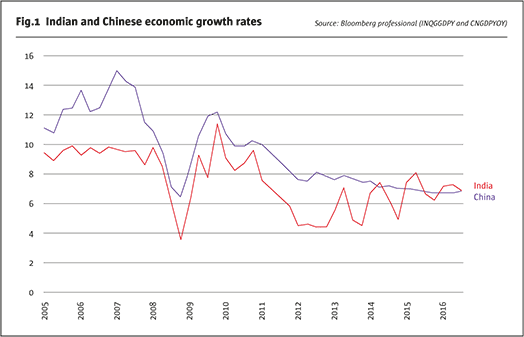

Neighbours and rivals, China and India have the distinction of being the world’s two most populous nations. With between 1.3-1.4 billion people each, they account for 36.5% of humanity. The similarities largely end there. Over the past three decades, China has become more prosperous than India, with an economy five times larger. While India’s 4-8% growth rate has been solid, it lags China’s red-hot pace, which has topped 10% for much of the past few decades.

However, this dynamic has begun to change. Since 2015, India’s economy has begun to pull ahead of China’s (Fig.1).

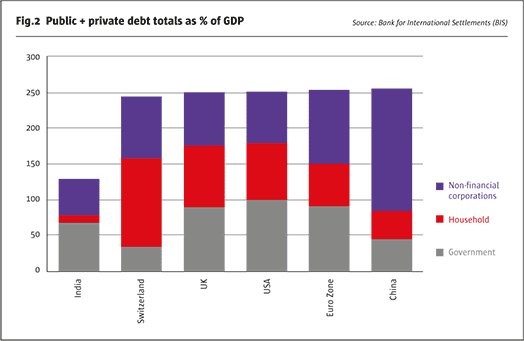

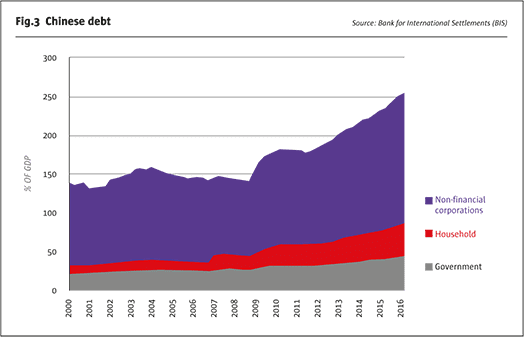

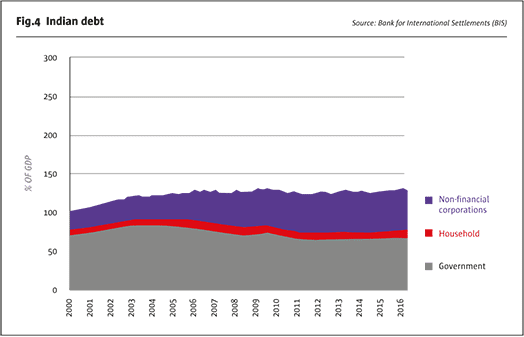

The drivers of China’s economic miracle, namely: a productivity-enhancing transition from being rural- to urban-based, and the impressive build-up of infrastructure, are past the point of diminishing marginal returns. In addition, the country is awash in debt. China’s total debt (public plus private) has grown to levels comparable to those in Europe and North America, and this portends slower growth. By contrast, India’s rural-urban transition, while well underway, is less advanced than China’s and could boost India’s productivity for many years to come. India’s debt ratios are only half of China’s and have not been growing during the past decade (Figs.2–4). This, too, could set the stage for many years of solid growth in India that could begin to exceed that of China as we move into the 2020s. We note, however, that short-term growth in India could lag China’s as a result of the damage to the economy from Prime Minister Narendra Modi’s withdrawal of high-denomination currency notes in an effort to crack down on the country’s vast shadow economy.

Debt levels correlate strongly with both economic growth and the level of interest rates. Yet in both cases, the relationship tends to be a chicken-or-egg sort of problem. Less volatile economies, which are often the slower-growing ones, can support high leverage ratios. But high leverage ratios can slow economic growth. Low interest rates can encourage credit growth and high debt ratios. High debt ratios, in turn, necessitate low interest rates so that public and private debt burdens can be financed.

When debt ratios are low, a country can grow by increasing leverage. One person’s spending or investment becomes income for somebody else. As debt levels rise, however, further borrowing serves mainly to service existing loans, and economic growth tends to slow. Eventually, interest rates will be forced down to very low levels as has happened in Japan, Europe and North America. China is already well down this path. India is not.

China, India, Trump and Trade

While China has outstripped India in terms of economic growth for most of the past 35 years, it has achieved this level of success with an economic model that leaves it vulnerable to any change of mood in Washington. Two closely intertwined factors drove China’s economic miracle: investment and exports. Exports now total 21% of GDP, and 18% of the exports (or about 4% of GDP) head to the United States. Chinese infrastructure investment has largely been geared towards facilitating exports: improving the transportation network for goods made in the interior to reach coastal shipping points, and improving the numerous port cities. In recent years, China has attempted to reshape its economy by increasing domestic consumption, with some success. But it has a long way to go, and is still highly dependent on the export sector.

India’s growth is much less export dependent. Exports account for 13% of GDP, and of those exports, 12% (or about 1.6% of GDP) head to the United States. Unlike China, with its strong centralised state, democratic India has struggled to develop export-facilitating infrastructure. Land reform has been a major obstacle as private property owners and local governments can block or delay the building of key infrastructure, something that is not a problem in China. This prevents products made in the interior of the country from reaching its ports easily and inexpensively, and has slowed the pace of India’s industrial expansion. As such, India’s growth has mainly been in services-oriented areas, and has been significantly more internally focused than China’s. While slower growth certainly has its drawbacks, India’s lack of dominance in the traded-goods sector may also help to avoid the ire of a more insular United States.

President Donald Trump has focused his trade concerns on two countries: China and Mexico. Judging from his public comments on trade, India doesn’t appear to be on his radar. This is good news for India and worrisome for China. Given China’s soaring debt, the last thing the country needs is a trade war with the United States – a war between the world’s two largest economies could destabilise China’s economy and augment the probability of a debt crisis and a currency devaluation.

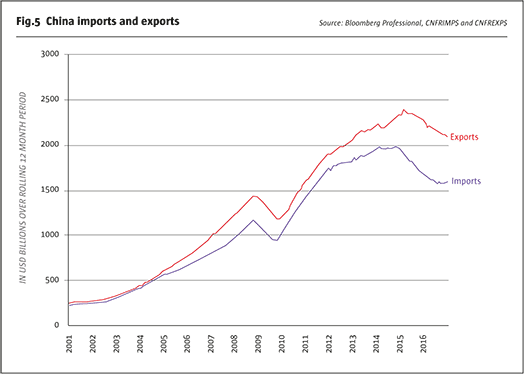

Already, China’s exports have been plunging. Given the abysmal trade numbers, when China claims to be growing at 6.5-7.0%, some observers wonder if they might be overstating their growth. We don’t think so. Paradoxically, despite plunging exports, the overall contribution of trade to GDP growth has been positive. The reason: up until the past few months, imports were plunging even faster than exports. As a result of the manner in which GDP is calculated (adding government spending, investment, consumer spending and exports and subtracting imports), when imports fall, it adds to GDP.

Chinese imports plunged from mid-2014 to mid-2016 mainly as a result of the collapse in commodity prices. Crude oil and refined products account for 15% of imports, and iron ore and copper another 6%. As oil and metals prices fell by over 50%, China’s import bill shrunk, contributing to an apparent stabilisation of GDP growth in the 6.5-7.0% range. Now that commodity prices have rebounded, imports are starting to grow again while exports continue to tank (Fig.5). Unless China is able to offset the negative contribution from trade with alternative sources of growth, its economy could slow once again, and decelerate faster than some observers might expect.

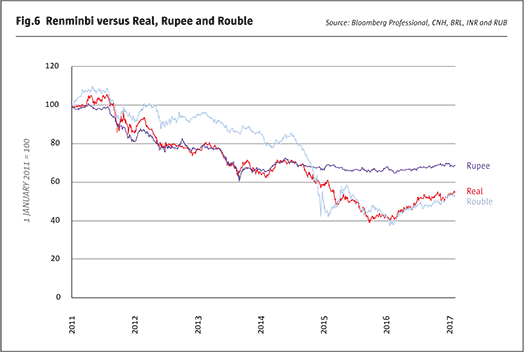

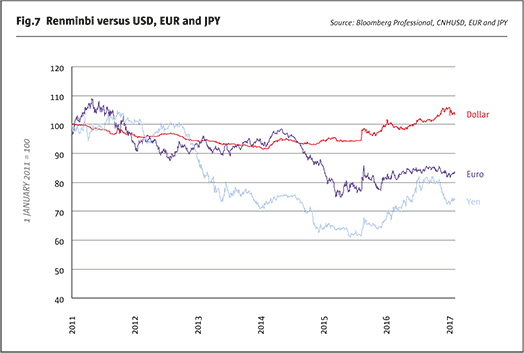

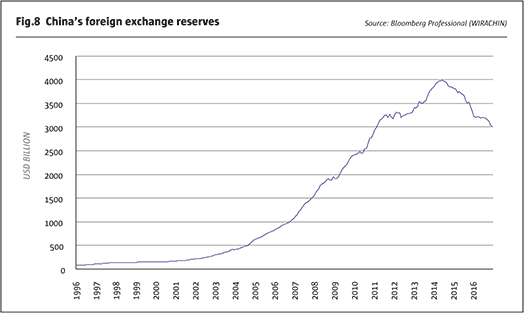

If the Trump administration gets aggressive with China on trade and begins imposing import tariffs on Chinese-made goods, China is not without defences. Its main weapon is its currency. On the campaign trail, Trump accused China of being a currency manipulator. This is true. Between 1998 and 2013, China amassed $4 trillion in foreign exchange reserves by keeping its currency artificially low. Since 2014, China has continued to manipulate its currency but in the opposite direction. It has sold $1 trillion of its reserves in order to hold its currency at an artificially high level. This can’t continue indefinitely. Given its overvalued currency, which has appreciated versus every major currency except the Korean won and the US dollar (Fig.6–7), at some point China might have to let the renminbi decline to a more appropriate value.

A faster pace of devaluation could send shockwaves through financial and commodity markets as it did in August 2015, when China announced a modest devaluation of a few per cent. For the Trump administration, the irony of a Chinese currency devaluation would be that it would most hurt Trump’s core constituents: those in rural areas who export agricultural goods to China, and those in areas where manufacturing is a key component of the local economy.

Given the $50 billion-per-month pace at which China is burning through its currency reserves (Fig.8), devaluing the currency will not be an act of trade hostility so much as an economic necessity.

In contrast to China’s overvalued currency, the Indian rupee is probably about fairly valued, having depreciated a fair amount between 2011 and 2013 ahead of the weakening in most other currencies. Unlike China, which has spent one-quarter of its currency reserves defending the renminbi, India’s FX reserves rose from $326 billion in early 2016 to $337 billion in early 2017. These reserves are modest compared to China’s, but they are growing rather than shrinking.

Monetary policy outlook and interest rates

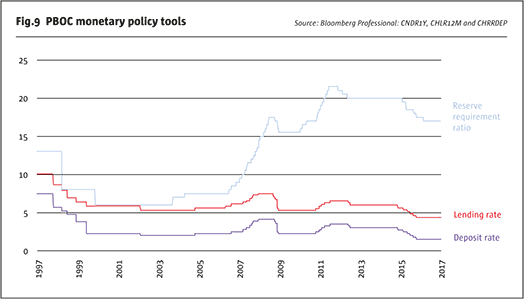

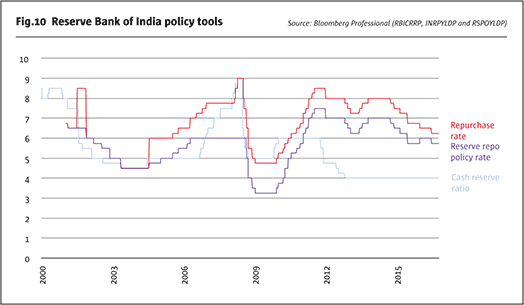

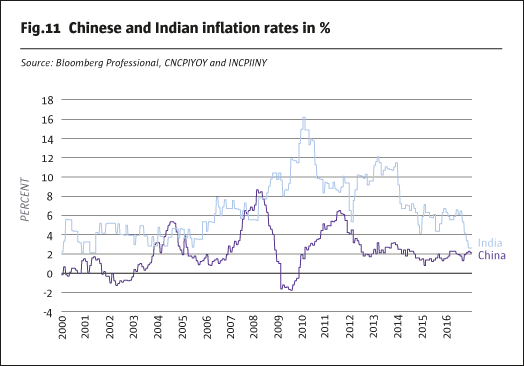

Both the People’s Bank of China (PBOC) and the Reserve Bank of India (RBI) have eased policy considerably in recent years (Fig.9, 10). In both nations, inflation appears to be contained at the moment, although this is a much more recent and probably temporary development in India than it is in China (Fig.11). Given India’s solid growth and the likelihood that inflation will rebound, one might ordinarily expect the RBI to begin a tightening cycle. Any rate hike cycle will depend upon how much damage the withdrawal of high-denomination currency notes has done to the economy – a question that we won’t have a definitive answer to until sometime in the second quarter.

The PBOC cut rates in 2014 and 2015 but stopped thereafter, probably as a result of fears of igniting an even bigger credit bubble or triggering a devaluation of the currency. In the long term, given its debt levels, China will have the incentive to pursue a near-zero rate currency like Europe, Japan and the US.

Equitymarkets

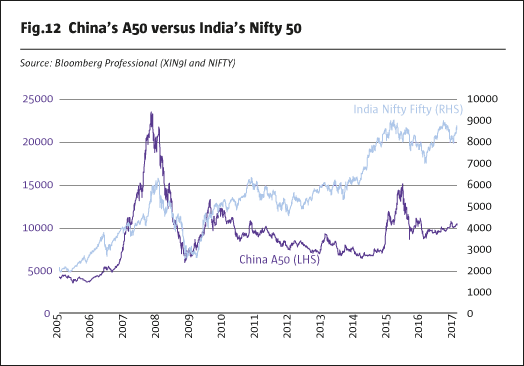

Unfortunately for stock market investors, the idea that India has more solid growth prospects than China already appears to be baked into equity markets. India’s Nifty 50 Index, which has vastly outperformed the China A50 in recent years (Fig.12), trades at 18.6 times earnings, as opposed to 12.8 times earnings for Chinese shares.

The difference in valuation ratios also stems in part from the industry breakdown behind the two indices. China’s market cap is only 4% weighted to technology stocks, whereas the number is closer to 20% in India.

Demographics and agriculture

For the past few decades, China has been the dream importer of commodities across all sectors, including agricultural goods, while India has largely been nondescript. This is about to change. Chinese per-capita consumption is now over 3,000 calories per day, compared to 2,500 in India. Moreover, India’s population will likely expand by 30% over the next 25 years whereas China’s will likely stay about the same despite changing the one-child policy to a two-child policy. That change will add about 0.1% to China’s population per year.

Given the expansion of India’s cities and its stagnating agricultural production, it defies credulity to think that India will be able to meet its consumption needs entirely domestically. As such, India represents an enormous opportunity for the world’s farmers, especially those who can provide lentils, peas, chickpeas, almonds and other dietary staples. Also, as India grows richer, consumption of dairy and vegetable oils will likely grow considerably.

One thing that India won’t need much of is animal feed. Of India’s 2,500-calories-per-day diet, only about 9 calories come from animal protein. Meat consumption could of course grow with wealth but will encounter significant cultural hurdles.

Lastly, while grain consumption typically stagnates with economic growth, there may be an opportunity to introduce more corn into India’s diet. China, by contrast, has a mature diet and its food consumption needs may not change a great deal going forward. THFJ

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 120

Will India Trump China as US Policy Shifts?

Changing times

ERIK NORLAND, SENIOR ECONOMIST AND EXECUTIVE DIRECTOR, CME GROUP

Originally published in the February 2017 issue