In Singapore, government agencies have, over the years, been making a concerted effort working closely with the financial and investment community to grow and enhance Singapore’s position as a regional and global asset management hub. The Monetary Authority of Singapore (“MAS”), in particular, has been instrumental in this regard with its reputation of being a very engaging, measured and forward thinking regulator.

The results have been stunning and arguably Singapore has successfully positioned itself as a leading regional asset management hub serving as a pan-Asian gateway for regional and global investors.

To build on the success and the growth of the industry, it was announced on 16 March 2016 by Ms. Indranee Rajah, Senior Minister of State for Law and Finance, that the MAS together with the Accounting and Corporate Regulatory Authority of Singapore (“ACRA”) were studying the introduction of an open-ended investment company regime for investment funds that will facilitate the local domiciliation of funds and promote the fund administration industry in Singapore. It is hoped that this new regime will give an added boost to an already vibrant asset management ecosystem.

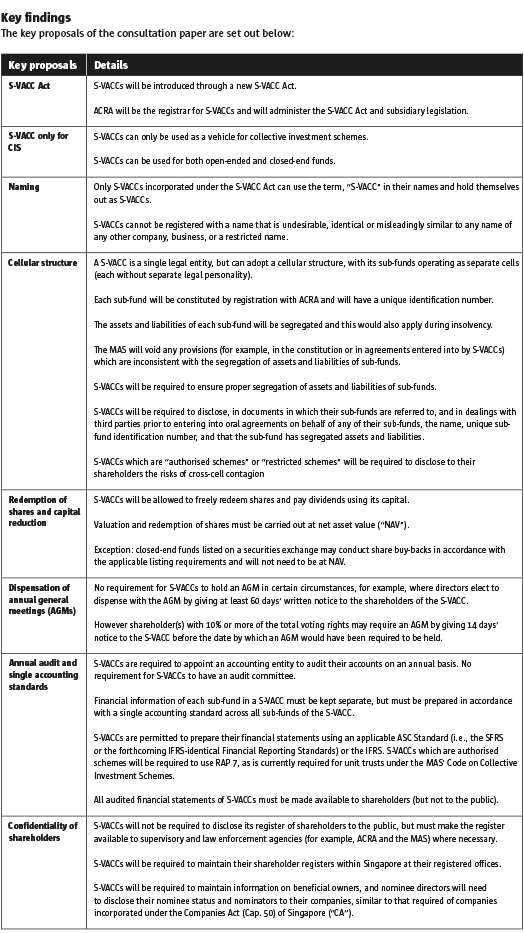

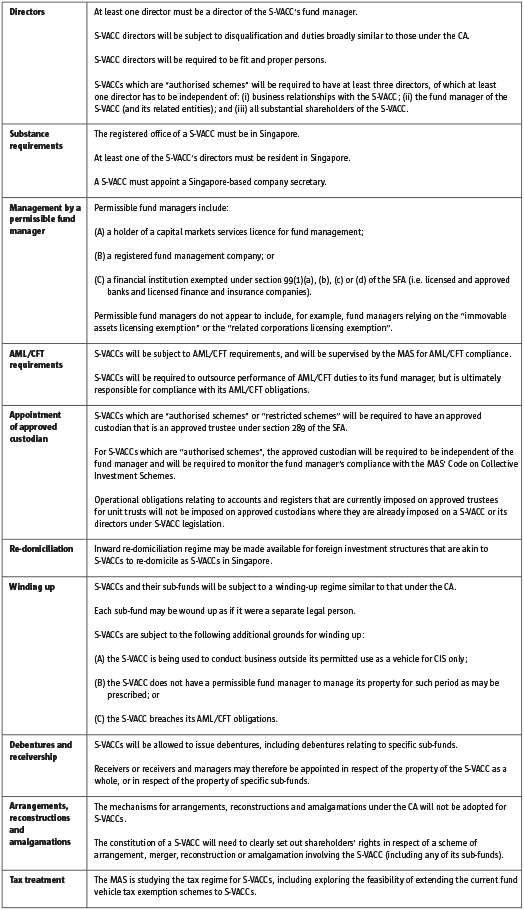

On 23 March 2017, the consultation paper on the new corporate fund vehicle, named the Singapore Variable Capital Company (“S-VACC”), was issued by the MAS. In coming up with the proposed new framework, the MAS took into account laws and practices of other leading fund jurisdictions such as Luxembourg, the Republic of Ireland and the United Kingdom where similar open-ended corporate-type fund vehicles already exist.

Hedge funds and other open-ended funds

For many years, private open-ended funds managed or advised by fund managers in Singapore have been and are still predominantly domiciled offshore (for example, in the Cayman Islands) or established as Singapore unit trusts.

The Singapore unit trust is more commonly used for MAS-authorised retail funds whilst the Cayman Islands exempted company remains the most popular offshore vehicle for hedge funds. This is due mainly to factors such as investor familiarity and general practice and precedents.

The S-VACC will provide a new option and is expected to pose significant competition to existing offshore open-ended vehicles.

As at the time of writing, the MAS has not published its responses to the feedback received from its public consultation. However there are certain areas which, we believe, will be considered more closely by the MAS having received various comments from industry participants. For example, whether the permissible fund managers should include fund managers who are relying on the “immovable assets licensing exemption” or the “related corporations licensing exemption”. This would encourage greater adoption of the S-VACC by fund managers based in Singapore.

Questions have also been asked as to whether the existing fund tax incentive schemes will be extended to the S-VACC.

We expect these issues will be addressed in the MAS responses to come.

Looking forward

There is much optimism that the S-VACC legislation will be passed into law and implemented before the end of 2018.

With the appropriate tax and regulatory backing as well as widespread industry support, the S-VACC is expected to be well-positioned to compete with the more traditional legal vehicles in the hedge funds space in Singapore.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical