Four big-picture themes – real-time risk, regulation, speed, and customisation – are driving forces behind the myriad features of Imagine’s offering. Imagine creates the market-leading technologies that help firms adapt to and succeed amidst the twin challenges of ever-faster markets and increasingly complex regulations. Imagine won The Hedge Fund Journal’s 2016 and 2017 award for ‘Best Real Time Portfolio, Risk and Regulatory Solutions’ and we revisited the firm’s New York offices to catch up on how Imagine is serving the industry.

Four big-picture themes – real-time risk, regulation, speed, and customisation – are driving forces behind the myriad features of Imagine’s offering. Imagine creates the market-leading technologies that help firms adapt to and succeed amidst the twin challenges of ever-faster markets and increasingly complex regulations. Imagine won The Hedge Fund Journal’s 2016 and 2017 award for ‘Best Real Time Portfolio, Risk and Regulatory Solutions’ and we revisited the firm’s New York offices to catch up on how Imagine is serving the industry.

Hamlin Lovell: How has your real-time risk offering evolved?

Scott Sherman: From the very beginning some 23 years ago, we have offered real-time risk management products and solutions. Our first product was geared to the listed equity options markets – which, at the time, were (and still are) among the most demanding in terms of speed and depth of analytics. Over the years, we have expanded our offering across all asset classes while still maintaining the same level of performance and best-of-breed risk analysis. Originally an enterprise locally-hosted product, we were the first to deliver a cloud-based turnkey solution back in 2000, before the adoption of the “cloud” terminology.

One thing we realized very early on was that our offering needed to be flexible, as the “science” of risk management is not as clear cut as one would like to think: every firm has their own take as to what is important, ranging from specific financial models to what type of VaR or which stress tests should be employed. Because of this reality, our original enterprise offering had a powerful API to satisfy these needs.

When we rolled out our cloud offering in 2000, we knew that we would have to provide similar flexibility – so out-of-the-box that our clients (chiefly hedge funds back then) had the ability to create their own multi-factor stress tests using our custom column functionality. These could be constructed by a front office user, that is, you didn’t have to be a programmer to make use of the custom columns. Just logical! This was the beginning of our cloud-based platform. And this cloud-based development platform was instrumental in bringing back the sell side institutions that we began with back in 1993.

HL: What does your client base look like today?

SS: We work with both the sell and buy side – and with financial firms of all sizes and types. The primary reason Imagine attracts such a diverse client base is our vast combination of data and analytics that allows us to create the novel products that can transform business offerings. Our risk platform, for example, now includes financial models for virtually every security traded in the world, as well as a powerful API – the Imagine Financial Platform (IFP) – that enables clients to add their own bespoke products to our platform – this is without peer in our industry. Driving our engine is a comprehensive database containing terms and conditions for more than two million securities, time series of market data to drive historical simulation and to estimate correlations and volatilities (yielding a seventy thousand by seventy thousand correlation matrix), as well as pricing curves – such as yield curves and volatility surfaces – which provide the necessary inputs for mathematical models. We get prices from over 115 exchanges and clearing houses, as well daily price histories for over 90,000 exchange traded instruments.

HL: What has changed in terms of clients’ risk needs in 2017?

SS: Clients of all types have a lot more regulatory risk monitoring requirements these days, and the requirements themselves are subject to modifications. Our IFP is a very timely solution in that calculations can easily be added and reports modified – without even engaging Imagine; our clients can do it themselves, and in fact over 90% of our clients do just that. Our sell side and some buy side clients now need to do all of this in the context of high-volume and high-speed trading — managing the risk and reporting on many millions of real-time trades per day for thousands of accounts in a race against time. Fast-moving markets are making it tough for market participants to keep current with account exposures and risk limits – and perform the now-required stress tests. Knowing that trading is not going to slow down and that regulations will only become more complex, Imagine worked with our clients to create the Real-Time Risk & Compliance (RRC) solution. The RRC technology functionality gives managers a single tool to monitor, investigate, identify and triage risk across the portfolio, trade-by-trade, tick-by-tick – for multi-millions of trades per day. Users can track their exposures relative to internal and external regulatory limits, drill right down into accounts, set limits – and even perform pre-trade risk compliance checks based on liquidity, factor exposures or any user-defined formula. The RRC can also simultaneously compute margin. What impresses clients is that even a pre-trade check as complicated as a VaR limit, which requires us to compute a “what-if VaR” on the client’s entire portfolio, can be done within fractions of a second.

And one more thing. Often overlooked when considering risk management needs is the data issue. The RRC comes with transparent consoles for monitoring processes that our clients may be running to assemble the current positions – trade feeds, collateral, client limits, etc. If a trade feed fails, or is running behind, it’s important to know that so you can focus on correcting it. This is something that we have been doing for our global ASP clients since 2000, and our RRC has the same tools. As they say, “Garbage in, garbage out”.

HL: Can you enter a potential trade into the system to see if it breaches any limits?

SS: Yes, that is the pre-trade compliance functionality. What differentiates our pre-trade compliance is the flexibility and versatility to check trades against multiple scenarios to see when they would or would not breach limits. Because the system is real time, this can also be done intra-day. Other pre-trade compliance systems are restricted to simple limits on concentration.

HL: How does the margin computation work and how is it being adopted?

SS: For regulatory reasons, the industry must move to real time, or T+0 as it is called, for margining, reconciliations, margin calls and collateral sweeps. The T+1 margin process is just not relevant in fast-moving markets where you need up-to-the-minute data. And our clients required a way to better control their capital and avoid untimely margin calls. Imagine calculates margin using the rules required by exchanges worldwide, including Portfolio Margin, Reg T, or even a prime broker’s house rules. Clients can simultaneously perform stress tests, for example, “what will my margin be if a particular market event occurs?” Users have complete visibility into the calculations, as well as the ability to change or add others. The system offers intra-day, what-if calculations and end-of-day margin replication – and it is fully scalable. Our users are also accessing Imagine’s risk portals to share information with their clients who can see their own margin positions, real-time, in the firm’s system and make quick decisions. This is a powerful product for managing capital.

HL: What are examples of types of stress tests and historical scenarios can you shock for?

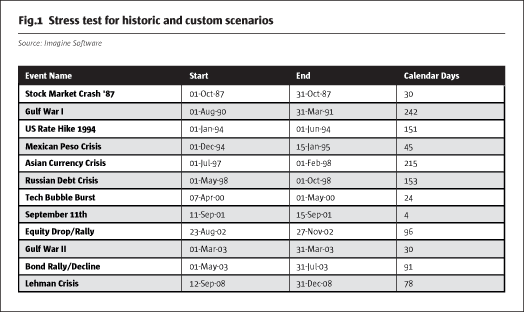

SS: Imagine calculates standard stress tests such as price -5%, volatility +25%, and credit spread +150 bps and can simultaneously shock 17 pricing inputs. Imagine users can also create custom stress tests, providing full control and flexibility for selected scenarios. Within the standard calculation library, users have access to a wide range of historical shocks such as 9/11, Enron, Asian Currency Crisis, and Brexit. Through both real-time or ad-hoc requests, all of the calculations and functionality can be accessed through Imagine’s software suite of programmatic APIs. Imagine provides data for the following key historical events, which may be used in historicalsimulations. (See Fig.1).

HL: What other new products and services are in high demand?

SS: Leveraging our IFP, we provide off-the-shelf apps for reporting, automating manual tasks, portfolio rebalancing, etc. In 2016 alone, our clients and partners created more than 500 unique apps for a wide range of risk management needs. The technology is easy to use – for the technologist and non-technologist alike – and the dramatic uptake of the apps speaks to the almost limitless ways the platform can be leveraged. We also have now decoupled our risk engine from any GUI – I call it “headless risk” – and the analytics can now be served out via a RESTful call to an external system, web site etc. This product, which we have termed “Risk-as-a-Service”, or RAS, is not just risk, but in fact any type of analytic or extracted data, and is now being used for a wide variety of applications ranging from powering client portals to enabling pre-trade compliance on a third party OMS or EMS.

HL: What kind of reports can firms receive as a service?

SS: Companies can send us their holdings or trades and we’ll run the analytics and return the risk reports and raw data that can be incorporated into their platforms. We’ll deliver the information daily, weekly or monthly as needed. Companies can also get our off-the-shelf risk reports – or we can create custom reports. With Imagine’s data, analytics and reporting, firms can easily create a value-added differentiator. All reports are designed with flexibility in mind, as we realise some firms may prefer a pie chart while others want a bar chart, so the approach is open architecture, generating service.

.jpg)

Top: RRC Executive Summary Dashboard

Above: Global View of Investments

HL: How are firms preparing to meet the requirements of the Fundamental Review of the Trading Book (FRTP), Solvency II and other upcoming regulatory changes?

SS: Many firms are facing a wholesale change in the way they manage risk, due to the implications of the FRTB and other regulatory forces. Companies with multiple risk systems now need a single risk engine to comply with standard approaches for calculating capital, along with the comprehensive data and analytics to perform stress tests and produce even more granular risk reports. The regulators are looking to create a level risk playing field so we don’t have a repeat of 2008, but it’s expensive and time-consuming for firms to completely overhaul their risk infrastructure. Imagine’s best-of-breed risk engine not only allows firms to deliver on the regulators preferences — but they can add their own models to our platform. For Solvency II, we help clients adopt standard models, calculate Solvency Capital Requirements (SCR) and Minimum Capital Requirements (MCR) to data deliver transparency. We also cover AIFMD and UCITS with the calculation of global exposures, what-if/pre-trades checks, VaR calculation, stress tests adapted to strategy, the 5/10/40 rule and limit checks on liquidity, geography, asset type, issuer, exchange, counterparty, etc.

HL: How do Imagine’s suite of offerings fit into firms’ cybersecurity and business continuity strategy and policies, which are the subject of more scrutiny from regulators?

SS: We havethe world’s most stringent security certification – the ISO 27001:2013. We also have an SOC 1 from two separate independent auditors. These are serious certifications and global standards of proof.

Clients can tell their regulators and shareholders that we have been safe since 1993. The Imagine system has never been down: we stayed up through September 11, the electricity blackouts and most recently Hurricane Sandy. We have two redundant systems that run at all times, with back-up power and multiple routers and feeds from multiple locations. We are as bulletproof as our clients require.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical