For more than 25 years SMN Investment Services has been generating annual returns averaging in high single digits with zero equity market correlation and remarkably strong “crisis alpha”.

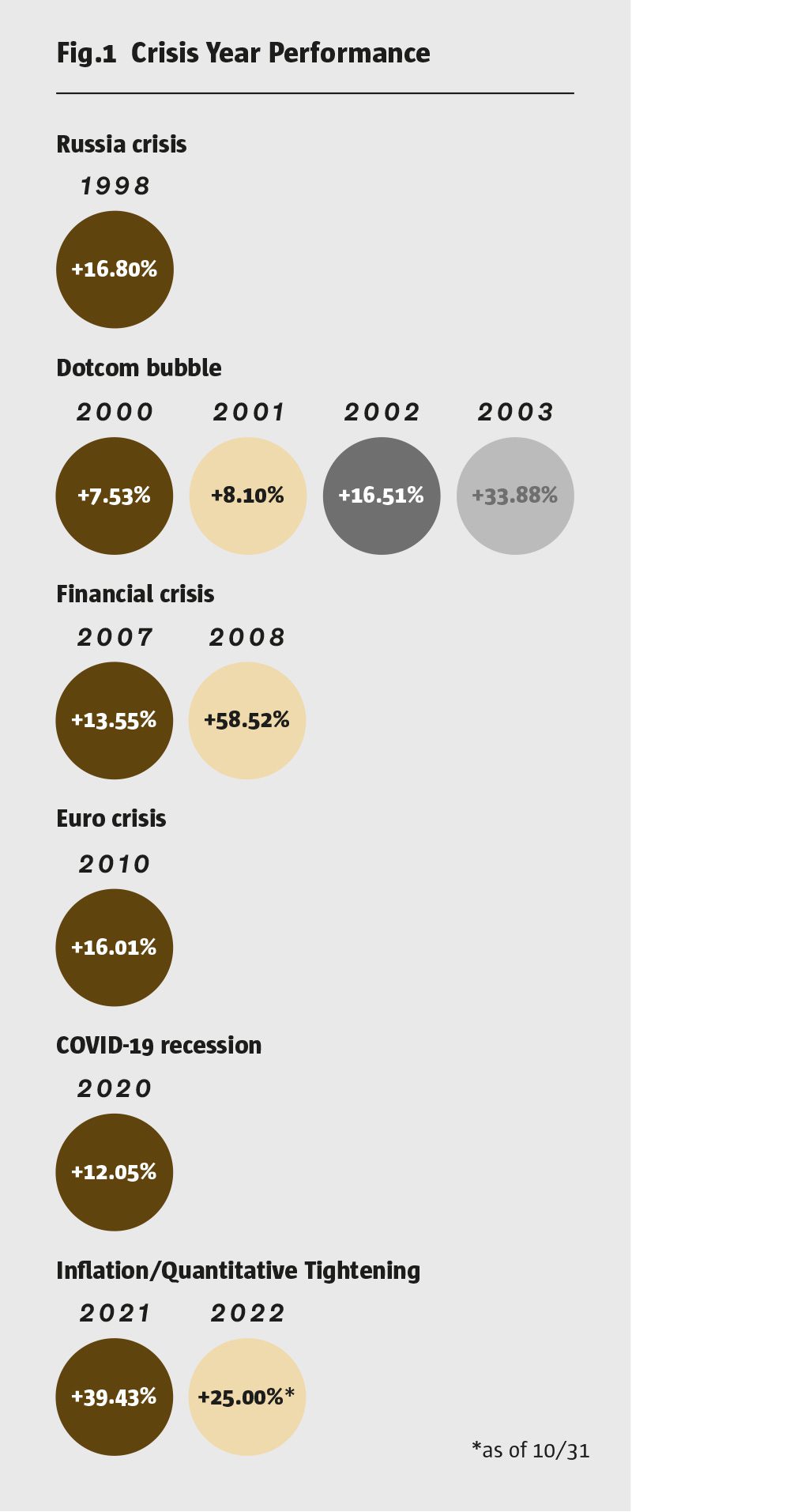

SMN has delivered consistently positive returns through multiple economic, financial market, pandemic and geopolitical crises, with returns in “crisis years” well above the manager’s historical average return. The flagship, Luxembourg-domiciled SMN Diversified Futures Fund, has averaged annual returns of between 8.23% and 9.9% annual to October 2022 (depending on share class and fee level), but has done better in nine “crisis years”, when it averaged over 20% over the full calendar years of 1998, 2000, 2001, 2002, 2003, 2008, 2010, 2020, and 2021 (see Fig.1). It is also up 25% in the first ten months of 2022.

The firm’s strategy is predominantly trend-following applied on a different set of markets, enriched by systematic volatility trading.

There has been a consistently high commodity weighting, including many less widely traded and niche markets, though all commodities are exchange-traded. In 2016, “structural alpha” markets were introduced, which are mainly commodities, and are viewed as being driven more by idiosyncratic or local supply and demand rather than broader macro variables such as economic growth or risk appetite. The structural alpha markets have recently made exceptional contributions including a record year in 2021.

The strategy remains a somewhat traditional trend-following CTA in using only price data and being substantially trend following, but it has some important differentiating nuances: trends are also followed beyond the front month; and in synthetic markets including baskets, market spreads and calendar spreads. Meanwhile a non-trend long/short volatility sub-strategy has been added. Additionally, innovation in risk management has devised dynamic risk allocation and correlation overlays that have enhanced risk adjusted returns.

Michael Neubauer, Co-Founder

Christian Mayer, Co-Founder

The genesis of SMN (Svoboda, Mayer and Neubauer) came in the 1990s when its three founders, Alexander Svoboda, Christian Mayer and Michael Neubauer, who had been working in stock and derivatives trading, sales and management in Austrian banks since the late 1980s, decided to set up their own company and to leave the banking industry after the Viennese financial sector cooled down following the boom from Central and Eastern Europe opening up. “We were partly inspired by an Austrian trend-following CTA, which generated very strong performance. Growing computer power gave us the capability to test our own novel technical systems, which spawned the SMN Diversified Futures Fund in 1996,” recalls Neubauer, who together with Mayer remains involved in day-to-day business development. Neubauer also oversees research and portfolio management, while Svoboda remains a board member and in common with many of the staff is a long-term investor in the strategy.

Seasoned and collaborative research team

The research agenda is driven forward by the portfolio management and research team of seven specialists, led by Joseph Waldstein and Gernot Heitzinger who both have decades of industry experience, and have been at SMN for over 15 years.

SMN also have some academic tie-ups with universities, including students on the local University of Vienna’s strong quantitative finance master’s program. The research team, whose specialisms range from signal generation and asset allocation to coding and statistical mechanisms, work openly and collaboratively on a broad spectrum of research streams.

SMN is a firm believer in the need to establish firm fundamental reasoning as the underlying of systematic models.

Michael Neubauer, Co-Founder

Selectively growing the investment universe

Medium to long term trend following has been a constant, applied to a growing investment universe, which has steadily expanded from 70 markets at inception to more than 200 in 2022, including over 300 instruments, because multiple maturities are traded for some markets. They are drawn from what SMN define as 10 asset classes or sectors. Classic markets are equity indices, equity volatility, short- and long-term interest rates (bills and bonds), currencies and commodities. Commodities are broken down into energies, metals, crops, softs and meats. “The aim is to obtain extraordinary diversification,” says Waldstein.

While some CTAs have their largest weightings in financials, including bonds and interest rates, SMN’s commodity weighting has always been around 40% to 50%, and has become increasingly diversified in recent years. Since 2016, SMN has been invested in structural alpha markets, which are mainly commodities driven by market-specific supply and demand rather than global economic forces.

Of course, the higher commodity weighting does not necessarily add absolute performance in every year and can detract in some years, but it does help to keep average equity market correlations near zero.

Market selection criteria

SMN has established a systematic market selection framework in order to both systematically determine the suitability of new markets and monitor existing markets for ongoing suitability. Liquidity is one among many market selection criteria, others are trading costs, counterparty risk, limited marginal diversification benefits and trending behaviour.

Credit and financials

For instance, trading corporate credit would not only require getting comfort on some operational and counterparty complexities. From an investment perspective, SMN also argue that “Trading corporate credit would be too correlated to equities and government bonds, and would therefore not offer much diversification benefit,” says Waldstein. In fact, very few equity, bond or currency markets meet SMN’s criteria for the structural alpha markets (two exceptions being short term interest rates in Australia and New Zealand).

200

The SMN investment universe has steadily expanded from 70 markets at inception to more than 200 in 2022

OTC and pricing risk

SMN are not trading any OTC or swap markets in structural alpha, and elsewhere FX forwards are the only OTC markets. SMN decided against clearing FX forwards, which are a small part of the book.

Some OTC markets can run into valuation subjectivity issues. SMN takes some pride in being able to easily price the portfolio: “In 26 years, we have never restated an NAV and were able to weather major market disruptions partly because we are well diversified. During Covid, we exercised rare discretion to cease trading some markets for fear of temporary closure; such discretion is only used to reduce risk,” says Mayer.

Execution on multiple exchanges

Yet SMN actively embrace selected smaller and niche markets and find their small level of assets is an advantage in being able to build impactful positions on some more esoteric venues. Accessing less well-known futures markets requires trading on 35 exchanges, including some regional US exchanges and others in Asia, Africa, Australia and Europe, such as European Energy Exchange (EEX) in Germany; Korea Exchange (KRX); Minneapolis Grain Exchange (MGEX); South African Futures Exchange (Safex) and Sydney Futures Exchange (SFE).

Two brokers who help with exchange connectivity are Societe Generale and Morgan Stanley. SMN’s Head of Trading has developed a rulebook for trading on various exchanges, with execution protocols sometimes tailored to the venue. “In 90% of cases, they trade in a standardised fashion at the open. But for some exchanges there are more elaborate guidelines on when to place trades and orders, and what to do if they are not filled. Potential investors can receive a detailed presentation on the execution approach,” says Mayer.

China

China’s commodity futures markets are some of the world’s largest and it does have some unique contracts, but currently Chinese commodity futures are avoided due to SMN’s assessment of counterparty, operational and political risks. They are however exploring some access routes that could provide an acceptable solution.

Russia

Legal restrictions and ethical concerns can also be relevant to market selection criteria. SMN ceased trading the Russian Rouble in 2022. “When Russia attacked Ukraine, we decided to close all Russia related trades. As investor protection remains a top objective for us, this decision was not based on profitability but rather on sharply declining liquidity and unpredictable risk effects of sanctions while also directionally fitting our moral compass,” explains Mayer.

Joseph Waldstein, SMN Investment Services

Exchange-traded emerging markets

There is no general prohibition on emerging markets – around 5% of instruments are in emerging and frontier market currencies. There is no exposure to emerging or frontier market interest rates however, because SMN has not identified futures contracts for the markets it would want to trade.

Transforming the universe into synthetic markets

One of SMN’s largest risk budget allocation is in fact synthetic markets, which are comprised of one or more other markets and/or maturities. SMN is creatively constructing a web of new relationships between markets, which identifies new trends and additional sources of diversification. The way in which SMN perceives, analyses and trades its markets differentiate it from other CTAs who might trade some of the same markets with different sorts of models.

SMN can trade both classic and structural markets both outright and as synthetic markets including baskets, spreads and calendar spreads. “The strategy is entirely quantitative, but some judgment is used to determine which baskets and calendar spreads to trade,” explains Waldstein.

As well as baskets of multiple markets at the same maturity, SMN trades trends in individual markets beyond the front month, and also trades calendar spreads made up of more than one maturity. A simple example of a calendar synthetic market in bonds would be a yield curve trade, pairing Eurodollar against ten-year notes, to trade curve flatteners or steepeners.

Whereas some discretionary traders use mean reversion for calendar spreads, SMN find following trends in calendar spreads works well over their lookback and holding periods, and the aim is partly to pick up carry from the curve. “This is partly related to the shape of the term structure. We are able to exploit enhanced price momentum in calendar spreads caused by contango and backwardation,” says Waldstein.

SMN’s synthetic markets are a powerful source of both returns and diversification. The synthetic markets account for roughly 20-25% of the risk budget and performance attribution, and form a larger part of the structural alpha markets. The synthetic markets’ correlation with the individual markets does fluctuate, but has averaged zero since 1996. In 2020 and 2021, the synthetic markets have been punching above their weight in terms of returns. Overall, synthetic markets have been a strong contributor to both returns and risk-adjusted returns, and they differentiate SMN from many medium and long-term trend followers.

The aim is to obtain extraordinary diversification.

Joseph Waldstein, SMN Investment Services

Research hit rates

Structural alpha markets and synthetic markets have been very fruitful and remain ongoing research drivers but in general multiple research initiatives do not necessarily feed into the programme. Only a small proportion of research projects have led to changes being implemented, but the process of eliminating alternative approaches helps to reinforce confidence in the robustness of core systems. “The majority of previously researched projects offer only marginal if any diversification benefits relative to the current models, or run into practical constraints,” says Neubauer.

Price data

SMN’s models do not rely on fundamental data in a strict sense. This is due to the belief that prices should reflect market participants’ analysis of non-price data. In addition, SMN also argue that price action will discount the impact of unique events such as sanctions, counter-sanctions, or wars blockading ports, as seen in 2022, and therefore do not model these sorts of events. “Fundamental data has an indirect impact on SMN’s decisions on the research agenda. SMN is a firm believer in the need to establish firm fundamental reasoning as the underlying of systematic models,” says Neubauer.

Risk and correlation overlays

Much of the research effort is focused on new models for signal generation, asset allocation, and risk budgeting.

There is no constant volatility target and in 2021 and 2022 one risk metric that has some link to volatility, margin to equity, has ranged between 12% and 25%. “The overall strategy volatility budget is partly a function of how many bottom-up opportunities the systems identify in individual markets, each of which have their own dynamic risk budget based on volatility and correlation,” says Waldstein. Weights vary between markets, according to factors including correlation, risk regime, market volatility, liquidity and signal strength. Signals from six proprietary systems are blended to arrive at the position size.

This dynamic and variable reweighting has not always been part of the program. “In 2015 fixed weights based on long-term sector correlations, intra-sector market count, liquidity and volatility, were replaced with a correlation-based dynamic risk allocation model that dynamically manages the correlations,” says Neubauer.

The dynamic weighting model is also partly a regime filter identifying if markets are in a risk on or risk off mode and adjusting positions accordingly, for instance it might cut long positions in risky assets in a risk off phase.

Another important advance was a dynamic cross-sectional correlation overlay added in 2010. For instance, when the correlation between bonds and equities turned positive in 2022, “The system reduced the position sizes for both asset classes, contributing positively to risk management by reducing unwanted correlation clusters, and to performance by a multiplier effect on the central timeline of the trend,” says Waldstein.

These two refinements have enhanced longer term risk adjusted returns, though of course in any individual year they could add to or detract from returns.

Gernot Heitzinger, SMN Investment Services

Rangebound markets and longer-term lookbacks

Other actioned research ideas include reducing sensitivity to sideways, rangebound and “choppy” markets, which can be challenging for trend followers to trade.

SMN has as well varied the lookback periods used to define and measure trends, while staying with a longer-term orientation. “The lookback periods are all medium to long term, since SMN’s research determined that the ratio of noise and thus false signals in case of short-term signals is simply unacceptably high,” says Waldstein.

The subsystems’ holding periods average 100 days, while lookback periods range between 80 and 750 days. The weighted average blend is generally categorised as long term.

These longer holding periods partly explain why the 1,200 round turns per million turnover metric is fairly low, though turnover is also reduced by SMN being quite selective about timing entries and exits. Whereas some trend followers maintain exposure to all markets at all times, SMN are on average exposed to a market for 60% of trading days, when the signals pass a strong enough threshold. SMN also tend to scale into positions quite slowly as the signals get stronger.

ESG

SMN have been researching ESG since the firm started. They are UNPRI signatories and currently make disclosures under SFDR article 6. However, as liquidity providers trading futures, they are deemed “out of scope” by the EU taxonomy.

SMN has published a thought leadership paper on ESG and awaits the development of widely accepted methodologies for measuring CTAs’ ESG performance.

In the meantime, they are seeking a certification: “We expect to obtain an ESG rating from an Austrian agency, and do not expect this will have any negative impact on the portfolio,” says Mayer.

Customised mandates, capacity and potential for UCITS

SMN has offered mandates purely focused on, or applying a higher weighting to, structural alpha markets.

SMN could entertain a strategy purely focused on the synthetic markets as well, subject to some caveats: “The synthetic markets are less scalable, so there might need to be either a capacity limit or a right to redeem the investor,” says Mayer.

Historical assets peaked at $700 million and capacity across both the Classic Trend Portfolio and the Structural Alpha Trend portfolio is around $2 billion, of which $800 million comes from the Structural Alpha Trend program.

SMN was used as an ATM by investors after crises such as the 2008 GFC and is running assets well below capacity. The company has diversified its revenue streams by distributing UBP Asset Management products in Austria.

SMN has no current UCITS but believes that the strategy’s liquidity profile could easily fit into a UCITS, and would be open minded about talking to platforms.

Inflation and outlook

Higher inflation is one factor that could bode well for CTAs. SMN note that, “When inflation last reached current levels, in the 1970s and 1980s, trend followers performed very well even though they only traded about 20 markets. Our analysis including the Barclay CTA Index suggests that CTAs can capitalise on uptrends in commodities and downtrends in other asset classes”. SMN made 40% in 2021 and 25% in 2022 to October, but has also done well in periods of lower inflation.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical