“The group has continued to make good progress in the face of challenging market conditions and encouragingly we saw net inflows of over $1 billion during the year,” said Tim Woolley. “Investment performance has been strong with seven out of eight long only funds in the top quartile for the year and four out of our six hedge funds ending the year in positive territory.”

European hedge funds dominate

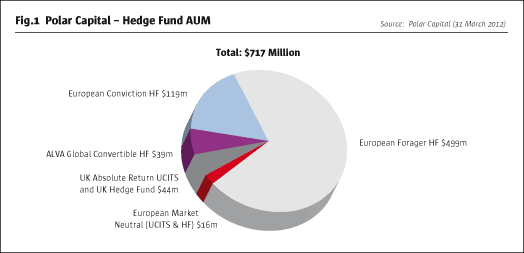

The overall growth in Polar’s hedge fund and alternative UCITS offerings masks some big changes in therelative success of different funds. The European Forager Hedge Fund and the European Conviction Hedge Fund, which dominate the alternative product range, boosted their combined AUM by 7% to $618 million. The picture was totally different with its hedge funds concentrating on UK focused investment strategies.

The impact on the UK Hedge Fund and the UK Absolute Return UCITS Fund was substantial as AUM fell to $44 million from $156 million a year earlier. This reflected investor disappointment with the UK Funds which finished in negative territory for the year and this led to further outflows from these products.

New market neutral funds

In October 2011, Polar aquired Ratio European Market Neutral Fund bringing with it the manager Tom Tjia. In February, Polar launched a UCITS version of the fund. The strategy had $16 million at 31 March. The ALVA Global Convertible Hedge Fund was flat at $39 million.

“We also continue to deliver on our strategy of diversifying our offering with the addition of three new teams and strategies, bringing us up to eleven teams in total, and expanding our distribution capability further,” Woolley added. “Assuming market conditions do not deteriorate further, we are well positioned for further significant growth in the year ahead.”

In October, Polar completed the acquisition of the Ratio European Market Neutral Fund bringing with it the veteran long/short portfolio manager Ton Tjia. In February, it launched a UCITS version of the fund. The UK Hedge Fund was also amalgamated with the European Market Neutral Fund as assets in the former had fallen below $10 million.

Monitoring capacity

Like other managers, Polar keeps a close watch on fund capacity. This is particularly the case with several of its niche hedge fund offerings.

“A number of our strategies have quite definite capacity limits if we are to maintain the excellent level of performance standards we expect,” Woolley said. “The highly successful Forager Fund has been closed to new investors for a number of years now and despite client demand we have remained and will continue to remain disciplined in our approach to capping funds.”

Though long only funds won’t earn the fee inducements that hedge funds can command, they often have substantially greater capacity. Several funds that Polar has acquired do have very large potential capacity since the underlying liquidity of big cap equity strategies is sufficiently large that performance should not be compromised even with billions of dollars of investor allocations.

As a public company listed on the Alternative Investment Market, Polar has well conceived policies on remuneration and alignment. Consistent with the company’s founding strategy of fostering an equity culture amongst its employees and providing high levels of transparency to clients, 45% of the equity is currently held by directors, founders and employees.

The firm also issues a separate class of preference shares to each of the leading fund managers on their arrival. These shares provide each manager with an economic interest in the funds that they run and ultimately enable the manager to convert their interest in the revenues generated from their funds into equity in Polar Capital Holdings plc, the AIM listed company.

Enhancing alignment

The equity is awarded in return for the forfeiture of their economic interest and vests over three years with the full quantum of the dilution being reflected in the diluted share count (and diluted earnings per share) from the point of conversion. Alignment is enhanced by the event being designed to be, at both the actual and the diluted levels, earnings enhancing to shareholders.

In addition to bringing in a market neutral capability, Polar also acquired specialist financials fund operator HIM Capital. That transported approximately $245 million in AUM to Polar and broadened out its sector expertise.

In April, Polar added a North American representative to be based at its office in Connecticut, who

The performance of Polar’s hedge funds not only attracted growing interest from investors. In January, three funds, including European Forager, earned nominations in their respective categories at the annual EuroHedge Awards. The Conviction Fund received an inaugural nomination, while the ALVA Global Convertibles Fund got nominated after its first year.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical