Juniper: Consensus Margin And EPS Estimates Lagging Management’s Longer-Term Guidance

Originally published on 19 May 2017

In May of 2016 at their Investor Day, Juniper’s management team established detailed long-term revenue, margin, and EPS targets through 2019. One year later, with a more competitive environment in many of their segments, are analysts expecting the company to achieve those targets?

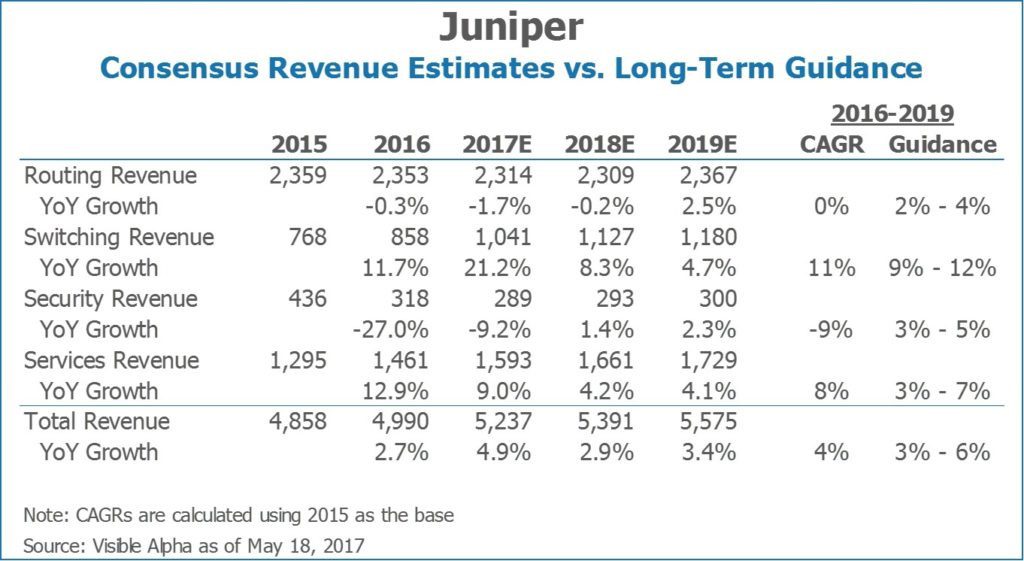

A look at overall revenue estimates show that analysts expect Juniper to achieve its targeted 3% – 6% CAGR through 2019. However, analysts are not expecting the company to achieve this exactly through its stated goals. Instead, consensus estimates have growth lagging the long-term target in Juniper’s core Routing segment and in Security. The shortfall is expected to be offset by growth in Services and Switching.

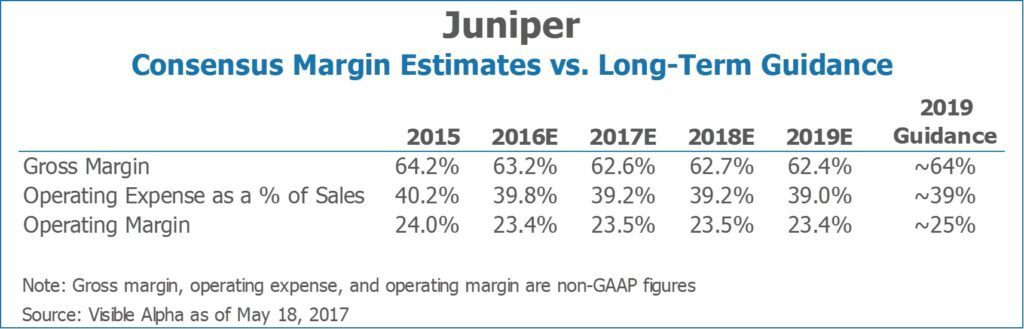

On profitability, consensus estimates are less optimistic. While operating expense as a percentage of sales is in line with management’s 2019 guidance, gross margin is expected to fall short of management’s 2019 target by 160 basis points. Analysts are somewhat concerned about competition from Arista and Nokia as Juniper targets Cloud customers. The shortfall in gross margin leads to a similar shortfall in operating margin vs. management’s guidance.

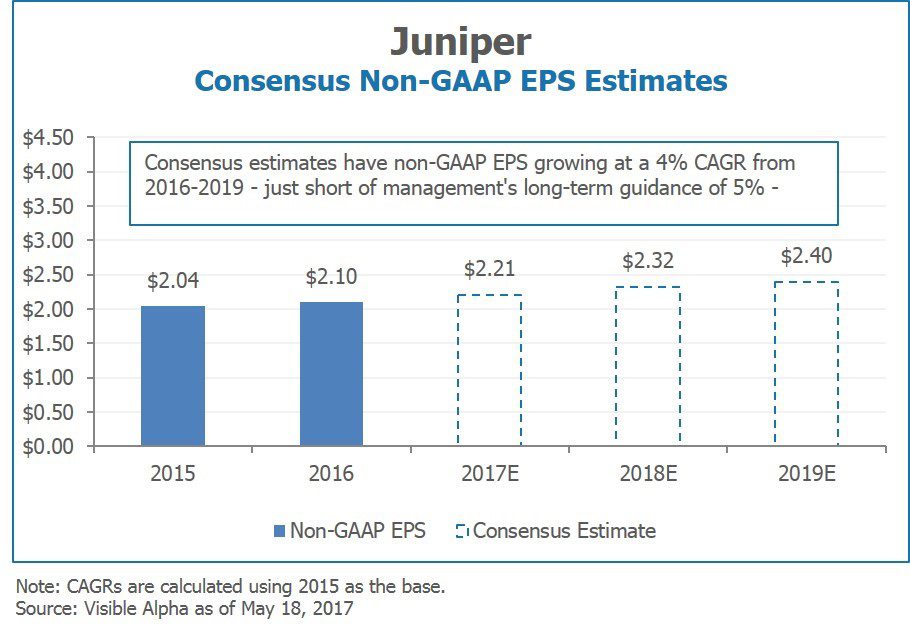

As a result, consensus estimates currently have Juniper growing non-GAAP EPS at a 4% CAGR through 2019, slightly lagging management’s 5% – 8% target.

This blog post was originally published by Visible Alpha. Visible Alpha is a data and analytics platform with comparable forecast models and data from equity analysts around the world.

- Explore Categories

- Corporate

- Funds

- People

- Regulatory

- Technology