Despite having the potential to be one of the more destabilising months in global financial history, very little happened to markets in October; volatility remains near all-time lows, while equity markets in several regions are near all-time highs. The month began with the government of the world’s largest economy in partial shutdown. The IMF had already downgraded US growth estimates without the impact of the shutdown. The exact impact to the US economy is unknown, but consensus estimates for GDP growth are now nearer to 2% than 3% as seen earlier this year. The longer the shutdown continued the clearer it became that any resolution would be rolled into the much larger issue of the renegotiation of the US debt ceiling.

Despite the possibility of a technical default by the US, markets across the globe were relatively calm. Though there was a jump in the price of one-year US Sovereign CDS, this move was neither excessive nor surprising given the magnitude of the potential risk. As we approached the deadline, one could infer from the benign equity market movements that investors were confident that the issue would be resolved. Arguably the biggest casualty of the episode has been confidence in the US political system, which will be tested again when we readdress the issue early next year.

Generally market prices discount future events. It is normally the case that there is one event in the near future that is sufficiently large in its importance, that discounting probabilities further than this point becomes harder because of the binary nature of the event. Recently markets have been looking forward to possible tapering, which then shifted to the debt ceiling and government shutdown in the US. Currently, there doesn’t seem to be any obvious point from which markets are taking their lead this side of year end. In any strong year for equity markets, a large portion of investors will have underperformed the market. This often leads to an inflow to equities in the last few months, to avoid reporting underweight holdings at year end. This could easily lead to the conclusion that the only way is up for risk assets. In support of this is the fact that the Federal Reserve is still in full stimulus mode, and whatever the ambivalence in the minutes, our central case is that this persists to at least the end of the year. Firstly, given the shutdown in the US, some participants have questioned the quality of the data to be released subsequently; in any case it has been somewhat softer than predicted. Secondly, as Janet Yellen has started just about the most influential job in the global financial system, we feel that she is less likely to take a significant risk in her first few meetings.

It was therefore interesting to note that towards the back end of the month several of our strongest conviction equity long/short managers began to pull back their net market exposure. Several managers also reported more difficult trading conditions in the final week of the month. This can be a harbinger of a pull-back in the equity market. This was particularly true of managers in the US, where markets are trading at all-time highs.

Emerging markets continued the recovery that was seen in the second half of September following the no-taper decision. Equities, fixed income and currencies in the region all had positive returns, as investors reverted to a search for yield mode; though the recovery decelerated into month end. Managers remain moderately positive in their short-term outlook for emerging markets, though longer term there are undoubtedly issues to overcome. Many economies still have a large dependency on capital flows being maintained. The non-taper decision by the Federal Reserve has kept the liquidity tap open for now, giving these economies time to solve their issues; however, the reality is that this is not a problem with an overnight fix. Market prices will be contained until the talk of taper re-emerges, at which point some repeat of the almost allergic reaction seen earlier this year becomes increasingly probable.

There were stronger data releases from China throughout the month, with the now compulsory questions regarding sustainability, and the economy still growing at a strong rate. At the same time growth in the US and much of Europe (though not the UK!) continues to slow. As a result, China’s share of world growth continues to grow; both as the relative size of China increases, and secondly as growth elsewhere remains anaemic. The effect of China on emerging markets remains one of some debate. Improvements in China will have provided some support to emerging markets in the form of flows; indeed the stabilisation seen in September was maintained throughout the month. The second channel that Chinese growth transmits to emerging markets is via support to commodity prices; it is the world’s largest consumer by some margin. This factor was somewhat lacking in October with the S&P GSCI Index down -1.56%.

We wrote recently that ‘With Japan also firmly in the grip of politicians… markets will largely be range-bound’. We were right. It is noticeable that there is a divergence of opinions on the direction herein of equity markets. The market has been in deadlock since June as a result. Despite the absolute level of the Nikkei remaining somewhat static, the daily moves of the index are still volatile. Having had such a large appreciation in value this year it is difficult to assign a value at which the market should trade. This will remain the case until there is decisive reason for the level to shift.

We have come through a large and completely visible risk in October, with very little adverse market moves. Japan seems to be just about the only place that does have any notable level of volatility, with levels in both the US and Europe still at almost absurdly low levels. We remain wary of some of the issues that may have been forgotten (has the European periphery really recovered?) and could cause unexpected stress.

Hedge funds

October was an excellent month for hedge fund managers. The HFRX Global Hedge Fund Index returned 1.2% in October with almost all strategies and regions positive. With equity markets across regions recording strong gains (particularly post the resolution of the debt ceiling), together with earnings season, it was hardly surprising to see equity long/short managers had another strong month. European manager returns were particularly strong, though they did marginally suffer in the last week of the month. One of the strongest areas of return generation was in the periphery of Europe. Some managers had sizeable positions here and benefited from the recovery theme; financial stocks also benefited from the same effect. It’s likely that some of the problems in the last week of the month were as a result of profit-taking, following the strong run over the month in widely held positions. Pleasingly, most variable bias managers in the region had reduced exposure and were only minimally affected. US manager returns were also positive, though the returns were less impressive than those from Europe. Generally managers lagged behind net exposure implied returns, with alpha generation on the short side continuing to be particularly difficult. This was particularly noticeable in a rather uninspiring round of corporate results, and amid weaker data releases. Managers here also cut exposures towards month end, and are now less bullish than for much of the preceding six months.

After a series of poor months, managed futures managers were amongst the strongest performing strategy in October. A strong driver of this performance was the equity market exposure that had built up coming into the month. This was true for almost every manager in the space. Indeed, across the sector there was very little performance dispersion, with equity exposure the only significant attribution and the majority of managers having similar exposures over the month. Having started the month with flat (in some cases short) interest rate exposure, managed futures are now long once again, albeit in fairly small size. Our opinion of the overall environment for these managers changed little in October. They have been much maligned over the past six month, with many of their problems well documented. There are, however, reasons to be more positive. The yield curve remains steep, offering returns from carry and roll-down and the longer-term decrease of correlation between instruments is also a positive.

Emerging market managers had a positive month in October, benefiting from the continuation of the recovery seen in the second half of September. The recovery badly hurt several managers in September; however, the majority affected had successfully turned their books around. Very few managers recorded strongly negative months. Managers are positive regarding the short-term environment, but are cognisant that when thoughts turn back to tapering in the US the environment will become challenging again. Attempting to time this is something that managers are for now avoiding; this was what hurt several mangers in September. For now our opinion that excess returns will be difficult to generate remains.

Event-driven managers once again recorded a solid month in October, continuing a pattern we have seen for the most part this year. Deal volumes remained in the range they have been for most of the year (ignoring the mega Vodafone deal), with several large popular deals completing over the month. Both managers that we speak to, as well as investment banks, are suggesting that there is far less activity now in the pipeline as we head towards year end. The one area that seems to be bucking this trend is European telecommunications. There have been several large deals in the sector already this year, and there is room for further consolidation. We are not overly concerned about the outlook for managers from here; although there is less activity forecast, this is an area that is notoriously difficult to predict. Managers also have a knack of generating returns even in supposedly difficult conditions.

Statistical arbitrage managers had a good month in October, their first for several months. Many of the themes that worked well for managers in the final week in September continued to contribute through October. The non-taper resulted in an inflow of longer-term capital to equity markets, benefiting high-quality and fundamentally strong stocks; implicitly this benefitted fundamental statistical arbitrage managers. This is exactly the reverse of the rally in high beta stocks that caused such difficulties following the initial taper talk. The end of the year should be more of a repeat of the first quarter for these managers. One of the issues for statistical arbitrage managers in the middle of the year had been the number of binary events for markets; managers price markets based on some continuous distribution based on past events. From here we don’t see this, and given managers’ books have adapted to the new environment, we would expect to see performance return. Despite the continuing environment of extremely low volatility across equity markets, volatility arbitrage managers ended the month flat in aggregate. The majority of managers are still running tactically long volatility currently, a position that has an attractive asymmetric pay-off given the low levels of volatility (limited downside). It was therefore pleasing to see directional managers end the month flat, in the most part avoiding bleeding capital. The low absolute level is also a negative for those managers without an explicit directional bias.

While some equity long/short managers reported some difficulties with capitalising on stock selection, credit long/short managers had no such issues. With the combination of a rising market and good levels of single-stock dispersion both credit value and credit long/short managers posted good returns. There is also still some dislocation between different markets; following the widening of spreads in May, high-yield and investment-grade recovered quickly, EM credit has gradually recovered but not to the same extent, and municipal bond spreads remain some distance wider. We continue to believe that high-quality credit long/short managers offer one of the most persistent sources of alpha generation. Credit value managers are still out of favour; the risk/reward is less attractive the greater the extension down the liquidity curve and further through the credit cycle we move.

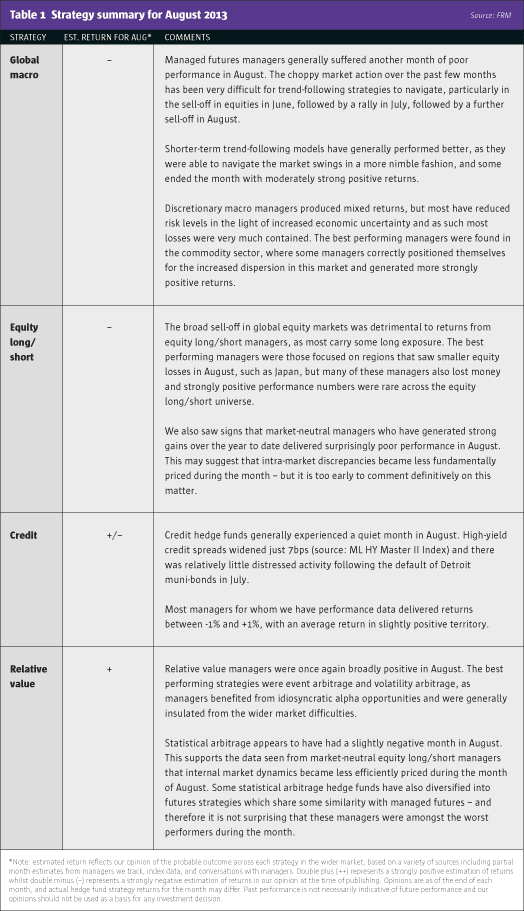

CLICK ON IMAGE BELOW TO ENLARGE

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 91

Potential Destabilisation Averted

Markets stayed surprisingly docile in October

FRM EARLY VIEW

Originally published in the December 2013 issue