The Long Wait

Risk assets struggle for impetus against negative newsflow

GERAUD CHARPIN, PORTFOLIO MANAGER, BLUEBAY ASSET MANAGEMENT

Originally published in the October 2016 issue

The uneventful meetings from the Bank of Japan (BoJ) and the Federal Reserve (Fed) earlier in September were broadly seen as a green light for risk assets, confirming that the largest actors behind the rise in asset valuations were still intent on keeping rates/yields at ultra-low levels. In the context of benign global economic data, continued stimuli in China, stabilised commodity prices and some repair work being carried out in emerging market countries, we believe that the very near term horizon (3-4 weeks) seems to present few areas of concern to justify a meaningful sell-off across markets.

Yet, since the immediate post 21 September Fed meeting uptick, the S&P 500 has found no strength, treasury yields are down over 15bps and the yen is almost up 1%. These moves are hardly a sign of investor confidence in risk assets, rather they are signs investors are not eager to buy into risk assets and are very nervous about valuations. The market has clearly failed to take the dovish central bank message positively and has instead focused its attention on any negative newsflow. Indeed, International Monetary Fund (IMF) comments on Portugal, Fitch comments on China’s debt binge, the resurgence of Trump in election polls and the number escalation from the US Department of Justice (DoJ) in financial litigation have not been brushed aside as mere distractions but duly reported on the radar screen.

Top-down themes

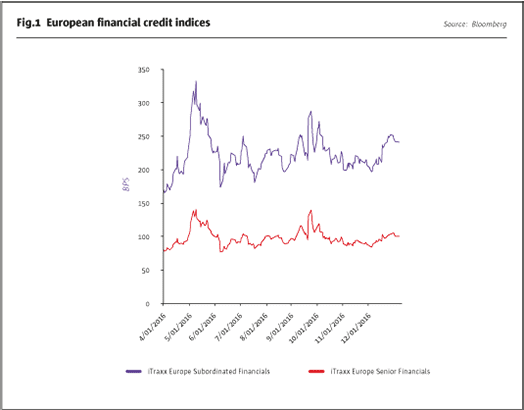

Financials have been in the spotlight and flashing red on investors’ radar screens. The US DoJ’s unusual tactic of leaking sky high demands of settlements has rung a few alarm bells given that numbers seem to be plucked out of thin air and enjoy an inflation rate that must be the envy of central bankers around the developed market world. While it seems very far-fetched that a prosecutor would request a fine that would trigger the collapse of a systemically important bank, the market is not ruling out any possibility that things somehow get out of hand. We suspect volatility and stress are likely to remain elevated until a final settlement figure is announced, probably in the next few weeks. We generally like the subordinated financial sector, though. While there are a few idiosyncratic developments that will generate volatility, banks are getting safer and regulatory bodies are becoming more receptive to the fact we need healthy banks if we want to support much-needed growth. We subsequently have a positive outlook for the sector.

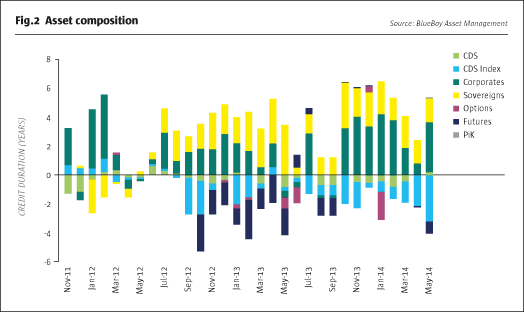

Our affinity for higher yielding financial debt is matched by our dislike of corporate debt at this level of yield and spread. While the scarcity of flashing dots on our radar screen is limiting our willingness to run extended directional short positions, we still feel much more comfortable trading this market from the short side. Given that single name corporate credit stories are few and far between in this low yield/QE dominated world, the themes in this space are more sectoral and currency-based in nature. For example, we feel relatively constructive towards the UK versus European corporate debt ahead of the Bank of England (BoE) starting its very own purchase program. Long UK and US corporate spreads, short European corporates, long subordinated banks and short mega oil and miners are the building blocks of our corporate investment strategy.

Yen a safe haven

A reduction in directional risk in the corporate debt segment can be advantageously shifted towards specific macro dislocations that are more idiosyncratic in nature. For example, a long yen position seems a sensible ‘risk-off’ currency position alongside a short sterling and offshore renminbi. The effort of the BoJ to re-steepen their yield curve is more likely to make yen assets more attractive with the unwanted side effect of strengthening the currency. At the same time, the yen is generally seen as a safe haven and could benefit from political risk events in Europe and the US. Conversely, we feel that the Mexican peso is pretty much pricing in a Trump victory. We are of the belief that it is likely to remain volatile as the campaign progresses but we feel the risk-reward is now asymmetric and believe that a small long position is warranted.

Politics driving sovereign sentiment

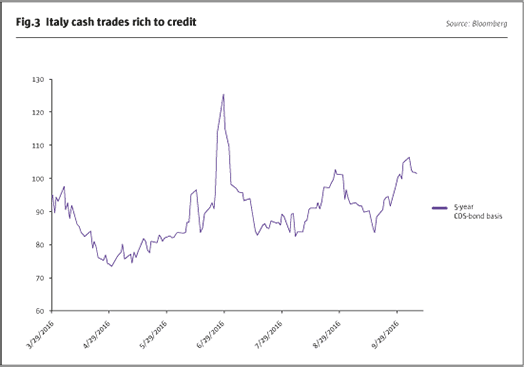

In Europe, we think Italy is going into an uncertain period and believe that Italian treasury bonds (BTPs) are too rich compared to Italy CDS. We also think that higher yielding assets like Cyprus or Greece offer better risk-return profiles than other assets in the region. We would offset these positions with shorts in Russia and Korea as bellwethers of sovereign risk rather than for purely idiosyncratic factors. We remain amenable to a long-risk positioning in sovereign credit but, the conviction has somewhat gone down ahead of important political events across developed economies.

Limited rates bias

With the BoJ, European Central Bank and BoE all looking for new ways to tweak their easing policies, we do not have a particularly strong view on the overall direction for interest rates globally and would settle for relative value positions with a medium-term investment horizon. We still feel that the UK should see the impact of a lower sterling translate into higher inflation expectations and like being short long UK rates against German and US rates. Similarly, the BoJ’s decision to target 10-year rates argues in favour of maintaining a short bias towards Japanese long yields versus US Treasuries.

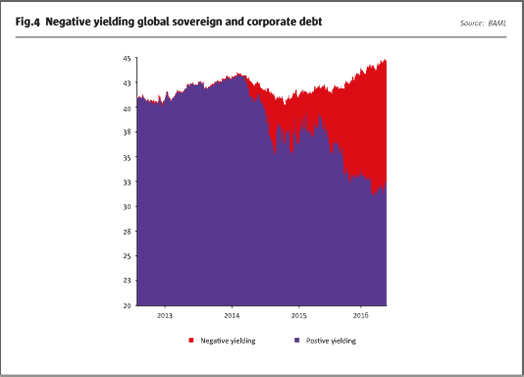

Central bank distortion

Looking forward, our conviction is that negative interest rate policies (NIRP) are destructive to the very fabric of our societies and cannot be maintained too long without causingmeaningful collateral damage. We would liken NIRP to a defibrillator: a great tool to resuscitate a patient by shocking it back into life but one that will ultimately kill the patient if used repeatedly. We believe that central banks will need to shift/twist or find new avenues to stimulate growth and inflation sooner rather than later. A failure to do so will only continue to fuel populist movements across the developed world. One of them will eventually put an end to NIRP and the sooner the better. Investors are too focused on “lower forever rates” when central bankers are already actively seeking a way out of it. Investors who follow the lead of central banks in buying assets regardless of value, trust a leader that has so far failed in its very mandate of restoring growth and inflation expectations. Ironically, they are also following a leader which is actually trying its best to force them away into other markets and assets.

It is a long and difficult wait for the bears but there is no ‘goldilocks’ scenario out there, but a desperate fight to generate growth out of an ageing developed world. Fights are always chaotic hence our conviction that we are unlikely to see a long and protracted period of ever diminishing volatility. We are not looking for a large catalyst (and do not see one) but a simple accumulation of small reagents is all that is required to generate a large price response given how unbalanced markets already are.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical