Lululemon Athletica: What’s to Blame for the Slowdown in Store Sales Growth?

Originally published on 26 May 2017

On LULU’s fiscal 4Q conference call, senior management noted a material slowdown in stores and on their website to start their 1Q17. Management noted that store traffic softened in February and March, while conversion on their website was negatively impacted.

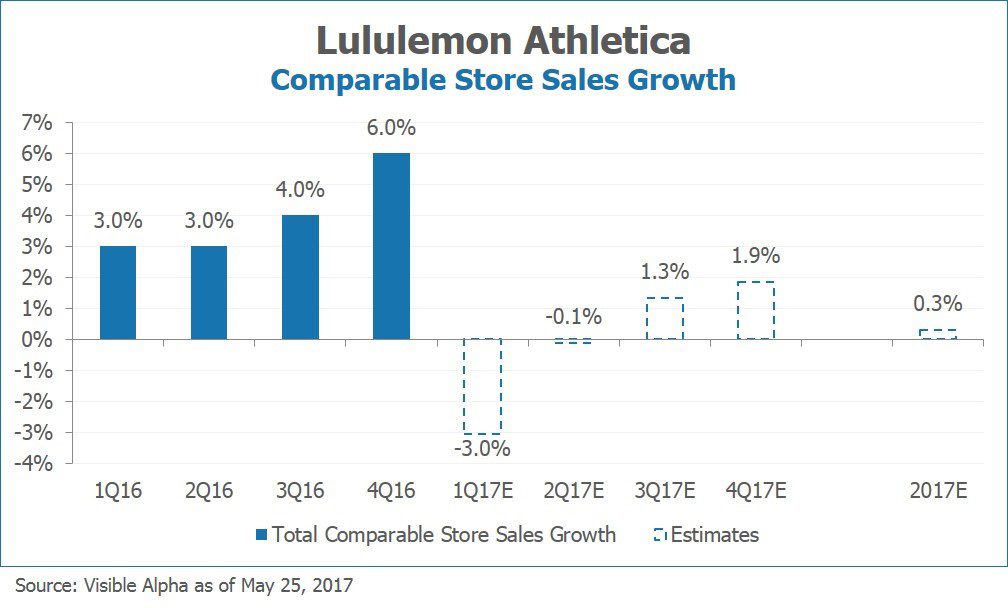

Since those results were announced in late March, investors have debated whether the slowdown was due to a more structural issue at the company or a temporary execution-related issue. Management’s comparable store sales guidance was for a decline of low-single digits in 1Q and an increase of low-single digits for the full year. Consensus estimates currently show that analysts expect Lululemon to recover beyond 1Q with positive comparable store sales growth in 3Q and 4Q. However, the full-year growth of 0.3% suggests analysts remain cautious about Lululemon’s ability to recover to the degree that management expects.

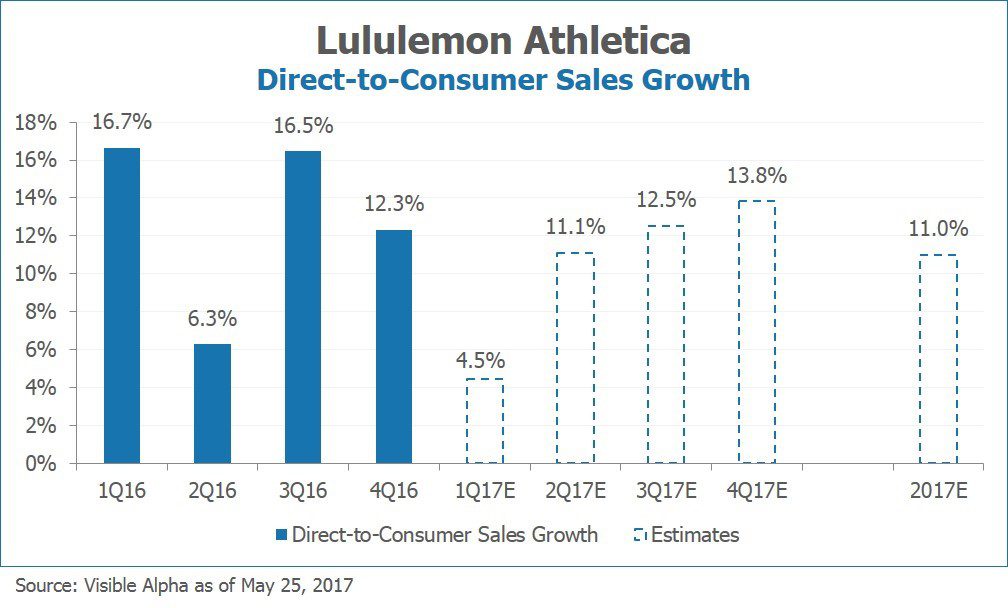

While comparable store sales growth estimates model just a slight recovery, analysts are modeling a greater degree of recovery in ecommerce. While consensus estimates call for a significant deceleration in growth in 1Q17 for direct-to-consumer sales, they also rebound to double digits through the remainder of the year, suggesting that analysts expect website issues to be resolved more quickly.

This blog post was originally published by Visible Alpha. Visible Alpha is a data and analytics platform with comparable forecast models and data from equity analysts around the world.

- Explore Categories

- Corporate

- Funds

- People

- Regulatory

- Technology