Quantitative or systematic investing is more competitive than ever. Cheap computation power, infinite storage capabilities, the proliferation of low-cost but state-of-the-art data analysis tools, online data scientist communities, combined with the progressive commoditization of well-known quant factors through the “smart beta” tag, undoubtedly raises questions about the value-add of a systematic managers in such an environment. If one hasn’t resigned oneself to the belief that all alpha has become beta, where is this alpha now to be found?

What are the elements that quant managers still can offer today to deliver differentiating results? A prominent factor of any systematic asset manager is ultimately to generate a distinctive return stream, which cannot be replicated by a simple combination of standardized, cheaply available financial products. Hence the objective should be to deliver independent and non-replicable return streams. It seems that in the current environment, this objective has become a much more challenging task than in the past.

To highlight where the value proposition of a systematic asset manager lies today, it helps to first understand the underlying drivers of a quant manager’s capacity to generate alpha or differentiated performance. The “Fundamental Law Of Active Management” introduced in 1995 by Grinold and Kahn states that an active manager’s value-add, which can be expressed by the Information Ratio (IR) is the product of his Information Coefficient (IC) and his Breadth (N):

IR = IC * SQRT(N)

The IR can be seen as the efficiency of a strategy for a given level of risk taken by the manager. The IC is to be understood as the correlation between ex-ante return forecasts and realized returns and provides an indication of the manager’s skill in predicting future security returns. The breadth relates to the number of independent investment opportunities or trading signals on which a manager is placing his odds. Consequently, to improve a strategy’s efficiency (IR) the manager should, according to the formula, increase his skill and/or increase the number of times he utilizes his skill.

Breadth can be increased via two major dimensions – one is the continuous time dimension which embraces the holding period or trading frequency. The other is the discrete opportunity space and is by itself multidimensional as it encompasses myriad dimensions – for example, the asset class, type of security, the trading concept (trend following, mean-reversion), regional focus or the number of securities traded per signal.

Given a certain level of a manager’s skill the trading strategies with longer holding periods and lower turnover can more easily increase their breadth along the discrete opportunity space, by maximizing the number of traded assets for instance, assuming that they can maintain the same level of skill (IC) for the new classes. This principle lies at the core of many CTA strategies, relying on the relative independence on various assets.

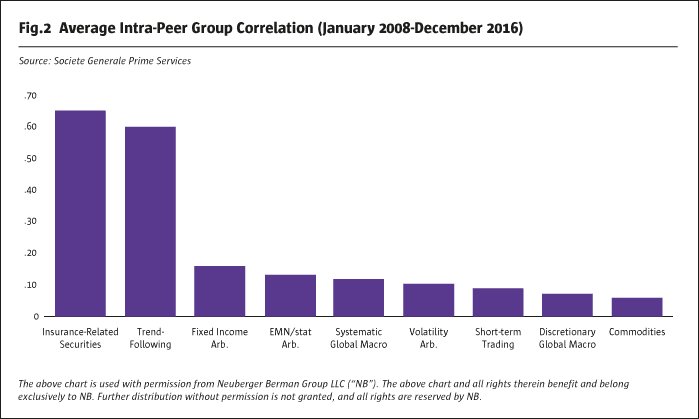

However, it is unlikely to be a return differentiator these days. Given the number of peers and the resulting level of competitiveness in the field and, above all, its maturity, the IC within trend following has become increasingly commoditized. This is underpinned by the long-term average pair-wise correlation among the constituent managers of the SG Trend Index which is 0.788* Consequently, many peers are chasing more or less the same opportunities over the same time horizon which results in the aforementioned high correlation among each other.

Similar observations can be made of “smart beta” products. Because “smart beta” praises itself on being low-cost, the underlying strategy of such products must be scalable, and attract significant assets to be profitable for the management company. The flipside of scalability is the fact that it forces the average holding period to be on the longer end, automatically limiting the breadth and increasing the correlation to the market. Additionally, smart beta vehicles use trading concepts which are fully transparent and well known to the public. Hence, by their nature these products are not offering access to a manager’s distinctive skills either.

The picture changes completely if one shortens the holding period or increases the trading frequency. The shorter the frequency of a trading-concept, the higher the degrees of freedom to impact both the skill and the breadth factor; and the higher is the potential IC. But the increase in the trading frequency and, hence, in the number of tradable opportunities comes at a price. First, the requirement in infrastructure and operational sophistication to overcome significant execution costs – commissions, and more importantly market impact – are increasing; and secondly, the strategy will encounter capacity constraints much sooner. These cost effects are completely omitted in this version of Grinold & Kahn’s formula. However, they can be compensated to a certain extent by either a higher IC and/or an increased skill in execution. On the other hand, the capacity constraints are there to stay.

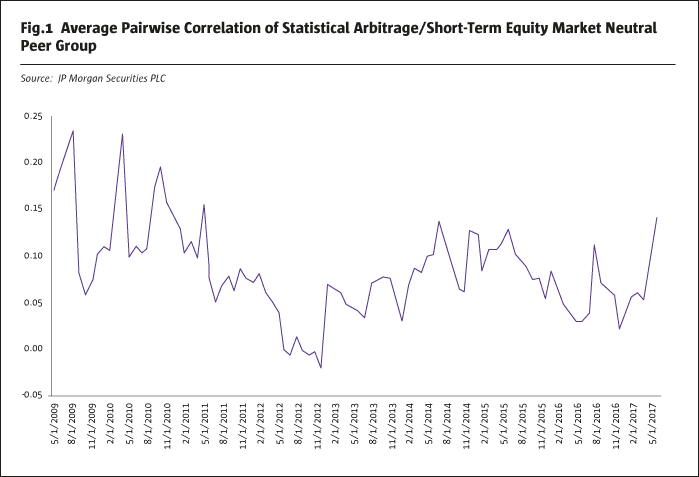

There is a frequency above which the ability to implement successfully a trading-signal becomes highly dependent on the manager’s execution skills. If a manager clears that hurdle, it will be rewarded with many more opportunities to deliver truly differentiated return streams. Looking at the universe of short to mid-frequency statistical arbitrage strategies, the average correlation between managers in this field is far lower than for longer-term CTA’s. Indeed, this figure is 0.267* for the SG Short Term Traders Index and is further exhibited in Figures 1 and 2.

Although most of these short- to mid-term managers do rely on the same data sources, and often on similar trading concepts, the number of possibilities to extract value naturally increases with the higher trading frequency.

In summary, one is more likely to find distinctive return streams with managers running short-term investment strategies. Due to the differentiating alpha profile and the capacity constraints of such strategies, most of the few successful short-term trading programs are closed to new investors, which indicates that there is still enough appetite for the current level of supply of exclusive alpha.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 124

The Hunt for Alpha Lies in the Short-Term

Delivering differentiating results

NICOLAS MIRJOLET, CIO AND FOUNDING PARTNER, TOLOMEO CAPITAL AG

Originally published in the July 2017 issue