by many.

What fees are charged is another area where pension funds may put pressure on managers. “If underperformance continues then pressure on fees will grow,” says Benzaken. This can be either at the absolute level or create a mechanism that gives a better alignment of interest. An incentive fee, for example, might be calculated annually but deferred.”

He adds: “Hedge funds need a catalyst to move to the next phase of growth. This could come from the combined impact of improved performance, clarity on the AIFMD and more adoption of managed accounts. We are extremely optimistic. If these things are forthcoming there will be big inflows from pension funds and other investors.”

Making inroads onshore

The development of alternative UCITS funds and the expected impact of the AIFMD may have a far-reaching impact on how pension funds allocate to hedge funds. This is likely to be particularly true for European-based hedge funds.

Aquila Capital, a leading German alternative funds operator with AUM of $5 billion, developed onshore UCITS III structures to provide tax transparency for German investors. It has had a strong appeal to European investors and also proved effective at raising allocations from Asia.

“As a precautionary measure the boards of pension funds and institutional investors are more cautious,” says Roland Schulz, an Aquila Managing Director with responsibility for international market development. “They will say they don’t want any additional risk. This is a global thing, not just European.” Schulz says that processes per se haven’t changed, but with a more diverse institutional investor base hedge fund firms need to invest in communications and share classes in different countries.

“Compliance is very important,” he says. “If an investor is in a regulated structure it takes out a great deal of risk concerning fraud or mispricings. But it doesn’t take out the risk of illiquidity especially during a crisis. So it doesn’t change the fact that you still need to do due diligence on the fund and the manager.”

Due diligence was certainly a part of hedge fund investing a decade ago, but more was taken on trust than occurs today. Now there is more on-site due diligence to see, for example, how trades are executed. Investors interview service providers and will examine how portfolios and NAVs have changed over different time periods. Schulz says it is understandable that investors get frightened when irregularities suddenly become public as happened with the Securities and Exchange Commission bringing a suit for alleged misappropriation of fund assets in late June against Philip Falcone, the founder of Harbinger Capital Partners.

“It is nothing out of the ordinary that there are irregularities,” Schulz says. “But why would a pension fund want to take a risk if there are good absolute returns funds with a regulated structure. The number of regulated funds whether UCITS or managed accounts or a special investment fund or qualified investment fund is growing, and it is beneficial.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 80

Pension Fund Investors

How hedge funds are adapting to attract allocations

BILL McINTOSH

Originally published in the September/October 2012 issue