The Hedge Fund Journal visited Weiss’s offices in New York’s Park Avenue to meet the team, hear how the firm has evolved over the years – and why Weiss sees seismic change for the investment industry over the next few years. “Back in the 1970s, George Weiss started one of the original market neutral hedge funds, with a focus on utilities, running money from Hartford, mainly for local insurance companies,” Jordi Visser, President and Chief Investment Officer of Weiss Multi Strategy Advisers, told us. Founder George Weiss explained that “we started running money for six insurance companies in 1971, but the basic philosophy of the firm has remained the same for more than 40 years, a focus on downside protection and preservation of capital.”

Through the 1980s and 1990s Weiss grew its staff to one hundred, often hiring from the Wharton School, which George Weiss has a major involvement with, and has made donations to as one of his range of philanthropic activities. In common with many luminaries of the hedge fund industry, Weiss at one stage became a family office, running money for George Weiss and the firm’s partners. But 2006 saw Weiss launch its flagship multi-strategy fund, Weiss Multi Strategy Partners (WMSP), which returned Weiss to its roots in market-neutral equities – and saw the firm once again open up to outside investors. Now aged 72, George Weiss, although still actively involved in the office, has crafted clear succession plans in the form of a unique partnership structure, to ensure that the brand survives the future.

“We want to leverage the brand and the culture in a world where the overall return climate is low,” is how Visser describes the firm’s vision. Weiss sees opposing forces for growth. Low returns in a post-2008 world mean allocators are under pressure to turn over managers more often. Yet huge potential exists for a mountain of assets to migrate from fixed income to alternatives. “The money earmarked for fixed income, looking for low and steady returns, in all environments, is looking for a new home,” Visser observes.

New offerings

Weiss as a firm senses that the investment industry is at an inflexion point. “The hedge fund industry is going through structural change, and we are at the cutting edge of new products,” foresees George Weiss. To tap into this demand, Weiss is adding to its range of investment strategies and vehicles. In 2015 Weiss has launched a new fund, Weiss Alpha Balanced Risk (WABR), a scalable balanced risk product combining unleveraged allocations to bonds and equities with a 25% weighting in the flagship Weiss product. Later in 2015 Weiss will launch a ’40 Act mutual fund product that could attract retail investors – as well as those institutions that prefer a ’40 Act structure. Weiss is revamping its internet site to cover “all aspects of the business from content delivery to marketing” Visser reveals.

Insurance companies’ unique investment requirements

Weiss has also identified a strong need for its style of investment management from certain segments of the insurance industry, which is itself a complementary business opportunity for the firm. Weiss’s latest venture in the space was architected with the aid of Richard Booth, former Vice Chairman of AIG and Vice Chairman of Guy Carpenter. Booth, George Weiss and the Weiss team researched the insurance arena and resolved that life insurance was the sweet spot. “There are only five or six real players whereas property and casualty is inundated with competitors,” explains George Weiss. Harking back to the Hartford origins of the firm, Weiss is managing money for a re-insurance company with a difference. Just as Weiss’s balanced risk product is very different from many offerings labelled as ‘risk parity’, Visser stresses that Weiss’s re-insurance company “is not going to be a typical hedge fund reinsurer.” Weisshorn is a mountain in Switzerland and Weisshorn Re is a vehicle domiciled in Bermuda (with tax status in Ireland) with a management team averaging 30 years’ experience. But, unlike some hedge funds inside a reinsurance wrapper, “it is a life company with real people running the business, geared to the opportunities around structural changes in life insurance,” explains Visser.

For instance, low interest rates and maturing policies have forced life insurers to sell off blocks of annuities at a discount to optimize use of their balance sheets, and Weisshorn is at the forefront of this opportunity. “This is not only a North American opportunity but also a global one” enthuses septuagenarian George Weiss. Weisshorn Re has as many as 25 NDAs (Non Disclosure Agreements) signed with various insurers in order to access their ‘data rooms’ to crunch the numbers before bidding for baskets of annuities. Weiss is optimistic about expanding its asset pool because few others have the capacity to absorb the annuities, or the wherewithal to be serious contenders in auction processes. Explains George Weiss, “this is a hard business to replicate because you need depth of management, offshore corporate structures and a 15-20 year track record of low volatility in order to receive a good credit rating from AM Best.” “Weisshorn will be my legacy,” he adds. While regulatory requirements dictate that 85% of Weisshorn Re’s assets be invested in beta fixed income, the remaining 15% will be invested in Weiss’ flagship fund, WMSP.

Insurers’ liability problems have also partly arisen from Zero Interest Rate Policy (ZIRP) that has been dubbed ‘financial repression’. As per Weiss’s January 2015 thought leadership paper entitled “Investing at the Zero Bound: A Role for Alpha in a Balanced Risk Portfolio,” “Anyone investing in fixed income has a problem with rates at these levels,” says Visser.

Weiss financial solutions

The insurance joint venture is just one example of how Weiss wants to tailor investments to the end client. Visser enumerates the factors making insurers’ investment needs rather unique: “regulatory constraints, a zero interest rate world, risk-based capital charges, Solvency II, all help to explain why insurance companies need products designed differently from banks or funds.” To this end a new firm called Weiss Financial Solutions will be devoted to creating bespoke solutions for individuals, corporates, mutual funds, and hedge funds, in a world where Weiss is firmly in the “lower for longer” camp when it comes to interest rates.

Alert to recession risks

Weiss’ strategy is partly informed by global macro views of the team, which contains experienced macro traders such as Visser – who ran a macro strategy before focusing on the overall business. Weiss is based on the east coast of the US, with the investment team in New York, and the middle office in Hartford. But since 2007 Visser has spent one month each year in China, to get a first-hand feel for conditions in what is the biggest contributor to global growth. He has been impressed by how fast cities are being built, by the numbers and ambitions of college graduates, and the length of queues outside Starbucks. But now Weiss thinks the collapses in share prices of multiple commodity producers add to the clear evidence that China is slowing.

That is now uncontroversial,but as long ago as late 2014 Weiss held a much more contrarian view: that the US economy could be at risk of recession. This fear emanates from a proprietary model that Visser has developed to forecast recession probabilities. The model focuses on rates of change in stock prices, commodity prices, jobless claims, household net worth and corporate profits. Visser admits that the model did throw up one false alarm, in 1998, and was somewhat early in forecasting slower growth for 2007, but the model has anticipated all US recessions. In late 2014 it ascribed a 60% probability to recession and by the time we spoke in September 2015 this had increased to 95%. Hence Weiss’s August 2015 thought leadership paper is entitled “An Investor Dilemma Update: Guilty Beyond Reasonable Doubt,” with recession being the ‘crime’. According to Visser “recession is already obvious in Texas and North Dakota” and he even entertains the possibility that the US economy as a whole might, in late 2015, already be in recession! If this is surprising, Visser illustrates the surreal nature of economic data with recent history from the relatively severe 2008 recession. This US recession has now been officially confirmed as starting in December 2007, according to the NBER, even though as late as summer 2008 nobody thought the US had entered recession.

Lower for longer

Though a collection of cyclical factors have coalesced in 2015 to slow down the economy, Weiss sees longer-term, structural forces, keeping interest rates low, irrespective of the ebb and flow of shorter-term economic fluctuations. “China’s dramatic shift from an infrastructure build-out economy to a service-based economy” is a secular trend that could persist, and “the regulatory side is not going to be reduced near term,” Visser thinks. Weiss also opines that very few people have grasped the profound implications of the “sharing economy” as a third driver of deflationary pressure: the level of innovation, combined with applications for sharing cars and property (such as Uber and Airbnb, with a new one for office space also relevant) help to restrain inflation.

Weiss’s worldview has clearly been out of kilter with the markets, which have been pricing in some tightening for at least the past 15 months. But in an upcoming thought leadership piece which Visser is writing, “Waiting for Godot” is a metaphor for how long investors might need to wait for interest rates to rise. Weiss thinks Federal Reserve rates will stay at zero for an extended period because there is now a high probability of recession. A more subtle reason why Weiss expects the Fed to delay is the signalling effect that its utterances have on markets. According to Visser, the ripple effect from Ben Bernanke’s taper talk in 2013 has already, indirectly, increased both interest rates, and credit spreads. “The market has done the job so the Fed does not need to,” is how he sums it up.

So, Weiss thinks the next move in market interest rates could even be down, and would not be surprised to see two year rates dropping from 0.70% to revisit the 0.30% level last seen in October 2014, when the S&P was near late September 2015 levels. Given his outlook for rates, why would he not pursue the variant of ‘risk parity’ that entails leveraging up bond allocations?

Risk parity comes in many flavours

While Weiss sees some potential further upside for bond prices, the risks have become asymmetric. Visser points out that “the interest rate sensitivity, or duration, of bonds has ballooned out so any move is almost assuredly a violent one.” As yields have compressed, a greater proportion of the return is back-end loaded at the maturity of bonds, increasing their sensitivity to rates. Weiss’s balanced risk product does not apply leverage to its bond (or its equity) allocation, in contrast to some risk parity products that can be 200-300% leveraged, according to Weiss.

Visser views the assumptions underlying some risk parity products as fragile, and is becoming sought after as a commentator on risk parity products. Just as there is no single type of long/short equity fund, there is no one type of risk parity fund, Visser expounds. The risk parity approach often sounds very scientific and mathematically precise, but when Visser lifts up the bonnet of these products he sees how much discretion is involved. One implicit judgment is assuming that the inverse correlation between bonds and equities will continue, based on the past 70 years of back-testing. Visser, however, thinks the next 10 years could be very different from the past 70 – as there may be a structural “regime shift.” In particular, it is clear that Visser does not share the view of some product designers that inflation is the main threat, nor that commodities are a useful hedge. “Historically, the classic balanced equity and bond portfolio needed leverage to reach its target return, and the key risk was inflation so commodities seemed a natural hedge.” observes Visser – but this mindset does not match a 2015 world.

Indeed August 2015 has proved to be a triple, and even quadruple, whammy for some risk parity products, with equities, commodities, and TIPS (Treasury Inflation Protected Securities) down substantially, not to mention some nominal bonds also losing money. This experience of synchronized losses across major asset classes is not entirely new – it also happened during the 2013 taper tantrum. An equal weighted composite of risk parity mutual funds has had drawdowns of 14.4% (May-June 2013); 6.3% (August-October 2014) and 13.4% (April-September 2015), according to Weiss. The firm points out that the potential decorrelation of the flagship Weiss strategy has potential to reduce drawdowns in WABR.

In summary Weiss thinks risk parity can have a place in portfolios, if it is structured appropriately. “Philosophically we agree with the diversification arguments on an efficient frontier basis,” Visser says. But he does not agree that risk parity is a holy grail of guaranteed products, nor that the weight of money behind the strategy has been driving the big market moves in August and September 2015.

Rising volatility and tail risks

Visser instead sees major fundamental drivers for the August 2015 pullback across multiple asset classes. China’s devaluation matters more as China is now the world’s largest economy on a PPP (purchasing power parity) basis, according to the IMF. Visser is concerned that the semi-pegged foreign currency regime looks a bit like Bretton Woods, and policymaking in China and emerging markets is “not coordinated in the way that the US, Europe and Japan are.” Visser also thinks that market moves in August may have been exacerbated because “credit and high yield markets became dysfunctional and are lacking liquidity.”

Volatility is clearly rising – as is volatility of volatility, Visser notes. Weiss thinks this cycle may have its origins in the commodity bear market that began with coal and iron ore in 2010, before the whole commodity complex succumbed. “Tail risk events are also happening more often” Visser has noticed, with huge standard deviation moves such as the de-pegging of the Swiss Franc in January 2015. Now Weiss managers fear that China’s devaluation could trigger competitive devaluations elsewhere in the emerging world.

Emerging market currency crises are one tail risk that Visser has witnessed first-hand. He wryly observes “you get 100 year storms about twice every decade,” clearly belying his scepticism over conventional statistical risk models. In the 1990s, trading derivatives at Morgan Stanley, Visser was following Mexico two months before its devaluation that led to the ‘Tequila crisis’ sparking contagion in the region. This formative experience has taught Visser that “liquidity door can close very quickly” and he now worries that regulations, including those having the effect of reducing the amount of inventory banks and brokers hold, are now making developed markets vulnerable to similar risks. “Eliminating the shock absorbers is like driving down the road with brakes that have a delayed effect” is Visser’s take on financial market liquidity in 2015. He also fears that the peak of central bank influence is now over, with the Fed’s balance sheet no longer expanding and China’s reserves actually declining. Hence the ‘central bank put’ cannot necessarily be relied upon to bail out markets.

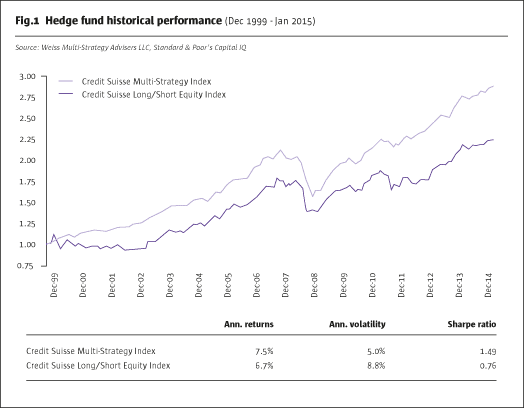

In this market climate, Visser favours equity market-neutral partly because he calculates that “long/short equity has become overly correlated, as high as 90%, with negative alpha between 2011-2012.” As well, multi strategy funds have substantially outperformed long/short equity funds over the long run, according to the Credit Suisse hedge fund data in Fig.1.

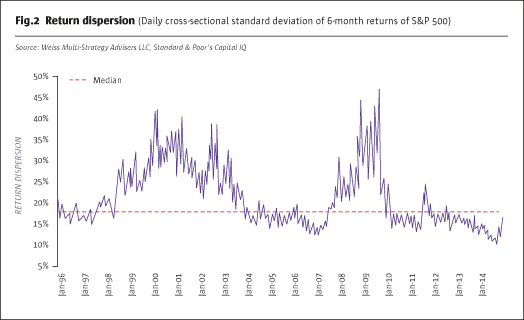

Return dispersion is one influence on the opportunity set for stock-pickers and Visser calculates that dispersion between 2011 and 2014 has been below the average of the past 19 years, as shown in Fig.2. But Visser thinks dispersion tends to widen out in an economic slowdown, and there are already signs of more differentiation. “In 2015 anything commodity or emerging market related has done badly, while developed markets have held up better. In 2008 the opposite applied as emerging markets were steady while developed markets suffered on US housing, meaning retail, housing and financials were the worst sectors,” he recalls. However, Visser is biding his time because he finds the “first spike in stock dispersion is never good. The real benefits come later on when a changing business cycle leads to greater bifurcation and decoupling in the markets.”

The sector specialist model

The conclusion of Weiss’s world view is that market-neutral strategies are suited to the current environment, and Weiss favours the sector specialist model. This multi-manager approach is well attuned to the collegiate culture at Weiss. There are top down, and bottom up, drivers for the allocations. The executive committee defines broad strategy and decides on hiring of portfolio managers. Then the allocation committee makes top down allocations. Visser belongs to both committees but characterises his role as “the quarterback of the other managers bringing their ideas to the allocation committee and enabling communication between the managers in a very interactive manner, which does not happen much in other firms.” The committees do not only contain front office, investment decision makers, but also encompass risk management staff and the chief operating officer, Frederick Doucette. Visser holds the title of CIO but in practice is more of a co-ordinator than a director. “I want to make sure that portfolio managers’ views receive an audience at the committee meetings” explains Visser.

The allocation committee allocates to 14 sub-strategies, of which 10 are equity market-neutral, two are macro oriented and two are credit oriented. No single book will exceed 12-15%. The size of allocations is partly determined by conversations amongst the managers. “We let our specialists drive the asset allocation as they have the best handle on opportunities,” Visser explains. Each manager operates within a framework of risk constraints. Risk adjusted basis and factor risk are monitored and a close dialogue is maintained with managers. Beta is limited to 25% with some variation between teams – some have zero while others are permitted some degree of tilt to beta or factors, according to their individual mandates.

The teams currently identify certain sectors and geographies as offering strong opportunities. “From a cross-sectional basis any movement as big as the oil price crash will throw up opportunities, with many high-yield issuers priced to go out of business. But this could help bigger survivors to grow their market share and this is already happening” Visser says, relaying the views of Weiss’s energy experts. If energy has been one of the worst performing sectors, at the other extreme, Weiss’s healthcare specialists seems to share the concern of Janet Yellen and some other hedge funds that biotech valuations may still be excessive. “So much money has moved into healthcare and has not exited yet,” they surmize. This contrarian bent is evident in other areas where Weiss is seeking opportunities: the hardest hit emerging markets, such as Brazil and Turkey, could be sources of neglected value at some stage, though over the next few months Weiss fears there may be more weakness to come in EM. Visser finds that Brazil and China have far more to offer than just commodities, and points out that the Shenzen Composite, often seen as ‘China’s Nasdaq’, is still the best performing index in 2015. Weiss rarely invests more than 10-15% directly into EM, but has indirect exposures through big blue chip names. “EM is over 50% of growth and China is over 30 percentage points of that 50% for most multi-nationals, which all have a business plan for EM,” he illustrates. Weiss portfolio managers have calculated that for some firms, the majority of the incremental growth comes from EM. In fact Visser goes as far as saying that “emerging markets are no longer emerging.”

The resurgence of China does not surprise Visser, as the world’s most populous nation has been the largest economy for most of Common Era history, from AD 1 to 1850. The 140 year period since 1850 that saw China decline economically, was the aberration. Nonetheless Visser fears “many companies were built for a China that no longer exists” as China’s delayed, catch-up, industrial revolution has now passed as they enter the information age.

Weiss corporate culture: longevity, co-investment and philanthropy

The willingness to look through near term volatility and take a medium-term view on markets is a hallmark of the Weiss culture. A hefty chunk of Weiss assets belong to the staff. Of $1.5 billion firm assets, some $450 million is internal money including partners’ capital, and employee profit sharing (a type of US pension). “We do not know of any other hedge fund with such a large profit-sharing fund,” says Visser, who thinks this evinces the longevity and stability of the firm. He adds “George Weiss is a very special person to everyone, who are impressed with his philanthropy.” Weiss has given away millions of dollars to charities including ‘Say Yes to Education’, which has financed college education for under-privileged communities in West Philadelphia, Syracuse and Harlem, NY; Buffalo, NY; Guilford county, North Carolina. Meanwhile The Orphan Disease Pathway Project aims to find cures for rare diseases.

The fee structure is also geared towards Weiss’s confidence in generating longer-term performance. The multi-strategy, ‘mini-prop desk’ model often involves individual traders’ performance fees being passed through to investors, who bear netting risk, which is borne by the firm at Weiss. Visser thinks that the absence of performance fee netting amongst managers in some multi-strategy hedge funds, and in most funds of hedge funds, “has historically been under-appreciated but is now becoming more widely understood as more people talk or write about it.” He argues that interest rates close to zero make netting issues of more acute concern. Weiss estimates something like LIBOR + 5% is a realistic median return expectation for hedge funds and there is always a distribution of returns either side of the central figure. “With LIBOR rates at 6%, few funds will be down on the year. But with LIBOR at zero, far more managers will be down,” Visser explains. Absent netting, investors can end up paying performance fees to those managers that are up even if aggregate performance is flat, or negative.

Weiss is able to recruit and retain managers, with its current fee structure of 2% management and 25% performance but at the same time “no single person matters so much that the firm would not continue to thrive without them,” says George Weiss. Some Weiss managers are ex-sell side, others were from other hedge funds and some are grown in-house, straight from university. But what they share in common appears highly unusual in the hedge fund industry: “our average portfolio manager tenure of 12 years does not exist anywhere else in the hedge fund world,” argues Visser, who previously spent 12 years at Morgan Stanley. Indeed few hedge funds do last that long, let alone the 37 years and counting that Weiss has been around for. “Weiss has a good reputation and people realize it is a stable place, which attracts more of them,” Visser surmizes, as he looks forward to the next 37 years. George Weiss is proud to have built “a culture that is unique to Wall Street, with incredibly loyal staff, minimal staff turnover and a shared vision. The firm is at a tipping point,” he concludes.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical