Pictured (L-R): Jamie Sherman, Equity Portfolio Manager, Massi Khadjenouri, Co-Founder, CIO and CRO, Jan Lernout, Co-Founder and Credit Portfolio Manager

Kite Lake Capital Management UK LLP, the London-based hard catalyst-focused event driven fund manager, celebrated its seven-year track record on February 1st, 2018 and in the process recorded its seventh consecutive year of positive returns.

The KL Special Opportunities Fund recorded a 10.3% net return in 2017 (for the USD A Share Class) and recorded a strong + 5% net return in the first three months of 2018. The average annualised returns over the Fund’s 7 year plus track record is 9 % net of fees with a volatility of 5.3%, a Sharpe of 1.7 and average correlation of 0.18 to the MSCI World Index. The strategy has profited in 21 of the 33 down months for the MSCI World Index during the period.

In May 2017 Kite Lake launched a UCITS version of the strategy which is lead managed by Jamie Sherman, the portfolio manager for the M&A and equity event driven strategies in the master fund. It invests in the same merger arbitrage and equity event driven positions as the flagship strategy but does not include the credit or distressed elements from the Cayman fund. As of April 2018, the UCITS fund AUM stood at $235m.

Before joining Kite Lake in 2011, Sherman was the co-Head of European Research at PSAM, having started his career at UBS in 2000. The KL Event Driven UCITS Fund has recorded a 3.67% net return in the first three months of this year.

History

Kite Lake was originally co-founded by Massi Khadjenouri and Jan Lernout who worked together at Cheyne Capital from 2005 before launching the KL Special Opportunities Master Fund in February 2011. Their partnership dates back even further to when Khadjenouri was a client of Lernout’s at Goldman Sachs where he was investing on a proprietary basis, when they co-invested in some deals. Khadjenouri, who featured in the 2012 edition of our biennial ‘Tomorrow’s Titans’ report published in association with EY, has been investing in the event driven market since its genesis twenty-five years ago. She began as a proprietary trader at Paribas with the team that was then spun out into Centaurus Capital, before setting up Cheyne’s event desk. Lernout, too, has been active since the infancy of Europe’s levered, stressed and distressed credit markets in the late 1990s.

A firm run by a woman has a different culture and a different perspective.

Massi Khadjenouri Co-Founder, CIO and CRO, Kite Lake

Cohesive team

Lernout is credit portfolio manager, Sherman is equity portfolio manager, and Khadjenouri is both CIO and CRO, but there is no star culture of any one person dominating. “It is very team oriented. Half of the team worked together before joining Kite Lake and we have over 70 years of collective event driven experience,” says Khadjenouri.

The flagship strategy is run as one portfolio without any silos. “We do not believe in silos. They create all sorts of problems, at the interpersonal and investment levels; in terms of forced investing, and internal competition over book sizes and returns on capital. Our portfolio managers are indifferent about the size of their personal book,” Khadjenouri adds. “Furthermore, a robust risk governance framework has been put in place by our “non-investment” team lead by Rupert Haworth-Booth. Our risk management systems and processes have proven themselves to be effective over the past 7 years,” says Khadjenouri.

The culture is perhaps in part a function of its diversity. Kite Lake is now amongst the largest hedge fund managers in Europe, or globally, co-founded by a woman. “A firm run by a woman has a different culture and a different perspective. We are very down to earth with our feet on the ground. Our culture is not conducive to creating ‘egos’,” explains Khadjenouri.

In 2018, Kite Lake has been chosen as one of the firms in the UK financial services industry to participate in a celebration organised by the History of Parliament Trust to mark the centenary of the Representation of the People Act. It will feature in Parliament’s commemorative book produced for this event.

The team is also very international: the thirteen-strong team contains nine nationalities: American, Belgian, British, French, Italian, Iranian, Lebanese, Romanian and Swiss.

If Kite Lake’s corporate culture is distinctive, its style of investing is also highly distinguished, investing across the capital structure and focusing on hard events while utilising modest leverage.

Hard events

Kite Lake’s low correlation is mainly a consequence of the ‘hard events’ it invests in being inherently uncorrelated, with around 95% of trades having a hard catalyst associated with them. They include announced merger deals and other contractual transactions, rather than softer situations such as early stage rumoured approaches or deep value with soft catalyst investments. On stock-for-stock deals, Kite Lake hedges with shorts in the acquirer’s stock, sometimes using options to create more deterministic risk-rewards. Apart from mergers, Kite Lake is very selective in other equity event trades, only engaging in non-M&A investments if they expect a forecastable, transformational event.

Hedging

Notwithstanding the effort to avoid equity beta, Kite Lake recognises that some trades can still have varying degrees of market sensitivity. Therefore, some dynamic hedging at the position level (if necessary) and at the portfolio level is also carried out in order to neutralise residual exposure or unintended equity beta.

Shorter dated

Kite Lake focuses on shorter dated events, with a multi-month time frame. The average holding period is between three and four months for merger arb trades and longer, but preferably shorter than one year, for the credit positions. The portfolio turns over around three times per year. For the credit investments, the team do not buy and hold to maturity but rather need to see a catalyst within a year to create the exit.

Capacity

Khadjenouri contends that Kite Lake’s style of event investing has limited scalability. “Having run larger funds previously, we know that for a proper, non-correlated, event strategy you have to stay small. Capacity is limited, especially in the credit sub-strategy hence our prospectus contains a hard cap at $1 billion. Larger AUMs could dilute returns and prevent us from doing what we want to do in a clinical manner,” she explains.

Kite Lake has a diverse investor base, across Cayman, Delaware and UCITS vehicles with over 100 investors including European and US Pension Funds, Family Offices and Private Banks, Insurance Companies, Foundations and Fund of Funds and also runs a separate managed account. The firm was seeded with its partners’ personal capital and they remain substantially invested.

Merger arbitrage – globally

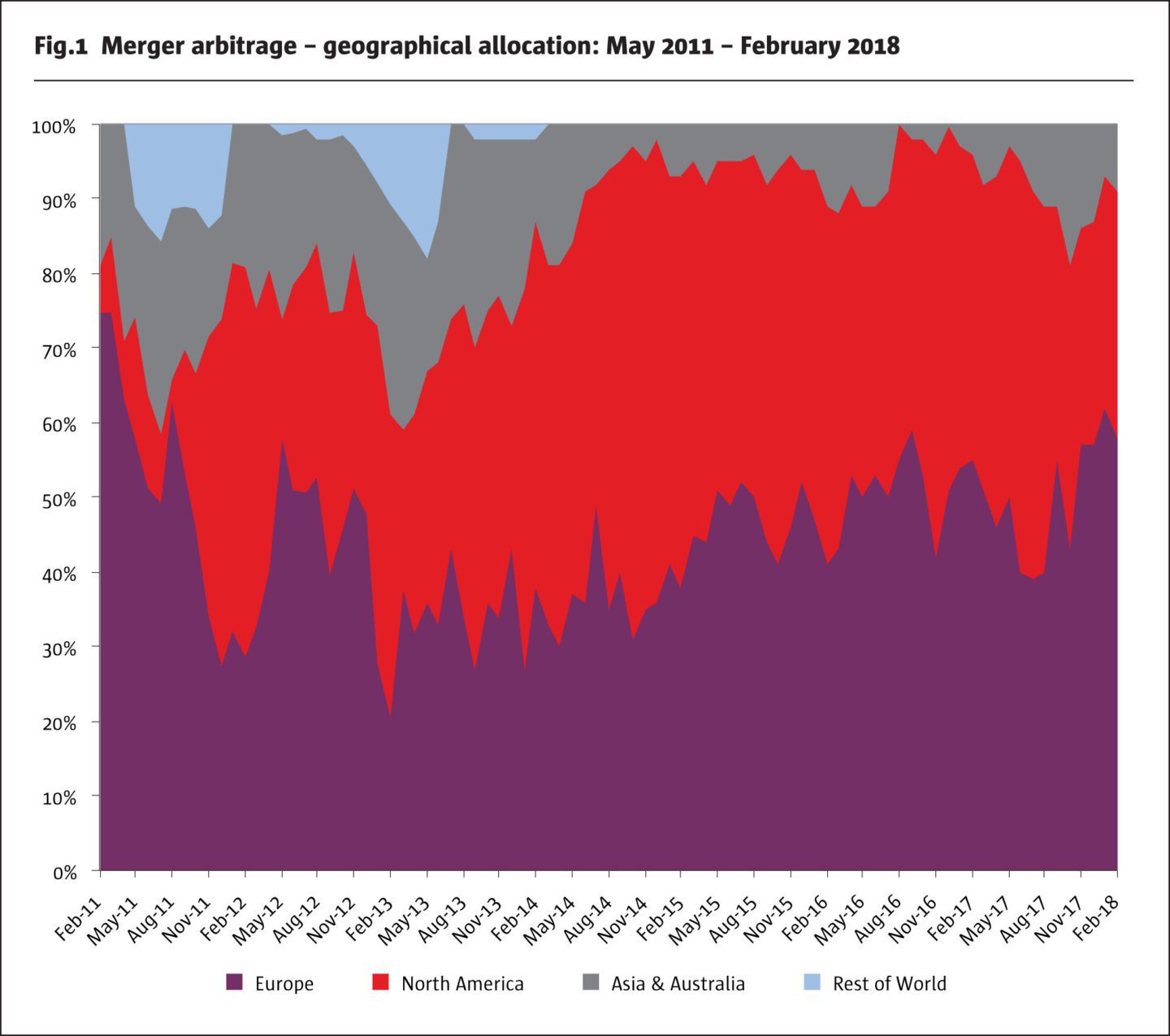

Merger arbitrage is the bread and butter strategy that has consistently accounted for the largest capital allocation in the flagship fund (and the predominant part of the UCITS fund). As Kite Lake invests in merger deals throughout the developed world, the geographic weightings have moved around. North America and Europe are regular fixtures and the fund has some exposure at times to various Asian markets with the team only operating in markets where there is a proper legal framework for contractual M&A.

Fig.1

In early 2018, Kite Lake are broadly sanguine about the outlook for M&A but expect the passage of the Republicans’ tax bill to continue to unleash pent up demand from corporations that were awaiting the details before acting. However, Kite Lake’s profitability is not so much driven by volumes of M&A. “We performed consistently even in quiet markets of 2011, 2012 and 2013. We run a quasi-concentrated portfolio but always find interesting deals even in a slower climate,” Khadjenouri points out. Trading around deal spreads is important. Sherman adds: “As we are small and nimble we want to be in the position to change our mind when the facts change, and be buyers when spreads widen for irrational or non-deal related reasons. This is an advantage over a multi-billion-dollar fund. We never want to be forced buyers or forced sellers.” Kite Lake has also pursued ‘reverse’ merger arbitrage trades that can profit from spread widening or deal breaks, though this has never been a big percentage of the book.

Equity events

Kite Lake does not engage in activist situations per se and does not join activists’ groups. The firm has sometimes been invested in announced deals before activists entered the fray seeking a bump in the offer price. Investments associated with softer events around management change, operational restructuring, open ended strategic reviews, informal early stage approaches and earnings releases are examples of the types of ‘soft’ catalyst trades that Kite Lake does not invest in. Share class trades and holding company discounts are other trade types that the team only invest in very selectively, because the events are too soft, require mean reversion and may be overcrowded. Crowdedness in itself is not taboo, because merger deals are crowded by definition.

The sorts of non-M&A contractual deals that Kite Lake can consider include selected minority squeeze outs, so long as they are not too illiquid or long-dated. The team also sometimes find companies going through divestiture of major assets interesting. Trades revolving around complex litigation or accounting issues can also be done. All of these tend to be sized much smaller than contractual M&A deals, which can reach as much as 18% for shorter dated unconditional deals.

Europe-oriented credit

The credit portfolio has regularly generated performance attribution higher than its share of the allocated capital, and this is by design. “Credit investments target a higher IRR to start with and have in certain years generated half or more of the flagship fund’s returns. For instance, in 2016 roughly half of returns came from an average 12% allocation to credit. And in 2012, credit generated the majority of returns as the European sovereign crisis had created interesting investment opportunities which became more pronounced at times of stress,” says Khadjenouri.

Indeed, Kite Lake finds it essential to stay nimble in credit markets to dynamically and opportunistically take advantage of dislocations if and when they happen. “If levered credit has a big correction we can be there and reposition the portfolio very quickly. An example was the mini-credit crisis of 2011. In August 2011, we bought when there was turbulence,” says Khadjenouri. Kite Lake patiently invests on a case-by-case basis. “The lesson we all learnt in 2008 is not to position yourself in a situation where you get trapped as liquidity evaporates and creates forced sellers. I am confident that this fund is unlikely to experience this kind of mishap because of its structure and the type of situations we invest in,” she reflects. Kite Lake can trade credit from the short side and profit from negative credit events, such as covenant defaults or profit warnings.

Whereas the merger and equity event strategies are global, credit focuses on Europe. “Distressed requires country-by-country expertise. We do not invest in the US as we have no particular competitive advantage in the US distressed market where seasoned participants have been operating for years.” explains Khadjenouri. Kite Lake has had some bias to Northern Europe as the portfolio managers have witnessed Southern Europe being less predictable over the years. “A judge may give a verdict and then change his mind,” says Khadjenouri. The portfolio therefore tends to focus on the UK and Northern Europe (the Netherlands and Germany) though “France is getting better in terms of the efficiency and fairness of the workout process,” observes Khadjenouri. Southern Europe is not off limits, but does require a higher expected return to compensate for the additional risk.

Distressed debt

High yield markets have suffered some outflows towards the end of 2017, and this is something that Khadjenouri welcomes as “we might get a big shakeout one day”. In the meantime, Kite Lake’s distressed team is focused on idiosyncratic situations, including the oil and oil services sector where some stressed and distressed situations are playing out.

Seldom does Kite Lake sit on creditor committees, though this is not for lack of expertise and experience. Lernout, who was one of the main workout specialists at Goldman Sachs ESSG in the early 2000s, has great experience. He has been involved in a large number of very lucrative work out situations in the UK power sector, in cable companies across Europe, and other situations in the early 2000s when the distressed market was very active in Europe. However, Kite Lake takes the view that “sitting on committees is a time-consuming affair and we would not participate unless it was really essential in order to protect our interest. Usually we can tell how a workout will pan out by talking to advisors and following the developments in the specialised news services. If it is going the wrong way, we will avoid getting involved,” says Khadjenouri.

Though distressed may be perceived as a long duration strategy, Kite Lake is able to find investment niches that are shorter dated. “We have great expertise in stressed and distressed, but we are not a distressed fund, as these funds are, by definition, directional and investment turnarounds can take a few years. Our dual criteria of deep value, with a transformational event to create the exit, apply to all of our investments. Therefore, we are not reliant on the health of the market to provide us with the exit, or dependent on refinancing of balance sheets by the market. The exits to our trades are events that we foresee, and these events provide the liquidity at the same time,” Khadjenouri explains.

Longer duration distressed debt investments would not fit in the liquidity profile of the current vehicles but could be pursued if Kite Lake launched a vehicle with a longer lock up, perhaps of five years. “We have started doing the work on the structuring of such a vehicle as this would be a natural by-product of our coverage of distressed,” says Khadjenouri.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical