Institutional investors have become the predominant audience for hedge fund investing over the past decade. Their view on where hedge funds fit into their portfolio, and their investment goals for their hedge fund allocations, have both undergone significant change over the years, with market leaders moving from capital-based allocations that placed hedge funds on the periphery of their portfolio to risk-aligned considerations that move hedge funds into their core equity and bond holdings.By balancing their holdings, investors are looking to maximize the shock absorption potential of their hedge fund allocations and create resiliency for any set of market conditions. This premise is likely to be tested in the near future – as is the efficacy of the risk-aligned allocation approach – as three major factors are perceived as driving up the risk in institutional holdings and increasing the focus on how investor hedge fund holdings will perform.

These three important changes in the macro investing environment are accelerating the move toward using hedge funds as a shock absorber in institutional portfolios. First, perceptions that assets are moving into equity long-only funds is increasing institutions’ overall portfolio risk. Second, the resurgence of illiquid fixed income products is creating renewed concern about a potential liquidity shock and encouraging investors to seek longer-duration products to insulate themselves. Finally, anticipation that we are approaching a turn in the long-term credit cycle is prompting investors to seek protection against rising interest rates through credit hedge products.

Industry flows are likely to increase in 2013 in response to these three factors, and hedge funds are likely to compete more directly for institutional allocations from asset managers and private equity funds than in previous years.

Flows to equity funds increase investors' risk profile

Equity market moves to record highs in early 2013 are being seen by many of the 82 institutional investors surveyed in depth this year by Citi as a signal that we are entering a renewed period of growth, and that the impacts of quantitative easing have advanced enough that cash may now be coming off the sidelines. Many expressed views that we may be positioned for a more directional period of market performance where idiosyncratic risks re-emerge, thus benefiting hedge fund trading styles.

Optimism about improved equity market returns is coming at a time when most institutional investors are struggling to meet their obligations. The technology bubble in the early 2000s, followed by the global financial crisis (GFC) in 2008, have both significantly affected most institutions.

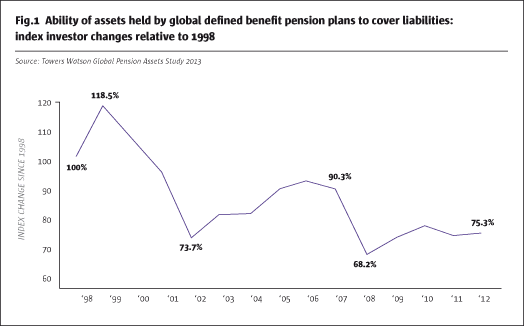

The impact of these events is clearly visible when viewing the asset and liability situation of the world’s top defined benefit pension plans. As shown in Fig.1, these organizations had sufficient assets to cover 106.9% of their liabilities in 2000, according to Towers Watson, but saw their ratio drop sharply in the wake of the technology bubble.

Over the following years, there was a rebound in their asset coverage, but pensions were still in deficit by 2007, when their asset to liability coverage was only 90.3%. The global financial crisis pushed coverage ratios down sharply, to as low as 68.2%, and difficult market conditions in subsequent years have limited a recovery. By the end of 2012, assets at these organizations were still seen as only covering 75.3% of liabilities.

Pensions are the largest segment of institutional investors in the hedge fund market, but their struggle is reflective of similar problems at endowments and foundations (E&Fs), and even of some sovereign wealth funds.

Although equity markets have risen post-GFC, they have not offered institutions much opportunity to increase returns because of their discomfort with the expanded volatility. Institutional investor interest in equities has been primarily in a risk-on/risk-off mode that has not allowed for any sustained investment move.

This reflects a growing realization across the institutional community about the over-concentration of equity risk they had been running in their portfolios. Institutions have realized the benefits of portfolio diversification for the past 50 years and sought such diversification in their allocations by balancing their portfolio across equities and bonds – most frequently allocating 60% of their capital to equity investments and 40% to bonds. The failure of this configuration to offer any insulation in the GFC prompted a realization that from a risk perspective, this 60/40 capital-based allocation was actually a 90/10 allocation, with 90% of the risk in the portfolio belonging to the equities component and only 10% with bonds.

As discussed at the end of the previous section, this change in thinking is what has driven many leading institutions to reposition more directional equity and event driven hedge funds alongside their core equity holdings. With a risk-aligned allocation approach, hedge funds that provide downside protection during market volatility can make the portfolio more resilient. This recent trend is confirmed by HFR flow data for these strategies. Net flows into equity and event driven hedge funds were positive in the first quarter of 2013. These are the first positive quarterly flows into these strategies since Q3 2011.

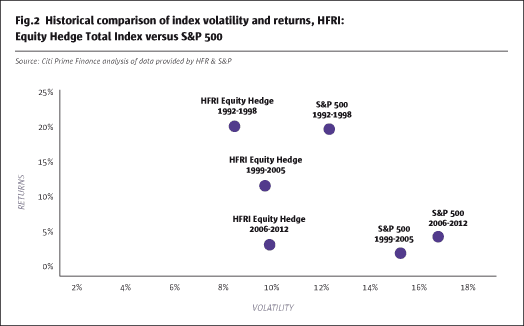

Historically, equity hedge funds have outperformed and offered lower volatility than outright equity exposure. A comparison of the S&P 500 versus the HFRI Equity Hedge Index over three separate six-year intervals, commencing in 1992, demonstrates that the HFRI Equity Hedge Index exhibits approximately two-thirds of the volatility with similar or better performance. As shown in Fig.2, the HFRI Equity Hedge Index had an average annualized return of +12.2%, with a volatility of monthly returns of 9.5% from 1999 to 2005. In contrast, the S&P 500 Index average annual return was +2.5%, with 15.4% volatility of monthly returns.

Equity hedge funds also exhibited much lower volatility during the most recent six-year period ending in 2012 – a period that includes the major market correction of 2008. Fig.2 shows that the HFRI Equity Hedge index reported slightly lower performance of +3.8% versus the +4.7% average annualized returns of the S&P 500 index from 2006 to 2012, but annualized volatility was significantly lower at 9.8% compared to 16.9% for the S&P 500 index.

Given the lessons of recent years, most survey participants expect institutional investors to up their allocation to equity hedge when they increase their outright equity exposures in 2013. This is a continuation of the movement of equity hedge strategies into an “equity risk” bucket.

A recent development, discussed further in this year’s survey, was the strategy of using credit-focused hedge funds for insurance alongside the investor’s core credit positions.

New long-duration credit funds are used to protect against a second liquidity shock

With equities having been seen as overly volatile and difficult for sustained investment, institutions have been looking elsewhere for returns in their portfolios. This has been a difficult proposition given that the 30-year bull market in fixed income and deliberate government interventions post-GFC have combined to push interest rates to record lows.

Against this backdrop, investors have been using their credit allocations to look for returns in some of the more risky and opaque areas of the market. The search for yield has begun to push many institutional investors out on the credit curve into increasingly illiquid products, raising concerns about a potential repeat of 2008 liquidity issues.

One investment that symbolized liquidity fears during 2008 by proving to be problematic to value and liquidate was collateralized loan obligations (CLOs). Just before the GFC, interest rates and credit spreads were low and investors were reaching for yield, much like the situation today.

CLOs are structured products that repackage a set of corporate loans that are then divided into tranches. Each CLO is unique to itself, and neither the CLOs nor the underlying loans trade on any exchange. These products offered investors yields that were higher than yields on traditional credit securities in the market in the period leading up to the GFC, and many investors seem to be mirroring this investment trend in 2013.

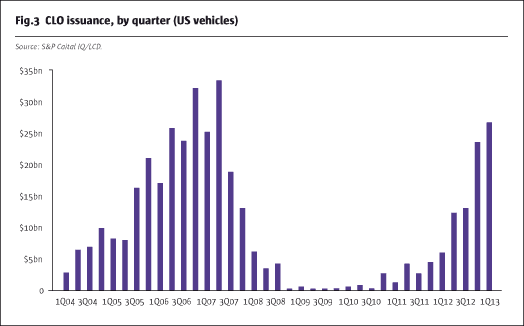

In order to satisfy investor demand for yield, CLO issuance volume reached peak levels in 2006 and 2007. As illustrated in Fig.3, quarterly issuance of CLOs is approaching levels not seen since pre-GFC. According to S&P/Capital IQ, in the first quarter of 2013 CLO issuance was the third highest on record. One theme in this year’s survey was a growing concern from many market participants that the move into these illiquid fixed income products could be setting the industry up for another liquidity shock.

Rather than looking to take on such exposure in an uncovered way, however, change has been noted in investors’ risk behaviour relative to the earlier pre-GFC cycle. Many institutional investors have been working with their credit hedge fund managers to carve out a longer-duration credit fund that minimizes any possible asset/liability mismatch by leaving them free to manoeuvre and seek short-side profits without fear of redemptions if another liquidity shock were to occur.

These long-duration credit funds are typically commanding a five-year lock-up that is positioning them as an alternative to a traditional private equity investment. Long-duration funds from hedge fund managers are seen as an insurance policy for investors when compared to traditional private equity, as the hedge fund manager is likely to pursue its strategy with a “trading” as opposed to a “banking” mindset and by offering a pooled investment vehicle as opposed to a deal-specific pay-out scheme. This is seen as increasing the likelihood that managers would be able to insulate investors’ portfolios if another crisis arises.

This is a distinct change in approach; these credit hedge fund managers previously only offered opportunistic ‘go anywhere’ credit funds whose mandate would allow the fund to span the liquidity spectrum within the credit markets. In order to properly manage the assets, these funds typically offer investors quarterly or annual redemption rights, and also limit the percentage that can be redeemed each period.

Moving to a long-duration structure is thus a marked change in approach.The fact that this shift is occurring with direct investor input and support is a sign of how credit hedge fund managers are partnering with their investors to dampen volatility and risk in the portfolio in much the same way that directional equity hedge fund managers are being placed.

Further evidence of this trend is the fact that in the past year, credit hedge funds have begun to launch not only long-duration funds, but they are also carving out the more liquid side of their portfolio and creating long-bias credit funds that are competing for allocations from the institutions’ core credit buckets.

Rising credit fears turn equity risk bucket to company risk bucket

Credit yields are lower than they were in 2007 in both US high-yield and emerging markets. In conjunction with tighter credit spreads, absolute global interest rates are also at historic lows. Quantitative easing by monetary authorities around the globe has brought about this lower interest rate environment. Changes in interest rates and widening of credit spreads in the coming years are a major concern for many investors when thinking about their fixed income exposures.

To address these concerns about a turn in the interest rate cycle, investors are shifting a portion of their liquid fixed-income bond holdings into strategies that offer some type of downside protection. Investors are interested in actively managed credit hedge fund products that vary in liquidity and duration profiles to fill this need.

These privately offered liquid credit hedge funds, including long/short credit funds, only utilize a manager’s more liquid strategies expressed by instruments that are readily priced and traded. Because of the more liquid nature of the underlying instruments and strategies, these funds can offer private investors more frequent redemption terms (i.e., monthly) compared to a hedge fund manager’s flagship funds that may only be redeemed quarterly or semi-annually. In addition, manager fees on these funds are typically lower than for a manager’s main hedge funds, in an effort to compete more directly with actively-managed credit funds.

This credit product extension is being driven by the same risk concerns that are prompting allocators to place more equity hedge strategies into their portfolio alongside their long-only equity allocations. If the credit cycle turns, the same companies in this equity risk bucket will be impacted, and having credit hedge strategies in the portfolio alongside investors’ core credit long-only funds should help to dampen such exposure. This trend is what is prompting us to widen our description of the equity risk bucket to be a broader company risk bucket for 2013 forward.

In this year’s survey interviews, it has been interesting to note the depth of collaboration taking place between the large credit hedge fund firms and their investors in designing these new products and in determining where they fit in the investors’ portfolio. Because of the size of their investments and the strategic, longer-term nature of their capital, institutional investors have built deep relationships with these managers and are working with them in a more collaborative, advisory manner.

This consultative approach with investors partially explains why large and franchise-sized credit firms are getting larger.

Credit hedge funds compete to provide portfolio insulation with a new class of publicly offered fund products

In looking to offer downside protection in the core credit holdings of institutional portfolios, credit hedge fund managers have begun to compete head to head with a new class of publicly offered funds that seek to offer the same portfolio insulation and protection in periods of market stress. We heard often in our interviews about publicly offered multi-strategy funds that have a more flexible mandate, and how they are gaining traction with investors.

These are broad strategy funds that include some hedging techniques that can be expressed with liquid instruments. They seek high total return over the long term that is consistent with prudent risk management by allocating assets actively across stocks, bonds and short-term instruments, with the various exposures to each asset type varying opportunistically in response to changing market and economic trends. What has been interesting about these publicly offered multi-asset funds is that they seem to be gaining a degree of traction with the institutional audience, while publicly offered equity funds with a degree of hedging are not finding this same level of receptivity.

There is expected to be ongoing competition between these products for institutional dollars, particularly among investors that are not yet fully developed in their hedge fund investing programmes.

In Europe, these funds are known as diversified growth funds, (DGFs) and they have also seen significant asset growth in recent years. These funds take a flexible approach to asset allocation and offer clients access to equities, bonds, alternative assets and cash within certain range limits. This approach allows these funds to dynamically switch between defensive assets, growth assets and diversifier strategies, with the aim of achieving strong risk-adjusted returns.

DGFs in Europe have raised $37 billion in total assets from 2009 through 2012, moving from $14 billion to $51 billion AUM – an increase of 270%. This growth is emblematic of a broader trend in Europe, where traditional private hedge fund allocations from key institutions are being driven toward publicly offered vehicles in response to regulatory pressure. Indeed, European regulations that have emerged post-GFC are working to reallocate a significant portion of private fund capital to publicly offered vehicles that offer lower fixed fees, daily liquidity and more frequent transparency. This is fundamentally altering the structure of the European hedge fund industry.

Privately offered fund industry will become increasingly institutional

Institutional investors have had a marked impact on the hedge fund industry over the past decade. Collectively, pension plans, sovereign wealth funds and E&Fs became the dominant investing class in 2008, marking a pivotal point in the industry as interest from this segment surpassed traditional investments from high-net-worth individuals or family offices.

Throughout our interviews in this year’s survey, we looked to gain insight into investors’ intentions for future hedge fund allocations. Thematically, most indicated that increased inflows are likely; on the other hand, many also commented that 2013 may be “Darwinian” for managers unable to show performance after two years of mediocre returns. Rather than withdraw allocations, however, investors indicated that they would shift assets to higher-performing managers while keeping their overall commitment to hedge funds steady.

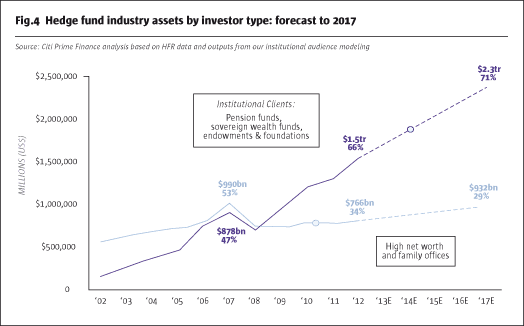

Relative to their total pool of investable assets, institutions continue to channel only a small portion of their overall holdings to the hedge fund industry. Fig.4 shows that, globally, institutional assets managed by pensions, sovereign wealth funds and E&Fs increased 23% between 2007 and 2012, rising from $29.1 trillion to $35.7 trillion. Based on that five-year rate of change, we forecast that this pool will rise to $44.0 trillion by 2017.

Institutional allocations to the broad alternatives category that includes hedge funds, private equity, mezzanine financing, real estate and other investments rose from 18% in 2007 to 22% in 2012. We project that growth to continue, with alternatives increasing to 27% by 2017. We predict institutions will continue to allocate assets to long-term investments in illiquid holdings, where they can take advantage of this historically low interest rate environment. They will also look to forge partnerships with firms that sit on the cusp of the hedge fund and private equity worlds.

Hedge funds as a sub-set of alternatives accounted for 17% of allocations in 2007, rising to 19% in 2012. We conservatively project that share to rise to 20% of alternative allocations in 2017. This implies that hedge funds as a percentage of global institutional assets will reach to 5.3% by 2017, compared to just 4.2% in 2012 and 3.0% in 2007.

The impact of this increase in allocations is illustrated in Fig.4. As shown, institutional assets invested in privately offered hedge funds are expected to increase to $2.3 trillion by 2017, up from $1.5 trillion in 2012 and $878 billion in 2007.

Had we projected the growth of institutional assets in privately offered hedge funds using a straightforward five-year average, it would have indicated $2.6 trillion instead of $2.3 trillion. The reason for this slight downward adjustment is that we re-categorized $220 billion in AUM for 2012, shifting those assets into a new designation of publicly offered liquid alternative funds owned by institutional investors or QIPs. Such publicly offered funds include alternative UCITS, alternative 40 Act mutual funds and ETFs – a category that we broadly classify as liquid alternatives. By carving out this pool, we can forecast how growth in liquid alternatives is likely to be driven by the traditional hedge fund buying audience or reflect new demand from a previously untapped retail audience.

To complete our estimation for the privately offered hedge fund industry, we used a three-year average rate of growth from high-net-worth and family office investors. It was not possible to use a five-year average, as the drop in assets experienced in 2008 was still sufficiently large as to keep that number negative; our interviews showed stable, not declining, interest.

As shown in Fig.4, we see growth resuming for the HNW/FOI audience with assets projected to increase from $766 billion in 2012 to $932 billion in 2017. Those flows, however, will not be sufficient to maintain their current market share due to the significant increase in allocations from institutional investors. We see assets from the HNW/FOI category falling from 34% to 29% of total privately offered hedge fund AUM – thus extending the institutional nature of the industry. In total, we expect hedge fund industry assets to reach $3.25 trillion by 2017, an increase of about 44% from 2012 or a compound annual growth rate (CAGR) of 7.6%. According to data from eVestment, this is on par with recent growth trends, as assets under management grew at a CAGR of 7.1% from March 2010 to March 2013.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical