Generalisations can be dangerous in European credit markets, because any rule has exceptions and it is precisely the anomalies that provide the greatest opportunities. Headline yields for European high yield are well below those for US high yield, but the tables can be turned for mezzanine structured credit, which pays significantly more in Europe than the US. Many segments of direct lending have seen yield compression as tens of billions have been deployed, but a number of niches can still command premium returns and AIMA’s survey Financing the Economy 2016 found that eight of the nine most attractive destinations for private credit were in Europe. Plain vanilla trade finance may now pay as little as 2-3%, but again there are sleeves in the space that offer double digit yields. In consumer debt, whole loans of high quality may only offer high single digit yields, but expertise in acquiring, warehousing and structuring these assets can generate much higher returns. At the same time, Chenavari has more liquid strategies, including a UCITS, with lower return targets and “private wealth managers are quite happy with high single digit returns which have been steadily delivered over the years,” says founder, CEO and co-CIO, Loic Fery.

He is proud of the firm’s first ten years, which have seen the company “build a solid infrastructure and assemble a talent pool to cover the full spectrum of credit assets, something quite unique in Europe”. Chenavari’s reach spans the most liquid indices, options and derivatives, to subordinated bank papers such as contingent convertibles, through to leveraged loans, structured credit, asset backed securities, private debt, bilateral loans with multi-year maturities, and a spectrum of verticals in speciality finance.

Assets of $5.4bn place Chenavari firmly in The Hedge Fund Journal’s Europe 50 ranking of the largest 50 hedge fund managers in Europe. Roughly half of the firm’s assets are now in illiquid credit and private debt. Impressive though Chenavari’s in-house team is, the mainly employee-owned firm (Dyal Capital Partners, which is part of Neuberger Berman, took a small passive minority stake in 2015) could not pursue all of its strategies in specialty finance without the help of its joint venturepartners. “We have more than nine partners in seven countries, originating over a billion each year and providing an edge in our ability to service these complex specialized assets where we can still find attractive yields,” says Fery. On top of Chenavari’s 107 staff, including 41 investment professionals, there are another 700 people working at these speciality finance partners in many European jurisdictions. Some new entrants to the European direct lending space might be opportunists, and “perhaps only relocate five or ten people to Europe,” observes Fery, but Chenavari works with those who know the terrain. “We have acquired several regulated companies that have over 20 years’ proven experience of underwriting and servicing loans,” Fery illustrates. Chenavari has already deployed over €4bn into European private credit.

Chenavari is not primarily in the business of originating debt in order to distribute it, though some structured deals may be partly refinanced. Chenavari is chiefly originating to retain loans for investors. Which means, “we need controls on risk underwriting, and we always focus on returns after cost of risk and cost of servicing, such as consumer loans and equipment leasing,” says Fery. “We have a consistent bricks and mortar approach to credit origination, as opposed to the one click approach that most peer to peer lending platforms offer,” he underscores.

These capabilities allow Chenavari to steer its portfolios towards the most opportune market segments. In mid-2017 “on a relative basis, mid-market lending to corporate, simply secured by EBITDA has become less attractive as spreads have narrowed and most importantly leverage has increased,” Fery observes. Instead, Chenavari rotated 4 years ago towards “asset-based lending, based on tangible collateral and private loans that can be structured with better downside protection,” says Fery.

Chenavari runs approximately $1.8bn in private credit closed ended funds, revolving around three sub-strategies: bank performing portfolio acquisitions, specialty finance origination and other opportunistic asset-based loans.

The alchemy of securitisation

“Chenavari had a first mover advantage in European bank deleveraging as we started years ago and we talk to more than 50 banks in 12 countries,” says Fery. Chenavari has the infrastructure to source, acquire, structure and securitise pools of whole loans, turning them into CUSIP codes for publicly traded securities, or carrying out private securitisations. This process of transformation can extract chunky spreads. One example was a pool of €500 million of consumer loans acquired in 2014 in the Netherlands. Chenavari used its Quander subsidiary (formerly known as Laser Netherlands), which has been originating and servicing loans since 1994, to do this deal. The average portfolio yield was 10% while running default losses are just over 1%, leaving a very attractive net yield higher than 7%, after cost of risk and servicing costs. What seems extraordinary is that Chenavari was able to refinance the top 80% of the pool at a weighted average yield lower than 2%, thus eating up less than 1.6% of the total pool’s net yield. Insurance companies, pension funds, and banks have a big appetite for senior paper offering this level of yield. The residual of yield, divided by the remaining 20% of capital, adds up to an attractive gross return on capital of nearly 30%, which Fery views as smart alpha, boosted by the combination of strong fundamentals in Netherlands and ECB monetary policy which is quite IRR-accretive to Chenavari’s investment strategy. Part of this can indeed be viewed as a QE windfall, because pre-QE the top 80% would probably have been refinanced at closer to 3.5%. “QE has increased the expected IRR on this type of specialty finance lending activities by between 8 to 10 percentage points,” Fery calculates. Nonetheless, even without the QE uplift, a significant arbitrage remained. Chenavari can of course see that QE tapering has begun but does not expect QE will vanish overnight. “Just look at how slow the process has been in the US,” Fery notes. When, and if, QE is fully unwound, naturally the senior part of the capital structure will revert towards previous levels of yield, but there should be ample time and forewarning to reposition portfolios accordingly.

European bank deleveraging

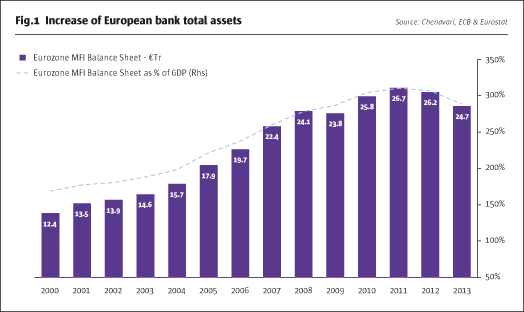

European bank deleveraging predated QE and could continue well beyond QE in Europe. It is one of those megatrends that seems to get bigger every year, but the dynamics are also changing. The annual notional of bank loans sold has trebled from around 30-40 billion euros per year in 2012, to over 140 billion last year, and the composition of the divestments has changed radically. At first banks got rid of non-performing loans as part of the process of cleansing and rebuilding their balance sheets. Now, more babies than bathwater are being cast aside. Approximately 40% of loans sold by European banks in 2016 were, in fact, performing. Some are RPLs or re-performing loans – hitherto NPLs or non-performing loans that have come good as Europe’s economy picks up. In other words, these were once delinquent loans that have now resumed making timely payments.

Yet the price action can remain divorced from the improving fundamentals for extended periods. Fig.1 shows how credit quality on Spanish RMBS has been steadily improving since late 2013, with delinquencies having roughly halved, and levels of subordination – providing a cushion against losses – having increased by two percentage points. However, the price of these assets fell between late 2014 and late 2015, and despite some recent recovery, they trade well below historical levels. The obvious explanation is that insufficient capital exists to mop-up forced selling from banks.

It is regulation that continues to force Europe’s banks to sell high quality assets and Fery thinks that the offloading could even accelerate due to 2019 deadlines, combined with preparation for still-to-be-finalised Basel IV. Europe’s transition from bank towards capital market finance is a multi-decade process.

If the supply of opportunities has increased, so too has the demand for them as yield-starved investors put tens of billions to work in the space. Spanish RMBS may still offer good value but some parts of the market no longer satisfy Chenavari’s risk/reward criteria. “Spreads have halved for some SME loans and mid-market leverage multiples are increasing,” observes Fery.

Some investors are of the opinion that longer dated assets, to pick up illiquidity and duration risk premia, are the only way to meet their target yields. To some extent, Chenavari would have to agree with this, but the manager is also searching for what could be termed complexity premia. Certain assets in the credit markets may pay a premium due to the barriers to entry entailed in sourcing, analysing, structuring, warehousing, refinancing and so on. Collateralised lending, equipment leasing, trade finance, secured corporate lending, real assets lending, and consumer finance such as personal loans and credit cards, all offer potential for juicier yields in certain countries.

Opportunistic private debt and speciality finance

Chenavari’s European Private Credit Fund and mandates focus on selected trade types in European speciality finance where banks’ retreat from traditional lending leaves gaps in supply chain and receivables finance that can be filled by speciality lenders. Three broad categories include specialty corporate finance, which can be trade finance, equipment leasing or corporate receivables; then consumer finance, such as credit cards and personal loans; and real assets backed lending, which can involve lending at low loan to value ratios against inventories, tangible goods, or transportation assets such as railcars and ships. Yields, on average, range between 8% and 12%, mainly in whole and senior loans, which will generally not be syndicated with others. Currently Chenavari is offering a customised product targeting 8-9% net over 5 years without leverage, particularly suited for insurance companies. Half of Chenavari’s 41 investment professionals are pursuing private credit and the plan is to do 12 to 15 deals per year, focusing on smaller deals. Chenavari has started looking for anchor investors for its third European Private Credit fund which it intends to first close in early Q4 and will include the full spectrum of Private Credit opportunities pursued by Chenavari, with a capital raise targeted at €750m to €1bn.

Chenavari is opportunistic in its geographic allocations, which are the consequence of where it finds the best opportunities. There is no cookie cutter approach for each country and deal types tend to be different in each. Personal finance and credit cards are focused on Belgium and the Netherlands, using two regulated originators: Qander Consumer Finance which was acquired from BNP Paribas Personal Finance in 2014 and BuyWay Personal Finance which was also once part of BNP before being bought out by a private equity firm. In the Netherlands, unsecured consumer debt was identified as offering a very attractive risk/reward. Pools of mortgages have been acquired in Spain and Ireland, where Chenavari accurately anticipated the drops in non-performing loans as these economies grew. Also in Spain, many SMEs are starved of bank capital and Chenavari are also providing working capital to companies through collateralised lending and factoring of short term receivables. In Ireland, buy-to-let mortgages, backed by Dublin real estate, are another segment riding on the resurgence of the Celtic Tiger and Chenavari has a minority stake in an established specialist buy-to-let lender, which is regulated by the Central Bank of Ireland. In France, equipment leasing, which can involve medical equipment for dentists or IT systems for companies, is particularly appealing as these items rank highly in the capital structure. Chenavari has quietly been doing deals in Greece for some time, and has recently become more vocal about this. Greece is of course classified as an “emerging market” in some indices, and Chenavari did much local research before taking the plunge. “We have people on the ground and spent a lot of time there, meeting banks, CEOs, and political leaders to identify several themes for deploying capital,” says Fery. One area is real asset-backed loans, at very low loan to value ratios, to leave a big cushion to absorb repricing. Another segment is the public healthcare system. What is less well known is that the hospitals themselves are owed money by central government in Greece, so there are opportunities for acquiring what should ultimately be a sovereign receivable.

Turbocharging CLO returns with rebates

Chenavari’s first CLO was priced in 2014 and the manager now runs approximately $1.6bn in European CLOs. Chenavari recently closed its third CLO, Toro European CLO 3 (TCLO3), and has a fourth one in the pipeline but Fery stresses “we are very much creating CLOs to retain the risk and are not in the asset gathering mode pursued by the firms closing several CLOs each year”. Chenavari co-invests in its CLOs ensuring the firm’s alignment of interest. For instance “Chenavari’s Taurus Originator retained a 5% minimum economic interest in the transaction, equivalent to the risk retention requirement,” the release states. When Chenavari’s vehicles, such as LSE-listed Toro, managed by longstanding portfolio manager and partner Benoit Pellegrini, invest in CLOs that are managed by Chenavari, some 50% of the management fees are retroceded to Toro, so that “investors can access CLO risk at a boosted IRR, potentially as high as 18-20%,” says Fery. Some US managers only retrocede 25% or 30% of the fees when sub-allocating to their own CLOs, according to Fery. Chenavari tends to close CLOs when they are largely invested, to permit maximum clarity for investors, and Fery is critical of managers who close CLOs that are only starting to ramp-up. Aside from these details, the overriding reason for being in the CLO business is that “the arbitrage still exists,” observes Fery. A spread between the cost of CLO liabilities and the yield on their assets remains. Toro, which has a Euro share class, announced on 12 May 2017, “The Company’s dividend target has been increased to at least €0.08 per ordinary share per annum, compared to the initial target of EUR 0.05 (annualised)”. A pay-out of 8 cents would equate to a yield higher than 9% on the current share price of €0.86, which stands at a discount of 14% to the April NAV of €1.0029. More information on the trust is available at www.torolimited.gg.

Real estate debt

In commercial real estate lending, Chenavari is also selective within each country. In the UK, Ireland, and Germany, Chenavari find student accommodation attractive partly as rental yields are so much higher than for other types of residential property. Prime retail is sought out in London, Paris, Madrid, Barcelona and the Netherlands, with several deals done in partnership with major international developers. Last mile distribution logistics is a common theme in several countries. Most projects involve transformation, and include a value-add component.

Liquid alternatives, including UCITS

Though much of Chenavari’s asset growth has come from the illiquid strategies above, it manages a total of $2bn in what it terms tradable credit hedge funds, which are managed on a daily basis by the other Chenavari co-CIO, Frederic Couderc. The firm has always been active in liquid credit and runs three liquid strategies. It has a weekly dealing UCITS fund, the Lyxor/Chenavari Credit Fund, which pursues European long/short credit in investment grade, high yield and financials. It sits on Lyxor’s UCITS platform (which has won The Hedge Fund Journal’s award for Best UCITS Platform). The UCITS has three broad strategies: corporate, financials and an option-oriented strategy, which has been negatively correlated to the other two. The trading strategy can, opportunistically, run significant beta and directional exposure but in mid-2017, Chenavari “is not looking for a home run from the beta trades which caused losses for some managers in 2015. We are known to be focused on downside protection,” says Fery about the firm’s tradable credit hedge funds. Given yield compression, their recent focus has been on relative value opportunities, with three market areas offering stronger yields. “In the European CLO space, when properly selected, mezzanine tranches still offer a massive premium over the US, and the deals are far from being breakable, as these exposures sustain a far greater default stress compared to the US market,” says Fery.

The complexity and unpredictability of European bank regulation, with various parts of the capital structure being bailed in or bailed out, in different ways, in different countries, may explain why European bank paper could be undervalued. Chenavari thinks that yields in selected European financial instruments, such as additional tier one (AT1), could tighten by 150 to 250 basis points. These obligations offer a premium over corporate high yield BB-rated debt, and there are constructive technical factors. “The ECB wants to reduce financial fragmentation within the Eurozone and the primary market is open even to second tier peripheral banks,” Chenavari’s presentation states.

The third source of additional yield in tradable credit is simply longer duration bonds, though Chenavari is treading more cautiously here: “this is indeed one of the last areas where investors will be chasing yield, but the curve will have to steepen at some point,” says Fery.

In liquid credit, portfolio turnover can be as high as 4-5 times annually so these can be shorter term, tactical, trades as well as longer term, buy and hold trades. The three themes above have paid off with the UCITS delivering strong returns since its “relaunch” in February 2016. The relaunch revised down the volatility target and set up a dedicated liquid alternatives team led by deputy CEO, Vincent Laurencin, and co-portfolio managers, Demian Duwe Brasil and Stephane Parlebas who are exclusively focused on liquid alternatives. Brasil has been a PM at Chenavari since 2008 and Parlebas has been a PM at the firm since 2010. Since relaunch, the fund has delivered more or less double its annualised return target of low to mid-single digits, making 13.02% between February 2016 and May 2017, which works out at an annualised return of 10.59%. Chenavari also runs a monthly dealing multi-strategy fund that has a similar mandate to the UCITS, but somewhat more flexibility over its investment universe.

Short oriented fund

Chenavari’s third liquid strategy is a short-biased fund, launched two years ago. This is intended to provide a tail risk, portfolio insurance, hedge that aims to make as much as 100% in a credit market crash or crisis, while containing the “insurance” costs in normal conditions. The short strategy is managed by Chenavari co-CIO, Fred Couderc, and can also be customized in dedicated mandates.

Brexit

The size of the French diaspora makes London “the world’s sixth largest French city” and Fery has lived in London for 15 years. The firm has just signed a 10-year lease for its 80-strong UK subsidiary on new, 12,500 square foot offices at 80 Victoria Street, London SW1; the firm also has also offices in New York, Hong Kong and Luxembourg, where the group is headquartered. Though Fery does think that a stronger Europe, associated with Macron’s victory, could bode ill for Brexit negotiations, he thinks that ultimately a sensible Brexit package will be worked out. Fery finds it inconceivable that the firm could not continue to employ the two thirds of its staff who come from other European Union countries. The number of European languages spoken by the team is invaluable for on-the-ground negotiations. Fery is confident that “Chenavari is hedged on a hard Brexit”, as the firm’s Luxembourg-domiciled vehicles will continue to avail of UCITS and AIFMD passports for distribution in the EU. Notwithstanding Brexit, Chenavari’s destiny lies indeed in Europe.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical