The dislocation in currency and fixed income markets is fertile ground for alternative investment managers. Market leading franchises like Brevan Howard and BlueBay, now part of the Royal Bank of Canada, have performed well for investors by deploying yield curve and emerging market sovereign credit trading strategies.

Their success is made even more conspicuous by the lacklustre performance of many equity long/short managers. With investors hungry for returns in a zero rate environment and equities out of favour it is a propitious time to look at strategies that seek to capitalise on how the FX and bond markets are driven by capital flows.

To do this, Stratton Street Capital, primarily a long only manager, has developed a model based on measuring the levels of net foreign assets held by different countries. The methodology underlies several related strategies, including the Wonda Bond and Currency Fund, a hedge fund product with $2 million, the New Capital Wealthy Nations Bond Fund and the Renminbi Bond Fund.

“Our simplified view of the world is that capital flows from those countries which have got it in the form of net foreign assets to those countries which don’t,” says Andy Seaman, partner and fund manager. “But in a bear market the opposite happens, as money flows from debtors back to creditors.”

Measuring net foreign assets

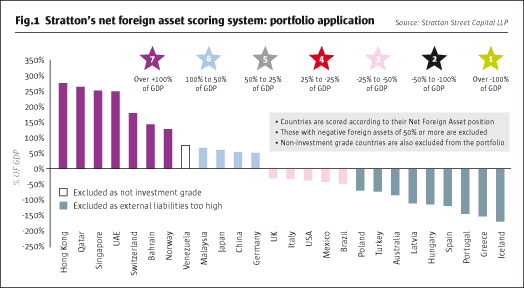

The net foreign assets measurement (see Fig.1) shows export powerhouses, led by Hong Kong and Qatar, with healthy positive balances. On the opposite end of the scale are the economically destitute. Worst off is Iceland following its deleveraging and devaluation, closely followed by periphery eurozone states like Greece, Portugal and Spain. Heavily indebted eastern European states like Bulgaria, Hungry and Poland also feature.

From this macro view Stratton Street use a scoring scheme, rating countries with net foreign assets above +100% of GDP at seven stars down to one star for countries with net foreign liabilities exceeding -100% (see Fig.1). They will only go long in credits with countries that are five star (net foreign assets of 25-50%) or higher.

Shorting in the Wonda Bond and Currency Fund is done principally through currency forwards owing to the ample liquidity. Among the currencies that have been recently shorted are the Hungarian forint, the Polish zloty, the euro, the Australian dollar and the Turkish lira.

Currency volatility

“We like using currencies,” says Seaman. “They are highly liquid and can move very violently which means we can move in and out quite quickly.” He recounts shorting the Australian dollar in 2008 which then fell 10% in a day. The position was closed, but when the currency rebounded 7%, the short was put back on.

“When we explain net foreign assets to people everyone understands that money must move from those who have it to those who don’t and back again,” says Seaman, who did extensive research into the academic literature on currency movements. “Everyone accepts that. But if you don’t know which countries are wealthy and which ones are poor that insight isn’t of much use.”

Obvious targets

The deleveraging that is going on around the world offers obvious targets for the strategy, particularly on the short side. The data shows that the whole of Eastern Europe with the exception of Russia is heavily in debt.

“In our view of the world it is quite easy to see what is going on,” says Seaman. “Each of the indebted countries is being picked off one at a time because capital is being reduced. We know European banks are deleveraging. We have got the greatest short exposure in Eastern Europe.”

In contrast, the J.P. Morgan Emerging Local Markets Index is maintaining a 36% net weighting in Eastern Europe. That will likely offset the gains of the weighting it has to Asian bonds and currencies. In comparison, active management to reduce net exposure to indebted markets offers clear advantages.

The Wonda Fund is actively marketing to high net worth investors. Through a link with the World Food Program the firm offers investors the option to direct the fund’s fees into paying for meals. So far, this has generated around 1 million meals in Asia, a figure that will grow as the fund attracts new investors.

The overall exposure of the strategy is 160% long on the US dollar, 40% long on the yen and 40% long on the Singapore dollar. The short exposure on the other currencies noted above is around 20% each. When significant moves occur in the market, the currency weights are reviewed and adjusted.

The volatility of the Wonda Bond Fund is higher than many investors may expect. Indeed the Value at Risk is around the same level of the Dow Jones Industrial Average thus giving equity-like volatility and returns. Investors who want lower volatility can choose the Wealthy Nations Bond Fund, which is a UCITS fund, or the Renminbi Bond Fund.

“We take a longer term view of whether our theory will be right over time,” says Seaman. “Month to month it can be very volatile and there is not a lot we can do about that. It is hard to know what will happen on a day to day basis.”

Due to the volatility, the Fund doesn’t put stop-losses on its forward currency positions. Having positions closed out automatically could lead to missed opportunities if a currency suddenly moved 5%.

For the first half of 2012, the Wonda Fund gained 3.48%, while the New Capital Wealthy Nations Bond Fund returned 9.62%. Stratton Street is managing total assets of $1.2 billion.

“The last few years have been an incredible period to manage money,” says Seaman. “We expect the opportunity set to continue to be good.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical