Executive summary

Shrinking returns and escalating investor demands. Downward pressure on fees and unrelenting requirements to have robust operating models. This year, competing forces came together to culminate in the perfect storm. In a year marked by lackluster performance and rising investor expectations, one inevitably asks: Will the challenges of today pave the way to a more successful tomorrow? That all depends on how you respond. As we look back on the year that has passed and look ahead to 2017, a few points come into sharp focus. Differentiation has become the touchstone of the future, and those funds that strategically embrace change for the right reasons and modify their business model in a way that responds to investor demands will be the ones that prosper going forward. Today, the pace of change is accelerating, and the magnitude of its impact and relevance are amplifying. As you turn the pages of this, our 10th annual Global Hedge Fund and Investor Survey, Will adapting to today’s evolving demands help you stand out tomorrow?, we hope the observations that have been gleaned help contribute to an ongoing and healthy dialogue that promotes the continued development and advancement of the global hedge fund industry.

First, we would like to extend sincere thanks to those managers and investors who provided viewpoints into the direction and development of this survey, as well as express appreciation to the 100 managers and more than 60 investors who gave their time and insight to provide such robust results. We believe that this combination of perspectives provides invaluable observations — both commonalities and differences — that continue to drive and shape our industry.

The change continuum

It is important to note that many of the key themes that we are talking about this year are those that have developed over the course of many years, and are now being thrust to the forefront as external pressures and competition for capital mount. The directive for managers has never been clearer: adapt or be left behind.

Key observations

This year, our survey focused on a variety of interesting themes, a few of which are briefly highlighted here.

The voice of the investor

2016 has revealed an unprecedented change in the appetite of investors. More so than ever, investors have achieved a level of sophistication that is challenging managers to more thoroughly explain how their offering achieves specific objectives within investors’ overall portfolios. Almost half of investors are continuing to actively seek out non-traditional products, and when it comes to investing in hedge funds, their choice is segregated accounts that generally allow for customization that more closely align with their specific needs. In addition, investors are demanding more and paying less. Many investors who have utilized low-cost, passive investment options or those who have reduced their reliance on money managers altogether and are trading on their own behalf are challenging the fee terms of their funds. And while management fees have continued to come down across funds of all sizes, investors are not materially any more satisfied with the fees they are paying relative to past years. Pressure on fees is not likely to let up, which begs the question: How do fund managers achieve scale to maintain profitability?

Differing priorities for different size managers

Although growth continues to be a priority for funds of all sizes, the smallest managers in particular view growth as an imperative to offset lost fee revenues, as well as mounting expenditures necessary to run the business. The largest managers are most able to weather industry volatility and uncertainty; having largely achieved their growth targets, they increasingly focus on properly supporting their business from an infrastructure and operating model perspective. Meanwhile, midsize managers are placing their bets on talent management, recognizing that their growth agenda and ability to compete with the largest managers can be served by attracting and developing the best and brightest talent.

The path to growth is changing

With asset flows stagnating and investors changing the way they invest, managers are facing the imperative to differentiate not only from one another, but from the growing number of alternative products that are available. We found that in this challenging fundraising environment, managers, particularly midsize and smaller, are emphasizing existing products rather than developing new ones. Amidst a crowded playing field, innovation and responsiveness to customer needs are imperative to standing out. Next generational data analysis is just one example of the methods that certain managers are deploying to enhance their investment strategy and appeal to investors. Additionally, those managers who identify and thoughtfully target the needs of specific client segments are finding themselves best aligned for success.

Large managers are out in front

The over $10b assets under management managers have the upper hand in today’s landscape for a variety of reasons. They have been most successful at raising capital, and have also been more responsive to changing investor demands — offering both the customization and non-traditional hedge fund products investors are looking for, along with the marketing, messaging and operational infrastructure that caters to evolving investor tastes. Investor desire to codevelop specific vehicles — those that provide the investor everything from unique fees to individual transparency and portfolio exposures — falls squarely in the sweet spot of the largest managers. While just 40% offered funds with customized fees and terms in 2015, 2016 has seen that spike to 63%. Similarly, while only 25% offered funds with customized portfolio exposures in 2015, that has now risen to 41%. In addition, the largest managers have sufficient size and scale to support a broader array of products, and as they add non-traditional products to their offerings, smaller managers that cannot support such launches are retrenching — adding more fuel to the allocation trend toward the largest managers.

The operational imperative

As top-line fee pressures intensify and the costs to run an evolved business model increase, the quest for profitability grows even more challenging. New products and customization being driven by investor preferences, while generally being lower fee generating, only add to operational complexities. And investors have clearly communicated that they will not compromise in their expectations that managers have robust infrastructures to support their business. However, investors are also vocal about their desire to not bear the costs of such enhancements. Inevitably, managers are responding by aggressively refining their infrastructure to eliminate redundancies and excessive costs, as well as cutting management fees. Investments in technology, including using robotics, are leading to improved automation, and cost reductions across big-ticket support functions in the middle and back office are contributing to declining operating expense ratios, which most managers believe have hit bottom. Conversely, nearly half of investors feel there is still more room to cut. Outsourcing is another way that managers will achieve further operational efficiencies and cost reduction, although there is still a major divide between the high comfort level that investors feel toward outsourcing compared with managers’ reluctance to relinquish control.

The changing prime brokerage industry

In last year’s survey, we saw the evolving dynamics of the prime brokerage industry take center stage, and this year is no exception. As banks face continued scrutiny and regulatory pressure, managers and their counterparties continue to grapple with the focus on optimization, funding, balance sheet and liquidity. As a result, many managers have fundamentally changed their prime brokerage relationships, entered into new ones, and increased the number of counterparties they do business with. A majority of managers say that their prime brokers have requested significant alterations to their relationship to keep it economically viable, including increased trade allocations, treasury optimization and platform changes. As a result, relationship monitoring and supervision has become more complex, and governance around relationship management has become more imperative than ever — with a need for formalized structures to drive consistent strategy and oversight of the process. Hedge funds managers are addressing these needs by formalizing the treasury function and adding headcount to this area of their business.

The war for talent

Talent management rose to the top of hedge fund managers’ and investors’ priorities this year as the war for talent has taken on additional complexities. Not only are funds battling each other for tomorrow’s star players, they now find themselves in heated competition with Internet giants and tech firms, as well as venture capital and start-up companies across all industries. Managers need to demonstrate to investors that they understand the changing talent market and have implemented programs that will help them secure and retain the talent that will drive their business forward. As borne out in this year’s survey findings, talent management now plays a critical role in the competition for institutional assets, with 75% of investors indicating it is a key element in their due diligence process. The focus on talent is sure to continue evolving, as a divide exists between what managers consider paramount versus what future generations of employees believe is critical to attracting them to employers.

Looking forward

As the industry embarks on this next phase in its life cycle, it is clearly fraught with challenges for both managers and investors. The ground rules have changed, and acceptance and adaptation to this dynamic environment are the keys to survival. Changing investor demands are driving a myriad of changes and those firms that listen, understand and strategically embrace change are the firms that will be best positioned to weather the storm. Will adapting to today’s evolving demands help you stand out tomorrow? At EY, we remain enthusiastic about the future of the global hedge fund industry and look forward to continuing to invest in and support its efforts to enhance financial well-being for investors worldwide.

Pressures on the industry

The hedge fund industry continues to be under pressure from several compounding forces. Performance has been pedestrian, with absolute returns challenged by external factors such as unprecedented central bank involvement and relative returns paling in comparison to the historic ongoing equity bull market. Disappointing returns have amplified the discussion among managers and investors as to whether the fees charged are appropriate relative to returns generated. Additionally, investors have become more sophisticated and strategic in developing their portfolios. They have more options than ever within the alternatives universe and are allocating funds to those managers that have a unique offering that is satisfying a specific need of the investor’s strategy. Oftentimes, this results in a shifting of assets from those managers who have been slow to react to managers who have been at the forefront of listening to their investors and creating strategic solutions to keep pace with investors’ needs.

Competition for capital is turning fundraising into a zero sum game

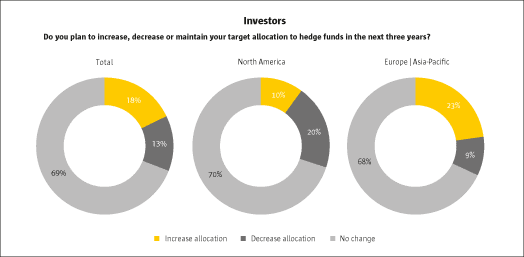

Headlines and news flashes would lead many to think that assets are departing the industry en masse. While there have been certain high-profile outflows, particularly by North American investors, asset levels across the industry remain relatively stable. Institutional investors continue to understand the benefit that hedge funds can provide to their portfolios and remain steadfast in their belief that hedge funds can fill specific needs. Compared with those forecasting outflows, a larger percentage of investors anticipate increasing their allocation to hedge funds in the coming years. This is particularly evident among European and Asia-Pacific based investors. The pensions and endowments in these regions tended to have allocated a smaller portion of their portfolio in the past to hedge funds and remain bullish in embracing this asset class as their allocations catch up to those made by North American-based investors. One in five North American-based investors responded that they are more likely to retrench, the first time that those pulling back have outnumbered those increasing their allocation in the years that we have been polling. North American investors continue to have significant return targets that hedge funds have not been able to deliver, so they are looking for lower fee options in exchange traded funds or other passive investment strategies. Capital flows are rapidly shifting to those managers who have been adapting to the evolving interests of the investor community.

However, investors’ tastes and specific needs are changing

Investor demand continues to evolve in ways that are forcing the industry to adapt. Investors have become more tactical in how hedge fund products fit into the broader construct of their overall portfolio. Where in the past investors used hedge funds to obtain different market exposures, similar exposures can often now be generated by the investor’s own direct trading or from lower cost alternatives. This is particularly true given the recent equity bull market. However, when market performance changes, so may the role of traditional hedge funds in investors’ portfolios.

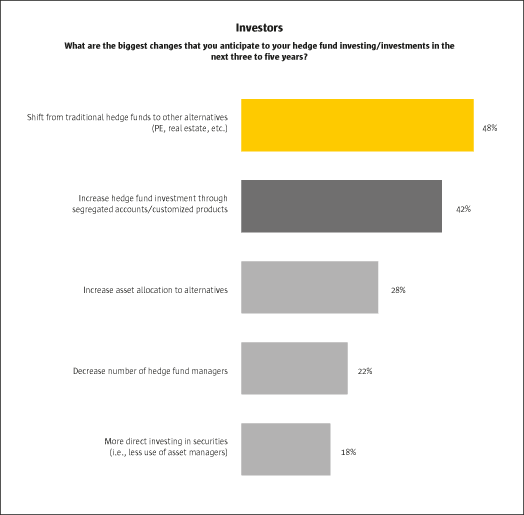

Almost 50% of investors expect to continue shifting assets to non-traditional products such as private equity and real assets – strategies that can be harder to replicate elsewhere. As a result, large managers that offer a diverse set of non-traditional hedge fund products are attracting capital and managers that offer solely traditional hedge funds are increasingly challenged.

When it comes to hedge fund investing, investors are seeking specific solutions as part of their broader portfolio and are choosing to invest more through segregated accounts that allow for customization. These vehicles generally give investors more transparency, flexibility and/or terms that are more closely aligned to the investor’s specific needs. Customization is thename of the game, the exception being for those managers who have unique, niche strategies.

Management fees continue to be compressed

Lack of performance during a significant bull market and the plethora of lower-cost alternatives, as well as investors’ increased comfort in trading on their own behalf, are causing investors to challenge the fee terms of their funds.

Managers are reporting significantly lower management fees year over year. This trend is particularly evident among the largest managers — where management fees declined by 25 basis points on average. For many managers, not only are the days of 2% management fees in the distant past, but investors have pushed below the 1.5% threshold as the average was reported at 1.35%.

Interestingly, while investors have been focused on management fees, managers are not feeling nearly as pressured on incentive fees. The investor sentiment appears to be that the incentive fees at least need to be earned by the manager, whereas investors believe management fees often turn into an automatic profit center for managers.

Despite this downward trend, investors are not materially happier with their funds’ expense ratios this year relative to last. Only one in five is currently satisfied with the expense ratios of their funds. Therefore, the fee pressure will

likely continue. Responding to the trends in investors’ changing preferences increases complexity in operating models and, therefore, puts more of a focus on the need for scale in order to maintain profitability.

Managers recognize that growth is a necessity to counterbalance industry pressures

Amid top-line revenue and cost pressures, managers continue to see growth as their top strategic priority. Increased assets under management counter lost revenues occurring as a result of fee reductions while also providing stability to the business in a time when the industry is facing volatility and uncertainty.

Not surprisingly, the smallest managers are most focused on achieving growth — a goal that has become significantly more important, yet increasingly difficult to achieve. The largest managers tend to place a slightly lower priority on growth, as many have achieved their targets and are now pivoting to ensure that their business is properly supported and scalable. They are focused on how to be more efficient and cost-effective from an infrastructure and operating model perspective.

Relative to bigger and smaller organizations, midsize managers are placing a greater focus on talent management. Many are looking to develop and acquire the right talent that will be imperative for them to continue their growth agenda and compete with the largest managers for investor allocations. Regardless of where each priority is ranked, investments in talent, operational infrastructure, and technology are imperative to support the strategic priority of asset growth.

Growth

For most managers, growth is a necessity to support the economic realities of today’s hedge fund industry. With asset flows stagnating among many of the traditional suppliers of capital to the industry, fundraising is increasingly turning into a zero-sum game. Managers need to be able to differentiate themselves among a crowded universe of not just hedge fund managers, but a growing number of products available within the alternatives marketplace.

Investors, those new to the industry as well as those who have supported it for many years, are changing the way they invest and looking for different solutions within their portfolios. Their interest in traditional commingled vehicles is waning and desires to have something customized and unique are increasing. Managers who best align their offerings with the desired solutions of the investor community are finding the greatest success in this challenging environment.

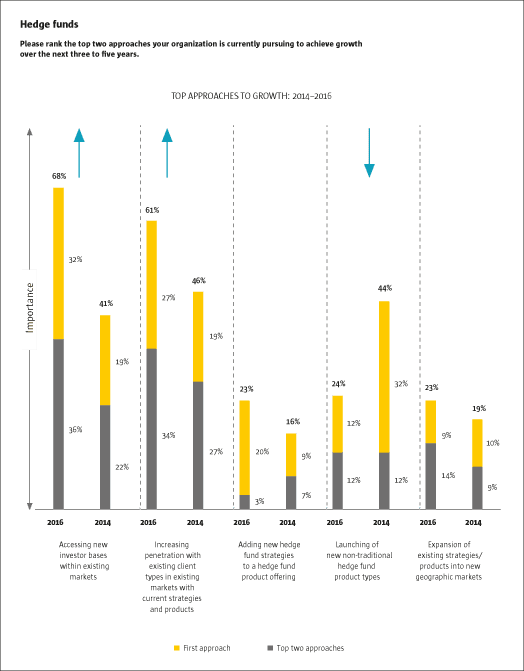

Strategies for growth have shifted over the past two years…

Although growth remains the industry’s top priority, managers are changing the methods they are employing to achieve it. Hedge fund managers appear to be coalescing around two key growth strategies: accessing new investor types (68%) and increasing penetration with current client segments (61%). In both cases, they are emphasizing existing product sets over new product development.

Less than one in four managers identified new product development as a top priority. In the past, managers followed the philosophy; if you build it, investors will come. However, this theory did not hold true as some non-traditional products (e.g., registered liquid alternatives, business development companies) did not gain as much traction with investors as expected. Some managers, though, most notably those over $10b, continue to find success with new product development as they have leveraged and invested in infrastructure and found robust investor demand in certain products, such as credit, private equity and real assets.

While the largest managers can pursue several growth strategies, smaller managers are more focused. Midsize managers are taking a measured approach — marketing existing offerings to the same kinds of clients they have succeeded with in the past. Smaller managers are seeking to expand into new investor bases within their home markets.

As managers pursue growth in today’s challenging environment, it is imperative that they identify the needs of their clients, align product offerings to the demands of target client segments and ensure the appropriate marketing messages are communicated.

…and large managers have the momentum

On a per capita basis, the largest managers have been most successful in raising capital. They have been more adept at adapting to a broader array of investor needs, offering customization and non-traditional hedge fund products and combining all of those with marketing infrastructure and messaging targeted at evolving investor tastes.

The results of the smaller manager represent the continued increase in barriers to entry, as well as long-term success. In fact, two out of three of the smallest managers in the study experienced no growth or net outflows.

While appetite for emerging managers continues to exist, investors fully expect them to maintain a robust infrastructure. If these managers do not achieve critical capital levels within two or three years, they will struggle to survive.

Some of this trend can be attributable to investors being more comfortable allocating to those largest managers that have a brand name; however, we also see the largest managers taking actions that best align them with their investors, leading to additional allocations.

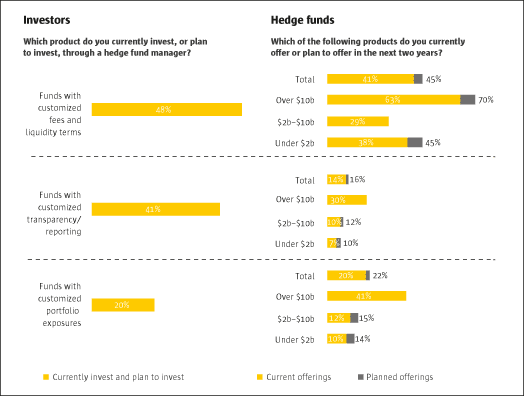

The largest managers are meeting demand for customization

Investors increasingly arelooking to their hedge fund managers to fill specific requirements in their overall investment strategies. As such, demand for customization is growing. Investors have a strong desire to co-develop specific vehicles that provide the investor with everything from unique fees to individual transparency and portfolio exposures.

The largest managers are responding: in 2015, just 40% of the largest managers offered funds with customized fees and terms, and only 25% offered funds with customized portfolio exposures. These shares have increased to 63% and 41%, respectively, in the current year.

Customized product offerings tend to result in increased costs, while often yielding lower fees. Profitability will be a factor to consider and will be dependent on the size of the mandate and scale of the business to respond to the operational burden of the offering. However, investor appetite shows a strong preference toward moving away from traditional commingled products to customized and non-traditional offerings.

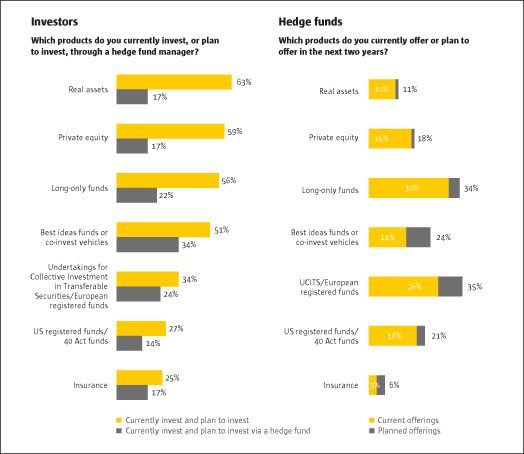

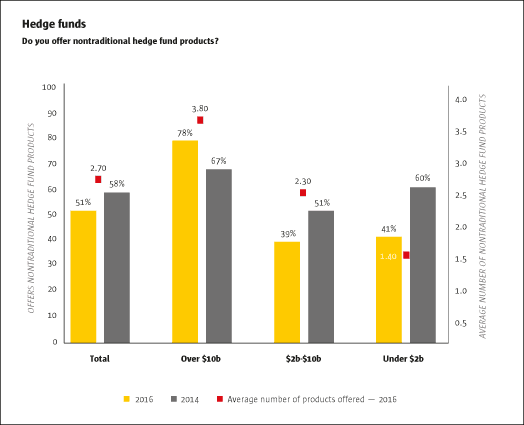

Investor appetite for a diverse array of products results in opportunities

As investors’ product demands expand, assets are flowing to the largest managers that offer a wide array of non-traditional hedge fund products. One in three of the largest managers offers private equity, real asset strategies and best ideas vehicles — compared to single digit percentages for smaller managers. Compared with 2015, smaller and midsize managers have retrenched and are offering fewer new products; however, larger managers have continued to maintain their market share for certain new products, while increasing it for others.

Many investors do not see any but the largest hedge fund managers as solution providers for mandates that extend beyond traditional core competencies. This likely reflects a perceived lack of availability and presents a clear opportunity for managers with capabilities.

Those managers who are able to demonstrate a competency and deliver a compelling offering in these non-traditional products are finding ample investor interest and a less crowded marketplace. In fact, the 2016 investor responses indicated increased demand levels of investments in all categories, except for insurance-related products, as compared to 2015.

The largest managers have sufficient scale to support a broader array of products, while others are rationalizing

While the largest managers are adding non-traditional products to their offerings, smaller firms are cutting back. This adds more fuel to the allocation trends, resulting in the big managers getting bigger at the expense of their smaller peers.

While most managers offering non-traditional products indicate that they offer more than one of such offerings, new products create operational challenges. Few managers — just two in five — say they achieved significant efficiencies in subsequent product launches from investments made to support prior efforts. Based on the nature of these vehicles, each generally requires its own individual investment and support, yet many of them are being offered with reduced fees. Given the current environment of cutting costs, these non-traditional products need to be carefully evaluated.

It is not surprising to see retrenchment by managers that have not reached sufficient scale to support the investment necessary to support a new product launch.

Managers of all sizes are elevating marketing efforts

As managers seek to better market their funds, they are expanding relationships with investment consultants and strategic partners, while also taking a number of different approaches in an attempt to reach new investors.

The largest managers uniquely favor providing increased transparency into their investment process and portfolio. As a result, the largest managers have been able to showcase their competitive advantages in an effort to differentiate themselves from the competition. This appeals to investors who have a desire and need to understand how the investment strategy aligns with the goals of their broader portfolio.

Regardless of the medium that managers use to market their offerings, it is imperative that they effectively present their value proposition and factors that differentiate themselves from other managers.

Managers need to understand investors’ needs to be able to articulate how their strategy or offerings could help investors meet their objectives. Those managers who do this most effectively are most successful at obtaining multiple mandates from existing investors.

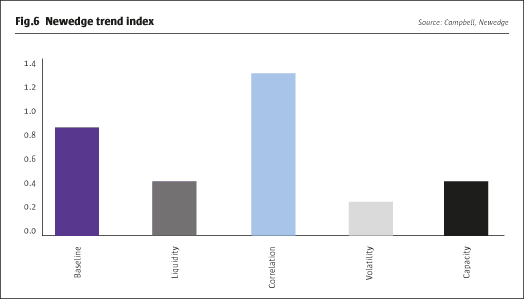

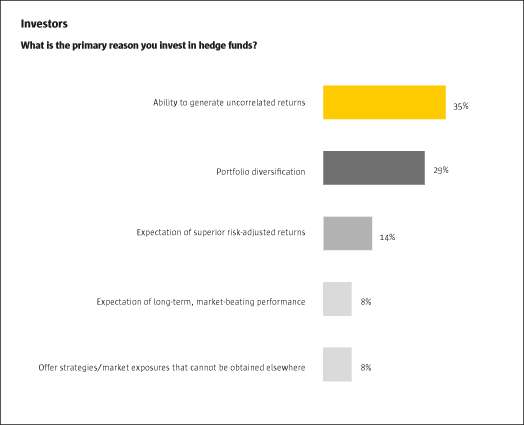

Reasons that investors invest in hedge funds

Investors choose hedge funds for a myriad of reasons. Key among them is generating uncorrelated returns and diversifying their portfolio. Given these top two responses, it is not surprising that investor sentiment has been somewhat sour on the industry recently, as returns for many managers have been increasingly correlated, if not underperforming to standard benchmarks, resulting in less diversification.

What should come as a surprise, if not a warning to managers, is that only 8% of investors indicated they are investing because they are getting one-of-a-kind market exposures through hedge funds that cannot be obtained elsewhere. This gives an indication of the competition in the market and the investors’ perception that many hedge fund strategies can be replicated through other channels.

For managers looking to achieve growth, smart strategic steps, like matching product offerings to evolving investor demand and investing in distribution channels, will fall short if marketing messages do not align with investors’ core motivations for investing in hedge funds. Further, managers should recognize that offering an innovative product that cannot be easily replicated will help them stand out in a crowded alternatives universe.

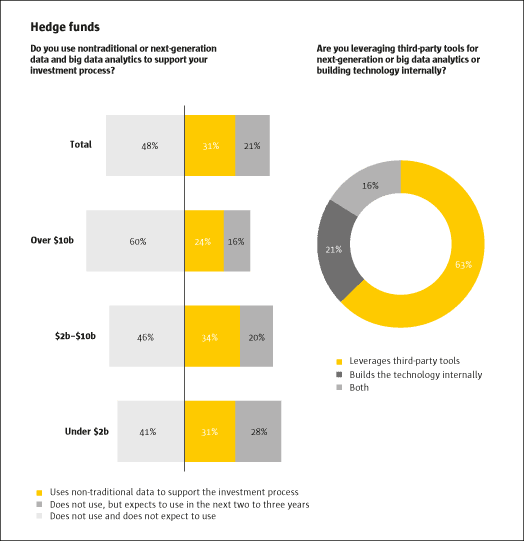

Next generational data being utilized by more than just the quants

Product and marketing alone will not solve the growth challenge. Managers need to seek every advantage in achieving performance and in offering differentiation.

Quantitative managers have been leveraging big data and non-traditional data sources to generate returns for years. Fundamental managers now also are looking to leverage big data to create opportunities for alpha generation.

More than half of managers either currently use or expect to use non-traditional data in their investment process. The smallest managers lead the pack, with nearly 60% utilizing this information. Many managers are using artificial intelligence programs to model and analyze large amounts of data. If used appropriately, non-traditional data can both aid in identifying investment opportunities, as well as providing an innovative and differentiating aspect to a manager’s investment program that could appeal to investors. However, it is critical that managers understand the data that is being obtained, what it represents and how to use it. A misunderstanding or misinterpretation can have severe negative impacts on the trading strategy.

The vast majority of managers currently in this space are buying rather than building the tools necessary to aggregate and analyze this data. The availability of this data could result in the convergence of the fundamental and quantitative strategies. Over time, as more managers pursue this strategy, the data could become commoditized. Differentiation will be driven by technological sophistication in using models and artificial intelligence in order to facilitate unique investing opportunities and speed to market.

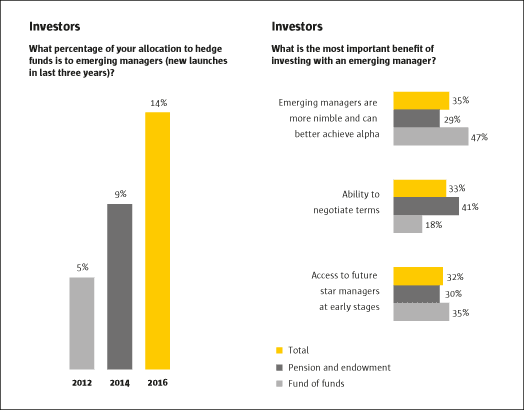

Emerging managers continue to play a role in investors’ portfolios

While the largest managers enjoy a number of advantages, there continues to be a robust appetite among investors for start-ups.

Emerging managers represent 14% of investors’ overall allocation to hedge funds, and fund of funds are driving this trend. As the broader investment community is fairly aware of and has access to invest in the largest managers, fund of funds have positioned themselves to research and identify emerging managers who may not be on the radar of other institutional investors. In fact, almost 70% of pensions and endowments indicated they had restrictions on day 1 investing in start-ups, compared with only 28% of fund of funds reporting such restrictions.

Two-thirds of investors choose emerging funds in a search for alpha — either for their nimbleness or to invest early with future “stars”. Others like the negotiating leverage they can achieve with new managers who tend to be more flexible on terms with initial investors. We also see that the newest managers are tailoring their operations to incorporate some of the new and innovative technology and tools to aide with their investment strategy.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical