RWC Samsara

Generating risk-adjusted returns

AJAY GAMBHIR

Originally published in the September/October 2012 issue

Samsara aims to generate absolute returns where the profile of the returns, as well their magnitude, is key. We follow the principle of ‘risk-adjusted return’, which means targeting an absolute return with significantly lower volatility than the equity markets and a positive monthly skew. This objective translates into the approach we use to manage the fund:

• A focus on ‘exit’ points from positions (both long and short) as well as ‘entry’ points helps monetise return and contributes to the positive monthly skew

• Looking to achieve alpha on both the long and short book through a blend of contrarian opportunities (called ‘turning point’ ideas) and pragmatic ideas based on valuation and growth (e.g., negative growth ideas for the short book where franchises are being eroded)

• A clinical approach to fundamental analysis which can help identify where the consensus might be most wrong-footed, and

• A top-down approach, 20-30% of the process, which helps steer the fund.

Attribution analysis shows the contribution of the long and short books in almost equal measure over time, but inevitably the short book can be the most intellectually rewarding, especially if the shorts are over-owned or consensus longs! In 2011, particularly in the first quarter, the fund benefited from its shorts in the industrial sector.

To our minds the sector was vulnerable because investors were embracing views that were unsustainable: firstly, that the cost-cutting, which many companies had instituted in 2009 in the teeth of a global recession, could be extrapolated; secondly, that the exposure to emerging markets would lead to continued revenue growth above analysts’ expectations; and, thirdly, no account was being taken of how higher raw material costs would pressure margins and hence earnings.

Analysis of consensus forecasts for a number of stocks in the sector exposed the over-optimism inherent in the sales and margin projections and to us constituted a potential future ‘negative turning point’. Thus, we expected the stocks would post earnings lower than consensus expectations and that the profit warnings would lead to share price declines. We also ideally like negative turning points to have very full valuations as the industrial sector did in early 2011. This allows a ‘double whammy’ in the share price decline, with earnings declining and the stock multiple de-rating at the same time, leading to a sharper or more extended decline in share prices.

Another example of the approach to shorting is a short that was undertaken in 2011 in the UK banking sector. The stock was a favoured holding in the long-only community and had outperformed the sector significantly. What caught our interest was, as with most ‘turning point’ ideas, that investors were extrapolating past financial trends but where the support for those trends was waning and new headwinds were emerging. Our approach to financial analysis rests on being clinical and dispassionate, and being generalists helps as this ensures that the team has no vested interest or attachment to any sector. In the case of the UK bank, we spotted that the balance sheet funding was not robust enough to allow net interest margins to expand how consensus had predicted them to, nor did we calculate lending growth to be the high single digit rate investors expected.

Our focus and time-frames are perhaps somewhat different to traditional fundamental investors: we actively try to distil out the softer issues and try not to become too embroiled in questions of corporate strategy or management, rather focusing on the numbers and seeing the company through the eyes of a CFO. This can make us more alert to looming surprises of a financial nature.

Our approach to the ‘top-down’ is also in some ways quite fact-based. We do not believe that it is possible to reduce volatility if we impose our view on how the macroeconomic cycle ‘should’ unfold. Instead, we carefully monitor different asset class behaviour and changes in the macroeconomic environment to inform our view on the risk/reward for equities (regionally and by sector). Adhering to this principle enables us to most often pre-empt changes in the equity risk profile. Where we are late at least we ensure we are not too late.

Furthermore, it is important to recognise that both economies and markets can confound the sceptics in both directions. The dogmatic view can become irrelevant for long periods of time. There are three main reasons for this: firstly, there are feedback loops from financial markets into the real economy which can accentuate economic developments in vicious or virtuous circles; secondly, economic data can be altered by the behaviour of people, their confidence and fears, which are difficult to forecast and thirdly, policy-makers can ‘interrupt’ forecasts by speeding up or slowing down economic development generally, or targeting particular activities (e.g., the housing market or business capital expenditure).

Risk management is an activity which resides both within the Samsara team and also outside of the team through independent analysis and oversight provided by RWC. Crucially, whatever models and analysis one undertakes, it is important to try to understand how the portfolio is behaving and what unintended risks may be within the portfolio. Overall, I think it is important to learn and adapt – I have made numerous mistakes over the years and look to see how we can improve the outlook for our clients by learning from them.

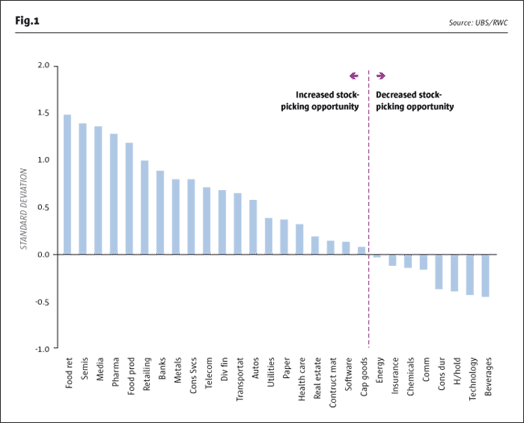

In terms of regional outlook, Europe has suffered the most dysfunctional markets and so most likely offers the most opportunity from a normalisation of the market environment. One key area is the spread of valuations which is at multi-year highs both between sectors and within sectors. Thus the medium-term prospect of valuation arbitrage is very real. At a sector level, the valuation dispersion is far greater in Europe than, for example, the US (according to data from Bank of America Merrill Lynch) and so the opportunity to make money from sector bets should over time be greater in Europe if there is mean reversion. By way of example, we see anomalous valuation gaps between, say, autos and industrials which are very similar in terms of their cyclicality and end markets, or telcos and the food sectors which are both classified as defensive but on very different multiples. In the bar chart (Fig. 1) one can also see that the spread of valuations within sectors is greater than it was five years ago for the majority of sectors, so in theory the stock-picking opportunity should also have improved.

We continue to believe that the key risks to global stock markets lie outside of Europe. Stock markets outside of Europe have less valuation support than Europe, and in many cases are more reliant on the expectation of central bank support, for example in the USA. Fundamental economic fragilities (such as high indebtedness, asset bubbles and current account deficits) are more worrying in our view in Asia Pacific, Brazil, Japan and the USA than in Europe. However, we need to acknowledge that stimulus is building in China and further stimulus may be actioned in the US soon; the amounts and consequences of such stimulus need to be monitored. In an uncertain economic environment we find that more of our long ideas involve restructuring or cost reduction plans to offer the prospect of earnings growth and stock re-rating; since valuations are most reasonable in Europe in a global context this re-rating prospect has a clearer risk/reward than in some other geographies.

Ajay Gambhir joined RWC in May 2007 to establish the firm’s European equity team. He was previously a Managing Director at J.P. Morgan Asset Management where he was lead portfolio manager for the Dynamic European Equity funds.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical