In the current low-yield environment investors should look towards long/short credit funds as a smarter way of accessing fixed income, to gain consistently high returns with lower volatility. The threat of rising interest rates and the fact that many ‘safe’ investments such as government bonds are barely returning enough to compensate for inflation mean there is a need for a new way of gaining debt exposure. Long/short credit fits this purpose, as the strategy can offer low correlation and low duration exposure to interest rate moves, while avoiding the pitfalls of a changing economic environment.

A new interest rate era

The ongoing financial crises which have peppered the last seven years have completely changed the credit markets. High-profile bank bailouts, ongoing volatility and the downgrading of some of the largest economies in the world have produced an era of uncertainty.

Political intervention has meant that rates have been slashed as central banks strived to accommodate economic recovery. This has resulted in the bond markets being turned upside down, with huge inflows into bonds pushing down spreads.

But now, with the Fed’s tapering programme and constant speculation on whether the European Central Bank and the Bank of England should raise interest rates, many investors will see this now dislocated market yet again turned on its head. The great bull run in bonds is over and investors need to be more daring to get the yield they want.

A smarter approach

Long/short credit can be this daring approach. The secret to the strategy is the use of corporate bonds and credit derivatives in an investment universe made of investment-grade and high-yield bonds with low duration periods.

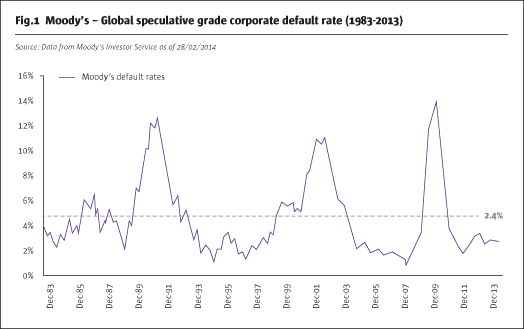

There is a strong case for the importance of the high-yield component. Recent data from Moody’s shows that the default rate for global high-yield over the past 12 months is well below the long-term average of 4.5%. As Fig.1 shows, the current figure is just 2.4%.

However, the expansion of high-yield corporate credits has not been without its difficulties, with some issuers dropping from the upper grades to more speculative grades, sharply impacting their bond valuations. But even while the default rates spiked at the height of varying financial crises, they have always recovered.

And as the US economy and refinancing conditions in Europe improve, a sharp rise in default rates seems unlikely. Corporates as a whole are looking more attractive, as the additional cost of servicing their loans when risk premia rose has seen them get back into shape.

For example,auto-makers and basic materials producers have cut their overall debt levels and refinanced on better terms, making their corporate bond programmes more sustainable. Banks have done the same, following a big regulatory push from governments who want to protect taxpayers from the cost of future bailouts.

This means that many of these ‘fallen angels’ could be the new rising stars seeking to upgrade once again to investment-grade. Investors could seek attractive returns from this transition.

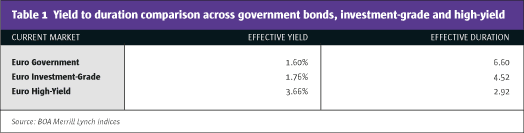

Duration is also important to consider for long/short credit funds. Shorter-duration instruments offer some protection for investors, as they limit time to exposure to interest rate moves that may disrupt returns.

As Table 1 demonstrates, in this market environment there is a strong correlation between effective yield and effective duration. Both investment-grade and high-yield bonds have an average duration that is lower than the overall government bond section. Thus, the data show that low duration produces higher yield than ‘safer’ sovereign bonds.

A dual-tracked, diversified portfolio

An additional advantage of a strong long/short credit approach over traditional bond investment is its dual-tracked nature. It includes both a directional portfolio and an arbitrage portfolio, allowing for greater diversification.

In the directional portfolio it is best to use a bottom-up approach, where securities are hand-picked. Long positions can be taken if the outlook is positive, and short positions used if there is a risk of issuer downgrade.

The arbitrage strategy can also consist of both long and short positions. For example, this could be between an issuer and the relative credit derivative, or between two issuers. In this way the strategy can capture asymmetry in the market and hedge out directional debt – primarily credit exposures and net interest rate exposures – by using options. The end result is high returns, but with manageable risk. This allows investors the possibility of highly attractive Sharpe ratios.

The fundamental shift in credit allocation

In this current environment an attractive risk/return profile is king. Major investors like multi-managers, family offices or insurance companies are at present only experiencing real returns of around 1.5%. This is comparable to the rate that private investors can receive on overnight deposits.

These challenges, coupled with ongoing regulatory, structural and technical changes, mean that investors are now starting to view alternative strategies as a vital part of their credit portfolios, as they try to optimise their risk/return profile.

Research shows that fundamental shifts have been taking place within allocation trends. Over the past three years an increasing number of investors have moved long/short credit strategies into their mainstream fixed income allocations, as opposed to segmenting them into an alternatives pot.

This is just another example of the fact that investors are finding new ways of dealing with the dysfunctional debt markets. While some remain cautious of ‘complex’ instruments, the reality is that the derivatives market has adapted a great deal to become more efficient than it once was.

Investors must be prepared

Ultimately the dislocated bond market means that investors must be prepared to adapt their fixed income portfolios away from the traditional. Nothing is simple. While rates will likely rise and disrupt the value of bond holdings, they will likely remain relatively low if we compare them across the past 20 years.

This means performance must come from the alphathat only a high-conviction, active management strategy can provide. If investors want to maintain their exposure to fixed income, while getting attractive returns in the current environment, they will have to look to alternatives.

Long/short credit strategies are well placed to deliver this, so long as the fund manager can demonstrate they have a good track record and a strong bench of experts able to navigate the new financial market environment.

Patrick Zeenni is deputy head of high-yield and arbitrage credit at pan-European asset manager Candriam (previously known as Dexia Asset Management).

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 95

The Time Is Ripe For Long/Short Credit Once More

Active management a smarter way of investing in debt

PATRICK ZEENNI, CANDRIAM INVESTORS GROUP

Originally published in the June 2014 issue