Whether and when Point72 might open to external capital is amongst the most ruminated but perhaps least productive avenues of enquiry; a spoiler alert is that we obtained no scoop on our visit to the firm’s art-adorned Stamford offices situated at 72 Cummings Point Road. But we did gather insights into the multiple directions in which the firm is developing. Point72’s growing confidence in the quality of its augmented hiring and training programs has resulted in most PMs now being home grown; Point72’s reopened London office and its three Asian offices are growing alongside its many US offices; Point72 has broadened and recalibrated its incentive systems to reward repeatable investment performance as well as contributions to the firm and wider community; Point72 has put in place extensive policies, processes and codes of conduct to anchor its aspiration for industry-leading standards of compliance and ethical behaviour, and other policies have been designed to foster an appropriate culture.

All of this and more amounts to what has been dubbed a cultural revolution that is the subject of a chapter in the book Primed to Perform by Neel Doshi and Lindsay McGregor, and a Harvard Business School case study. Research is also moving along in multiple directions with initiatives including Big Data, fintech, supply chain analytics, quantitative analysis and behavioural finance. Meanwhile private equity and venture capital sit alongside Point72’s core long/short equity, macro and quantitative strategies.

Reopening and returns

Nobody has any real insight over the timing of any opening, but Point72 President Doug Haynes did offer some background and set out some criteria that could feed into any decision. Prior to the January 8, 2016 settlement of the SEC’s administrative charges against Steve Cohen, any speculation over opening was premature because Point72 did not want to pre-empt any settlement. Though the exoneration of Michael Steinberg (related to the seminal Newman ruling on insider trading) left the SEC only claiming that Cohen had failed to supervise Matthew Martoma, “there was no reason to consider options ahead of the settlement as we had no reason to think it would go one way or another,” says Haynes. The settlement may permit external capital raising from 2018. But the common assumption that Point72 will now open as soon as possible in 2018, because it can do so, is misplaced. “It is actually a big decision and many firms that turned into family offices remained as such,” Haynes says.

Point72’s overriding objective is to maintain the level and quality of investment returns and Haynes points out “there is a very clear relationship between capital and returns and it is potentially dilutive to bring in capital. Some hedge funds have become more oriented to fees and asset raising but Steve Cohen has never operated that way and under any scenario his capital will be a very large part of the capital base”.

The pattern of returns also matters. Point72 considers three dimensions of correlation: relative to the hedge fund industry, to general markets and internally between geographies, sectors and strategies. Cohen has recently acknowledged, at the Milken Institute Global Conference in May 2016, how overcrowded trades have made alpha harder to find. Running more money would make the search for uncorrelated alpha still tougher.

Hiring and nurturing in-house talent

The search for alpha is inextricably linked to the search for talented money managers, both nascent and actual, and Point72 is picky. “There are many very talented people managing money in the industry but not a lot of truly distinctive people as that is a very high bar,” says Haynes. Even after bringing on board the right people (and only 2-4% of Point72 interviewees are hired) their potential needs to be developed at the appropriate pace. Cohen’s many years of data, trial and error has informed insights about the time taken for people to become good investors. “We have in the past ruined talented people by trying to grow them too quickly and driven them into underperformance partly for psychological reasons,” says Haynes, who draws an analogy with sports: it is very rare for an NFL draft pick to be a starter on the team in their first or second season (with Peyton Manning a possible exception).

The ages of Point72’s 400 investment professionals globally are not formally tracked as this could be unlawful discrimination in the US, but in broad brush terms analysts are typically in their twenties or thirties, and portfolio managers are mainly in their forties. The oldest person working at Point72 is Steve Cohen, who turned 60 on June 11th, 2016. There are four or five other portfolio managers of similar age, some of whom have been there for 24 or so years since SAC was started in 1992, and some of whom were even earlier colleagues of Cohen at Gruntal & Co.

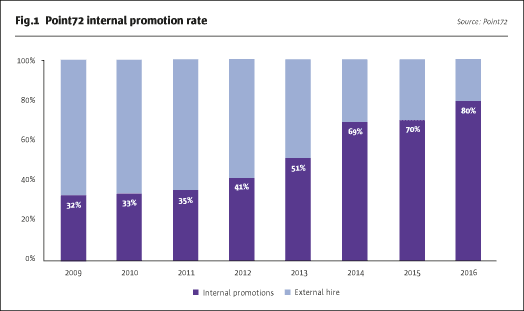

Yet these old timers are not typical as Cohen historically recruited mainly from sell side investment banks or other investment firms with 70% of PMs hired externally in 2009. Now 80% of PMs are developed internally, as shown in Fig.1.

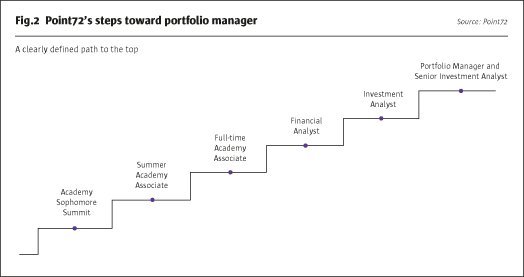

“We can take somebody all the way from undergraduate level to being a PM managing over $1 billion with meaningful development support at every step of the way,” says Haynes. Point72 offers a set of clear sequences of six steps towards Portfolio Manager and Senior Investment Analyst (see Fig.2), starting with ‘sophomores’, which is an American term for undergraduate students in the second year of their studies, typically for a bachelor degree.

Several senior hires have been made to manage the recruiting and training programs. Equity researcher and academic teacher, Jaimi Goodfriend, CFA, was hired to set up the Point72 Academy that recruits graduates fresh from their first degrees for a 15 month training program, as well as offering 10 week summer internships to undergraduates. There is also a case study competition that teams from more than 50 US colleges have participated in. Head of Investment Talent Development, Johnathan Jones, came from behemoth BlackRock where he was Global Head of Lateral Recruiting. The overarching head of human capital is Mike Butler who has held top HR positions in several large firms.

The first Point72 Academy class are just coming through and their success has exceeded expectations. Haynes says the firm has “a very high degree of confidence in distinguishing between luck and skill in the quality of their fundamental analysis”. The firm is also reaping the rewards from its investment in internal training: “Staff who ran their first book at Point72 have outperformed those hired from outside, based on an internal study using five years of performance data,” Haynes confirms.

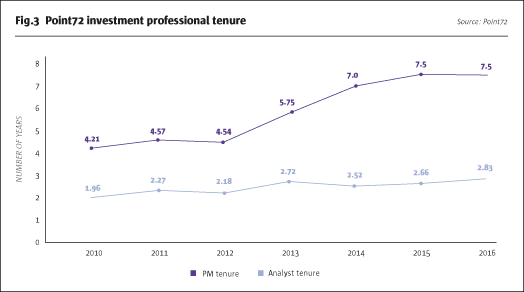

The loyalty of staff underscores employees’ confidence in Point72’s long term vision and future. The average job tenure at Point72 for a portfolio manager is 7.5 years, which is nearly twice as much as the industry average. Average tenure of analysts has increased to just under three years. Turnover of portfolio managers and analysts is also below the industry average of 25% per year, with voluntary departures from 4-8% and involuntary of similar size, according to Point72’s Head of Communications, Mark Herr (see Fig.3).

Bicultural and multicultural traders in Asian and London offices

US offices including the Stamford headquarters and two New York locations are the largest by staff numbers, but this is a global firm with big ambitions in Europe and Asia. Cohen has been in Asia for 10 years, with offices in Hong Kong, Singapore and Tokyo, and is targeting 100 staff. The attractions of Asia include more volatility, government intervention creating price dislocations and lower correlations. In particular Point72 has found that the beta orientation of many investors in Asia increases opportunities for alpha generation. Though local capital markets are of interest in Asia — and the firm does not think staying up all night to trade Asia from abroad is a sustainable lifestyle — global markets can also be traded by those based in the region. Haynes recently caught up with an Australian Point72 employee based in Singapore who trades global markets from there and this is not unusual. “Twelve PMs in the firm take a truly global approach,” says Haynes.

The preference in Asia is to hire locals, but train them in the US in the Point72 style of management to create what Point72 has dubbed ‘the bicultural trader’. Equally, some US traders are encouraged to relocate to Asia. Marc Desmidt, CEO of the Asia Pacific region, who joined from BlackRock in January 2016, is actively recruiting and particularly keen to hire more analysts and PMs from Japan, Hong Kong and Korea.

The London office has re-opened and is headed by William R. Tovey who helped build Barclays’ European equity business, hiring over 250 people. At Point72 the plan is to bring on board as many as 70 staff. PMs from Moore Capital, Millennium and Brummer have already been hired.

Creating appropriate incentives

Point72’s human resources approach combines ‘hard’ components such as performance-based rewards with ‘soft’ aspects that try to get under the skin of staff and work out what makes them tick. These can be categorised as the ‘yang’ of predictable tactical performance and the ‘yin’ of adaptive performance through culture, according to Doshi and McGregor’s book Primed to Perform: How to Build the Highest Performing Cultures Through The Science of Total Motivation.

Both forms of incentive systems are based on finely calibrated criteria with no simple formula. The simplicity and purity of the traditional hedge fund performance fee model is for some a quintessence of the industry, but Point72 now pays more attention to performance attribution. Point72 has therefore devised incentive systems designed to reward longer term and sustainable alpha generation. Haynes admits that “separating luck from skill does get more difficult with more senior staff where investment decisions are more impacted by market variability”. The entire secret sauce of the bonus formula is not disclosed but Haynes sets out the principles. “One day, week or month does not tell enough as profits need to be repeatable, and we have found that certain patterns of profit are more likely to be attributable to skill than luck.”

In particular single stock alpha – picking stocks that out or under perform their peers – is more likely to be repeatable than anticipating which styles of management are in fashion or calling the direction of the market. However, the practice of paying bonuses for single stock ideas tagged as ‘best’ ideas has been ended. The emphasis on single stock alpha applies to the equity professionals; macro traders are expected to take broader market directional positions and are rewarded for doing so. Recently hired Point72 Chief Economist Dean Maki, who was previously Chief US Economist at Barclays, has been recognised for the accuracy of his macroeconomic forecasts.

Financial incentives are also offered for making broader contributions to the firm through sharing ideas, contributing to problem solving issues and, most unusually, for non-profit making activities in the local community. Though many firms encourage voluntary activity it is rare to offer explicit financial incentives. Point72’s ‘Community Matters’ and ‘Rewarding What Matters’ programs can pay a bonus up to 4% for ‘volunteer work, charitable giving and community leadership’.

‘Sticks’ must exist along with ‘carrots’ in any incentive system. SAC’s supposedly infamous ‘down and out’ policy – whereby staff losing more than a pre-set amount were asked to leave – was seldom invoked. “Only two PMs in the last five years were terminated because of this, the last in 2011” according to Herr. ‘Down and out’ has been jettisoned and the risk framework leaves managers with room to breathe. SAC was often characterised as having highly intrusive and heavy handed risk management policies, but this perception does not fit our impression of Point72. “It would be unprecedented for the risk team to step in and close out individual positions. If risk limits are exceeded portfolio managers are asked to correct the breach,” Haynes explains. Point72 views risk as ‘partners not policemen’ and wants to allow portfolio managers to flourish. “We attract the brightest talent in the industry and support it to an unparalleled level, giving managers the freedom to learn and grow and innovate and make mistakes,” Haynes explains.

Much thought has gone into crafting the incentive systems. Point72 want to avoid those that can result in perverse incentives. For instance, ‘Primed to Perform’ identifies the practice of ‘stack ranking’ – whereby staff are ranked against one another on a relative basis – as having adverse unintended effects. This type of reward system can make for myopic behaviour and even lead teams to try and discourage top performers from joining them for fear of reducing their own stack racking.

Point72’s approach to staff motivation is also broader than financial incentives. Portfolio managers can have an input into overall firm management at the Portfolio Management Advisory Committee, and have the opportunity to voice their opinions through surveys, as do all other staff. The ToMo (Total Motivation) concept is explicitly measured through annual surveys containing 200 questions designed to gauge “are we making progress in pursuit of our mission and behaving according to values” and find out what motivates staff, according to Haynes. Responses are anonymous and the 80% response rate is exceptionally high, Haynes says.

The survey applies to all staff and the aggregated, anonymised results are communicated to the whole firm, globally. “The big magic of the survey is what happens afterwards when the management team get together to consider the survey,” says Haynes. A key discovery from the survey has been that staff do not perceive Point72 to be as innovative as it could be, and this is being addressed partly through multiple research initiatives that we touch on below.

<spanstyle=”font-size:14px;”>Culture change and management change

These new incentive systems are one aspect of the cultural change at Point72 that was the topic of one chapter in ‘Primed to Perform’, and is also now a Harvard Business School case study. The culture is embodied in a mission and values statement and other codes of conduct. Point72’s mission is: “To be the industry’s premier asset management firm through delivering superior risk-adjusted returns, adhering to the highest ethical standards and offering the greatest opportunities to the industry’s brightest talent.” The values are entitled: Ethics and Integrity; Firm First; Innovation and Excellence; Growth and Development; and Community. Though Point72’s compliance manual is the foundation for good behaviour, it is supplemented by ‘The Canon of Professional Standards’ that aims to instil the right attitude and act as a guiding star that transcends laws and regulations. The canon commits staff to “adhere to the highest ethical standards and behave with exemplary professionalism at all times”. These three documents – the compliance manual, mission and values statements and canon of professional standards – are all complementary.

In a wider context, Haynes holds the view “any firm culture is part of a community, in collaboration with and not isolation from the community.” He recognises that neglecting concern for the community can have negative consequences for shareholders and vice versa, citing the example of a particularly resilient retailer that donates items to developing countries. Some Point72 managers take account of ESG (Environmental, Social, Governance) criteria, though they are not required to do so.

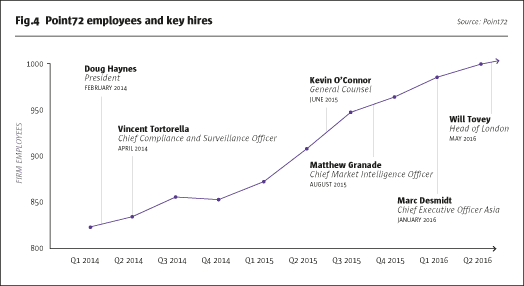

The cultural change has gone hand in hand with some new senior managers including Haynes, who was formerly a Director of McKinsey & Company, who helped build its TMT practice. Cohen worked with Haynes on the Robin Hood Foundation Board. Six cornerstone hires are shown in Fig.4. Additionally Point72 hired Timothy Shaughnessy from IBM to be COO, in a sign that hedge funds may be competing for staff with giant technology firms.

In addition to new executive management, Point72 has created an advisory board drawn from business, education and investment firms. Richard Foster lectures at Yale School of Management; Victor Ganzi chairs PGA Tour having run Hearst Corp; Gary Goldring was a partner of Goldman Sachs; Joel Klein, the former head of DoJ Antitrust under President Bill Clinton; Donald Marron chairs Marron Capital family office; and Tom Tisch runs family investment firm Four Partners. All of them have multiple board engagements.

The advisory board is intended to both confirm and challenge policies. “As a business leader it is easy to lose perspective,” admits Haynes. This board has total transparency, and are encouraged to voice their opinions without reservation regarding management, ethics, compliance and technology.

But the new culture should not be entirely attributed to new managers or external advisers. Significant numbers of new senior managers have been hired over several years but there has not been any wholesale purge of the former leadership. Some of the turnover arose from people being at the natural end of their careers after 20 or 25 years and of the top 20 personnel Haynes reckons roughly half are pre and half are post Point72. Rachel D’Antonio is one example of a senior manager who joined SAC in 2004 as Head of Operations, before moving on to a role as Treasurer handling counterparty and broker relationships.

Leading edge compliance aspiration

Cohen has survived SEC allegations of insider trading by six staff (with cases against Horvath and Steinberg having been dismissed) partly because he could afford to pay the $1.8 billion fine associated with the first settlement, but also because Point72 has a real passion for building an industry leading investment business. For instance Point72 demonstrated a commitment to improving compliance policies, in many ways that go beyond what was stipulated by the SEC. The regulator has required independent compliance monitors to confirm that policies and processes should prevent a recurrence of insider trading. Lawyers Seward and Kissell will be on-site independent monitors for at least four years from January 8th 2016. They report back to the SEC, which could also make examinations. Seward and Kissell is now the third independent compliance monitor. In 2014, Cohen’s firm retained former SEC Commissioner Paul Atkins’ Patomak Global Partners to conduct an unvarnished review of compliance policies. Shortly thereafter, Guidepost Solutions LLC was used as part of the 2013 DoJ settlement. All of the compliance monitors have complete access to all staff and records. Indeed, Point72 is a big consumer of legal expertise with 10 in-house lawyers and 30 external law firms used.

Compliance changes were the very first made, with some instituted in March 2014 even before Point72 was formed in April 2014.

As well as these monitors the compliance function has been revamped with a whole raft of heavyweight hires, technologies, and policies. Amongst hires from the FBI, CIA, SEC Enforcement and the Department of Homeland Security, Point72 General Counsel Kevin O’Connor was previously US Attorney for Connecticut and had been the number three official at the DoJ. A new role of Chief Compliance and Surveillance Officer was filled by Vincent Tortorella, also ex DoJ and a former federal prosecutor. Healthcare Compliance Officer, Kimberley Frasso, Pharm. D., was hired to review ideas and participate in calls with doctors.

In terms of technology, Palantir Technologies, co-founded by Silicon Valley investor and one time macro hedge fund manager Peter Thiel, is used by the FBI, CIA and SEC. As far as we know Point72 is the only hedge fund manager to have publicly disclosed the use of Palantir to bolster compliance and surveillance units and spot patterns of errant behaviour. Palantir was not able to confirm to us if any other hedge fund managers were clients.

We highlight three notable new policies. US-based portfolio managers and analysts are not permitted to use Instant Messaging (IM) nor Bloomberg messaging for external communication, and must use email for communication (other staff can use messaging). Point72 scrutinizes its trading and research counterparties and data vendors’ information policies and has ceased doing business with those that fall short of its requirements. The compliance and surveillance teams also carry out background checks and need to approve new staff hires.

Though Point72 has not yet received an SEC examination, Haynes claims Point72 has a perfect compliance record with “zero point zero” breaches identified. If this can be sustained it would be extraordinary, as anecdotally we hear that the majority of firms that are examined receive a ‘deficiency letter’ from the SEC.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical