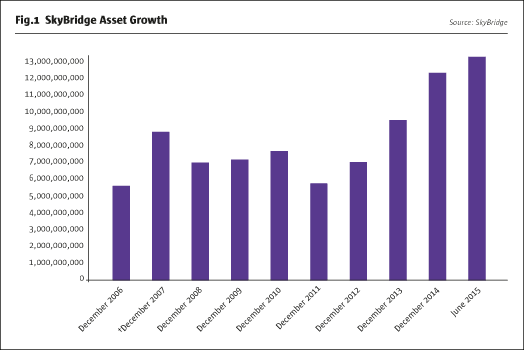

THFJ visited SkyBridge Capital’s New York offices as the investment team celebrates over ten years together, during which time the strategy has surpassed many investors’ expectations for performance and seen assets more than triple, despite the headwind of a contracting fund of funds industry and the worst financial crisis since the Great Depression. SkyBridge has a stable team: “Of the 24 people that came over from Citi only one junior analyst has departed” says CIO, and co-Managing Partner, Ray Nolte. The team process is ten years old, having originated in Citi’s fund of hedge fund business, Citigroup Alternative Investments Hedge Fund Management Group, which SkyBridge acquired in June 2010, bringing in some $1.3bn of discretionary assets and $3bn of advisory managed account assets. SkyBridge founder Anthony Scaramucci led the Citi acquisition after being connected to Nolte through mutual industry contacts. Since then the firm has seen spectacular asset growth, from $4bn to $13.4bn (shown below). Nearly all of this has come from the core business, which is structured as a comingled funds of funds. SkyBridge views its investment structure “as a multi-strategy fund that allocates externally”- across a broad array of asset classes, strategies and managers. “We take a thematic approach to our investment theses and actively express high conviction views. Our more tactical and dynamic process resonates with investors and has resulted in performance gains and steady asset raising” states Nolte. Further, SkyBridge has used its size, as one of the world’s largest allocators, to negotiate lower fees from 84% of funds it invests in, “The benefits of lower fees are passed on to our investors,” Nolte makes clear.

Investor Education and The SALT Conference

SkyBridge continues to play a prominent role in industry advocacy and investor education, through the SkyBridge Alternatives (SALT) Conference, conceived by partner Victor Oviedo and held annually each May in Las Vegas since 2009; and other international thought leadership events that are held throughout the world. Anthony Scaramucci is also the co-host of the iconic US television show Wall Street Week and is a regular contributor to Fox Business News. He has also published two books titled ‘Goodbye Gordon Gekko: How to Find Your Fortune without Losing your Soul’ and ‘The Little Book of Hedge Funds’. All of these efforts have been designed to “bring the hedge fund industry to a broader audience with the goal of providing investors with access to the world’s most relevant thought leaders and industry decision makers from the intersecting worlds of finance, politics, public policy, science, and philanthropy.” says Scaramucci.

SkyBridge views SALT as being independent from, but complementary to, the investment side of the business. “SALT has evolved from a hedge fund conference into a forum for alternative thinking,” confirms Scaramucci. “The program is designed to facilitate meaningful discussions and balanced debates on the world’s most relevant and controversial issues, while identifying strategies and solutions that allow us [investors] to capitalise on opportunities for the year ahead.”

Scaramucci is supporting Republican Presidential candidate Jeb Bush, but of course the hedge fund industry contains plenty of prominent Democratic supporters as well: including Renaissance Technologies founder Jim Simons, D.E.Shaw founder David E. Shaw, and Avenue co-founder Marc Lasry. “The goal behind SALT, and Wall Street Week, is to personalise and humanise the alternative asset management and add personality to stories such as that of Lee Cooperman” says Scaramucci. Growing up in the South Bronx, Cooperman is now a billionaire who has signed up to the Warren Buffet pledge to bequeath most of his money to charity. “He is vilified as politicians want to pit haves against have nots, which is anti-American and against the way we grew up” frets Scaramucci. These personal narratives bring the industry to life and Scaramucci is naturally also pleased to see SALT raising the public profile of SkyBridge.

Dynamic and Tactical Strategy Reallocations

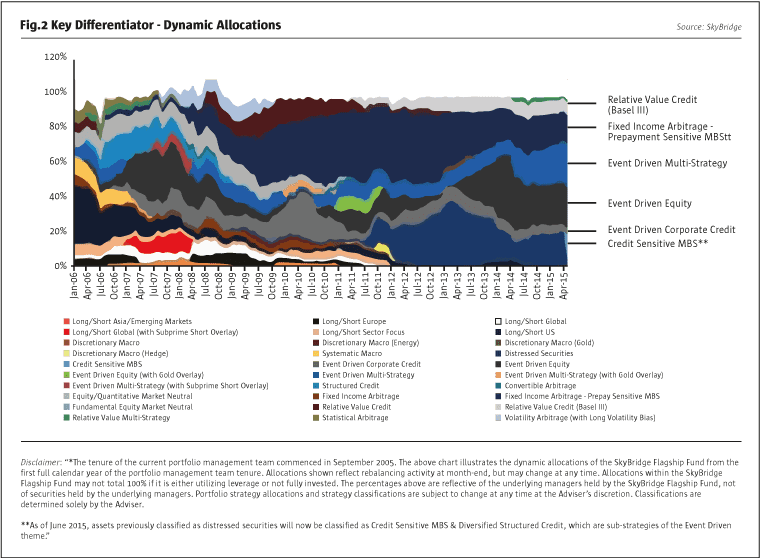

Funds of hedge funds’ performances were historically often attributed to the strength of their rolodexes, but the notion of selling access has become as outdated as the rolodex itself; younger readers who exchange electronic business cards might not even know a rolodex is a contacts list. “As transparency and openness have increased, the access argument fell by the wayside” argues Nolte. SkyBridge differentiators include the team’s ability to “invest and take risk more like a multi-strategy fund and tactically shift exposures around”. But Nolte would not want to be restricted to ten or so internal teams as he wants a broader palette from which to craft the portfolio each month. “We are always thinking about where the incremental next dollar should be invested over the next three to six months, and constantly refreshing our portfolios” he says.

SkyBridge has made shrewd strategy allocation choices. Cash-flow generating strategies, including prepayment-sensitive mortgages and corporate credit, have made substantial contributions to SkyBridge performance since 2009, and in 2009-2013 at as much as 80% of the book was in various ‘coupon clippers’ that were priced to factor in larger default losses, or mortgage prepayments, than occurred. Most of the collateral backing SkyBridge’s cashflow-generating investments revolves around mortgages, and specifically the poster children of the credit crisis: older, pre-crisis, loans, including alt-A, sub-prime, and option ARMs. “This paper has now aged, with good cash-flow, low credit risk, and better collateral as home price appreciation has helped and equity tranches have taken a hit leaving mezzanine and senior tranches looking relatively safe and offering attractive cash-flows of 15% or more” Nolte judges. Though big picture themes can receive large weightings, they are diversified through specialist sub-strategy managers. SkyBridge’s major call on mortgages between 2009 and 2011 was expressed through “spread trading, new issuance, and jumbo prime loans, which all have some commonality but different correlations” Nolte recalls.

If ‘rebalancing’ often implies tinkering around with over-weight and under-weight tilts towards or against particular strategy, ‘reallocation’ better describes SkyBridge, which is in the business of wholesale shifts in allocations. As well as making contrarian calls on credit and mortgages post-crisis, Nolte swam against the tide of consensus investors by virtually eliminating two directional strategies that garnered strong inflows following their robust 2008 performances: macro and CTAs. Having had plenty of macro and managed futures exposure in 2008, Nolte had exited by June 2009 and has only just started re-entering these tactical trading approaches with a 4-5% weighting, which is small by SkyBridge standards as the manager can go up to 40% in one strategy, and owns far fewer than the fifty or so managers some advisers are exposed to. Nolte has established a toehold in macro and CTAs because he thinks “when rates start to turn in 2016 to 2017 that’s positive for those spaces”. SkyBridge also argues that divergence between normalising Fed policy and QE-driven ECB and BOJ policies could be good for macro. And reflecting on his 30 years’ of experience in finance, Nolte reads the number of managers throwing in the towel and closing down funds as positive because, “when you get these flush-outs it’s a sign you are getting closer to the bottom”. That applies to discretionary commodity traders just as it does to macro funds.

CLICK IMAGE TO ENLARGE

Tactical equity and event exposure

Though SkyBridge has had little or no exposure to external macro managers post-2008, SkyBridge itself has been making tactical macro calls on variables such as equity beta. Long short equity strategies also took a back-seat role between 2009 and 2012, but by 2013 Nolte (and Partner Robert Duggan, Senior PM for Directional Equity and Directional Macro) resolved to “equitise the portfolio and move equity beta up from 0.2 towards the top end of our equity beta range of -0.1 to 0.5”. Since then there have been at least two major shifts in equity beta exposure. It was pared back to 0.25 in the second quarter of 2014, but SkyBridge then took the October 2014 selloff as an opportunity to shift back up to 0.3 or 0.4.”We decided that some of the geo-political risks were overblown and that investors were over-reacting to tax inversion as merger deals were still getting done” Nolte reflects.

Indeed, it was SkyBridge’s confidence in corporate activity that lay behind a big push into the event driven space, including activists, which are the province of Partner and Senior PM for event driven and relative value arbitrage, Troy Gayeski. This allocation peaked at 40% before being scaled back to 20%, but SkyBridge retains high conviction on European event and merger strategies.

“We think Europe could be coming out of recession and a pickup in GDP growth, albeit from modest levels, should be enough to get deal flow moving again” Nolte foresees. An acceleration of restructuring in European companies could be another opportunity. He also thinks a stronger dollar makes some European corporates attractive targets for US buyers. These three drivers illustrate how SkyBridge “likes to play themes from multiple angles rather than betting on binary trades” Nolte explains. Core themes are also expressed through several managers, with event driven managers currently including Nelson Peltz’s Trian, Dan Loeb’s Third Point, John Paulson’s Paulson and Barry Rosenstein’s Jana.

Late 2015 Outlook

‘Event driven’ can be a very broad hedge fund category often including high yield, but SkyBridge devises their own strategy categories, sub-dividing event driven into multiple sub-strategies and looking at high yield separately. In October 2015, SkyBridge was out of US high yield as spreads are too tight, so Nolte does not think investors should expect returns to be more than coupon income in general. “But there may be pockets of value where the dislocation, which related mostly to energy, has artificially widened non-energy names”. Would Nolte return to high yield if spreads return to late 2011 levels? His evenly weighed answer is “probably, so long as the US does not re-enter recession”.

That is a remote prospect, SkyBridge thinks. Their base case is for “modest 2% GDP growth through the election period, which may be a big catalyst for markets” Nolte expects. His reasoning belies SkyBridge’s frustration with Obama: “the current administration is perceived as so anti-business that whoever the next President is, they will be more business friendly than the current administration”. In the meantime, Nolte takes heart from the two trillion dollars of cash sitting on US corporate balance sheets. Though some of this is overseas, it is effectively being defeased through debt issuance. The cash mountain could be transformational if it were deployed into the economy instead of being returned to investors. “Capital spending and R&D are more stimulative than buybacks or dividends” Nolte reckons. If this finally releases the inflationary genie, he could even start getting excited about CTAs again.

Late 2015 is unusual in that SkyBridge’s portfolio is more diversified by strategy than it has been for many years, as Nolte’s view is “When we look at the market today we do not see any single strategy as a huge standout. There are opportunities to potentially achieve 6-10% or 8-12% returns. Opportunity sets coalesce in similar areas, and we then add diversification, by allocating to managers with similar risk and return profiles”.

Operational Due Diligence (ODD) And Risk Vetoes

Operational and risk chiefs have veto rights- but have virtually never exercised them. When SkyBridge starts researching a manager, the operational specialists are alerted and will typically identify any concerns early on that result in the process being discontinued. “Fund proposals with ODD reservations should die before they get to the manager selection committee so that everyone does not waste too much time if it is a dead duck” says Nolte. On the operational side, examples of deal-breakers for Partner and Head of ODD Kenneth McDonald, could include inadequate controls over cash movements, such as insufficient signatories being required; concerns over valuations or trade settlements; inadequate separation amongst front, mid and back offices; or a lack of independent auditor, administrator or prime broker. On the risk side, Partner and Head of Risk Management Tatiana Segal (previously of Cerberus) looks closely at risk profiles, policies and procedures to ensure they meet SkyBridge criteria. The potential for overcrowded positions amongst managers in similar strategies is one reason why SkyBridge gets monthly position level data, analysed using Imagine Software, to avoid undue position concentration.

Partly as a consequence of these operational and risk criteria, SkyBridge thinks its investible universe is probably around 2,000 funds as 7-8,000 hedge funds are really “personal trading accounts masquerading as businesses” in Nolte’s view. The 2,000 at the top of the funnel drop to 300 that are met and around 30 funds that capital is deployed to. At any time SkyBridge could have a buy list of 100 or 120 approved funds, though multiple funds from the same company mean that the number of management companies is smaller.

Fund Liquidity: Finding a Happy Medium

SkyBridge’s dynamic strategy shifts – with portfolio turnover as high as 70% in 2014 for instance – clearly require some degree of liquidity and here a happy medium needs to be found. Nolte does not think that ‘liquid alternatives’, which he defines as daily dealing vehicles, under the as ’40 Act, are ideally suited to the strategies and managers SkyBridge invests in (though he does seem open minded about the possibility that some of them could fit into a twice-monthly dealing UCITS structure).

This does not mean that SkyBridge is going to the other extreme and following a ‘Yale Endowment Model’ approach of seeking to capture long haul illiquidity premiums that might be associated with strategies that have multi-year lock ups, such as direct lending. SkyBridge recognises that “alternative income is a huge growth area given the continuing hunt for yield, and ongoing evolution in shadow banking driven by excessive regulations on traditional banks” Nolte notes. But alternative income does not meet SkyBridge’s liquidity requirements (and insurance related securities and catastrophe bonds are also avoided as they are short volatility strategies). Direct lending is “very interesting but not liquid and if we want to exit at an inopportune time we have to go through foreclosures or workouts, so direct lending is only good in healthy environments” Nolte reckons. Similarly “two to three year activists are a hybrid with private equity. We may do a one year soft lock with an option to pay fees to exit early” says Nolte. SkyBridge might invest via exchange listed closed end funds, if discounts break through 10%, though Nolte has worries about the ability to exit without pushing the discount wider.

Alignment with SkyBridge’s own fund terms is the over-riding concern. “We offer investors quarterly liquidity so we do not want to run a big asset/liability mismatch and try to keep to quarterly or better, with a few one year lock ups. We paid outapproximately 35% of our Flagship fund as redemptions in 2008” Nolte remembers.

SkyBridge has developed at least two tactics for obtaining shorter effective liquidity terms than would normally be implied by open ended fund terms. Prospectuses sometimes prohibit or penalise revocations of redemption notices, but SkyBridge uses its relationships with managers to negotiate more flexibility. SkyBridge creates a rolling series of staggered options on redemptions, by pre-emptively submitting notices that can either be enacted – or revoked if SkyBridge decides to remain invested. This modus operandi relies on an open, pro-active and regular dialogue with managers to keep them in the loop of SkyBridge’s thinking so that the managers should not be surprised when SkyBridge does finally decide to redeem, and will still have had some notice. The dialogue is perhaps made easier by another of SkyBridge’s means of getting better liquidity. Investing in managers that have families of similar funds lets investors above a certain size, including SkyBridge, “swap and switch between vehicles within the same family, without putting in notice” Nolte reveals; (some managed account platforms (MAPs) also offer this facility across much or all of their range, though here Nolte has different concerns about some MAP feeders underperforming fund feeders).

In addition to SkyBridge’s ability to obtain liquidity from predominantly monthly or quarterly dealing funds, Nolte is prepared to acknowledge a more pragmatic reason why some hedge funds, including SkyBridge, avoid launching more liquid products: cannibalisation. “If you replicate your flagship in a liquid version, with lower fees, you cannibalise your higher margin business” he warns. SkyBridge nonetheless recognises the hundreds of billions of inflows into UCITS and ’40 Act liquid alternative funds as partly “an outgrowth of fear around the financial crisis as investors want the liquidity as an extra level of comfort”.

Multi-Faceted Marketing Strategy

Choosing appropriate fund vehicles is only one example of the thought and effort SkyBridge has put into its global marketing strategy led by senior partner Jason Wright. An accessible and open image is one driver of SkyBridge’s highly successful, multi-faceted, asset raising strategy that covers four continents. ”We want to reach out to a wider audience than institutional and high net worth investors” says Nolte, and asset growth has come partly from lower minimum tickets of $25,000 but, contrary to some reports, not from broad retail investors: US investors must be accredited, which typically requires a minimum net worth of $1 million and other criteria. The US fund structure is specifically designed to appeal to individual US investors, and not only tax-exempt ERISA plans that may otherwise go for offshore vehicles.

SkyBridge has some distribution partners in Europe, mainly private banks in the UK and Switzerland, with two people employed in Switzerland, but echoing concerns about an increasingly protectionist ‘Fortress Europe’ Nolte admits “the product is not distributed it most European countries because the regulatory environment is not friendly”. Instead, there is more distribution in the Middle East, Latin America, and Asia. SkyBridge has been well rewarded for its decision to focus on Asia three years ago, with quarterly visits to the region and a native speaker on the ground in Korea helping to attract heavyweight investors: “Clients include sovereign wealth funds, and other institutional investors in Japan and Korea” says Nolte. Most managed accounts run pari passu with the comingled fund of funds, though sometimes funds of one request more or less concentration or can exclude certain sectors.

Separate from SALT, SkyBridge has started putting on smaller, more exclusive, invitation-only symposiums that are not promoted or advertised. These are held in Asia and Europe each year to target institutional investors, and are structured largely as business development events and less so as industry platforms or educational forums like the flagship SALT Conference. Yet SkyBridge still flies in thought leaders for keynote sessions, with Ben Bernanke and John Paulson attending recent events in Tokyo which were attended by 100 institutional clients from all over the region.

Scaramucci thinks the firm could run $20-30 billion and expects this to come from a mix of strategic acquisitions and organic growth. But the multi-strategy product is not being used to seed new strategies. “In-house standalone strategies, such as our dividend value fund, will not be invested in by the comingled product due to an inherent conflict of interest” Nolte confirms, and stresses that the portfolio managers of standalone strategies are treated as distinct from the analyst team running the fund of funds. In 2013, SkyBridge hired Portfolio Manager Brendan Voege from SunAmerica to create a product that expands the firm into the long-only mutual fund space, offering investors access to additional portfolio allocation strategies inclusive of increased fixed income options. Voege launched the SkyBridge Dividend Value Fund (SKYAX) in Spring 2014 and in its first year achieved a number one ranking on The Wall Street Journal’s category kings list of “total return for the top 10 funds ranked by year-to-date performance as of Apr. 30, 2015.”

Short memories and longer perspectives on hedge fund investing

SkyBridge may be dynamic in making tactical allocations, sometimes with a multi-month view, but the manager is informed by decades of financial market history. “Interest rates cannot stay at zero forever and the current forces of deflation may unwind into other things” Scaramucci expects. One of his favourite soundbites is that “We are actually in the fashion business. Ten years ago investors took a 75 year view like college endowments. Now they take a 75 minute view”. This should not be interpreted literally to indicate SkyBridge is keen on short term traders, and the firm has no high frequency traders. The message is more that many people in the industry today have short memories. Scaramucci reflects that “a whole generation only lived in the post crisis era, and few remember that rates can get tightened, with one in seven Wall Street professionals never having seen a rate increase as the last one was in April 2007 before the first iPhone”. In contrast Scaramucci and Nolte take pride in being able to remember exactly where they were 28 years prior to the date of THFJ’s interview. On ‘Black Monday’, October 19th, the day of the 1987 stock-market crash, Nolte was on his honeymoon while Scaramucci had a job interview at the Charles Hotel.

Though SkyBridge’s own performance has exceeded that of the wider industry, SkyBridge makes the case for hedge fund returns at a time when the six year bull market in equities has left some investors losing patience. Its latest thought leadership paper, “Why Investors Should Allocate to Hedge Funds”, is publicly available on the SkyBridge website, and revisits rationales for investing in hedge fund strategies – which will be familiar to THFJ readers though not necessarily to the general public.

Diversification is one. “Hedge funds do not benchmark to equities or bonds, and you should consider hedge funds to diversify away from those two, and combine different return streams for a more efficient portfolio” Nolte states.

SkyBridge also points out how hedge fund portfolios can dampen portfolio volatility and compound at an attractive rate because “everyone is a long term investor until they have short term losses” Nolte reflects. Drawing upon the lessons of behavioural finance, he observes that “human nature is to sell at inopportune times’. Indeed, it seems to be a truism that money-weighted returns tend to fall far short of time-weighted returns for most funds. But a smoother ride means investors are more likely to stay the course. What should investors expect from hedge funds? SkyBridge has delivered “return streams over the last decade roughly the same as the S&P with one third of the volatility and a low but positive correlation to equity”. This steadier return profile should give investors more comfort to more fully deploy capital. Deep drawdowns also arrest the compounding process. The asymmetry of drawdown recovery means it is harder to recover large losses – as a 50% loss (as seen in global equities in 2008 or 2002) can only be recovered with a 100% gain whereas a 20% loss (as SkyBridge incurred in 2008) is recovered with a 25% gain.

SkyBridge acknowledges that post-crisis hedge fund returns have been lower but does not expect all of the reasons for this to persist. Granted, Regulation FD is here to stay (at least in the US), making it harder for equity hedge fund investors to obtain informational advantages. But other regulations could even be helpful. The Volcker Rule brings two benefits for hedge funds. “Proprietary trading desks are no longer there as shock-absorbers so the downdrafts are so much more violent, creating better opportunities” Nolte expects. A less well known benefit of new US rules is the strengthening of minority shareholder rights: the threshold for requisitioning a board meeting and putting questions to boards is now lower, according to Nolte.

Moreover, the higher correlations between stocks, sectors and countries that made life harder for stock-pickers are already giving way to greater dispersion, increasing the potential for alpha generation. Macro has also suffered from higher correlations but should benefit from macro divergence as the major economies are at different stages of their economic cycles with some tightening while others are loosening monetary policy. If interest rates do also normalise, the various long/short, market neutral, and less cash-intensive strategies will once again receive a positive return on their cash, adding to their investment returns (or offsetting any investment losses and sometimes keeping overall returns positive).

SkyBridge’s future projections for broad hedge fund industry returns are of the order of 6-10%, which they think is far more than investors can expect from bonds at current yields, though also less than their 10% forecast for equities. Though many US pension funds and endowments still, controversially, have high single digit return targets, a growing number of institutional investors are quite content with mid-single digit returns, given liquidity better than private equity or real estate.

A Broader Asset Management Firm

SkyBridge started in March 2005 in the hedge fund seeding business, raising $330mm and in 2008 sold a stake to Australia’s Challenger Financial Services Group Limited. The firm entered the crisis with $450mm of assets but redemptions and some losses returned it to $350mm. Post-crisis the firm has opportunistically reoriented its focus by launching the SALT Conference; building one of the world’s largest 20 funds of hedge funds, and adding a mutual fund along the way, taking total assets to $13.4bn. A long only dividend value strategy added two years ago is “part of SkyBridge’s transition to a broader asset management firm” says Nolte, and more strategies – both traditional and alternative – may be added. SkyBridge is one of the biggest brand names in the industry for a reason, or two.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical