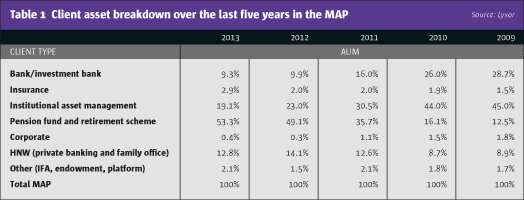

The hedge fund industry has changed out of all recognition since 2008. Increased institutional participation in the asset class coupled with more focus on risk has forced providers to adapt to the new rules of alternative fund management. Add to this an increased regulatory burden, and an industry that was once founded on private wealth and the skills of boutique fund managers looks to have transformed completely.

In order to adapt to the requirements of institutional investors, many managers are being forced to revisit the way they run their firms, the strategies that they sell and their entire approach to investor relations. For some this is proving to be a painful process. Adapting to the new environment requires investment management businesses to look and think more like their institutional investor base.

The recent success of Lyxor, for example landing a $450 million mandate from CalSTRS or providing a managed account platform for PGGM, is based on just such an approach. Apart from its scale and its understanding of its market, Lyxor is implementing systems and processes that are designed to win the confidence of some of the most demanding money managers, including the CIOs of pension funds and sovereign wealth funds.

Lyxor now has a team of 90 investment professionals dedicated to its alternative investment products, including multi-strategy alternative portfolios and funds of funds. Altogether, it has $9 billion in fund of hedge funds assets and $11.8 billion in managed accounts, making it one of the leading players globally. With teams based in New York, London, Paris, Hong Kong and Tokyo, and a track record stretching back to 1998, it has already made its case as a market participant that is serious about being a centre of hedge fund expertise.

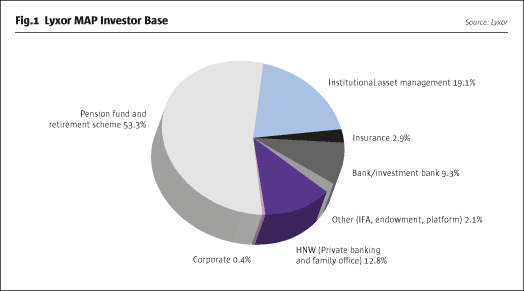

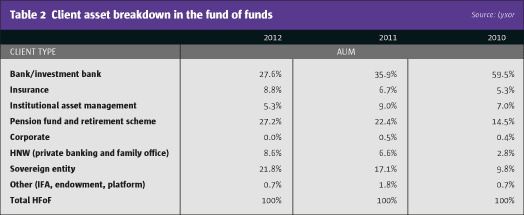

More than 80% of that AUM figure is managed in the form of dedicated advisory portfolios for a client base dominated by large institutions, including corporate pension schemes, insurance companies, sovereign wealth funds and private banks.

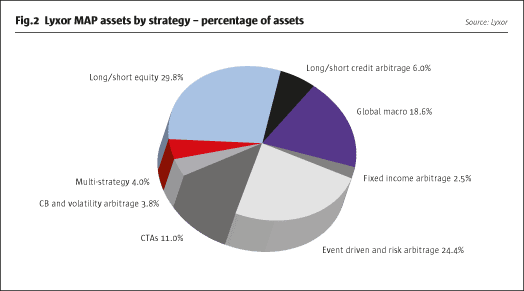

“What we try to do is to maximise the performance we can generate for our clients while minimising the risk and the correlation to traditional asset classes,” says Jean-Marc Stenger, chief investment officer for alternative investments. He focuses on two key areas – idea generation and portfolio construction – in order to achieve his results.

For its idea generation, Lyxor relies on an integral research team of 19 analysts and an established portfolio construction process. The hedge fund research team has cross-asset capabilities, allowing it to identify opportunities and risks contained within each strategy. In addition, a quantitative research team supports the portfolio managers via portfolio optimisation and computation of implicit correlations in the portfolios Lyxor builds. This then feeds into an enhanced risk management framework.

This emphasis on correlation stems from an awareness that single-manager funds and funds of funds have historically been very strongly correlated. Industry analysts frequently missed this association, and correlation has played a role in the disappointing results some investors saw from alternative portfolios in the period 2010-12.

“You cannot understand the trends in the fund of hedge funds industry if you don’t understand what is happening at the hedge fund level,” explains Stenger.

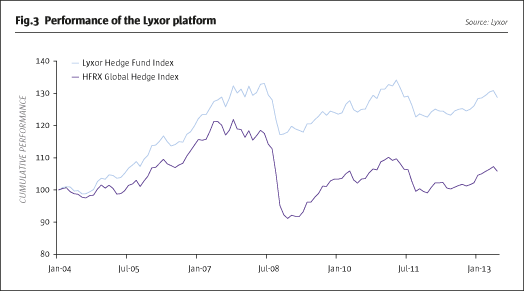

He points to the historic performance of the asset class since the financial crisis in 2008, where a number of years have yielded returns that were vastly inferior to those achieved in the past, both in absolute terms and accounting for diversification. There was a doubt that hedge funds would ever be able to generate a double-digit return again, but recently performance has returned to LIBOR plus 700 basis points. But on top of improving performance is also the fact that the fund of funds model itself has become somewhat of a casualty of the financial crisis. Part of this was the failure of many firms to shield investors from collapsing funds or gates. Liquidity problems scared many private investors out of the asset class, often permanently. For investors looking at the fund of funds option, there is also the issue of the extra layer of fees a fund of funds represents. With lower performance, can it still be justified as a business model?

Consolidation within the industry has meant that more capital is focused in the hands of a smaller number of firms. Niche players have been forced out of the market as investors have turned to either building internal solutions or allocating to the largest funds of funds. While their share of the market has slipped from 60% before 2008 to approximately a third today, inflows to the survivors have increased recently. The pace of asset gathering has remained conservative, however, well below the levels experienced pre-2008.

Stenger calls it “a stabilisation” of the fund of funds industry, not a boom. And in such a tight environment, it is critical that providers selling fund selection expertise are able to deliver differentiation. A key competitive element is customisation, as larger investors are averse to one-size-fits-all solutions that were the hallmark of portfolio management in the 1990s. Every institution has specific investment objectives and guidelines, and this is an expectation that Lyxor has been able to address thanks to its secure and comprehensive investment universe.

Christophe Baurand, head of the alternative investments business line at Lyxor, says he is seeing more demand for hedge fund investments rather than fund of funds solutions, although in both cases there is still a demand for increased transparency and risk control. “This has been visible on the commingled managed account platform and on the dedicated managed account solution side,” he says.

Risk management

Baurand’s comments demonstrate how risk has largely emerged along with performance as a major selling point. Says Jean-Marc Stenger: “We have been extremely stringent about our risk management and this is highlighted in our track record and is visible in our culture.” This includes due diligence where separate investment, risk and operational due diligence teams are maintained. The risk and operational due diligence teams maintain a right of veto before a fund can be admitted to the investment universe and report into the head of risk and not to the CIO.

Apart from a stringent risk culture, Lyxor has also made significant inroads in the institutional marketplace via the managed account structure where a high level of transparency and liquidity allows for more dynamic portfolio management. This also supports customisation, where even investors with the same diversification and asset mix objectives may still require different underlying funds.

Lyxor is alive to the fact that investor requirements are measured not just by raw performance, but by higher demands, including diversification, return enhancement, risk reduction, or asset class requirements informed by other aspects of their portfolio. When designing a portfolio, Lyxor has to take into consideration liquidity requirements, expected returns, volatility tolerance and maximum correlation. This will also help to establish a suitable benchmark – one that can also be tailored to the investor if necessary.

“We have a very clear mandate from the very beginning,” says Stenger. “This is key for every client, and key for the asset manager. There have to be clear guidelines for the risk parameters and it is important that the investor knows when his/her investment is generating or destroying value. It is important to be able to measure the performance drivers of portfolios.”

Possibly one of the pinnacles of its emphasis on customisation came with Lyxor’s mandate from PGGM three years ago. Being a Dutch pension fund, PGGM already had a high degree of familiarity with alternative investments but wanted infrastructure in place that could support enhanced risk visibility. Lyxor created a multi-billion dollar dedicated managed account platform specifically for PGGM which functions like a tailor-made fund. Lyxor is responsible for on-boarding the manager, putting in place a trading advisory agreement and appointing the service providers and market counterparties. It also wrote the risk management guidelines for the fund managers and monitors them for the life of the account.

“This is the type of dedicated service we can render to very large investors like PGGM,” explains Christophe Baurand. “The PGGM platform is not a simple copy-paste of the Lyxor commingled platform. The PGGM platform is Irish-based while our funds are in Jersey and soon in Luxembourg with the implementation of the AIFM Directive. We also run a specific risk monitoring policy for them. Eventually, PGGM implements its own governance and practices in running their platform.”

Lyxor serves other clients who have asked for dedicated managed account platforms, although PGGM is the largest. Baurand expects to see more requests for this type of service going forward, especially from the pension fund and sovereign wealth fund sectors.

The changing regulatory landscape

As an institutional specialist, Lyxor needs to be aware of an increasingly defined regulatory environment affecting both investors and hedge funds. In July, the introduction of the AIFM Directive has yet again re-shaped the landscape for hedge funds. Nathanaël Benzaken, a managing director and deputy head of the alternative investments business line with Lyxor, has recently suggested that the new directive could be a major catalyst for institutional investors in Europe who have previously treated hedge funds with suspicion.

It was already noticeable that the UCITS IV Directive had made those managers who could comply more palatable to pension funds, and the AIFMD could well do the same for the broader universe of hedge funds.

“Up until July 22 hedge funds were offshore. From that date onwards, you have to be onshore to be able to distribute hedge funds in Europe. As an investor you have the choice to either invest in an unregulated Cayman hedge fund or to invest with the same manager and strategy (the AIFMD does impose trading constraints, as UCITS does) via a fund domiciled in Europe, probably Luxembourg or Ireland. The fund is no longer unregulated or offshore but is onshore with a much higher level of regulatory oversight. All of a sudden, the hedge fund has become respectable for the board of trustees or the investment committee.”

Benzaken sees the current regulatory environment as a transition from the old ways of doing business to a new, more regulated world. It will take time, he admits, and the staggered implementation of the AIFMD across Europe, including in Lyxor’s ‘home’ market of France, is evidence of this, but it is an important step.

“To put it in perspective, look at how Europe adopted hedge funds compared with the US and Asia,” he says. “Europe has been slower to adopt hedge funds as a respectable route to diversify their global portfolios. The AIFMD and potentially UCITS will act as a catalyst to enable pension fund managers to increase their allocations to genuine alternative strategies.”

The managed accounts solution

Lyxor’s core managed accounts platform constitutes over 100 funds advised by external managers, including both established managers and relatively new teams. Part of Lyxor’s value proposition is to deliver the alpha-generating skill of the original manager with the third-party infrastructure and oversight delivered by Lyxor. This includes upgraded liquidity terms and segregation that might not be available from a Cayman Islands fund, for example.

Lyxor has been managing its platform since 1998, and it now has close to $12 billion in AUM. It is a compelling offering, coupling product management tailored to institutional requirements with advanced fund selection from the available universe. This is a business that has been able to weather a number of storms in the markets and in the alternative investments business, and to have sailed through them all the wiser.

“Unlike some service providers, we are an asset manager and we share that part of our DNA with our clients,” says Lionel Paquin, head of the managed account platform at Lyxor. “We also provide an advisory service and our edge is that we have an institution-type mindset. Many of our clients have selected us on the basis that we are also asset managers.”

Paquin describes the managed account platform as a “living organism”, saying that the company continuously adds and removes funds to stay in step with investors’ demand and the changes in the underlying markets. “We closed a number of funds this year and rationalised our commingled range in order to focus on the most attractive ones. We have also been adding new ones to make sure that our investment universe remains comprehensive as the largest one available in the industry,” he explains.

Aside from mutualised managed accounts, Lyxor has also launched four UCITS funds, again turning to star-quality managers and niche strategies less easily replicable in a UCITS format to advise the products. For example, in February it tapped TIG Advisors for the Lyxor/Tiedemann Arbitrage Strategy Fund to provide investors with access to a pure merger arbitrage strategy in a UCITS wrapper. In February as well, the Lyxor/Canyon Credit Strategy Fund did the same for an event-driven credit-oriented strategy advised by $21 billion Canyon Capital Advisors. Such launches respond to investor demand for leading hedge fund strategies in a UCITS strategy, backed by solid infrastructure and research/diligence teams.

As a pioneer in the industry since 1998, innovation plays a large role in continuing to address investor demands. It never pays to stand still in the hedge fund industry. Lyxor has been working to address the issue of fees, launching a new institutional share class in January for commingled investors on the managed accounts platform. It is aimed at mid-sized institutions and sports a bigger minimum investment level and less favourable liquidity terms in return for a better deal on fees. “We’re taking this major initiative in the area of fees because this is a top priority for institutional clients,” says Paquin. “The share is designed to give access to a hedge fund at exactly the same total expense ratio as the benchmark hedge funds.” The firm has already delivered the new S-shares on 35 funds and has seen considerable take-up from its larger clients.

The new share class slots in between the dedicated platform model used by the likes of PGGM, and the smaller commingled model used by investors writing tickets in the area of $100,000. It targets institutions, which are prepared to accept monthly liquidity and high minimum investment (at least $5 million) in return for lower fees. In addition, they don’t have to go through the pain of negotiating better fee terms with managers.

“Managers are smart people – they adapted years ago to where managed accounts needed to be in terms of transparency and other institutional requirements, and many of them understood that this was the way to access mid-sized institutions,” says Paquin.

Well positioned

Lyxor stands well placed to benefit from the new changes we are now seeing in institutional investment appetites. It has evolved a proven process in terms of risk management and portfolio design, and matched this to a high degree of awareness regarding the requirements of individual clients. It has also expanded its client knowledge beyond European shores with mandates like that of CalSTRS. Going beyond mere fund selection, its expertise in the development of policies and procedures is saving investors time and effort in managing hedge fund allocations, and providing a smooth introduction to a more risk-aware, yet innovative approach to hedge fund investment.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical