Most of River and Mercantile Group PLC’s (R&M) strategies and firm assets – advisory, fiduciary and asset managed – of GBP43.2bn of AUM/NUM at year end 2019 are in traditional institutional investment approaches, albeit enhanced by distinctive proprietary investment processes. But R&M is increasingly catering for a wider variety of client mandates, including liquid alternatives targeting absolute returns. In 2018 the firm seeded an innovative global macro strategy (GLOMA) that uses proprietary analytics including fundamental and technical indicators, correlation forecasts and asset allocation techniques.

The vision is coming from senior management: erstwhile former CEO and co-founder, Mike Faulkner, who stepped aside from business management in order to focus his energies fully on being Group CIO and manager of the strategy. The launch was a bold move at a time when macro was unfashionable, but it has paid off. Though many managers bemoan the climate for macro investing, GLOMA has delivered annualized returns of circa 5%; profited in the fourth quarter of 2018 when equities were down; already garnered industry awards and gathered close to $200m of assets in its first two years.

The coronavirus pandemic has seen some performance setback in February 2020 as GLOMA deleveraged, and eliminated “risk on” exposure, but it eked out a small positive return in March 2020. The pandemic has also provided a real-world stress test proving that the strategy’s risk management was realistic and resilient, and liquid enough to be enforced, in a crisis situation. The pandemic may justify multiple superlatives but for GLOMA it was a fairly typical drawdown: “Over the past 10 years [of the back-test] we’ve seen three drawdowns of a similar magnitude – during the start of the Euro sovereign debt crisis, the Tohoku earthquake and tsunami, and the taper tantrum,” the GLOMA February newsletter states.

Given that the GLOMA process is substantially systematic, CTAs and quant macro funds are probably the closest peer group, though the strategy has been lowly correlated with them and the firm’s history, culture and product range are very different from those of any other CTA manager.

R&M’s origins are a somewhat unusual alliance between the eponymous cash equities house, which was founded in 2006 by R&M CEO James Barham, and a fiduciary and consultant, P-Solve, which was founded in 2001 by GLOMA lead portfolio manager, Faulkner; these two entities merged and did an IPO in 2014, “which was a distraction, but we shielded investment staff from it,” recalls Barham.

P-Solve had been one of the first movers in the UK’s fiduciary management market in 2003, providing a delegated governance and decision-making structure for pension funds that lacked such a structure, while R&M had carved out an impressive track record of outperformance in equities. The two founders had been friends and business partners for over 26 years, when Faulkner was usually the consultant – founding P-Solve and earlier at what was then Towers Perrin – and serial entrepreneur Barham – who having started his career at James Capel following the army, was part of the team who founded and subsequently floated the business that became Liontrust – was the asset manager.

“The 2008 crisis was what first deepened the relationship as P-Solve’s fiduciary business sought a deep value equity recovery strategy to take advantage of very depressed asset prices. We rose to the challenge and designed a mandate together led by our equity CIO, renowned value and recovery investor Hugh Sergeant, which targeted a 100% return and achieved precisely that in 2009,” recalls Barham, who now feels a sense of déjà vu. He recently opined (when R&M released its interim results on March 16, 2020) that the firm’s value-oriented equity strategies, “now provide very exciting return characteristics not too dissimilar to the environment immediately post the Global Financial Crisis”.

Negative interest rates mean gold in effect has carry; central bank accounting changes make it easier for them to hold gold; and it is also benefitting from the same distrust as crypto-currencies.

Mike Faulkner, Group Chief Investment Officer, River and Mercantile

The opportunistic equity recovery strategy demonstrated the evolving philosophy of responding to client reverse enquiries rather than purely a blind build and sell approach to product development. The approach matched the regulatory zeitgeist very well as a regulatory rejig from the FSA to the FCA encouraged a focus on conduct, shifting the mentality from marketing to designing solutions tailored to client needs. “It also fitted perfectly with the mindset of investment consultants who understand the holistic need of clients covering both liabilities and risk assets,” says Faulkner. R&M architecture is open enough for it to interact with other consultants: its diverse offerings are an important building block for other advisers and the firm has relationships with more than 15 UK investment consultants across a range of its other operations such as derivatives and equities.

The five pillars of R&M today are: advisory with circa £25 billion AUA; fiduciary running circa £14 billion; a risk management business spanning derivatives, LDI, and structured equity which has NUM of circa £22 billion, and active equities management – running circa £5 billion – in the form of funds that were mainly long only and equity oriented, until 2018 when GLOMA was launched, and an emerging markets equity team based in Chicago was acquired.

GLOMA launch

“We did not set out with the objective of building a global macro fund, but rather aimed to design a strategy with certain objectives and arrived at the conclusion that global macro would be the best way to leverage in-house capabilities. Infrastructure, systems, counterparty relationships, a dealing desk, expertise in designing and executing derivatives, risk managers, and a large research team of ten staff are all valuable resources that the global macro fund shares with other parts of R&M,” says Faulkner.

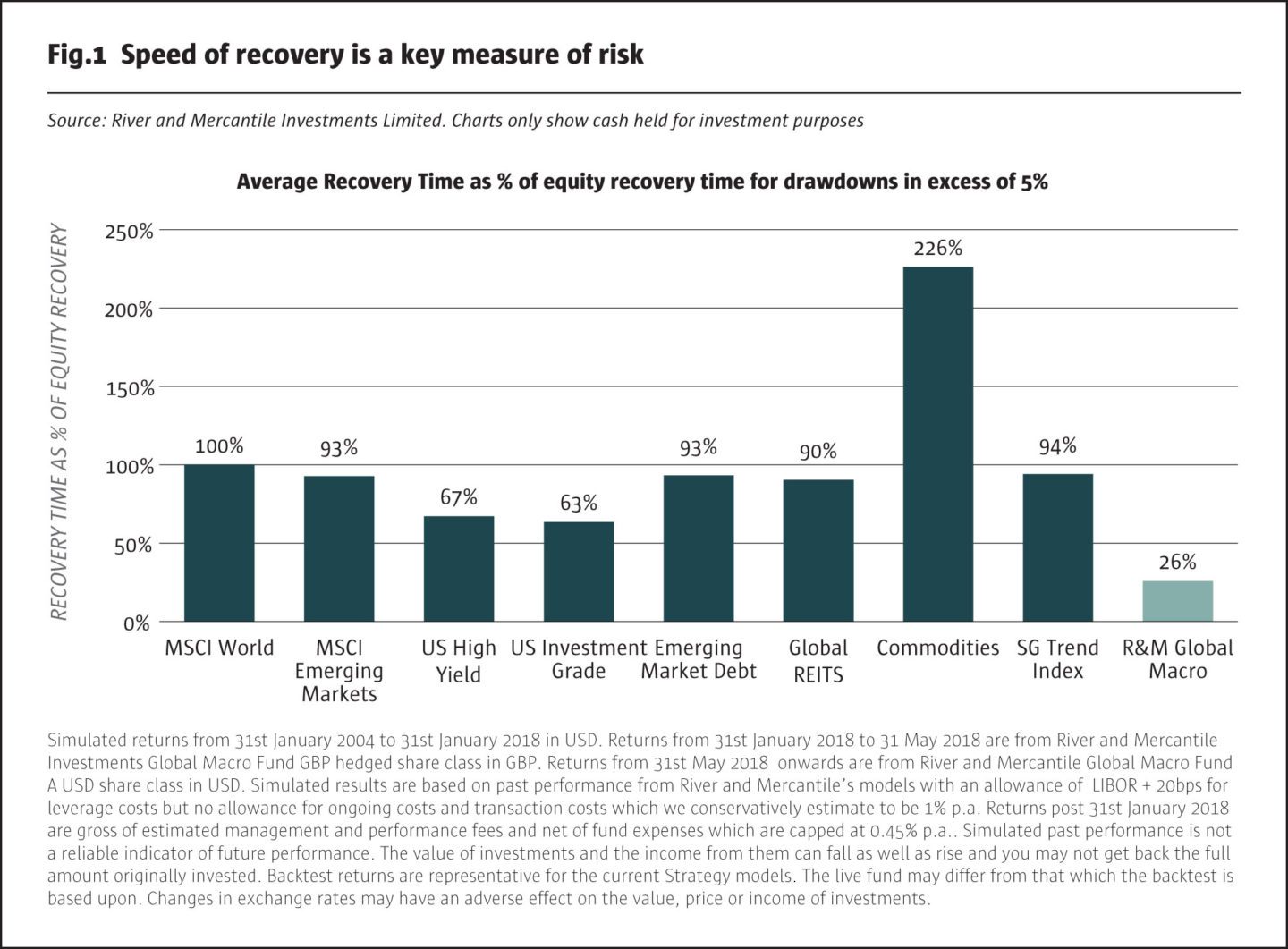

The strategy aims to deliver a Sharpe ratio of one, lowly correlated to equities, make positive returns during extended equity drawdowns (of more than three months), and keep volatility and liquidity inside UCITS constraints. It builds on nearly two decades of macro expertise within the firm. The fiduciary business had plenty of experience of running derivatives mandates embedded within these structures and the longest running fiduciary mandate dating back to 2003 has annualized at 10% with volatility of 8.5% to end 2019: about 3% p.a. ahead of equities with a Sharpe ratio of around 0.9. This was no mean feat, but the global macro fund aims to do better by freeing itself of various constraints.

GLOMA can use varying amounts of leverage or sit entirely in cash; go short as well as long and is not bound to diversify by asset class or to maintain any minimum or maximum weights in any asset class, though it is unlikely to short corporate credit.

Given that R&M applies consistent house macro views across all multi-asset strategies, the long book of the global macro fund is likely to have some overlap with the long only asset allocation strategies run in the R&M Solutions business, though the global macro strategy is faster moving and higher conviction. “Fiduciary mandates are measured on 12-month performance, whereas the global macro fund is focused on monthly performance and aims to be positive even when equities are negative. This is a best ideas, least constrained, version of our house macro views. The macro strategy is the highest touch one,” adds GLOMA deputy portfolio manager, Joe Andrews.

Though the UCITS diversification constraints might somewhat cramp the style of a very concentrated equity stock-picker, for macro investing it is easy enough to express an asset class view, such as a bond allocation, by splitting it amongst multiple issues without diluting returns.

(L-R): James Barham, Group Chief Executive and Mike Faulkner, Group Chief Investment Officer

An eclectic macro approach

The strategy is not easily bucketed into a traditional global macro mould however. Notwithstanding its name, GLOMA currently synthesizes three approaches: systematic macro based on fundamental data; a technical CTA approach which can opportunistically, selectively and tactically follow trends when they align with fundamental views; and style or factor-based equity approaches that can be both directional and market neutral. Over time the strategy is set to further diversify its suite of strategies as other new ones are added, particularly in the relative value space. All of this draws inspiration from three main sources: there is some grounding in academic research, a growing body of in-house research, and the strategies are informed by the broader R&M teams’ extensive experience of engaging with external managers though the outsourced CIO business: “we have seen what worked and what did not,” says Faulkner.

Opportunistic risk budgeting

Many systematic macro strategies target constant volatility (and most macro or currency overlays are mandated to do so), but Faulkner is of the opinion that: “varying position sizes in proportion to confidence is a key source of alpha. In theory, volatility could range all the way from zero to an annualized level of 25% around the ceiling of the UCITS constraints”. The back-test volatility fluctuated in a somewhat narrower range – between about 5% and 20% – but this is still a much greater degree of variation than many macro or CTA strategies will see. These variations in risk budgeting raised the back-test Sharpe ratio from circa 0.75 to circa 1, both by accentuating the upside and truncating the downside.

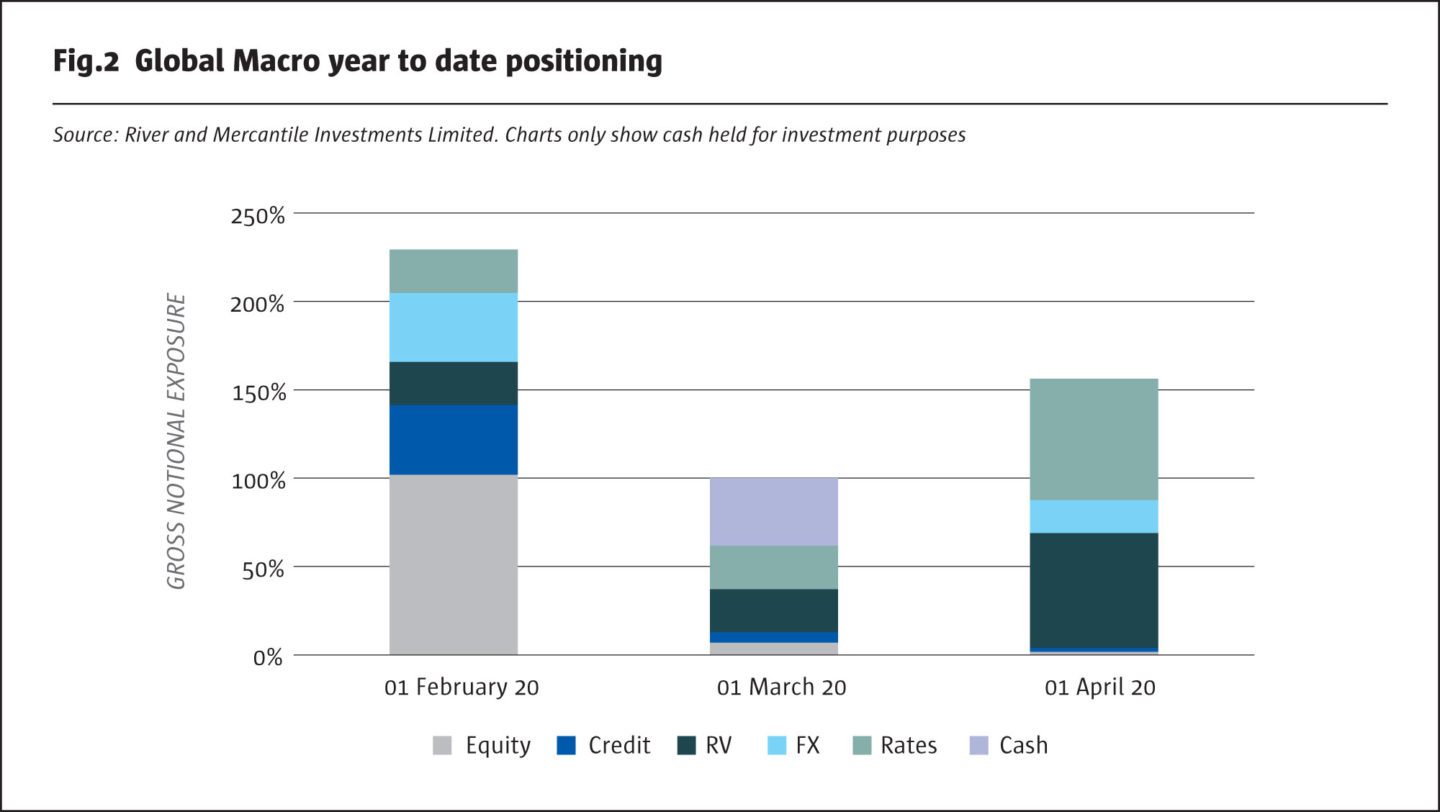

In practice, Andrews expects that volatility through the cycle could average 10-11%. For the first 22 months of the strategy, March 2018 to January 2020, it had been running lower volatility at around 5%. This did not indicate any lack of conviction: long exposure of up to 300% in government bonds was held for much of the period. Volatility had been towards the lower end of the back-test range partly because bond market volatility has been historically subdued, and equity market volatility had also been relatively low when the strategy had equity exposure. A negative return of 9.04% in February 2020 increased the annualized volatility since inception to just shy of 9%, but deleveraging in March 2020 has brought it back down again, reduced forecast volatility to a 1 month 99% VaR of 1.85% (which translates into about 6% annualized).

This opportunistic positioning is based on a proprietary asset allocation application of the Kelly criterion formula, which calculates expected information ratios for each asset and allocates the volatility and leverage budgets accordingly.

It is also opportunistic in asset allocation. Whereas many macro strategies maintain exposure to at least three or four asset classes for diversification reasons, GLOMA has for much of the past two years been mainly in government bonds, which has been a good call: over this period, ten year US Treasury yields have dropped from 3.2% in September 2018 to all-time lows of below 1% in March 2020.

The rationale provides some insight into how the GLOMA process weighs up various inputs over different time horizons. Many discretionary macro investors have not been prepared to buy bonds on negative real (inflation adjusted) yields and some have even shorted them. Faulkner recognizes that bonds are not historically good value, but the GLOMA process views valuation as a longer-term driver of market prices, over 12-36 month time frames. In the medium term, over 6-12 months, economic data is given more importance, and expectations of a deterioration in leading indicators of GDP such as purchasing manager indices (PMIs) have contributed to the long bond stance. Near-term factors, including benign credit conditions, had been supporting bonds and equities until February 2020.

But GLOMA adjusts valuations to the macroeconomic backdrop, which resulted in a dramatic shift in their view on equities, based partly on R&M’s proprietary credit conditions indicator which has been a reliable predictor of equity market performance. Broadly, between March 2018 and February 2020, R&M were of the opinion that a stable macroeconomic climate and upbeat credit markets warranted higher valuations for equities. Conversely, the macroeconomic uncertainties around the coronavirus pandemic as of March 2020 now mean that, although equity prices are 20-30% lower, valuations are not currently deemed to be attractive. As of early April, GLOMA was sitting on the sidelines, awaiting an improvement in credit markets and clarity on exit plans from lockdowns before revisiting “risk on” trade such as equities.

5%

Though many managers bemoan the climate for macro investing, GLOMA has delivered annualized returns of circa 5% and profited in the fourth quarter of 2018 when equities were down.

Proprietary economic data models

R&M uses traditional fundamental macro data, such as PMI readings or credit spreads, but manipulates the data in its own way. R&M expects macro indicators to be both predictive and to make intuitive economic sense; they are not mining the data for improbable relationships. For instance, R&M would expect emerging market equities and debt to outperform developed markets when commodity prices are rising. This is not only statistically proven but also makes sense given the preponderance of net commodity exporters in emerging markets.

Bonds and equities have dominated exposure over the past two years, but R&M has also designed models for currencies and for various commodities. Faulkner views gold as a commodity rather than a currency and finds it easy to explain its rally: “negative interest rates mean gold in effect has carry; central bank accounting changes make it easier for them to hold gold; and it is also benefitting from the same distrust as crypto-currencies. That said, we don’t necessarily view gold as a defensive asset and it did not perform well in late 2018,” he points out.

Defining market motion: a nuanced perspective on trend

GLOMA needs to register market action confirming its fundamental views in order to build up decent position sizes. The approach to technical analysis pays some homage to one of the oldest hedge fund strategies, trend following CTAs. GLOMA recognizes that the simplest possible trend following strategy – trading in the direction of last month’s market move – would have outperformed a buy and hold approach, in absolute and risk adjusted terms. But the GLOMA approach to trend following is to use it as a secondary filter – a qualifying factor helping to determine whether, when and in what size fundamental data signals are actioned. For long positions, there needs to be some positive market momentum, while shorts require the absence of positive momentum (and would need negative momentum for maximum position sizes).

The approach is quite nuanced in that GLOMA categorises market movement into five states. In addition to upwards and downwards trends, there are consolidating upward phases, consolidating downward phases, and drifts. These acknowledge that markets are not in trending mode all of the time, and it is rangebound periods that can be challenging for some sorts of trend followers.

The next refinement is to apply probability distributions to the motion categories. The technical motion state of a market can only be known for certain with the benefit of hindsight, so some judgement has to be made about how much confidence the models have in bucketing recent market moves into one of the categories. These probabilities are derived from fundamental macro data, so there is a symbiotic relationship between the datasets here: the technical data not only acts as a filter for the fundamental data but is also conditioned by the fundamental data.

Additionally, the time frame for defining market motion can be varied. Trends are usually measured over a six-month time period, but this can be reduced to two months in faster moving markets.

Rebalancing and reweighting

The speed of trading can also vary. The strategy will generally scale in and out of positions quite gradually and incrementally as the multiple inputs behind the signals ebb and flow. But it can move much faster when market prices or shorter-term fundamental indicators – such as credit conditions – make a sudden move. For instance, if R&M’s proprietary credit conditions indicator spikes up, or if markets see a sharp pullback, they could close out positions in a matter of days. The shorter-term indicators also include market correlations, corporate earnings and commodity prices.

Notwithstanding the ability to invest solely in one asset class, correlations do feed into position sizing. R&M has a proprietary technique for forecasting market correlations that is quite accurate and can add or subtract 50% from overall exposures. This contributed to a scaling back of exposure in February 2020. The strategy back-test historically has delivered better risk adjusted returns when correlations are falling, but the relative value bucket strategies have done better in high correlation episodes. Hence the relative value bucket has been expanded in March 2020.

Just as the portfolio could have any combination of long and short asset class exposures it could have any combination of exposure to four thematic buckets: “risk on”, “risk off”, “relative value” and “currency” books, though it is very unlikely to be entirely in relative value. In late 2018 it was entirely in the risk off category. In March 2020 it was in a mix of bonds, currencies and relative value.

Short book

The relative value strategies have short books but there was no outright short exposure in March 2020. GLOMA rarely shorts because the upward drift of asset markets stacks the odds against it, and historical Sharpe ratios from shorting are much lower than on long positions. Valuation alone does not determine GLOMA’s directional positioning, though overvaluation is a necessary condition for shorting. For instance, “overvalued equities combined with weakening economic data and deteriorating credit, would provide the basis for a large short position. This was seen in 2007 and 2008, but not in fact in 2018. By the time negative momentum kicked in, the overvaluation had disappeared,” says Andrews. Similarly, in March 2020, though credit conditions were clearly adverse, and economic indicators dropped precipitously, GLOMA did not get strong enough signals overall to go short of equities, he revealed on the monthly investor call held in April 2020.

Relative value

Relative value strategies are a focus of research, not least because negative interest rates make directional approaches less attractive. The fourth quarter 2019 newsletter entertained the notion of shorting government bonds but concluded that more attractive risk/reward was probably on offer from defensive long or relative value approaches.

GLOMA is relatively unusual for a macro or CTA strategy in that it can allocate to both directional relative value strategies, such as value style emerging markets or large cap US equity, and market neutral relative value approaches. These are far from typical alternative risk premia (ARP) approaches, however.

Proprietary equity factor strategies

R&M has developed proprietary strategies based on various equity factors. Traditional factor investing will go long of stocks with one set of characteristics and short of those with the opposite ones – so a traditional value factor will own cheap stocks and short expensive ones. This is rather natural and intuitive given that a double negative equates to a positive in both mathematics and the English language, but Faulkner contends the approach does not make sense for factor investing. “Expensive stocks may be really fast growing, so for our value factor we would rather replace single stock shorts with a market index short book. We also consider value mainly on an intra sector basis, for most sectors, but can make exceptions for some. Whereas most value factors have lagged markets by a massive margin, our value factor has generated a few percent of alpha per year. Our quality factor has done even better,” he says.

“Our quality factor is massively different from generic ones. It is largely sector-neutral to avoid the biases that can arise from being long of defensives and short of cyclicals. We were frustrated with traditional quality measures based on debt ratios, profit stability and margins that over-emphasised capital structure. These implied that no real estate company could be invested in because property companies tend to use more leverage. I have been a CEO of companies for many years, over two thirds of my working life, and based on being a business leader we think that the quality factor should be based on the concept of a well-run company. Our metrics include an ESG overlay with indicators such as human resources, which measures employee satisfaction,” says Faulkner

“These factor approaches also vary the definition of factors according to the market regime. The way we define growth is very different as markets rally. In a down phase, stable profits are more important,” he adds.

“Some factor investing approaches can imply turnover of 170% or more per year. We have also developed proprietary methods to stabilize turnover and thereby reduce transactions costs,” Faulkner points out.

So far, a strategy based on R&M’s quality factor has been rolled out as GLAQ (Global Quality). Other equity factors may be offered and a multi-factor approach could be developed, rotating around factors according to the market regime. Relative value approaches could also be developed for other asset classes.

The GLOMA UCITS currently has a 400% leverage guideline (calibrated to ten-year bond equivalents for government debt) that was designed to allow directional strategies to keep within the UCITS volatility caps. But this limit is not set in stone, and could be revised to accommodate larger allocations to relative value strategies. GLOMA uses the VaR UCITS approach rather than the leverage limit of 200% to allow for derivative strategies in the first place, and this VaR limit leaves plenty of headroom for using greater leverage.

GLOMA can also allocate to R&M’s emerging markets strategies, which have their own approach to factors.

Elements of discretion

The GLOMA process is substantially systematic, though the models used have also informed R&M’s discretionary fiduciary mandates since 2003 and it is worth enumerating where discretion enters the process.

Given the prevailing set of models, the only element of discretion over their implementation is the potential to de-risk the whole portfolio if the models are missing something. Discretion cannot be used to increase risk levels nor change individual positions. But the models are not constant: existing ones can be honed and refined while new ones are being developed in an ongoing and evolving drive. “We are directing research for the whole macro team. If we see weaknesses looking ahead, we may direct research into those areas to evolve the models over time,” says Andrews.

“Discretion also determines the investment universe, which has recently added currencies and will contemplate adding commodities in a UCITS compliant manner (likely to involve swaps),” Andrews adds.

There is also some judgment over the choice of instrument used to express trade ideas, which might be futures, swaps, cash instruments, options and so on. “This is reasonably formulaic as it is usually fairly obvious which the cheapest and most liquid instrument is,” clarifies Andrews.

The final element of discretion can occur over the timing of trade execution. The portfolio is usually rebalanced monthly (absent any discretionary de-risking or breaches of UCITS risk caps) to control transaction costs but might be done a bit earlier or later to avoid possible volatility around policy decisions for instance.

Vehicles and instruments in Europe, US and Australia

GLOMA is currently offered as a UCITS for the European market. R&M might package it into Delaware and Cayman structures for the US market and already has an Australian unit trust platform for that market, which is the world’s fourth largest pension market by assets. “Our four main markets are the UK, Europe, the US and Australia,” says Barham.

The UCITS product is imminently introducing a 6% hurdle rate under the 15% performance fee. The hurdle rate will be defined by the appropriate interest rate benchmark for each currency share class. In its early days the fund’s non-fee expenses were capped at 0.45%, with R&M covering any excess. Now that assets are close to $200 million the non-fee expenses are spread across a much larger pool of assets and so are a much smaller percentage. Capacity for the strategy is estimated at $10 billion.

“The equity factor strategy is currently offered as a total return swap, which is also very capital efficient for insurance companies. Long only equities attract a capital charge of 40% but our zero beta TRS has one of only 7%. It also has lower fees than many hedge funds, and lets investors dial up or down to their preferred risk target,” says Faulkner.

R&M has an insurance solutions division (P-Solve acquired specialist insurance consultant, Meridian Consultancy, in 2011).

Firm outlook

GLOMA fees – and those on R&M’s total return swaps – are competitive by hedge fund standards, but also much higher than the fees R&M can obtain for its more traditional, fiduciary and derivatives strategies. A back of the envelope calculation suggests that if R&M can raise a few billion of assets for liquid alternatives, it might multiply its revenues. Net performance fee income also contributes towards a special dividend for shareholders in the LSE listed firm. In late March and April 2020, several R&M directors expressed their confidence in the company’s prospects and acquired shares.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical