Alternative asset managers are accustomed to acting nimbly in their quest for alpha. In the last several years, this agility has manifested in the form of strategy expansion. Formerly pure-play investment shops are eyeing separate asset classes and fund structures while considering making the leap into new territory to attract new investors and diversify their returns.

A growing number of alts managers will begin to seriously consider this trend as they seek to bounce back from the COVID-19-fueled downturn, from which managers have encountered a surge of redemption requests, slowed deal flow, dramatic downward valuations in high impact sectors (such as transportation and hospitality), and widespread uncertainty across the market.

In 2019, hedge funds made up a third of institutional investors’ alternative investments, down seven percentage points from 2018.

Peter Sanchez, Head of Alternative Fund and Omnium Business Services, Northern Trust

Against the current volatility and elevated uncertainty, all alts managers should be actively assessing their current footing to respond to new information. As the fog clears, and managers and investors alike are ready to start making bold moves – strategy expansion included – once again, there will be a premium on the speed and robustness of alternative fund responses. Those who assess their positioning and acquire the right resources now will be able to strike more quickly and witness returns ahead of the competition.

The road to blurred alternatives strategies

Notwithstanding the pandemic’s effects, alts managers continually balance their reactive versus proactive efforts to execute their strategies. While the private funds have experienced an extended stretch of outperformance, hedge fund managers in particular have looked to diversify after the industry delivered years of lackluster returns, underperforming compared to the market for the entire past decade with the exception of 2018. As a result, investors’ money began leaving hedge funds and entering private equity. In 2019, hedge funds made up a third of institutional investors’ alternative investments, down seven percentage points from 2018. Meanwhile, private equity grew to 25% of institutional investors’ alternative investments, up from 18% the year before.1 As a result, more than a quarter of hedge fund managers now have a private equity or venture capital offering.2

Recently, the movement of alternative strategy expansion has been most prevalent in the form of pure-play hedge funds expanding into closed-end private structures – primarily private equity (PE), and private debt, less so in real estate and infrastructure. There are also instances of PE shops exploring open-ended fund structures, but the inherent imbalance of portfolio versus investor liquidity in this space is a persistent challenge.

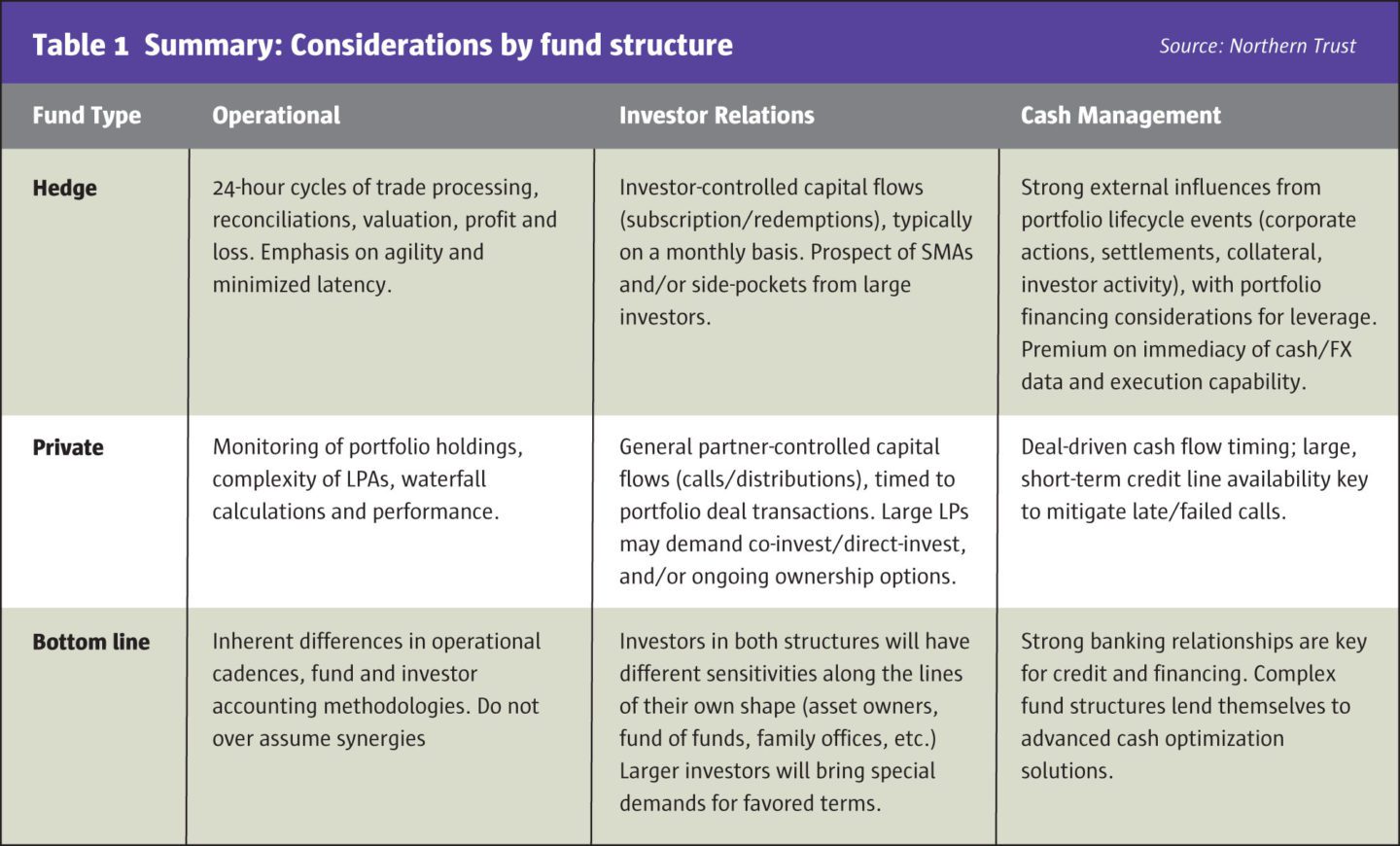

But expanding into new products isn’t a move to take lightly. The emergence of these traditional hedge funds into “hybrid” structures has strong implications for their own operating models, as well as for service providers and other stakeholders. Operations and investor needs can differ vastly between different product types. Deep expertise in the middle- and back-office demands of one product does not necessarily proxy into others, and missteps can be costly. Managers’ time is well-spent understanding the practical demands of the new territory they’re considering and their own ability to handle the expansion.

Is strategy expansion the right choice?

The needs between separate alternative asset classes can differ drastically, and alts managers need to consider those factors when reflecting on whether an expansion is the worth the work. For those who seriously consider a multi-strategy approach, they should contemplate the following questions:

- Motive – Managers should deeply evaluate why they’re choosing to expand their strategy. Is it simply to serve as a hedge on returns or do they feel like they have the expertise and capabilities to truly and valuably serve new and existing investors through this move? Both may be justified answers, but the reasoning should dictate how a manager leans into the expansion. A credit strategy hedge fund, for example, may develop a complimentary closed-end private debt fund while a multi-strategy hedge fund may add pure private markets strategies as a diversification play.

- Implementation – Before diving into an expansion, managers should question whether their new products will feel like a natural and holistic offering or if they will feel like a bolt-on strategy. If the manager doesn’t have (or cannot quickly and efficiently muster) the resources to achieve the former, it may not be worth it to expand. The new offering should achieve synergies across operations, investor relations and technology, rather than require a full stack of independent capabilities to support the new strategy.

- Positioning to investors – Managers should consider the positioning of their potential strategy expansion to their current investors as well as the investors they’d hope to target. Current investors shouldn’t feel concern for the viability of the strategy that they signed on for as the manager pursues new projects. Managers will want to plan for a promotional strategy that communicates to current investors that the new offering will not dilute the quality of the original offering, while still efficiently attracting new investors. In this arena, strategically aligned, synergistic expansions are easier to position and rationalize to investors than diversification-driven, bolt-on efforts.

- Operational preparedness – Before launching a new strategy arm, managers should ensure they have the needed service providers to support the offering and to advise from risk-reduction and cost-savings perspectives. Plus, from a business resiliency standpoint, managers should make sure the strategy expansion can thrive under current remote work operations and be able to seamlessly transition back and forth in the future under similar circumstances.

The reflection process of deciding whether to expand a strategy likely occurs over an extended time period. But if a shop decides that a new alts offering has sensible motives, an important next step is to seek resources that can help with execution.

The search for the right partner

As alts managers enter new territory when expanding their strategies, an administrator can bridge the knowledge and experience gaps. While a good partner can fill a manager’s operational needs, the ideal partner goes beyond to serve as guide as the manager defines their new strategy.

How can alts managers evaluate potential partners to find the perfect fit? Firstly, they should seek out a provider with the experience to anticipate their own needs. As such, the relationship should be less transactional and more consultative. As a formerly pure-play shop steps into new territory, an administrator or solutions partner should feel prepared to guide the manager with its deep experience across the alts space, including in matters related to fund structures, regulations and cash management. Knowing their administrator is ready and able to support future changes gives a manager assurance that they can execute their strategy and make a successful, sustainable play into new ground.

In addition to the experience to advise a manager on the subtleties of new asset classes, an ideal partner should provide a wide breadth of services, allowing the manager to access a one-stop shop of capabilities as they navigate a new asset class and fund structure. They should also be able to deliver a streamlined experience for the manager, so that if the manager uses multiple services, the administrator should communicate cohesively rather than as multiple fragmented teams.

The future of alternatives

As the lines between alternative asset classes blur, managers who deem expansion the right move for their firms will require appropriate guidance and services to help generate alpha. The drive to diversify alternative investment strategies will pick up steam and the balance will tip in favor of these non-traditional funds, making a transition seem even more appealing. But as discussed, the move into new asset classes isn’t a simple or quick journey. As managers blend their strategies to incorporate new products in separate asset classes, they must have a clear strategy, deploy seasoned expertise and seek out the ideal service providers to assist with their mission. The alts managers that do this successfully are better positioned to navigate through current economic uncertainty and outperform the market and their competitors.

Footnotes

- EY, 2019 Global Alternative Fund Survey, 2019

- Ibid

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 150

The New Alts Manager

How to expand an alts strategy the right way for the right reasons

Peter Sanchez, Head of Alternative Fund and Omnium Business Services, Northern Trust

Originally published in the August | September 2020 issue