Regulations enacted subsequent to the financial crisis intended to reduce market risk are directly impacting the manner in which prime brokers service the hedge fund industry. These regulations put in place as a result of the Dodd-Frank Act and Basel III have changed the basic ability of prime brokers to offer financing and maintain hedge fund assets. Increased focus on optimisation, capital liquidity, funding and the balance sheet have impacted banks’ capacity and economics, resulting in an evolution in how prime brokers view hedge fund relationships. Prime brokers have increased focus on balance sheet and collateral management, and are re-pricing clients when necessary. Relative to other challenges highlighted in this study that have been playing out for many years now, the evolving prime brokerage environment is in the growth phase of its life cycle. It will be a long time before we understand the full effects of the changes, though we do know the impact will be felt across the board — from prime brokers, to investment managers, to investors.

Managers face new pressures as prime brokerage fees increase

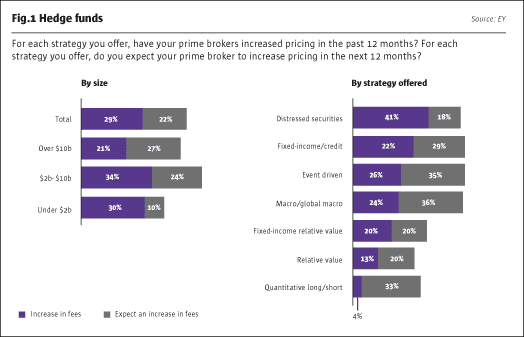

Our study identified that nearly 30% of managers have reported experiencing price increases from their prime brokers, with an almost equal number indicating that they anticipate price increases to occur in the next year.

A variety of factors will impact when and where in the re-pricing cycle managers will begin to feel these increases, but it is clear that this issue will impact a majority of managers regardless of size or strategy.

Those first reporting increases are managers who have a combination of balance sheet intensive strategies and trading in products that are traditionally not as profitable for prime brokers. On the opposite end of the spectrum, quantitative and equity long/short strategies appear to have been spared in this initial re-pricing as they tend to trade higher volume, high-quality liquid assets that result in lower net balance sheet exposure and/or greater internalisation/optimisation for the prime brokers. That said, these strategies are still anticipating price increases in the future as the cost of servicing all clients has risen and thus the current return on these assets is not optimal for the prime brokers.Talent remains paramount, but also in the back and middle office functions. This trend mirrors other industries (i.e., technology) where major firms differentiate themselves in their ability to identify, train and maintain top talent.

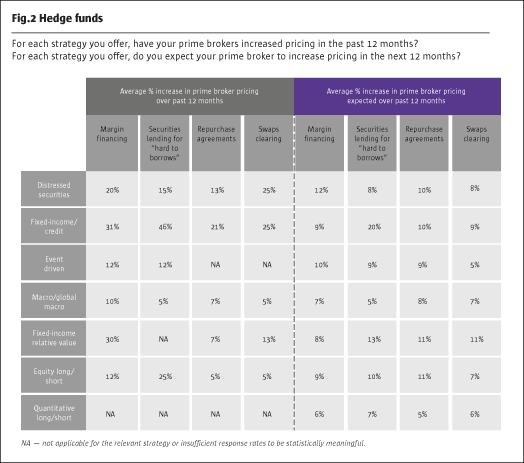

Financing cost increases are substantial, directly impacting trade economics

The magnitude of trade financing price increases will vary depending on each manager’s unique facts and circumstances, in particular, the types of assets the manager trades. However, what is clear is that all forms of financing are becoming more expensive — in some cases, being at or above 25%. These costs have a direct impact on overall trade economics and will cause managers to evaluate the feasibility of certain trades given these increased costs. It is worth pointing out that the actual price increases reported by those managers initially impacted tend to be larger than those expected in the future by those managers spared from re-pricing initially. While this is partially driven by the prime brokers taking first action with those managers whose financing economics required the most improvement, and thus required larger increases, this expectation gap of more muted price increases is likely not going to be the reality.

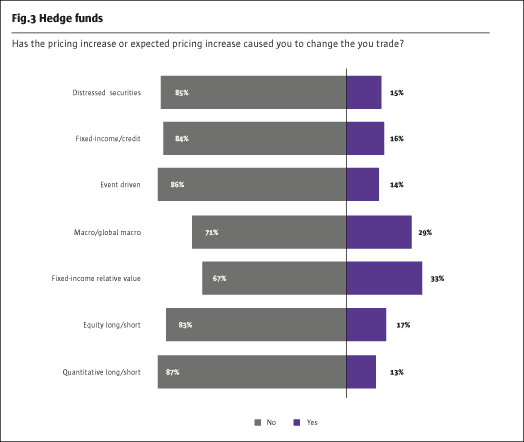

One in five managers expects pricing increases to change the way they trade

When faced with price increases, managers can either bite the bullet and incur the cost or they can search for ways to shift their trading strategy. It is interesting to note that one in five managers embraced the latter resort and actually reported changing the way they execute their trading strategy.

In an industry geared toward supporting the trading behaviours and preferences of the front office, we are starting to see a clear shift in mindset. Managers, particularly fixed-income/credit and global macro, are responding that they have materially adjusted their operations so that trading is responsive to the new reality.

Whether it be moving toward swap-based trade execution, reducing repo financing or an overall reduction of leverage, managers of all strategies are having to make hard decisions about whether certain trades make sense given the associated costs.

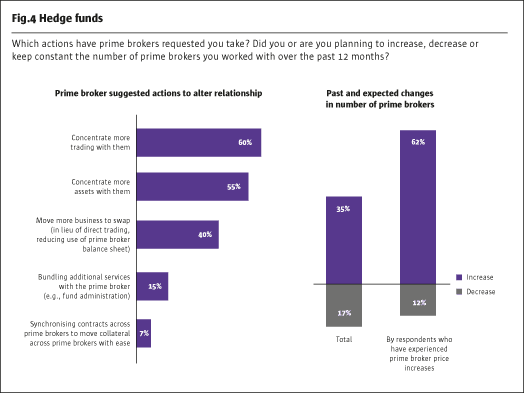

In addition to outright re-pricing, prime brokers have suggested other changes in their relationships with funds

In addition to outright price increases, prime brokers have been having conversations about how to alter relationships so that managers better fit within their evolving business model.

The prime brokers’ preference is for managers to concentrate more business with them to maximise cross-selling revenues. However, managers are taking the opposite approach by continuing to add relationships. New entrants to the market have provided managers additional options to complement their existing relationships. While a third of all managers have increased their relationships, 60% of those managers impacted by re-pricing have expanded. This expansion is driven by the fact that managers are larger and more complex than ever with increased financing needs. As many prime brokers have less capacity to offer, the primary solution for managers is to increase relationships.

Whereas after the 2008 crisis we witnessed an expansion of the number of prime broker relationships as managers wanted to mitigate counterparty credit risk, now we are seeing an expansion of relationships to mitigate counterparty capacity risk.

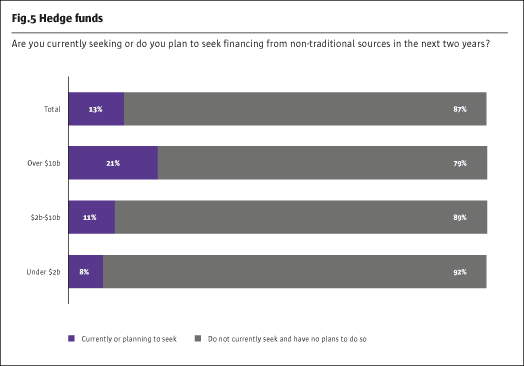

One in five of the largest managers is seeking financing from non-traditional sources

In addition to the new boutique prime brokers entering the industry, we are beginning to see an appetite from managers to seek financing from other non-traditional sources, whether it be from institutional investors and sovereign wealth funds, custodians or even other hedge funds. While the percentages are not large, going back two to three years, these financing means likely would have been non-existent.

The biggest managers tend to be on the leading edge of many of the industry’s innovations, so the fact that just under a quarter responded “yes” could be an indication that this trend is only beginning and that we will continue to see managers seek fresh and inventive ways to finance their operations. Whether this holds true will depend equally on whether there is sufficient supply from these alternative counterparties in addition to whether managers will provide the demand. This trend creates both risk and opportunity. The lack of traditional financing options could continue to cause liquidity constraints and hinder managers’ ability to finance their strategies in a cost-efficient manner. New entrants will view this as an opportunity to enter an industry once dominated by global investment banks and capture market share by providing the industry’s financing needs.

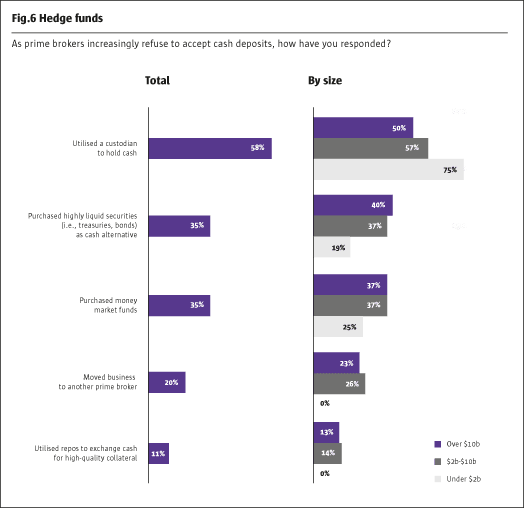

Cash is not king (for the prime brokers) requiring action by managers

A final complexity that managers need to address is that many prime brokers are reluctant to hold cash as a result of how such balances are classified toward the banks’ capital reserves.

A majority of managers have responded by moving cash to custodians while a third have reported purchasing cash equivalents such as treasuries or money market funds.

While these alternatives are available to all, the results show that the smaller managers tend to primarily utilise custodians rather than other mechanisms. This suggests that smaller managers have made the determination that these other tools are not an effective solution (whether from a cost or operational perspective).

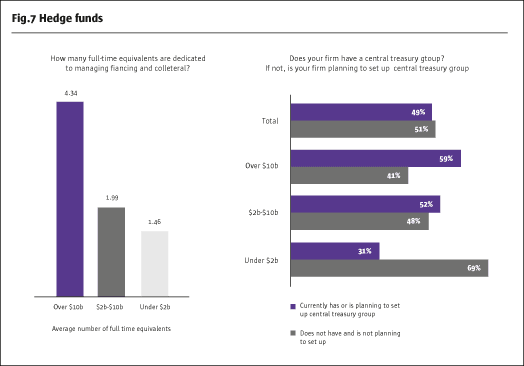

The increasing complexity of financing and cash management activities and managing a growing number of relationships with prime brokers comes at an increased cost of building out an infrastructure and personnel to handle these responsibilities.

Centralised treasury has become an integral process in managing the overall business

As a result of the changing prime broker landscape, the need to better manage counterparty risk and collateral, as well as other treasury functions, has become an increasingly critical component of a manager’s operations. Managers have responded by having individuals dedicated to this function to help optimise their activities and conduct business in the most economically sound way possible. The largest managers, due to necessity and the means to implement, have responded the most quickly and have built out groups that can focus on these efforts.

Though it is not surprising that the smallest managers have not yet developed these groups — they are less complex and/or focused on growing their businesses — mid-sized managers could benefit from the support of a more robust treasury team. It does seem noteworthy that half of all managers do not currently have a central treasury function. Given the evolving environment we have been describing, we believe this will be a critical area of focus to build out in the immediate

future.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical