Platinum generated its greatest outperformance between 2000 and 2002. As with some other active managers, this came in the aftermath of the TMT bubble. During this three-year period global equities underwent a peak to trough drawdown of c 50% while Platinum’s flagship international long/short equity strategy generated positive absolute returns.

In 2019, valuation dispersion has, once again, reached extreme levels that might set the stage for a similar phase. Even advocates of passive management acknowledge that active managers tend to outperform at key turning points. That said, according to Platinum CIO, Andrew Clifford, “the most expensive parts of the market are not quite as extreme as they were in 2000”. Clifford has assumed the helm as part of a succession plan that saw the firm’s founder and previous CEO, Kerr Neilson (famously dubbed “Australia’s Buffett”), transition into a research and mentoring role. Clifford points out that the nature of market leadership is different. “Growth defensives are attracting the highest valuations, along with consumer staples, some of which have not really grown in five or 10 years,” he says. “Each quarter, consumer staples firms manage to portray growth in the business, and the market ignores the realities. It is not clear who would really want to own them, apart from quant funds and passive index trackers.” Neilson elaborates that, “Consumer staples are not the same companies that once attracted Buffet. They are losing pricing power as they face threats from own label manufacturing and the bargaining power of Amazon and other retailers. The sector should be lower in a few years’ time and is clearly vulnerable to rising rates.” Back in 1999, some consumer staples firms such as Unilever languished on high single digit PE ratios.

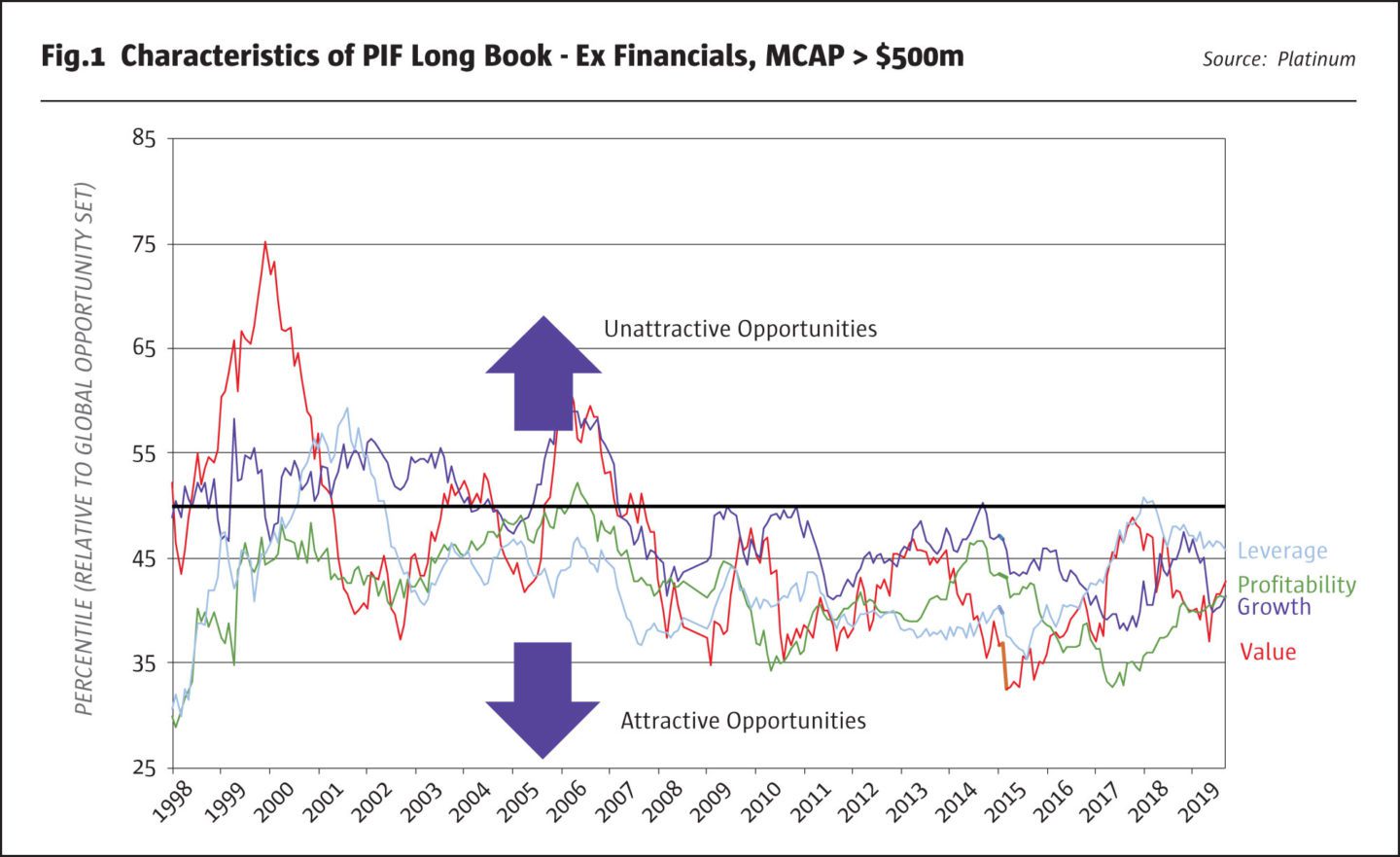

We track value, profitability, growth and leverage over time and consider them together. We do not find value versus growth is particularly useful.

Andrew Clifford, CIO, Platinum

Staples sit on one side of the broad valuation dichotomy between non-cyclical and cyclical companies, where “banks are bereft of hope”. But according to Neilson “this could change if there is some directional shift in interest rates, which could be caused by fiscal stimulus”. Cyclicals and especially automakers may be overly discounting recession risk. “Toyota on a PE of 8 is the cheapest in its history, with c $76bn cash on the balance sheet. Its valuation of c $100bn is only 40% of annual sales of $235bn, and all configurations of autos are covered: hydrogen, electric batteries, hybrids, ICE. The firm should easily be able to meet EU emissions rules,” declares Neilson. “It also has a distribution network that would be hard to replicate.”

Japan portfolio manager Scott Gilchrist points out that, “Toyota is at a 50-year valuation low, though it has obvious issues with capital allocation. There is no rational way to justify holding so much cash.” The valuation also seems anomalous given that Toyota is at the leading edge of some technologies. Gilchrist, who studied engineering himself, says, “Toyota has been making EVs since 1994 and its 400-page internal book on the hybrid drive-chain for the Prius has become legendary amongst engineers. Autonomous vehicles are a very complex problem, involving LIDAR; cameras; GPU; CPU; neural networks; circuit boards and ultrasonics, but we expect Toyota may roll out an AV with a high degree of safety as soon as 2024.” Even though autos are generally cheap, Tesla is an outlier with no profits and a short position for Platinum. Neilson asserts that, “Tesla may struggle to produce 500,000 electric cars this year, whereas BMW could make 2.5 million while Daimler and Audi are gathering traction. In Norway, Audi is already outselling Tesla by a factor of three to one.”

Another dividing line is growth versus value, where, according to Neilson, “it is hard to see how the divergence could get wider”. Late 2019 has seen some degree of repositioning, though it is not clear how much follow-through there may be; the value style also had a brief resurgence in late 2016.

Dispersion within technology

One difference from the 1999 period is the degree of valuation disparities within as well as between sectors. Where in 1999 most TMT stocks became highly valued and old economy sectors were much cheaper, there is now substantial dispersion within technology. “SAAS (Software as a Service) stocks can be valued on substantial multiples of sales, which can sometimes be justified where they succeed and deliver quantum growth,” says Neilson. “Elsewhere there are idiosyncratic anomalies, with Intel on around 13 times earnings and other semiconductor chipmakers even cheaper. Semiconductor valuations for companies such as Samsung and Micron have ascribed no value for memory chips and China is not yet threatening them.” Clifford amplifies that, “Chip makers have bounced off their lows, but extraordinary value remains. Their IP forms a very deep moat around the business and profitability has fundamentally changed over the past five years. All of them have net cash, are paying dividends and buying back stock. When we bought them at book value and on PE ratios of four, the prospective return on investment was 25%, based on a through the cycle return on equity of 25%. Even now a 17% return on investment is good going.”

Myopic markets over-react and over-extrapolate the near term whereas Platinum looks through short term uncertainties and takes a view on profits through a full cycle, which might be five years or so.

The semiconductors partly reflect time arbitrage. Myopic markets over-react and over-extrapolate the near term whereas Platinum looks through short term uncertainties and takes a view on profits through a full cycle, which might be five years or so. “We did not dispute the consensus view that some semiconductor makers might see a 50% or more drop in earnings in 2019,” continues Clifford. “But longer term we see supply tightening from more disciplined supply behavior from the three main players.”

The strategy also owns a handful of mega-cap tech stocks on PE ratios of 25-30 including Facebook, Alphabet, Tencent and Alibaba, and tends to buy into them upon setbacks and top slice them as their valuations expand. For instance, Anta Sports has been a ten-bagger over the past decade, but Platinum has regularly shaved the position as its valuation has expanded to around 30 times now. “A major bias is anchoring to original expectations,” says Clifford. “If companies keep outperforming, we do not want to sell them completely, but would rather trim positions.”

Online travel agency, Booking.com, is another firm with some degree of earnings cyclicality, but Neilson was happy to pick up the stock on an earnings yield of five per cent after a pullback. “Longer term, margins are already 30%, the firm can help hoteliers spend less on Google searches and may be able to cross-sell leisure attractions,” he says.

A multi-factor approach

Indeed, Platinum is not a rigid or dogmatic “value” manager by any means and cannot easily be bucketed into growth or value. “Our average PE is generally a bit below the market mean, though it can sometimes match the mean with higher growth and quality. We track value, profitability, growth and leverage over time and consider them together. We do not find value versus growth is particularly useful,” says Clifford. Neilson points out that, “Platinum’s technology fund has even owned some stocks that are not yet profitable”.

Platinum’s portfolio has seen some degree of rerating over the past year: “The average forward price-to-earnings (P/E) ratio for the long positions in the portfolio is 11.3x, which is higher than 10.3x at the end of 2018”, according to its quarterly report. This still stands at a hefty discount to global equities. But the average headline PE belies what is something of a barbell approach, ranging from coal companies on three times cashflows to technology growth stocks on PE ratios in the 30s. The manager sold out of Paypal on a PE of around 35 and generally Neilson feels that, “competitor responses are far less certain in newer sectors such as SAAS, social media or the sharing economy. Uber would appear to have advantages in terms of its maps and payment systems but its network externalities and first mover benefits have not translated into profitability, partly due to new entrants. Salesforce looked so simple in hindsight but you had to have a driven maniac behind it.” He fears that, “some technology companies could end up as regulated utilities. For instance, payments companies that generate additional revenue from the data associated with payments might at some stage be needed to separate charging for payments from data, which itself may require customer consent and possibly compensation.”

Resources

Part of Platinum’s value bucket resides in very unfashionable resources stocks, particularly in the oil, copper and coal sectors. Neilson explains that, “We expect higher oil prices, partly because US frackers that have been responsible for much of the incremental supply may struggle to get funding after disappointing investors. At this stage of the cycle, Platinum is emphasising oil services firms such as rig operators, which offer more operational leverage. They are increasing their day rates as the productivity of offshore rigs improves. They are more like jet engines and more performance rated.” Clifford adds that, “Electric vehicles are a key driver for nickel and copper, as EV engines might use 80 pounds of copper against 40 pounds in an ICE. Copper and coal prices are close to marginal cost curves, which could lead to higher prices in future that would put metals stocks on single digit PE ratios. Coal names are already there with Peabody Energy probably close to a 30% free cash flow yield. Metallurgical coal maker, Warrior Met Coal, also has a 20-30% FCF yield in what is a very tight market. Metallurgical coal should also not face the sunset industry risk that may apply to thermal coal.” Coal is possibly the most despised sub-sector, but Neilson argues that, “we cannot switch off coal power. India and China are reluctant to forsake it and it will take time to bring wind and solar facilities on stream. Peabody has uncertain liabilities but is distributing some cash to shareholders.”

Asia and Europe

Asia and Europe are currently larger weightings in the global fund because they are less efficient markets where Platinum has historically generated more alpha, with average outperformance of indices close to double digits. As at 31 December 2019: Platinum Global has annualised at 12% vs 7.3% for the MSCI AC World Index since inception in March 1994; Platinum Japan has annualised at 11.1% vs 3.1% for the MSCI Japan Index since inception in June 1998; Platinum Europe has annualised 12.3% vs 4.1% for the MSCI AC Europe index since its inception in June 1998; and Platinum Asia ex-Japan has annualised at 15.1% vs 11.2% for the MSCI AC Asia ex Japan Index since the strategy started in March 2003.

Platinum is also overweight Asia and Europe because their economies are at an earlier stage of the economic cycle than the US economy and have stronger secular growth prospects. Asia manager Joseph Lai judges that, “trade war risks may be overstated in China: since only 4% of China’s GDP is exports to the US, a stress test for worst-case scenario hit to China GDP could be around 0.5%. Our base case is that infrastructure, technology and reforms drive growth in Asian economies, irrespective of the trade war. In five or ten years from now, three of the world’s top five economies should be in Asia. Nonetheless, the trade war is dampening business confidence and we are trying to avoid companies directly impacted by it.”

Valuations are compelling. Lai continues that, “Most markets in Asia are on cheap valuations on a price to book value ratio. The Hong Kong and Korean markets are close to or even below GFC levels. Domestically focused China stocks are also on low valuations.” But he is not just buying and holding. He has been actively trading around the volatility, which has seen tweets or protests knock 3-5% off the Hong Kong market. “We have reduced exposure or shorted when people were less worried,” he says. “Net exposure has sometimes been as low as 60%. We have then added it back on selloffs. In early December, net exposure is back up to 87%.” He does not expect that the US will rescind the 1992 free trade agreement with Hong Kong – the US Hong Kong Act. “It would not be in the interests of the US or mainland China. Many US companies have headquarters in Hong Kong. In any case, the latest Hong Kong democracy act allows the US to sanction individuals in Hong Kong or elsewhere who are deemed to have reduced autonomy or human rights.” Recent contrarian trades have included buying into Hong Kong property, after it swooned on protests.

Lai has also been quite aggressive in trading around the BAT Complex (Baidu, Alibaba and Tencent) stocks. He eschewed the Alibaba IPO and bought into the stock much later on after it sold off on concerns about fake products. Then during the 2018 slowdown he had no exposure to any of the trio. Lai currently owns Alibaba and Tencent but has nothing in Baidu, because Chinese consumers are in effect disintermediating internet search by directly accessing their favourite sites, such as specialist ones for plumbers or jobseekers; Alibaba or JD.com for shopping; travel sites for travel.

He asserts that, “E commerce is more interesting in China partly because privacy laws (or rather the lack thereof) make it easier for companies to collect personal data. Alibaba and Tencent know about shopping habits from their payment systems Alipay, Wepay and Tenpay. They also own mobile phone, video and social media sites in China. Moreover, mobile internet commerce penetration is higher as more people in China use an app rather than a laptop or desktop to search for holidays, cars etc.”

Domestic China exposure includes higher quality banks and a few property developers. Lai recognises that, “China’s property market is constrained due to difficulties in obtaining credit, and requirements for large down payments, but there are companies on multiples as low as five times earnings that can continue growing. The most compelling long-term growth story could be in life insurance, where Ping An trades on a PE of 10 despite having a long track record of compounding earnings growth at a rate of 20%. We also own AIA, which will soon be able to target a much larger addressable market – perhaps five times bigger than its current footprint – when certain subsectors are opened up to competition.”

Domestic stories are also owned in India. “India’s economy has been cyclically slowing since late 2018, and we are avoiding the non-bank financial sector, which has problems, but this is allowing stronger banks to grow their market share. The Indian economy remains lukewarm but there are some signs of stabilisation eg in car sales. We are generally positive on consumption related stories, and like two strong players – telecoms companies Reliance and Bharti, which have just raised their prices by about 40% from a very low base – Indians used to pay about $2 per month for 10GB of data.”

Most of the Asia strategy’s exposure is in the larger markets – Greater China, India, and Korea but there are smaller weightings in markets such as Thailand, the Philippines and Malaysia. Vietnam is an example of a less liquid frontier market that could be realistic for the Asia strategy to invest in, but may be too small for the US$ 11 bn global international strategy “Vietnam may benefit from the trade war, and it is possible to find retailers growing at 20% on a PE ratio of 10,” asserts Lai. Pakistan is another frontier market that might sometimes feature in the Asian fund.

54%

Platinum view Japan as the cheapest developed market and a super cheap market, with 54% of companies having net cash.

Europe and Eastern Europe

Europe’s banks are one of its cheapest sectors, but according to Europe manager, Nik Dvornak, there are also value traps for the unwary. “Lessons learned from our experience of investing in Japan for three decades have helped us to avoid ‘value traps’,” he says. “In September 2019, Europe’s banks were as cheap as in 2009 and almost as cheap as in 2012, but where those were stressed episodes, Europe is now growing with much credit risk flushed out of the system and Eastern Europe is growing as fast as 3 or 4%.” He continues that, “There are pressures from negative rates in some countries squeezing net interest margins and higher capital requirements, but these factors can help to entrench the position of incumbents. We generally favour consolidated markets with a tight industry structure and small number of strong players, which increases market power. Hence Swiss banks have been able to pass on negative rates while those in Scandinavia have raised borrowing rates. Ireland is another concentrated market. Italy too is interesting because smaller banks are handicapped by bad loans which means larger and stronger players can grow market share. Bank of Ireland was briefly a deep value play on one third of book value.”

Dvornak also tells how, “We have selectively invested in a number of banks in the Eastern European region, which is seeing wage growth of 5-10% and having to attract Ukrainians to fill jobs. Household debt is low partly because citizens were given their own homes after Communism. People have neither a mortgage to service nor rent to pay and therefore have more disposable income. This means that credit can grow twice as fast as the economy, and there is also more scope for fee income from cross-selling.” So far, “We have taken profits on Hungary’s OTP and Austria’s Erste Bank, but still own Raiffeissen and Banca Transylvania, and Sberbank of Russia”. He explains that there are some political risks in the region. “Slovakia and Romania have raised bank taxes, Austria did so a few years ago and Poland might impose retrospective penalties in relation to Swiss franc mortgages. But one estimate for the impact of the Polish proposals on Raiffeissen would be about one year of earnings, and the stock is on a PE of 6”.

High disposable incomes in Eastern Europe also underscore the investment thesis for budget airline, Wizz Air. “Eastern Europeans fly only about 20% as much as Western Europeans, but they should catch up as incomes converge,” he says. “Wizz mainly competes with state carriers. It is comparable with Ryanair in terms of cost base, but there is not much overlap on routes (bar in Poland). Wizz flies to secondary cities on point to point routes and is popular with locals. Growth is coming from volume rather than price. On a PE ratio of around 15 times, and growing at 20% Wizz Air is attractively priced. There is no dividend as cashflows are redeployed into leasing planes. In future Wizz may be able to reduce costs by owning planes.”

Leases also hold clues for the valuation of luxury automaker BMW. Depending on how the leases in its finance business are accounted for, the stock could be ascribing little value to the industrial business, according to a presentation by Platinum’s Julian McCormack. “In any case, the finance business is a high quality one where BMW has first right of refusal over financing and cherry picks the best borrowers. In 2009 in the GFC, the loss rate was as low as 1% when prime mortgage default rates hit 4% and the finance business might therefore warrant a valuation of two times book value. The firm has continued to grow volumes in China, where luxury penetration is low and the brand is a status symbol. A PE ratio of 7 and a dividend yield of 5% make this a value stock,” he adds.

Dvornak has a couple of shorts in highly valued consumer staples firms but is wary of sizing the positions too large because even if Nestle reached a PE ratio of 40 times it could still be reasonable value for Swiss investors facing negative rates on their bank accounts.

Japan

Platinum view Japan as the cheapest developed market and a super cheap market, with 54% of companies having net cash. “It is possible to buy unlevered assets close to book value, leaving no value for the annuity part of the business, including features such as supply and distribution chains,” says Neilson. Japan portfolio manager, Gilchrist concurs. “Based on cash, cross-shareholdings and Treasury shares, Japan is by far the cheapest developed market in the world,” he says. Of course, it is not always possible to monetise this value, but the prospects of doing so are growing as corporate governance improvements in Japan encourage companies to buy back shares, introduce or increase dividends, and spin off affiliates. “There have been big changes over the past three decades,” he continues. “Empire building and mismanagement have become less common as companies have responded to pressure from the government, asset owners and investors. A profit motive is now clear in most of Japan.”

Platinum very occasionally works with certain activists whilst avoiding more bellicose ones. “One example was Lixil, where we helped to install new and better management. Here, several foreign asset managers were involved, and were ultimately supported by domestic investors who were less vocal,” he explains. “The company should now have some of the best corporate governance globally, on a par with best practices. It should be able to slim down its portfolio, exit weaker, underperforming businesses, and pay down debt. The new designer has also revamped the range.” Incidentally, it is very rare for Platinum to go public with activism. Gilchrist recalls only two other instances of corporate actions since he joined the firm in 2001, both involving mining companies.

Like Lixil, trading house Itochu has a chequered history, having made bad investment decisions, but now seems to be focusing on capital allocation, buybacks and dividends. “Its opaque conglomerate structure makes it hard to get full visibility on all units,” he declares, “but we can see the financial performance of listed entities and have talked to analysts who are familiar with other parts of the business. Indeed, though some of Japan’s c 4,000 listed companies do not have formal analyst coverage, there are experienced analysts in the market who may visit every AGM and cover them on an informal basis. He adds, “Our cheapest holdings are a handful of businesses with no analyst coverage. They are trading below half of book value.”

Value has lagged in Japan just as it has everywhere else. Platinum is not exclusively invested in “value” stocks there. Nintendo has been a core holding for a number of years. “We identified the opportunity when the valuation was low, and there were large cash balances and Treasury shareholdings. Now, many elements have played out, including the extended game console cycle, mobile gaming and theme parks, but online subscriptions are only just starting,” says Gilchrist. Another more “growth” oriented stock is Rakuten, which has a 5G network that could be a game changer everywhere, reducing the costs of competition by synthesising the whole thing and segregating hardware from software. “If they can execute the revolutionary network, there will be interest from spectrum owners worldwide.

We judge a high probability of this coming to fruition. 5G networks are also important for autonomous driving and the internet of things. Rakuten also offers consumers access to a portal of e-commerce sites,” says Gilchrist.

Drugmaker Takeda has been a core holding, partly based on cross fertilisation of ideas within the 36 strong investment team in Sydney. Gilchrist has received a positive second opinion on the stock from healthcare portfolio manager, scientist Bianca Ogden, who liked the valuation, sentiment, the Shire deal, and over 200 external collaborations. “At its core, Takeda wants to solve medical problems, and is one of the better corporate citizens,” he says. “It is developing a new vaccine for dengue and a treatment for narcolepsy. We have added to the position as it has cheapened over the past six months.”

Some other growth stocks in Japan are avoided for various reasons. Gilchrist declares that, “E-commerce firm Monotaro is a very good company, founded by Kinya Seto, but is too expensive. Fast Retailing is run by one of the best corporate managers in Japan, and indeed the world, but has generally looked expensive. We have never spent enough time and effort to understand it. We are also not sure on robot demand globally. Most of the valued added is in autos and it has not spread to many other industries. We expect more of a slow grind than a Cambrian explosion in robot use. We do not own Fanuc,” says Gilchrist.

“Even after a 30-year bear market and generally low valuations, there is wide valuation dispersion and there are very expensive companies. These can be blue sky companies with no earnings, highly valued firms, or those threatened by the hyper-competitive dynamics in some sectors. We have shorted some of them.”

Japanese banks are also avoided. Though they have added fee income to interest income, negative interest rates and very low lending rates are difficult for the financial system. Yet Gilchrist’s outlook for Japan’s economy is probably more constructive than the consensus. He says, “Employment is at record highs and female participation is rising. It is not as moribund as it looks.”

The Japanese Yen is a big influence on corporate earnings, both via export revenues and via foreign asset ownership. As much as 60% of Japanese earnings come from overseas according to some estimates. If the yen did strengthen, Gilchrist expects that Japanese companies might then deploy more cash overseas, which could weaken it again. Platinum has sporadically taken positions in the yen as part of its active currency strategy, which has added an average of 1-2% annually to performance over the years. There is currently a long USD, short CNY position and also a small long GBP.

Internal and external research synergies

Japan has some of the thinnest analyst coverage but very few stocks in the international strategy have no sell side coverage at all. Platinum does in house research but also uses three external sources of research. “Sell side analysts who have followed a stock for 10-15 years are a great resource for answering questions,” says Clifford. “We do not rely on their opinion, but it is part of the information set and it is remarkable that consensus views feature in so many discussions. We also use expert networks like GLG for similar intelligence, and some independent research providers,” he continues. Platinum’s teams have some degree of autonomy, and might have different opinions on certain stocks, but there has never been a case of one manager being long a stock that another one was short of. Differences and diversity of opinion are seen as a source of valuable information.

ESG, governance and corporate profit outlook

Neilson judges that some managers’ ESG strategies are motivated more by expediency and product proliferation than any sincere commitment to being righteous. Platinum does not have a dedicated ESG strategy, but has been integrating ESG for some years. He points out that Japanese company accounts state their social obligations in the mission statement. Clifford declares that, “Sustainable investing has always been fundamental. All elements of companies need to be considered, including environmental rules, social licenses, and poor governance. What has changed is a greater client need for it to be demonstrated that we are doing that, and we could do a better job of communicating to the client base.” Platinum’s excluded sectors are tobacco, and weapons (defined as entities engaged predominantly in supplying munitions of military weapons).

Neilson is not sure if future years will be as benign for corporate profits as recent decades. “There is more obstruction to trade, and more intervention in corporate governance and behaviour,” he says. “The profit pool won’t be as untampered with for so long and management compensation in particular will come under closer scrutiny, in terms of ratios of average worker to CEO pay. Executive remuneration is egregious at some US companies, and we generally avoid investing in them. A good example would be Jack Welch, who got paid over a billion dollars, while GE has subsequently destroyed hundreds of billions of shareholder value.” In this type of environment, the need for active management to pick winners and avoid or short losers will be more important than ever. The short book has performed intermittently, making the best contributions in years such as 2000 and 2008, and it may yet come to the fore when the next bear market eventuates.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical