“It’s a bad omen to win performance awards for two consecutive years,” is Geraud Charpin’s characteristically circumspect opening gambit. His unconstrained liquid investment-grade credit hedge fund, the BlueBay Credit Alpha Long Short Fund, has won The Hedge Fund Journal’s Europe 50 award for “Best Performing Credit Relative Value Fund” in both 2013 and 2012, thanks to its stellar Sharpe ratio – which might be tough to maintain. Although, the outperformance predates these awards.

The fund’s track record begins in November 2011, but between January 2009 and October 2011 Charpin had full responsibility for the credit relative value strategy within BlueBay’s multi-strategy credit fund and achieved an impressive annualised net return of 23%. After earning his stripes within this vehicle, Charpin was given free rein over his own fund, accessible by outside investors.

By drawing on his repertoire of trade types, and at times tactically tilting exposure to a short stance, Charpin aims to deliver absolute returns throughout a credit cycle. He does not target any specific Sharpe ratio, but is confident that his relative value security selection approach is likely to generate better risk-adjusted returns than directional macro investing. Although the erstwhile lead UBS European credit strategist selectively takes macro views – and has made some excellent macro calls – he has a humble respect for the difficulty of predicting market direction, so most of his risk budget is devoted to credit selection. After gaining valuable experience working with credit in five different banks, Charpin believes that the major macro markets are so well defined and understood that there are fewer opportunities to obtain competitive edge. In contrast, he views the credit investment universe the fund occupies as more inefficient, and therefore sees more opportunities within his reach.

Trading not carry

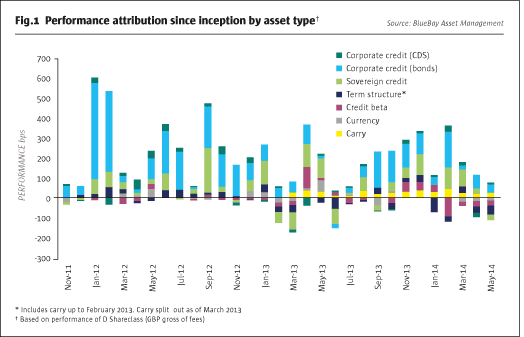

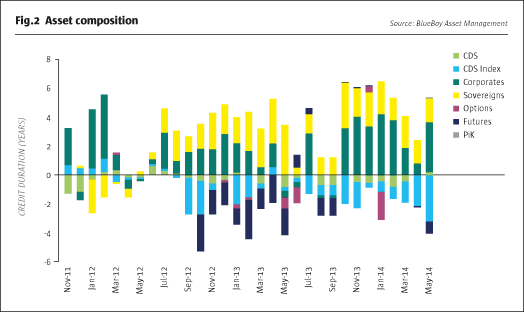

Credit is often seen as a coupon-clipping strategy in which carry contributes most of returns. This is seen to be especially true in the long-only or long-biased world. But, unlike many credit hedge funds, Charpin has sometimes been net short, which can imply negative carry, and the fund’s returns have shown a slightly negative correlation to investment-grade credit. Almost all of the returns have come from trading profits and not carry. The investment-grade credit space is his canvas, but the portfolio turnover is around 10 times per year with typical holding periods of between one and six months, which means that price movements matter far more than the fund’s minimal and variable carry. Credit spread exposure is limited to plus or minus one turn of unleveraged exposure to a six-year corporate, which is very modest in comparison to other funds that take on multiples of this risk.

The rationale for prioritising trading is clear: “It is much easier to find trades that might make two, three or four percent over two, three or four months, than it is to find any investment-grade asset making 10% or 12% over a full year,” says Charpin. So if buy and hold, carry-focused investors who target double-digit returns are finding it difficult to be enthused by Spanish 10-year bonds now yielding 1.5% more than German Bunds, Charpin is excited by the possibility of making a capital gain of 4% in a few weeks or months if the yield tightens by another 0.50%. “If we are now in a new regime where Eurozone break-up is out of the question, then Spain should tighten much further – and compared with corporates it offers good value versus Germany,” he says.

Style rotation

Charpin is opportunistic and selective in reallocating capital amongst trade types. There are no minimum or maximum allocations to each sleeve and he will “never have all trade types on at the same time as we will not find opportunities everywhere.” Still, he does think that there are always opportunities somewhere: “It’s a rich universe, with different sources of alpha present at different periods in the cycle.” The sub-strategies include capital structure arbitrage, event-driven credit mitigation, sector trading, relative value, curve trades, basis trades, rates and directional views. “Sometimes I am pure relative value – sometimes just capital structure,” he reasons. In 2009, basis trades were the most compelling opportunity as huge negative basis existed between yields on cash and derivative credit instruments from the same issuer. Some investors would view this as a carry trade, lock in the yield differential, and then buy and hold. That is not Charpin’s style. He was simply interested in playing the re-convergence between yields on cash bonds and credit derivatives. This mean reversion occurred within a year. Today, not only are the opportunities for negative basis few and far between, but the relatively low correlation between CDS (credit default swaps) and cash markets makes it difficult for Charpin to build up conviction.

Charpin is a chameleon. “I have been in credit for 20 years and every 18 months the market reinvents itself, so I need to adapt sources of alpha to the current environment.” So, in a very directional market where there is often less dispersion between securities, relative value does not work so well. Sometimes, however, all the stars are aligned. 2012 was a highly unusual year when both directional and relative value trading worked well and Charpin made 26% net of fees. “In 2013 it was a tale of two halves,” he reflects, “with the first seven months of the year being very directional before giving way to the latter part of the year when fundamentals reasserted themselves.” So far 2014 has been similar, with the first two months throwing up ample relative value opportunities, while March and April became much more directional.

Charpin believes the market is focused on the macro picture in terms of whether the data will allow the Fed to be dovish or force faster tapering. So, if credit market cycles might average 18 months, this year the regime shift has been telescoped into just two months. When we met, Charpin enumerated risk events as “the US data, European elections where young unemployed can do protest votes, Ukraine, working out if China will undershoot.” In this type of environment, when the macro climate is riskier, Charpin wants to “simplify the portfolio and reduce risk because I am driving a truck, not a Ferrari, that needs to adapt to a bumpy road ahead with plenty of rocks and potholes.” That translated into a smaller book with less directional exposure in May 2014. This is not unusual, as most of the fund’s performance has come from bottom-up, relative value trading, an area where Charpin thinks a 75% hit rate is realistic. He also estimates that up to 75% of performance has come from this area since inception, but the balance does vary a lot according to the type of market environment.

A la carte instruments

With a wide menu of trade types, Charpin insists on going à la carte when it comes to ways of expressing trade ideas. The fund is not wedded to any one instrument because liquidity ebbs and flows over time; the regulatory backdrop evolves and so too does the relative valuation of different instruments. Pre-crisis, structured product desks and prop desks were particularly active in CDS but now “the market has disintegrated”. Charpin hopes that central clearing might rejuvenate the moribund CDS market and inject some fluidity. The European ban on buying naked sovereign CDS did not affect the fund because it has the flexibility to short in several other ways – borrowing cash bonds, shorting repos, futures or total return swaps. This need for a full trading toolbox explains why Charpin has no plans to launch a UCITS – even if his strategy would appear to be more than liquid enough, with 90% of the book saleable within one day. Charpin not only wants to choose the optimal instrument for each idea, but, as with the CDS basis in 2009, or indeed capital structure arbitrage, he sometimes wants the flexibility to arbitrage different instruments from the same issuer. A prix fixe UCITS would cramp his style by restricting him to shorting via swaps. BlueBay has an absolute return UCITS, is a sub-adviser to a 1940 Act fund and a 3(c)7 fund, but these all have return targets in the order of 4-6%, which is well below the double-digit level that Charpin aims towards and has thus far delivered.

Of BlueBay’s $62 billion assets, some $27 billion is in investment-grade credit, where there are 21 investment professionals with an average of 11 years’ experience. This provides a rich resource for Charpin to draw upon, and he can also bounce ideas off BlueBay’s high-yield, emerging markets and convertible bond teams. The fund seems like a boutique within a behemoth, with assets currently around $300 million and no ambition to run billions; capacity for the strategy is currently set at $750 million. Granted, investment-grade credit offers abundant liquidity, but Charpin needs to stay nimble for his dynamic and flexible trading style. Still, liquidity is not a problem at all – Charpin points out that although Slovenia, for example, is one of the smallest sovereign debt markets, it is still much bigger than most corporates.

Peripheral Europe is heterogeneous

Peripheral European countries such as Slovenia only became a potential source of alpha after May 2010 when Greece requested a bail-out; hitherto Greek bonds had traded within a whisker of German Bunds. Charpin started getting involved on the short side in May 2011 with Italian bonds. He does not refer to the “PIIGS” (Portugal, Italy, Ireland, Greece and Spain), and has never viewed them as a homogeneous bloc; he has made different decisions at different times for the individual countries. At one stage Charpin was putting on mean reversion trades between Spain and Italy, but has not done so for some time. “Italy has different dynamics with a large stock of debt, whereas Spain is more about the flow of debt,” he says. “Ireland has rallied too far already, but Portugal should be a strong convergence story with encouraging data suggesting it may follow in Ireland’s footsteps,” headds.

Charpin was actually long Spain for part of 2011, before shorting in March 2012 on a catalyst. In contrast, the reverse sequence applied to Italy: a short was cut and reversed into a long after Mario Monti took power in late 2011. It was Draghi’s seminal “whatever it takes” speech in July 2012 that turned Charpin towards looking at the periphery story from a positive angle, but even then he has not taken an indiscriminately positive position in all countries. Even if Greece and Cyprus had not been ruled out after losing their investment-grade credit ratings, Charpin had and has other concerns about them. Neither Greece nor Cyprus offer the type of fundamental, bottom-up story that appeals to Charpin. In fact, he argues, “Greece has macro headwinds of growth and employment, poor leading indicators and elevated political risk.” Greece is thus perceived as an emerging market for many investors. The emerging markets are investible for Charpin, but it seems that the number of investment-grade names that satisfy the fund’s liquidity criteria is quite small. “Investment-grade is mainly developed markets, although we do look at Gazprom, Petrobras, America Movil,” he says. Chinese real estate credit, however, is still considered out of bounds.

Sovereigns are a huge part of the investment-grade credit universe and so too is paper issued by banks. In the financials space, Charpin can buy contingent convertibles (CoCos) and regulatory capital instruments, but only those that are marked to market. Conversely, the structured, bilateral and bespoke deals tend to be marked to model and are more of a multi-year, buy-and-hold trade that is clearly not compatible with his trading style – or indeed the fund’s monthly liquidity. Regulatory capital is still interesting, he says, because “if banks had to issue tier one capital at 10% yields they would still do it, as regulators want the asset to exist and banks still have to raise a lot of capital.” Charpin sees scope for this paper to appreciate more. He is not particularly worried about the AQR (Asset Quality Review) or delays to EBU (European Banking Union), and the French national does envisage a harmonisation of European banking. He thinks that eventually the ECB will become “the ultimate regulator and unify rules, removing fudges and swaps, so you get a level playing field.”

Satellite macro trades

Charpin’s macro outlook is broadly sanguine. He thinks that central banks are behaving transparently and have said they will follow the data, which is improving. “The forward-looking US data is good, as seen in ADP, PMI, ISM and FOMC statistics and statements,” he notes. Consequently, the fund does have an active bet shorting certain bonds and this should be viewed separately from his credit selection portfolio. The relative value credit book has hardly any interest rate exposure anyway, either because it is market-neutral or because ideas are expressed through credit default swaps that move in line with credit spreads rather than overall yields. As Charpin invests in spreads, he finds no advantage in buying floating rate debt. So the short Treasury and Bund position is not a hedge for any residual duration exposure elsewhere in the portfolio. The size of the short rates stance should not be exaggerated – it is around four years’ duration, less than the fund’s ceiling on credit spread duration.

The currency strategy is also a fairly small part of the fund, making up no more than 20% of risk. As with interest rates, Charpin reckons his success ratio will be low with currencies as it is “a very low Sharpe ratio strategy”. But BlueBay did find the Japan reform story very compelling, and the fund does have the flexibility to use a variety of asset classes to express views. “JGBs were not volatile enough so we used the Yen and the Nikkei,” says Charpin.Although the Japan trade contributed less than one tenth of returns in 2013, that is actually quite a large contributor by Charpin’s standards, because his performance attribution is very broad-based. “We have very diversified sources of alpha, with individual ideas rarely making more than 0.2% to 1.5%, and often as many as 50 ideas contributing in a year,” he explains.

Dispersion to persist

Charpin thinks the climate for security selection will improve, even if it has sometimes been challenging lately. In contrast to 2012, Charpin admits that the past 18 months have been very hard to make money from shorts. “Even when companies are in trouble, you can get a white knight event,” he says. So takeovers of two shorts did cause losses, both from spread tightening and ratchet clauses, but these losses were not noticeable in the monthly returns because the book is so well diversified. In general, Charpin finds that M&A can throw up good opportunities, because it generates dispersion between names. He recalls how in 2004-2005 M&A was more private equity-driven and tended to be releveraging stories that reduced credit quality. “Now, there are also deleveraging stories,” he explains, although outcomes are not always completely predictable. Execution risk and changes to capital structures can all create volatility and trading opportunities.

Charpin expects this dispersion to persist. He thinks it is fallacious to view tighter spreads as reducing security selection opportunities and points out that 2006 was the only year when dispersion was low enough to meaningfully reduce security selection opportunities. In terms of absolute value, spreads are still above 2006 levels, but what makes it interesting for alpha generation is that the market structure is now completely different. “Back in 2006 banks had unlimited access to essentially free capital, so they could easily arbitrage discrepancies via prop desks, making the market very efficient,” he recalls. Now that banks are being forced to bolster their balance sheets and retreat from proprietary trading, there are far more dislocations and anomalies – and also fewer hedge funds to pick them off.

The universe of opportunities is also now much wider as “there is far more going on in sovereigns and also more volatility,” Charpin salivates. Even in the corporate space, the easy environment of emerging market growth and low labour costs has been superseded by a new normal of slower growth, with China perhaps down to 4-5%, and higher inflation due to wage hikes. This opens up a divergence where companies have different responses, “meaning that shareholder and bondholder interests are no longer aligned”. Companies that decide they no longer need an investment-grade rating and releverage to reward shareholders can be short opportunities for Charpin, as Safeway was. Other companies restructuring and refocusing on core strengths can be improving credit stories. So while Charpin does not promise to repeat the returns of the past five years, the French engineer remains confident about the opportunity set for his strategy.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical