Sissener’s assets have grown to over two billion Norwegian Krone, which is approximately $250 million at current exchange rates. Nearly all of the investor base is Norwegian, high net worth individuals. Most are based in Norway but there are a few expatriates. Sissener has, thus far, done very little marketing outside Norway, and has not yet registered the fund for sale in many other EU countries. Having passed the five year mark that many institutions insist on, Sissener is now seeing inflows ramp up and some local pension funds have started allocating. All of the firm’s assets are now in the UCITS fund. When the company started eight years ago, assets were in unlisted closed ended funds for the first few years.

The team has grown to five analysts and portfolio managers, three in risk and compliance, two in the middle office and two salespeople. The analysts to some degree specialise in sectors, such as financials, shipping, energy and oil services. Sissener is looking to hire an international stock-picker, likely to be aged 35-40 with a strong track record. The individual would probably be based in Oslo, and would probably need to be fluent in Norwegian, but Sissener would not rule out opening a London office for a strong candidate. Founder Jan Petter Sissener jests that he might relocate to London if the Social Democrats return to power and further increase Norway’s already high taxes. In truth, Sissener – who spent most of his career running and building brokerage businesses on the sell side – has lived through plenty of socialist governments before and mentions the local joke that “under the Socialists, the market goes down for three months and up for three years because they spend so much. Under the Conservatives it goes up for three months and down for three years”. Irrespective of politics, Sissener’s returns have been remarkably consistent through the Labour-led coalition under Jens Stoltenberg (who is now Secretary General of NATO) and then the Conservative-led grouping with Erna Solberg as Prime Minister.

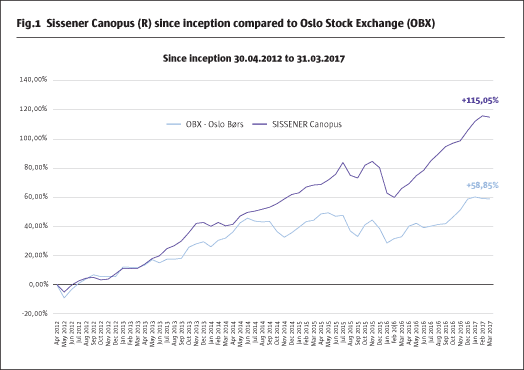

Sissener aims for absolute returns in all market conditions, and has attained this aim with positive returns in all calendar years since inception. Returns have annualised at 17.5% over the fund’s first five years, well ahead of the local market. This has been attained with net equity exposure typically ranging between 50% and 80%, which implies substantial alpha generation relative to the Olso market. Because the volatility of returns has been relatively low, Sissener Canopus has generated high risk-adjusted returns, which have earned the fund The Hedge Fund Journal’s UCITS Hedge award (in the Global Long/Short Equity category) no less than four years in a row. Awards have been calculated in the 2014, 2015, 2016, and 2017 rankings, for risk-adjusted returns over various time periods of between one and four years.

Short book profits

Though an unconstrained mandate allows for freedom in asset allocation, it is equities that have been the best source of opportunity – on both the long and the short sides. Sissener’s short book has been relatively small over the life of the fund, but it has made an important contribution. Sissener does not view shorts as a hedge for other positions, but rather as profit centres. The firm is quite open about its short book, partly because Norwegian regulations require public disclosure of short positions in excess of 0.5% of a company’s equity. The biggest short winner, which has contributed 2% points of performance to the fund this year (net of some losses on the debt), has been oil services firm, Seadrill. The fund began shorting the stock at a price of NOK 260 (pretty close to the peak) and covered much of it at NOK 5. “The company has poor management and a complicated structure,” says Sissener, who is a stickler for good corporate governance. The cost of borrowing the equity has recently been as high as 40% annualised, and, though Sissener was able to locate some borrow at between 28% and 32%, he has not been able to add to the position lately. Sissener expects shareholders to end up with about 3% of the enterprise value after a refinancing. The fund owns some Seadrill debt, which he views as quite cheap. Now that the equity short trade has played out, he plans to stick with the debt. Elsewhere in oil services PGS (Petroleum Geo-Services ASA) was shorted on the basis that it faces “oversupply, and competitors that own their boats and are cutting rates”. Offshore seismic has been an important short theme for Sissener for several years.

Another heavily indebted short has been low cost carrier Norwegian Airlines. “Depending on how leases are accounted for, only about 6% of the enterprise value is equity and the rest is leverage,” points out Sissener, who thinks “the company needs to de-lever by raising a lot of equity or needs to sell some planes as it is committed to take delivery of 35 billion NOK worth of planes”. The high debt burden makes Norwegian – which is currently borrowing at around 4% – vulnerable to higher interest rate rises that Sissener foresees. The firm has never paid a dividend and management regularly sell their own shares partly to pay Norway’s wealth taxes. Unfortunately, Norwegian stock has, like Seadrill, become hard to borrow. “Though the management lend out their own shares, they recall them annually,” says Sissener. For now, Sissener has covered the short at a profit but it may be revisited. A short also motivated by overcapacity and price wars is fertiliser maker Yara International.

Meanwhile, other shorts have different types of rationales. A short in Danish energy firm, Dong Energy, is designed to profit from a specific catalyst: when a lockup expires, certain shareholders are likely to sell down their stakes. There are also concerns about whether Dong will be able to effectively compete for bidding on windmill projects, absent subsidies, without suffering some margin pressure. A valuation-driven short position has been Schibsted (SCH) media, which “dominates printed media in Scandinavia but has a high valuation, and is threatened by Google and Facebook,” says Sissener.

Oil price plays

Moving to the long book, Sissener’s two big picture macro themes are higher oil prices, and higher interest rates. Sissener expects oil prices to be floored around 50 with scope to rise to 60 or 70 dollars per barrel in the near term, and confidently predicts higher oil prices on a four year view. The fund’s largest oil holding is Royal Dutch Shell, which satisfies all of Sissener’s criteria: “it is high yield, high potential, high quality and high liquidity,” he says. Sissener thinks that “the 7% yield is sustainable because the firm will not risk anything to cut the dividend”. Sissener bought into Shell via its acquisition of BG, which means that, in effect, the fund bought Shell at a discount – because BG was trading below Shell’s offer. Another core oil holding is local giant Statoil (whose previous chief executive, Helge Lund, briefly headed up BG). “Though Statoil still has too much government influence, it has new management and is reasonably priced with a 6% dividend yield. All of the oil majors have cut costs as oil prices came down and Statoil should report good numbers. It is mainly a way to play our oil price outlook,” Sissener explains. Another mature oil company position is Russia’s Lukoil, which is very cheap and cash generative with a strong dividend yield of 7-8pc.

Oil companies with higher risk profiles are smaller positions. These include London-listed Faroe Petroleum. “This is an interesting small E&P player. It only produces 17-18,000 barrels per day (bpd), but has a stake in a big discovery at Brasse that could contain up to 80 million barrels equivalent. This and two other fields could increase production to 30-40,000 bpd by 2020,” says portfolio manager, Viktor Sandland. As well as growth, the valuation is appealing. “It trades at 0.5 times NAV, while other players trade at NAV,” says Sandland, who also thinks that Faroe might find further M&A opportunities after its acquisition of assets from Dong Energy last year. “Bigger players such as Exxon and Shell are selling out of smaller fields,” Sandland points out. He reckons Faroe can break even at an oil price of between USD 30 and 35. “The firm has a strong balance sheet with cash, a 300 million revolver facility, and limited capital spending needs because it is picking off in-fill developments rather than big projects,” he adds.

Sissener also has exposure to Aker BP, which took over BP’s Norwegian assets, having previously taken over another oil company. Sissener is playing Aker through buying long-dated options, partly because the team recognise that the stock could have downside. The fund is also short of some options on Statoil. The net effect is that the fund is paying away very little premium and this is typical of how Sissener trades options – one option position will be, to some degree, funded with another. All of the option positions are exchange-traded.

Notwithstanding these compelling fundamentals, Sandland admits “at the end of the day it is all about the oil price and you have to believe in a higher oil price”. Sissener’s thesis for higher oil prices echoes some of the arguments presented by oil trader, Pierre Andurand, who has been interviewed for this publication (see Issue 120). The upside risk to oil prices is based partly on global oil industry capital spending, which has fallen by 50% between 2014 and 2016, and is forecast to be flat this year. Against a backdrop of declining production from major oilfields, reserves are not being replaced fast enough. Despite strong US shale production, and uncertainty over OPEC, Sissener is, on balance, moderately bullish.

Financials and interest rates

Norwegian life insurer, Storebrand, has fallen in value due to concerns that the costs of guaranteed liabilities on its policies could force it to issue equity. Consensus opinion on the shares is negative but the firm has attracted the interest of a local activist – Tor Alav Troim – who has held management and board positions for a number of companies controlled by mogul John Fredriksen. Troim and his wife, Celina Midelfart, own over 3% of Storebrand. Sissener expects “rising interest rates, which reduce the value of liabilities, should be good for life insurers including Storebrand”.

Another more long term, structural trend, is the need for personal pension saving in Norway. Given the gargantuan oil fund, it may seem surprising that individuals are choosing to save more for retirement, but the oil fund only backs government pension liabilities. Elsewhere in the Olso market, Sissener has now taken profits on general insurer Gjensidige, which has more than doubled in value since it was privatised in 2012. Globally, the fund owns UK insurer Prudential, which has been an early mover in Asia and built up a strong franchise in many Asian markets. Prudential is present in fourteen Asian countries, running the gamut from frontier markets like Myanmar and Cambodia, to middle income countries such as Indonesia, Malaysia and Thailand, and the most developed economies, including South Korea and Japan.

Den Norske Bank has been a top holding for Sissener for some years. Valuation is a relative concept: DNB’s multiple of 1.1 or 1.2 times book value certainly seems expensive relative to European banks at a discount to book value, but DNB stands at a hefty discount to Swedish banks valued at 1.7 or 1.8 times book value. A growing dividend is another attraction: DNB’s yield of 5% today could increase to 6 or 7% over the next few years. This is because DNB has finished rebuilding its balance sheet, which is no mean feat in Norway. In common with Swiss and Swedish regulators, Norway’s “gold plates” the Basel banking rules with additional capital requirements. Norway adds about 10% to the Basel levels. Another holding, Denmark’s Danske Bank, demonstrates how much well-capitalised banks can boost their pay-outs: Danske has doubled its dividend over the past few years. There are fears that Danish property is in a bubble, but Sissener points out that “Copenhagen house prices are still below Stockholm levels”. Amongst smaller financials, Sissener views “small Norwegian bank, SkandiaBanken, as a potential bid target. Its main owner is a private equity firm, Alcor, which could be looking for an exit. The likely buyer is a retail bank,” Sissener expects.

Technology

Sissener has personal capital invested in the fund and this is one reason why he likes to take a global approach and invest across asset classes. Though the fund has thus far had a bias to Nordic equities this is only because the team have found abundant opportunities in their home market. The Sissener Canopus fund is substantially unconstrained by geography, asset class or exposure, with a couple of exceptions. The fund is limited to 20% in bonds for reasons related to the Norwegian tax code, and currency is hedged back to Norwegian Krone.

The fund contains some Norwegian microcaps that are not, at this stage, for public discussion and at the other end of the spectrum Sissener is also invested in some of the most well-researched mega-cap technology stocks in the world: Apple and Facebook. Sissener bought into Apple at 93 and so is already up 50% on the trade, which is, perhaps surprisingly, far from a consensus position. Active equity managers remain underweight of Apple, partly because benchmark-constrained managers tend to be structurally underweight of mega-caps. Apple is a high conviction position for Sissener’s IT analyst, who points to its valuation: Apple is sitting on over 200 billion dollars in cash and looks cheap just on its earnings. “The launch of iPhone 8, which will mark the tenth anniversary of the iPhone, could be a catalyst for the stock, with new casing, features and gadgets expected,” Sissener points out. He also sees potential for Apple to exploit driverless cars.

Facebook trades at a higher valuation than Apple, and at a premium to the US stock-market. But Sissener judges that Facebook’s valuation of 20 times is only a little more than the US market on 18 times, and is justified by Facebook’s growth prospects. Simply put, Facebook lets advertisers access 1.8 billion users, globally, in a second. A global perspective helps to explain why the Nordic region is punching above its weight in being home to a significant number of leading hedge fund managers, including Sissener.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical