UCITS versus Offshore Hedge Funds

Still David versus Goliath?

Marcus Storr, Head of Hedge Funds, FERI AG

Marcus Storr, Head of Hedge Funds, FERI AG

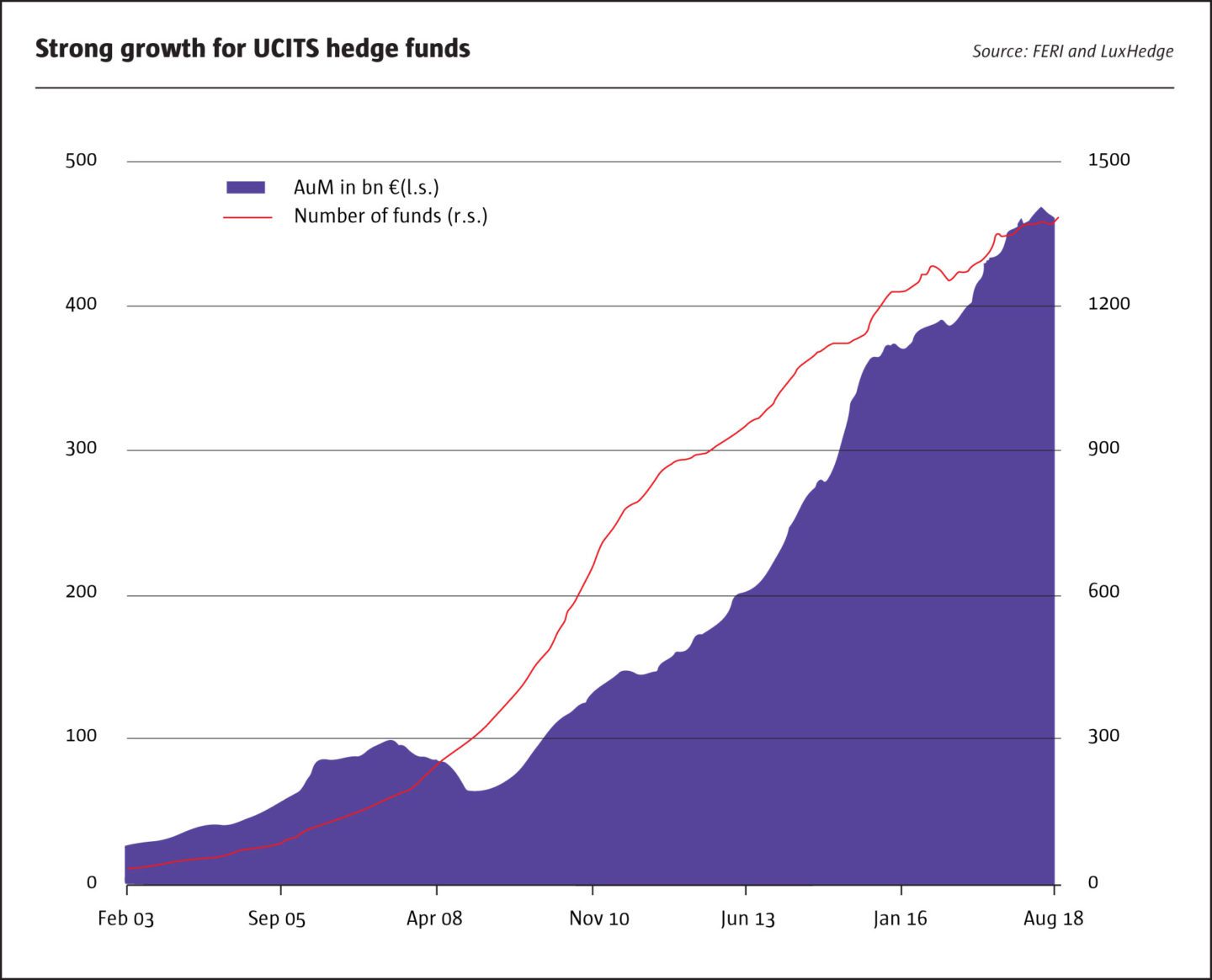

“UCITS” or Undertakings for the Collective Investment in Transferable Securities are investment funds regulated at European Union (EU) level. In recent years, UCITS funds that follow hedge fund strategies have enjoyed a strong increase in number and assets under management.

The low-yield environment and the efficient distribution of UCITS funds in the EU lend themselves as main reasons for the Alternative UCITS’ current popularity. They have to fulfill more stringent requirements than traditional hedge funds with regards to liquidity, instrument eligibility, leverage, position concentration, short-selling, as well as transparency, operational and internal controls, and conflicts of interest.

These requirements affect the way in which hedge fund strategies can be implemented within this framework. For example, the main obstacle for UCITS funds when implementing any Equity Long/Short or Fixed Income Long/Short strategy is the framework’s ban on outright short positions – ie implemented by borrowing cash securities. While single name short positions can still be achieved indirectly via such cash-settled derivatives as CFDs, swaps, and options, such workarounds are generally less cost efficient in terms of trading costs than outright shorts, arguably biasing the UCITS manager towards index shorts or a higher net exposure altogether.

Liquidity requirements bias UCITS funds towards equities of larger market capitalisation (Stefanini et al. (2010), p. 121) and towards bonds of larger issue size. While a contested issue, it is routinely argued that due to better analyst coverage, higher liquidity and higher transparency, large-cap equities are more efficiently priced than equities of smaller market capitalisation, which would reduce risk-free return through stock selection skills (“Alpha”) as a potential source of return. Furthermore, the regulation poses fundamental challenges to the pursuit of Event Driven strategies. First, restructuring situations are difficult to exploit within the framework due to their impending illiquidity. Infante (2015) estimates that the great majority of distressed securities do not reach the UCITS-required liquidity levels. Bank loans and private securities are principally banned by the regulation, which makes it difficult for UCITS funds to provide financing in the form of loans during a restructuring. Holding large portions of a firm’s stock in the context of lengthy activist campaigns is irreconcilable with both the concentration rules and the required provision of at least semi-monthly fund liquidity ie twice per month. Popular sub-strategies within the Relative Value category are Fixed Income Long/Short, Convertible Arbitrage, Statistical Arbitrage and Volatility Arbitrage. Difficulties for Convertible Arbitrage UCITS hedge funds include the lower liquidity of convertible bonds and the fact that most of the strategy’s trades involve a short position in the underlying stock. Statistical and Volatility Arbitrage are restricted by the framework’s leverage limits. Managed Futures UCITS funds (CTAs) are hampered by the framework’s ban on direct investments in commodities and its position concentration limits.

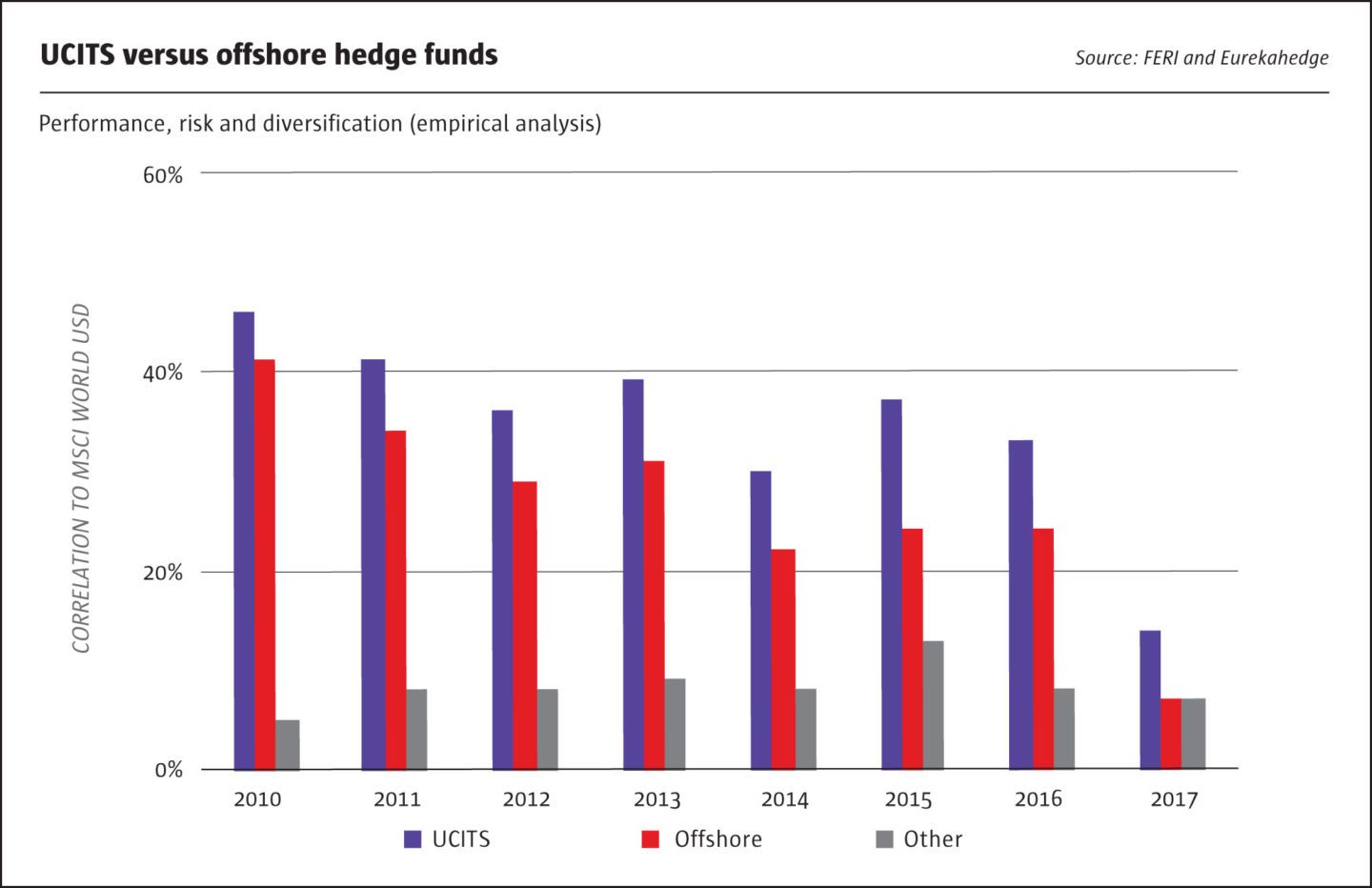

We hypothesise that a possible consequence of these obstacles is that Alternative UCITS are more exposed to the risks of traditional asset classes than hedge funds and Alternative UCITS funds are biased towards a more diversified portfolio of long positions in more liquid, exchange-traded securities. More than traditional hedge funds, Alternative UCITS funds should thus exhibit returns more similar to those on indices of liquid stocks and bonds.

In a recent working paper (Bongartz S., Kutsarov I., Maier T. und Storr M., “How alternative are Alternative UCITS funds?”, 2018) we hypothesise that alternative sources of return, in such forms as illiquid or private securities, are less available within the UCITS framework. We also hypothesise that Alternative UCITS hedge funds should be more than hedge funds exposed to traditional sources of return.

To test our hypothesis, we break down the universes of Alternative UCITS and Offshore hedge funds by liquidity as well as strategy and geographic investment focus and regress the individual funds’ excess returns against a large set of directional, style, and spread risk factors, the exposure to which could be achieved at low costs with smart beta or traditional beta products. For each combination of factor and fund, we consider the statistical significance of the relationship sensitivity separate from the economic impact of normal and extreme risk factor movements.

We find that the Alternative UCITS’ hedge funds returns generally can be explained by exposure to directional stock and bond risks more often and better than the Offshore hedge funds.

Matching Alternative UCITS and Offshore hedge funds in terms of strategy and geographic investment focus, we find that the differences in risk exposure are not driven by funds following Equity Hedge strategies, but by those following Relative Value and Tactical Trading strategies. The higher excess return volatility of classical hedge funds (Dewaele et al. (2013); Darolles (2014)) generally translates to a more aggressive risk profile, which is characterised by higher gains (losses) under positive (adverse) normal and extreme risk factor realizations. Once we control for volatility, Alternative UCITS hedge funds are still more exposed to the risk factors.

Our results indicate that among the three strategies considered, the Equity Hedge strategy is the most feasible to replicate Offshore hedge fund strategies within the UCITS framework. As a result, we still consider the Offshore hedge fund world to be more attractive for potential hedge fund investments.

Marcus Storr

Marcus Storr joined FERI in 2005. He is responsible for the entire Absolute Return Portfolio Management, manager selection (offshore & UCITS) and due diligence within FERI’s Investment Management department. Furthermore he is responsible for hedge fund operations including client reporting. He started his career in 1994 as an advisor to UHNWI before moving to London in 1998 to join the Investment Banking division of Robert Flemings Ltd. (acquired by JPMorgan). Until 2003 he was a Director within the Global Equities department of Dresdner Kleinwort Wasserstein in London. He has over 20 years experience in capital markets, corporate transactions and manager selection. He has written several articles and book chapters on hedge funds which have been published in professional journals and industry magazines. Mr Storr holds a masters degree in Finance/Capital markets and international management/economics from Humboldt University Berlin in addition to a two-year apprenticeship as a bank manager. He is married and father of three children.

TRUXT Investimentos

Alpha from LatAm equities and macro

Alexander Gorra, Partner & Senior Investment Strategist

Alexander Gorra, Partner & Senior Investment Strategist, TRUXT Investimentos

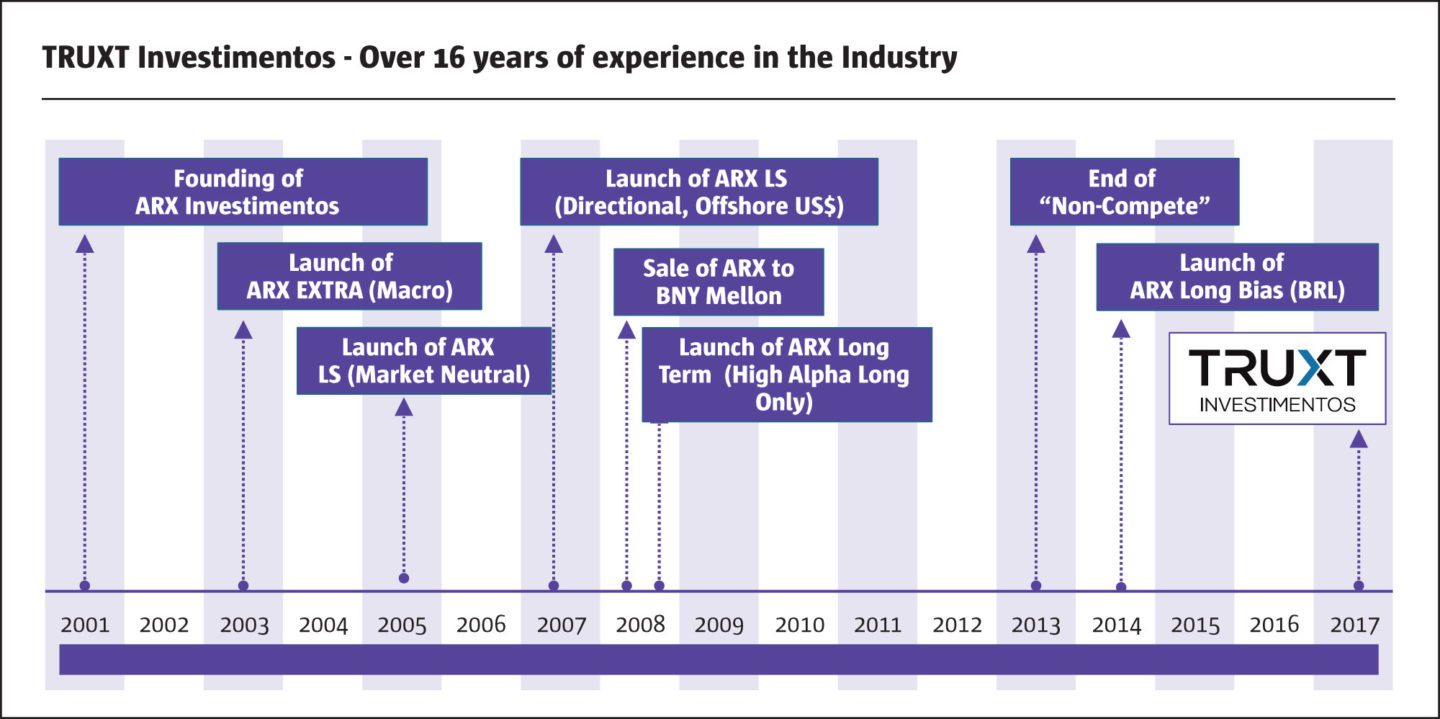

Since 2001, TRUXT’s founding partners have pioneered the local asset management industry and hedge funds in Brazil, launching one of the first long/short equity funds, and setting up offshore vehicles for overseas investors in 2007. TRUXT is now wholly owned by its partners, having spun out of BNY Mellon in 2017, which acquired the previous entity, ARX Investments, in 2008. TRUXT founding partners have been together from its start, in 2001, and the same portfolio managers have run the flagship long/short equity strategy since 2005. TRUXT has 33 professionals of whom 22 are partners. Ten focus on bottom-up equity analysis, while eight concentrate on top-down macro analysis.

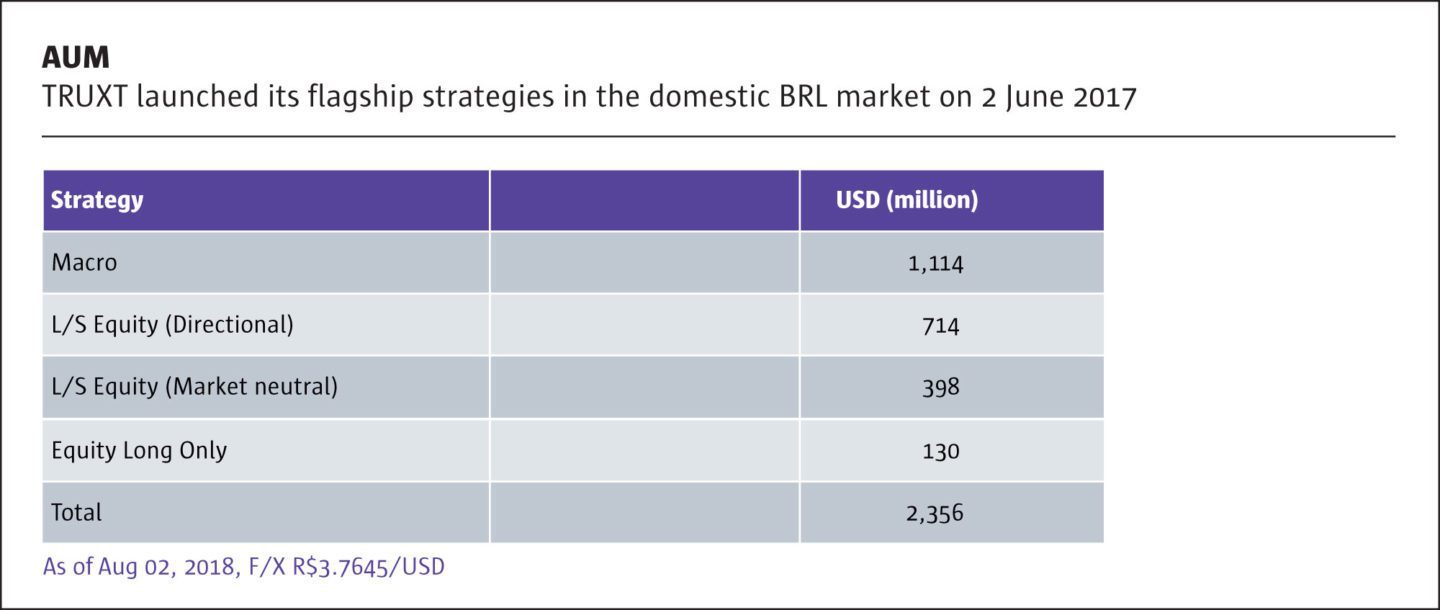

TRUXT manages approximately USD 2.3 billion, mainly in long/short equity, macro, and high alpha long only strategies as well, all of which have track records of at least ten years. TRUXT avoids illiquid small cap stocks and hard to value stocks. TRUXT has share classes for onshore Brazilian, offshore and US taxable investors.

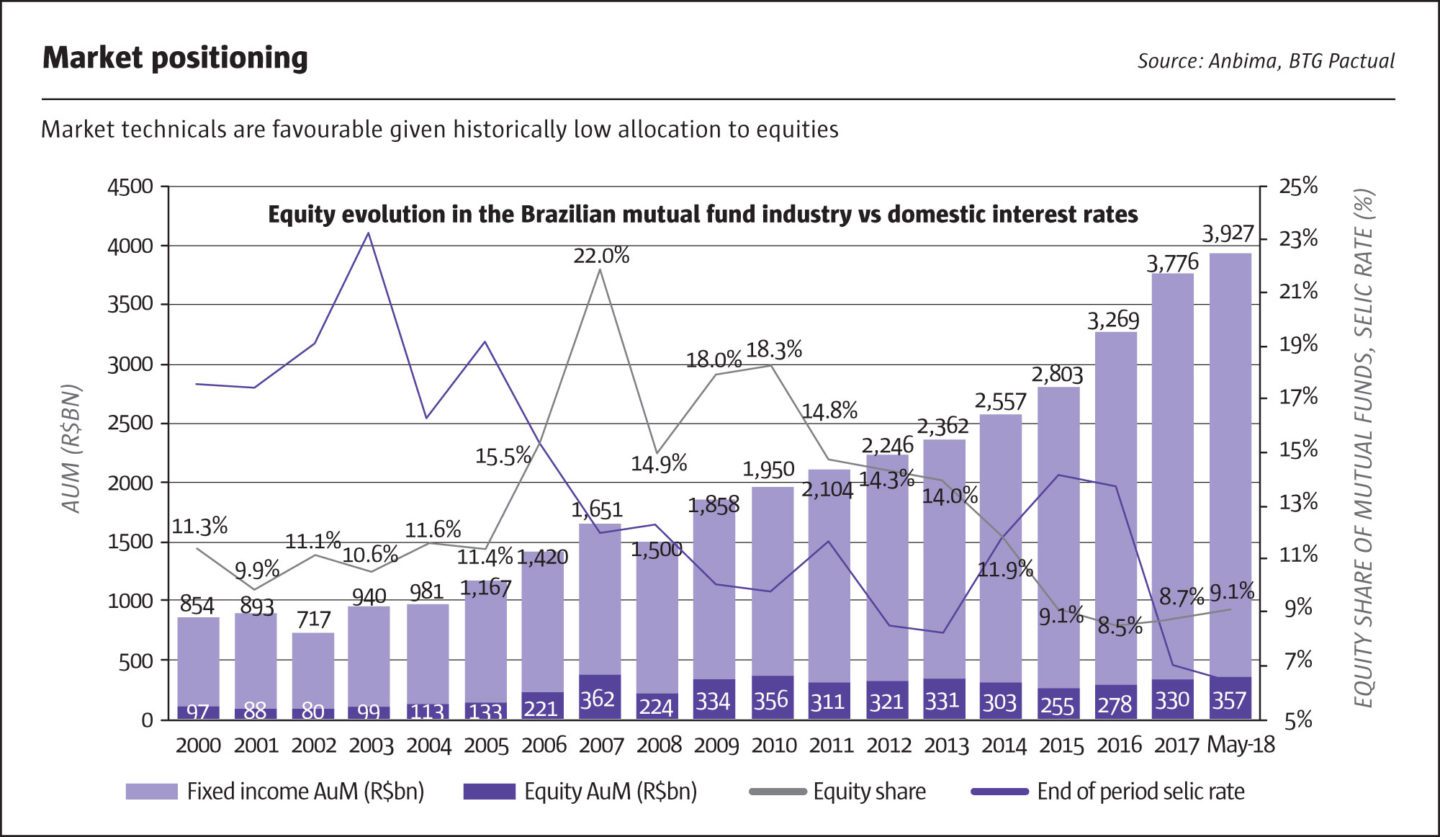

TRUXT believes that a buy and hold strategy is very risky for Brazil and the rest of Latin America. The region has been fraught with political corruption scandals, impeachments and imprisonments of presidents, as well as frequent changes of government and finance ministers, all of which contribute to market volatility. The IBOVESPA index has doubled from its early 2016 lows, but in September 2018 it has only slightly surpassed the peaks it reached back in 2010. Little wonder then that retail investors are shy of equities: Brazilian mutual funds have an average allocation of just 9% to equities, which is well below the historical average of 15-20%, and also falls far short of the average for emerging market countries. The market is far from being overbought.

TRUXT is becoming cautiously optimistic about the macroeconomic, political and corporate backdrop. The first round of the elections on October 7th clearly demonstrated the Brazilian electorate has rejected populist, left-leaning policies. With the sentiment that small government, fiscal discipline and reduced benefits for state workers is essential, there is a strong chance for a positive economic and financial cycle in upcoming years. Inflation is down to levels of 3%-4%, compared with 18% in Turkey and 30% in Argentina.

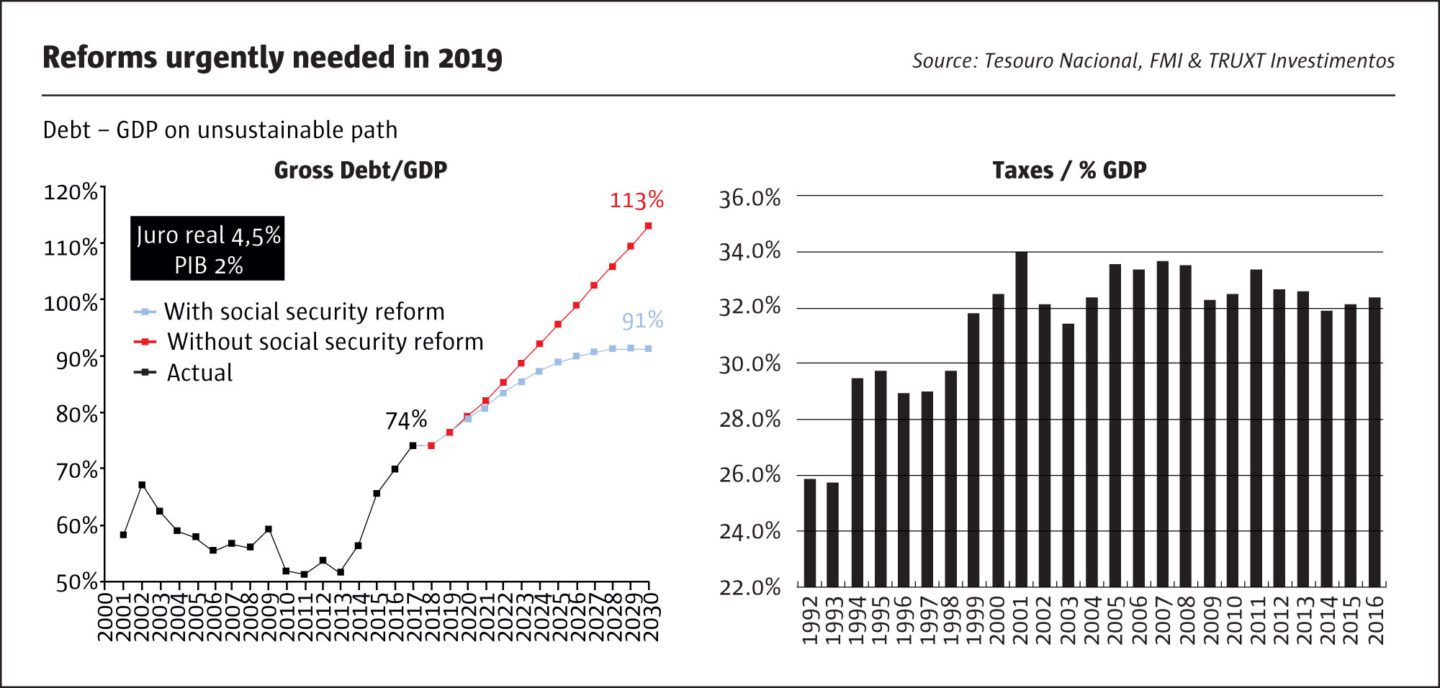

The next administration will need to tackle the growth of debt to GDP and high tax burdens. The chief culprit is the retirement system in which one million public sector pensioners (out of 20 million retirees) retire with gold-plated pensions at the age of 55, through which they receive at least 70% of their wages. This privileged group accounts for most of the social security deficit.

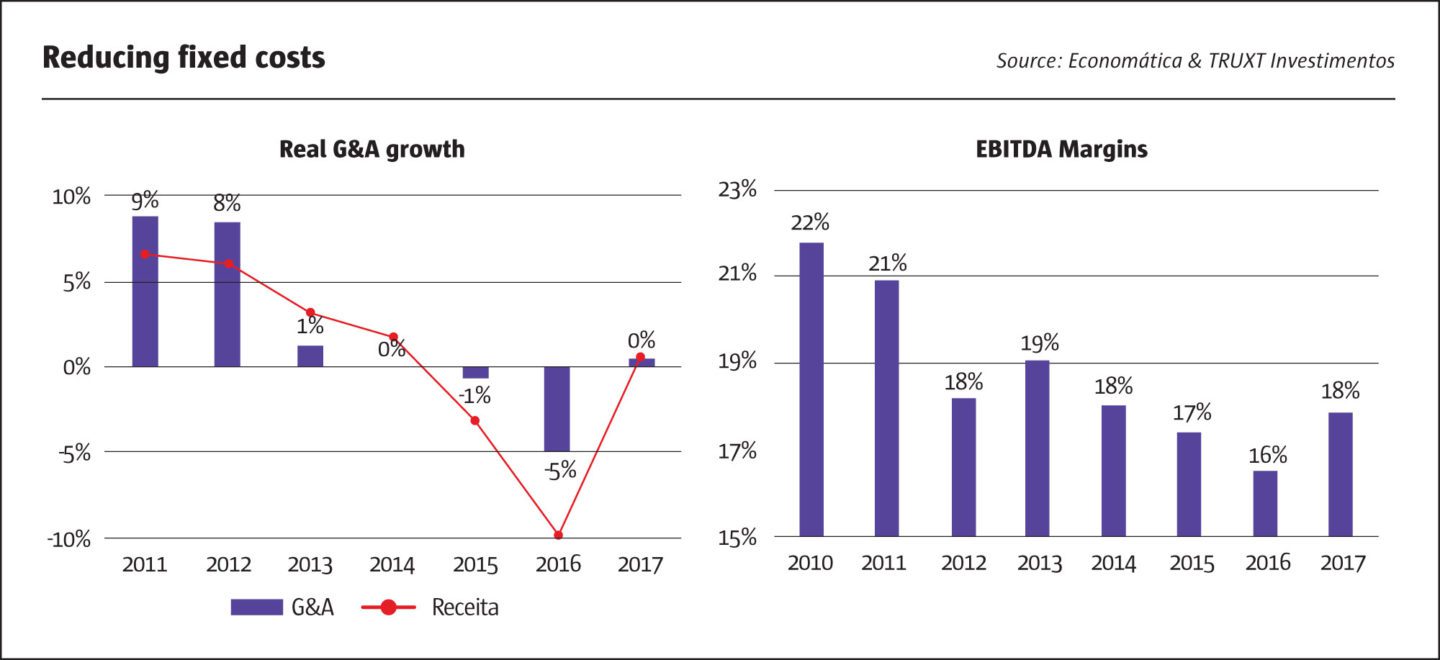

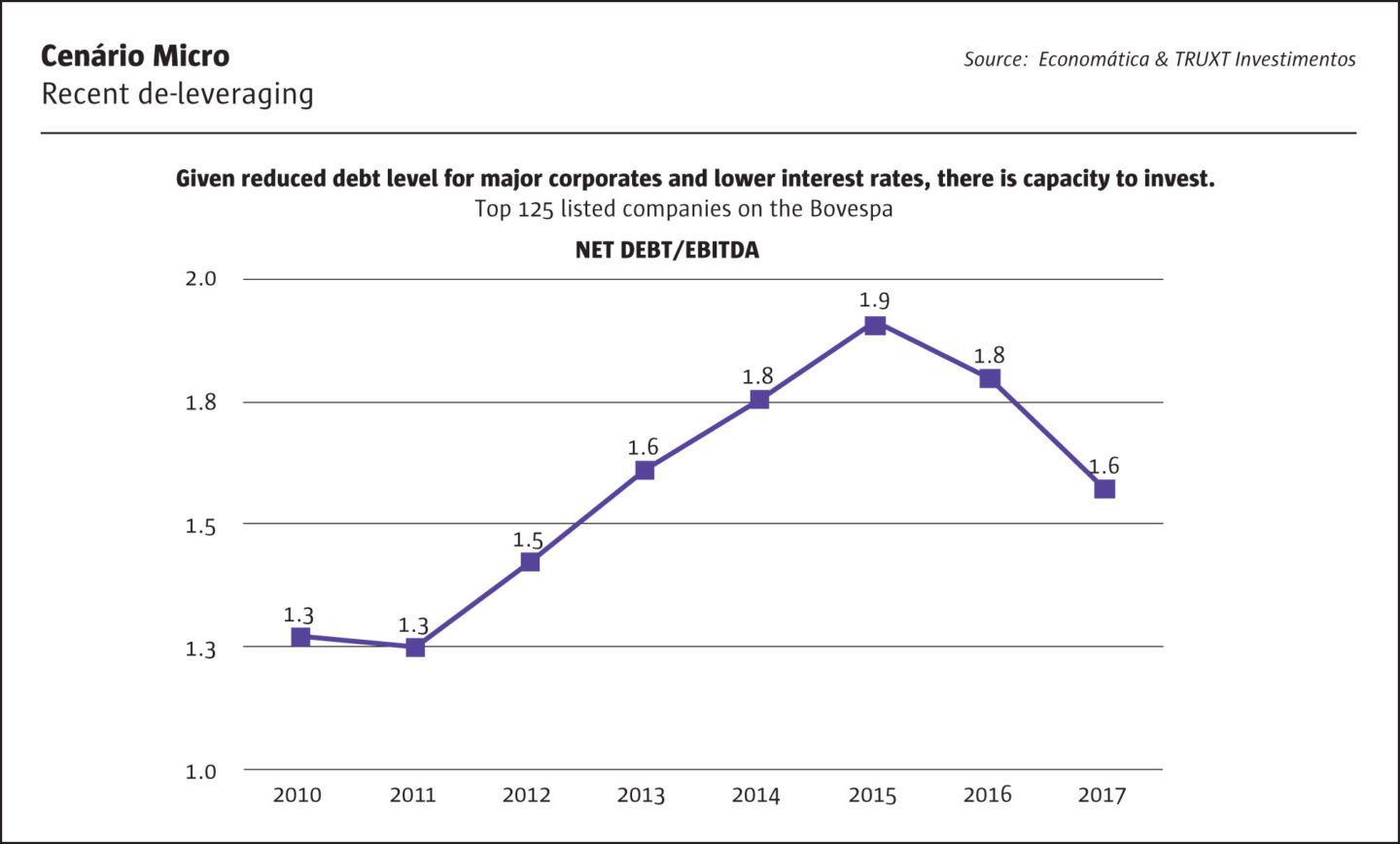

Despite the macro/political uncertainly, corporates have become adept at cutting costs, innovating and improving efficiency, without major capital spending. If economic growth picks up, low capacity utilisation creates scope for operational leverage to kick in, sharply increasing margins and corporate profits. Corporates have also been deleveraging and reducing their net debt to EBITDA ratios.

TRUXT has substantially outperformed the local equity market over the years due to its strong equity research on both the long and short side and leveraging macro expertise in managing net equity exposure and using macro hedges. The flagship long/short strategy runs a variable net exposure ranging between -20% and +100%, with a typical range between 10% and 70%. Gross exposure has also fluctuated between about 100% and 160% over the same period. While TRUXT’s equity strategy is primarily focused on generating alpha, during volatile years like 2018, net exposure management leveraging its strong macro team has been essential in generating positive returns.

TRUXT has been gradually rebalancing its allocations from the commodity stocks linked to global growth towards more domestically oriented stocks over the past few months. TRUXT has invested in mining, paper and pulp companies which have sales of over 90% in US Dollars, but costs in Brazilian Real, giving them a strong competitive advantage.

Brazil’s regulated fund market

Brazil has an efficient and highly regulated asset management market, similar to UCITS. Assets under management of over USD 1 trillion rank Brazil as number seven in the world. All managers are registered with the regulator, and all local funds are required to publish daily NAVs, and provide portfolio transparency with a 30-day delay. TRUXT’s local Brazilian funds are bound by these rules.

On the domestic front, TRUXT has identified some secular local growth stories. Consumer retailing groups Lojas Renner (ticker LREN3) and Magazine Luiza (MGLU3) are examples of superb long-term investments. Both have invested heavily in successful e-commerce and logistics infrastructure. In addition, there is Localiza (RENT3), a car rental company that is tapping into the growth of Uber. Brazil is Uber’s second largest market and the car rental company offers a turnkey solution in a market where sourcing well-maintained vehicles is not straightforward. Certain segments of healthcare are also compelling growth plays given Brazil’s ageing population; indeed, United Health of the US has invested close to $8 billion in Latin America over the last years.

TRUXT also invests in other Latin American markets, including Mexico, Argentina and Chile. Several regional multinationals have emerged over the years that have footprints in a number of these markets and regional trade flows are significant. Careful attention is given to position sizing given the tighter liquidity in these markets.

TRUXT has generated alpha from both long and short books. It has been short of some stocks that are vulnerable to political and regulatory risks. There have additionally been pairs trades in sectors such as airlines.

TRUXT has been cautiously optimistic, running a net exposure of approximately 40% prior to the first round of the Brazilian elections. The team has used macro hedges ahead of Brazil’s Presidential election. Given the increased chances of a favourable election result, the TRUXT team has gradually increased its allocation to banks and consumer discretionary names.

Alexander Gorra, a Founding Partner of TRUXT and its investment strategist underscores that the sweeping political change in Brazil and other LatAm markets is creating a very interesting opportunity for investors after many years under more populist administrations.

Alexander Gorra

Alexander is a founding partner and senior investment strategist at TRUXT Investimentos. Before co-founding TRUXT Investimentos Alexander was a senior strategist at ARX Investimentos (2006-2017), and also responsible for Investor Relations for both domestic and international clients. Prior to ARX, he was responsible for the Key Client Group at UBS in Brazil (2001-2006). Alexander was a Corporate Finance specialist at Rothschild (1996-2001) focusing on mergers and acquisitions, privatizations and capital markets transactions. Prior to Rothschild Alexander was a member of the Mergers and Acquisitions team at JP Morgan in New York, São Paulo and Rio de Janeiro (1994-1996). He graduated from the Wharton School of Business of the University of Pennsylvania (1994) with a degree in economics and a specialization in Finance.

Kite Lake Capital Management

Hard catalyst events

Jamie Sherman, Partner & Portfolio Manager

(L-R): Jamie Sherman, Equity Portfolio Manager, Massi Khadjenouri, Co-Founder, CIO and CRO, Jan Lernout, Co-Founder and Credit Portfolio Manager, Kite Lake Capital Management

In September 2018, Kite Lake Capital Management UK LLP (“Kite Lake”) partner and risk arbitrage portfolio manager, Jamie Sherman, judges the market climate for mergers as being really attractive on deal flow, in a globalising world where M&A is the choice for companies looking to build their business. Sherman has been working in mergers and acquisitions for nearly 20 years, initially on the sell side at investment bank UBS, and on the buy side for over 10 years, as the co-Head of European Research at PSAM before joining Kite Lake.

Kite Lake’s founders all came from big organisations, and wanted to work at a smaller place, running limited assets – for both personal and professional reasons. Kite Lake manages $1.2 billion and staff are co-invested. Co-founder Massi Khadjenouri (who has featured in The Hedge Fund Journal’s 50 Leading Women in Hedge Funds survey, in association with EY) had pioneered European event-driven investing at BNP Paribas, Centaurus and Cheyne Capital, while her Cheyne colleague, Jan Lernout, had been a high yield analyst at Goldman Sachs. “Kite Lake’s aim is to be a speedboat not an oil tanker,” says Sherman.

Kite Lake invests in predictable hard catalyst events, expected to occur within 6-9 months, across the whole capital structure. The strategy has returned 77.6% over the past 7.5 years, with volatility of 5%.

Allocation between strategies

Kite Lake’s UCITS, launched in May 2017, focuses mainly on merger arbitrage while its offshore funds also allocate to credit and distressed debt situations such as debt for equity swaps or liquidations. They can also carry out capital structure arbitrage trades, and may get involved in some workouts, restructurings and liquidations where key events are expected to occur within a year.

Kite Lake contends that siloes, between sub-strategies or portfolio managers, are detrimental. Therefore, the investment committee of three people determine investments from a bottom-up perspective, and sign off on investment decisions. In a team of 14, there are nine investment professionals, remunerated on overall fund performance rather than their sub-strategies.

In late 2018, merger arbitrage is consuming most of the risk budget but Kite Lake can swiftly shift capital into credit trades as opportunities arise. For instance, in 2012, Kite Lake allocated 40% to credit in order to take advantage of dislocations around the European sovereign crisis, such as Luxembourg banks, Italian and Greek sovereign debt. By 2013 this opportunity had played out and since 2013 Kite Lake has been predominantly invested in merger arbitrage. Kite Lake finds that merger arbitrage and distressed debt are complementary as their best opportunity sets occur in different economic environments.

Announced, contractual merger arbitrage

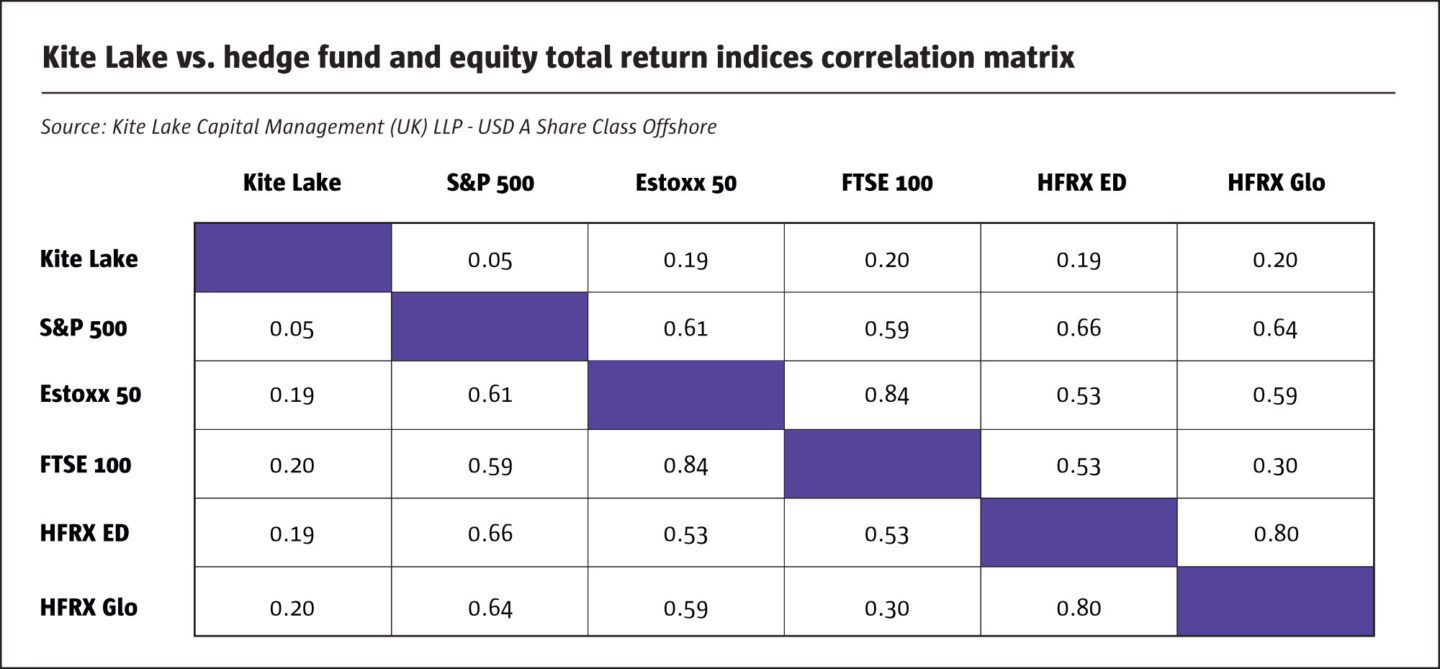

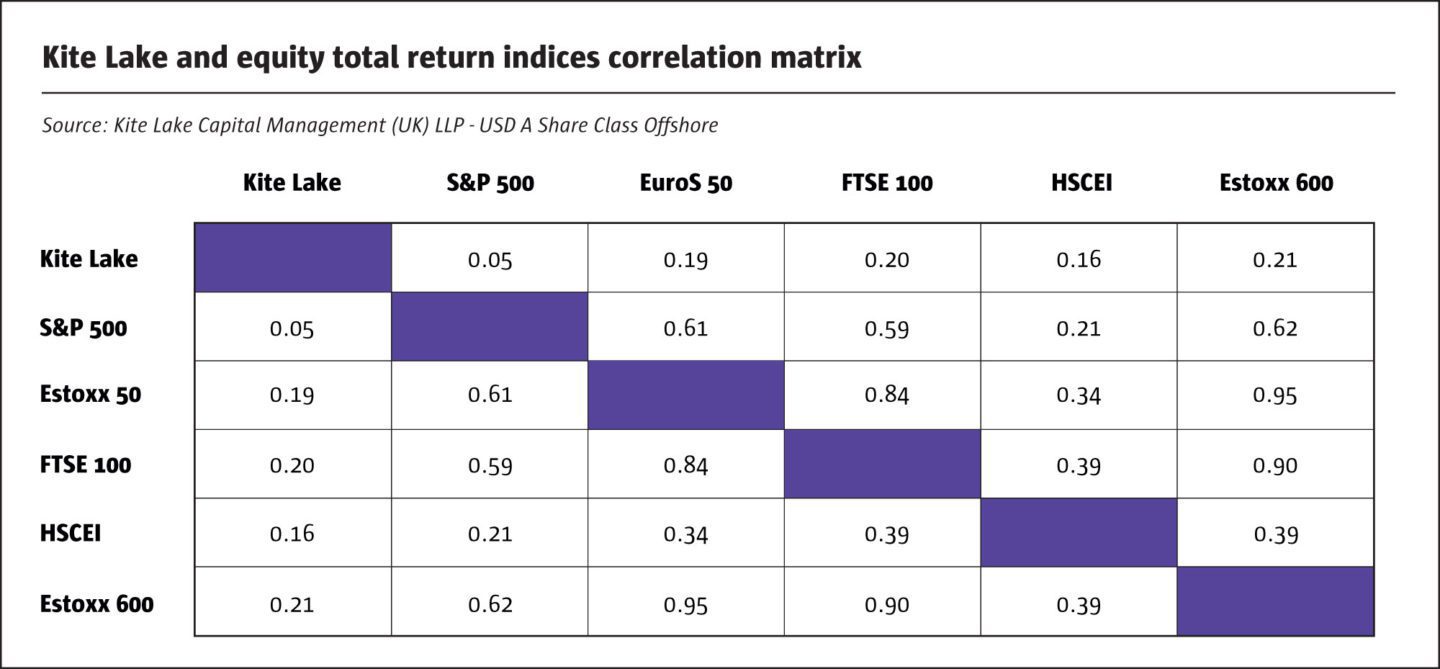

But common to all trades is the aim that idiosyncratic, individual events should have low volatility and low correlation to equity and credit markets. “Merger arbitrage can offer positive returns, with little or no equity beta, and little or no interest rate durations,” according to Peter Chiappinelli, writing in GMO Asset Allocation Insights: “Merger Arb and Unicorns”, in August 2017.

Kite Lake’s returns are driven by the complexity rather than volumes of merger deal flow, which, at USD 2.477 trillion in the first half of 2018, are second only to 2007 on a 20-year lookback. Greater complexity around cross-border deals, regulatory and anti-trust considerations, politics and macroeconomics, creates potential for higher returns.

For instance, the largest ever cash deal – Bayer/Monsanto – is conditional upon disposals, as is the Linde/Praxair tie-up, where Kite Lake has been researching the US regulatory situation. Such deals can offer double digit percentage spreads, which compensate investors for the risks of deals breaking, for reasons such as regulation. Intra-European deals may be subject to political discussions over trade unions, employment and headquarter locations.

Over his career at Kite Lake, Sherman has worked on over 800 deals that have closed. Kite typically invests in around 100-120 each year, with average holding periods of 90-100 days, and around 30 in the portfolio at any time. This portfolio diversification means that no single deal should make or break a year’s returns. Kite Lake selects its preferred, more complex and higher quality, deals from a universe of 500 or 600 globally each year.

Most equity events traded by Kite Lake are announced, contractual M&A – as distinct from rumoured or discussed M&A. Kite Lake forms a view on whether the spread between the offer price, and market price, correctly reflects deal completion risks. Kite Lake is generally long of this spread but can also go short of it. Kite Lake also trades other hard catalyst situations which are not merger arbitrage deals, such as an auction process or asset sales.

Kite Lake invests globally, in markets with predictable rule of law, such as the largest market – the US, Brazil, Europe, Scandinavia, South Africa, Hong Kong, Australia, Taiwan, Japan and Thailand.

Outlook for merger arbitrage

In late 2018, Sherman is of the opinion that US Tax Reform, cheap credit, and corporate cash mountains, are all positive drivers for merger arbitrage, while interest rate hikes should not kill deal flow – even if some opportunities are marginally slowed down. Sherman recalls modelling merger deals as a banker when rates were 7 or 8%. Today he argues that the effective PE ratio of cash is so high that almost any deal can be accretive.

Moreover, Sherman argues that merger arbitrage is not only about CEOs being confident. Some deals can be based on defensive motivations, or a desire to avoid getting acquired, in industries such as traditional media and generic pharmaceuticals that face headwinds and need to cut costs. As such it can be seen as an “Evergreen strategy”. Sherman sees scope for novel deal structures to increase deal flow. For instance, Takeda’s all-shares bid for Shire has historically been a very rare structure for a Japanese acquirer, due to flow-back concerns. Private equity and activist investors can also put companies into play – and sometimes scupper deals.

There are also political risks of deals being blocked. In the US, CFIUS rules have been used to block deals by both the Obama and Trump administrations. And Sherman has also noticed increased European reluctance to accept inbound Chinese M&A.

Jamie Sherman

Prior to joining Kite Lake as a Partner in July 2011, Jamie worked in the London office of Peter Schoenfeld Asset Management (PSAM) from 2007 until June 2011, most recently in the capacity of Co-Head of European Research. At PSAM, Jamie focused primarily on equity and credit risk arbitrage as well as other event driven strategies. Previous to PSAM, Jamie worked for 2 years as a Director at UBS‘s Fundamental Investment Group. Prior to that Jamie worked in the Event Arbitrage Group, providing bespoke sell side research and trading strategies and advice to international hedge funds and proprietary trading desks. Jamie started his career at UBS in 2000 in the Mergers and Acquisitions team in the investment banking division, working on numerous transactions, defence mandates and capital raising for clients as diverse as the Jardine Matheson Group, EMI, De Beers and Sanofi Aventis. Jamie holds a MSc in International Finance and Accounting from the London School of Economics, and a dual Bachelor of Arts from Emory University in Economics and International Relations.

Systematica

Systematic trading beyond managed futures

Leda Braga, Founder & CEO

Leda Braga, Founder & CEO, Systematica Investments

Systematica’s quantitative and systematic investing strategies have track records dating back as far as 2004. The firm has been independent since it was spun out in January 2015. It now runs c.$9 billion for a diverse institutional asset base. There are 105 staff, spread over five regulated offices including Geneva, London, New York, Jersey and Singapore. The firm is not a room full of computers, but is a global team of people, who communicate regularly via videoconferences.

Culture and philosophy

Systematica emphasises technology and team work. “Researchers are not necessarily the best technologists; and technology guys are not necessarily best at operating systems or communicating. Labour is divided amongst a team with complementary skill sets. Team-building activities include offsite parties, and musical bands. Systematic is also part of the wider systematic investing community, which also gets together for networking events such as dinners,” says Braga.

Talent-scouting and interviewing potential teams is an important part of Braga’s role, and Systematica keeps an open mind about hiring discretionary investment professionals, who are providing different perspectives and insights. Argues Braga: “discretionary and systematic investment processes are the same, they look at information and try to make good investment decisions. Discretionary investing is also process-driven, even though the process may not have been explicitly coded into an algorithm”.

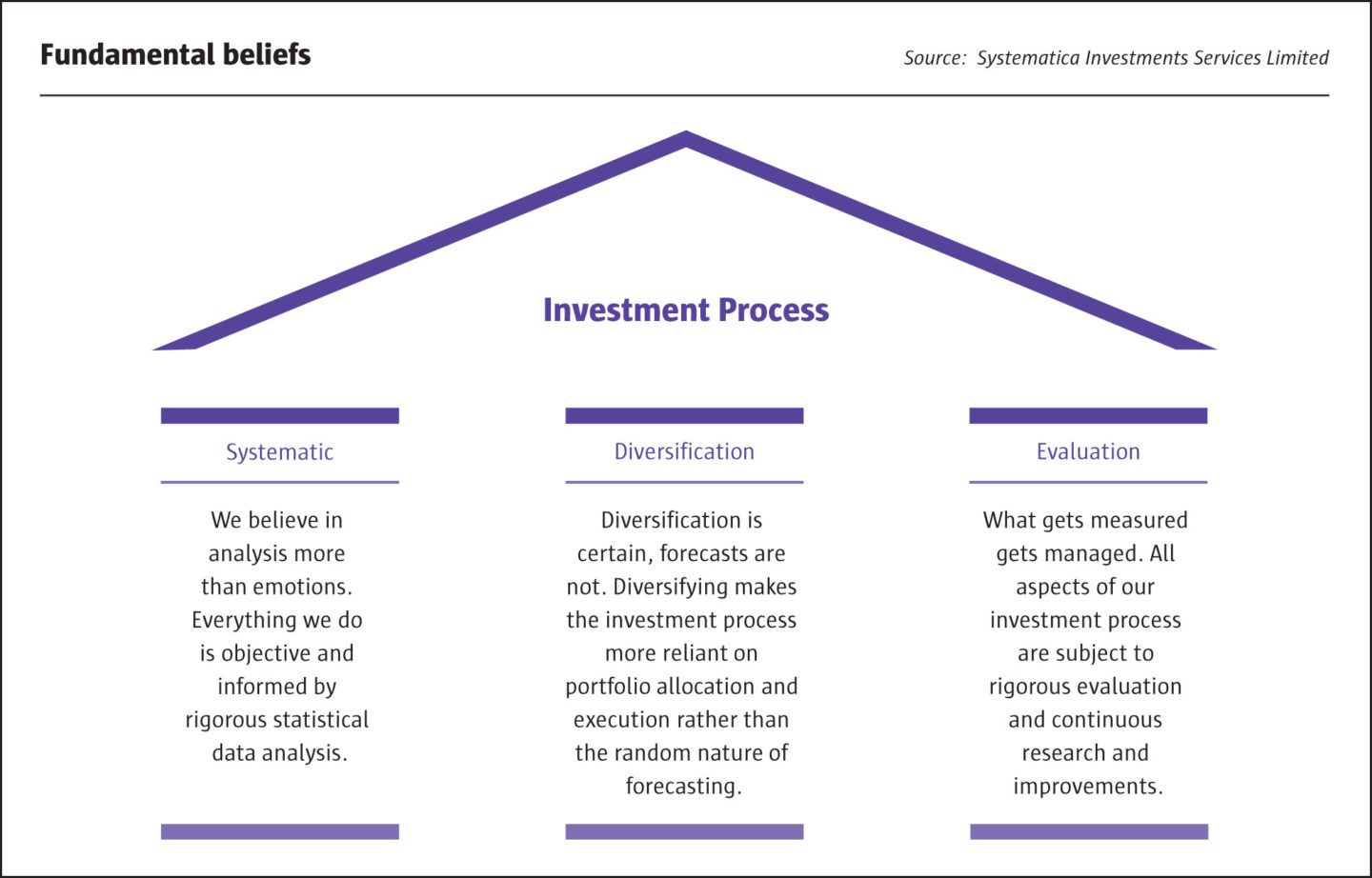

Systematica’s three tenets of systematic investing are that: analysis matters more than emotions, so objective and rigorous statistical data analysis informs decisions; diversification, which is certain, matters more than forecasting, which is random; and evaluation is important – what gets measured gets managed, so that the investment process continually improves.

Futures trading

The genesis of systematic investing – managed futures – dates back to ancient Greece, when Aristotle wrote about how futures markets existed to capture the olive harvest contractually. In nineteenth century Chicago, futures markets developed for agricultural commodities. The first futures fund launched in 1948. A federal regulator, the CFTC, was set up in 1974, followed by a self-regulatory organisation, the NFA, in 1982. Both oversee futures trading, and are amongst Systematica’s regulators. “This regulation was only one reason why futures proved popular with systematic investors. Futures also offer transparency, abundant real time and historical data; lower trading costs than their underlying physical markets; a broad spread of asset classes and markets facilitating diversification, and a high degree of embedded leverage,” says Braga.

AI, Machine Learning and Algorithm aversion

“Artificial intelligence, Machine Learning and Big Data is now being applied to financial markets, but autonomous investing is much more challenging than Amazon or Netflix analysing their vast customer bases. Financial data is sparse and noisy, and the best equation to explain asset prices contains random elements” says Braga.

“Now, the cool kids all want to study data science, but human psychology is another obstacle to wider adoption: algorithm aversion is inherent for all of us. Investors shy away from systematic investing for multiple reasons: because they do not understand it; perceive it to be an opaque “black box”; view it as being less transparent than discretionary, or think it is based only on historical data,” she continues.

Factor investing

Yet many investors may already be familiar with the results from quantitative investing. The returns from some discretionary and systematic hedge fund strategies can be explained by algorithms. To the extent that investors are seeking to obtain the average return from very broadly defined hedge fund strategies, this has historically been possible through factor investing. Braga cites a study by Harvey et al in December 2016, that classified 9,000 hedge funds into four categories: systematic macro, discretionary macro, systematic equity, and discretionary equity. Of course, there is substantial return dispersion within each of these strategies, and underlying managers have sometimes held opposite positions to one another, but their average exposures net out to produce a return stream that closely tracks a relatively small number of factors. Systematic macro apart, the other three return streams, between 1996 and 2014, could have historically been substantially replicated using well known factors, such as Fama/French size, momentum, and carry. Alpha over and above these alternative risk premia/style/factor returns, was only of the order of around 1% a year. Systematic macro appeared to be the odd one out, generating annual alpha of nearly 5% on top of the specified explanatory variables.

Signal generation

Systematica’s signal generation engines include some of the sorts of academic variables that were used in the Harvey study. The asset manager also uses public data, and analyst estimates. “Increasingly, Systematic is using less commoditised, alternative signals, based on analysis of company linkages, supply chains, news and events. The firm is also designing and constructing proprietary signals, sourcing data directly or using data that is not widely available. These signals include an anti-noise trader signal, based on natural language processing (NLP)-based mean reversion techniques. Imagery and Wikipedia data can also feed into other models,” says Braga.

Systematica realise that macro directional strategies have a low standalone Sharpe ratio, but their ability to short falling market can make them a powerful portfolio diversifier. Systematica’s directional macro sleeve is complemented by its fixed income relative value allocation trading very liquid and related instruments in nine countries and two credit curves.

The manager also trades a volatility arbitrage strategy in FX options, designed to profit from anomalous option pricing arising from market makers’ hedging activity.

Portfolio construction and execution

If Systematica divides the investment management process into portfolio construction, security selection and execution, Braga argues that, “systematic investing has beaten discretionary approaches for portfolio construction and trade execution but not necessarily for security selection”.

Each part of Systematica’s investment process is integrated. For instance, signal speeds need to be coordinated with portfolio construction reaction speeds. Systematica’s optimisation process takes account of factor, exposure and position size limits, as well as considering liquidity and transaction costs. Portfolio construction also needs to be alert to breakdowns in patterns of correlation.

In execution, Systematica is trading USD 5-10 billion of notionals per day across 300 macro markets, and around USD 300- 500 million per day across 4,500 single equities in 25 countries, and doing this 22 hours per day. Systematica trades some markets and signals over days or weeks, others over mid-frequencies of minutes to hours, while some some high frequency orders are placed over microseconds. Algorithmic execution uses proximity-hosted servers in five locations.

The team analyses rich and dense, tick-level data, sometimes using simple neural networks. The simplicity of these techniques is vital as “the biggest crime in systematic investing is to over-fit a model and not even know that you have done so,” warns Braga.

Systematica strategies include: trend-following in liquid or OTC markets; equity market neutral; macro relative value, and combinations thereof in multi-strategy or customised products. Systematic also has an alternative risk premia (ARP) offering.

Braga argues that “systematic hedge fund strategies have the potential to offer lower fees as they are more scalable”.

Leda Braga

Leda acts as CEO of Systematica Investments, a Jersey–based institutional hedge fund manager with around $8.2 billion in assets under management. Systematica was formed in January 2015 as a spin-off of BlueCrest Capital, where Leda was President and Head of Systematic Trading for 14 years since 2001. Prior to BlueCrest Leda was part of Cygnifi Derivatives Services (a J.P. Morgan spin-off). At Cygnifi she was part of the management team and was head of its Valuation Service. Prior to Cygnifi, Leda spent nearly seven years at J.P. Morgan as a Quantitative Analyst in the derivatives research team. Her past experience includes modelling of interest rate exotics, FX/interest rate hybrid instruments and equity derivatives. She holds a PhD in Engineering from Imperial College London, where she worked as a lecturer and led research projects for over three years prior to joining J.P. Morgan. In addition Leda has served as an advisor to the board of the pension fund of the CERN in Geneva and she is currently on the advisory board of the London School of Economics‘ Systemic Risk Centre.

Acion Partners

Asian investment opportunities

Feng Hsiung, Founder & CIO

Feng Hsiung, Founder & CIO, Acion Partners

Acion Partners, which was founded almost four years ago by CIO Feng Hsiung, are Asian equity and credit investors who are fundamentally-driven, value-oriented and catalyst-focused. Acion invest with a long term and private equity mindset, often seeking out securities that are dislocated to find asymmetric risk-reward.

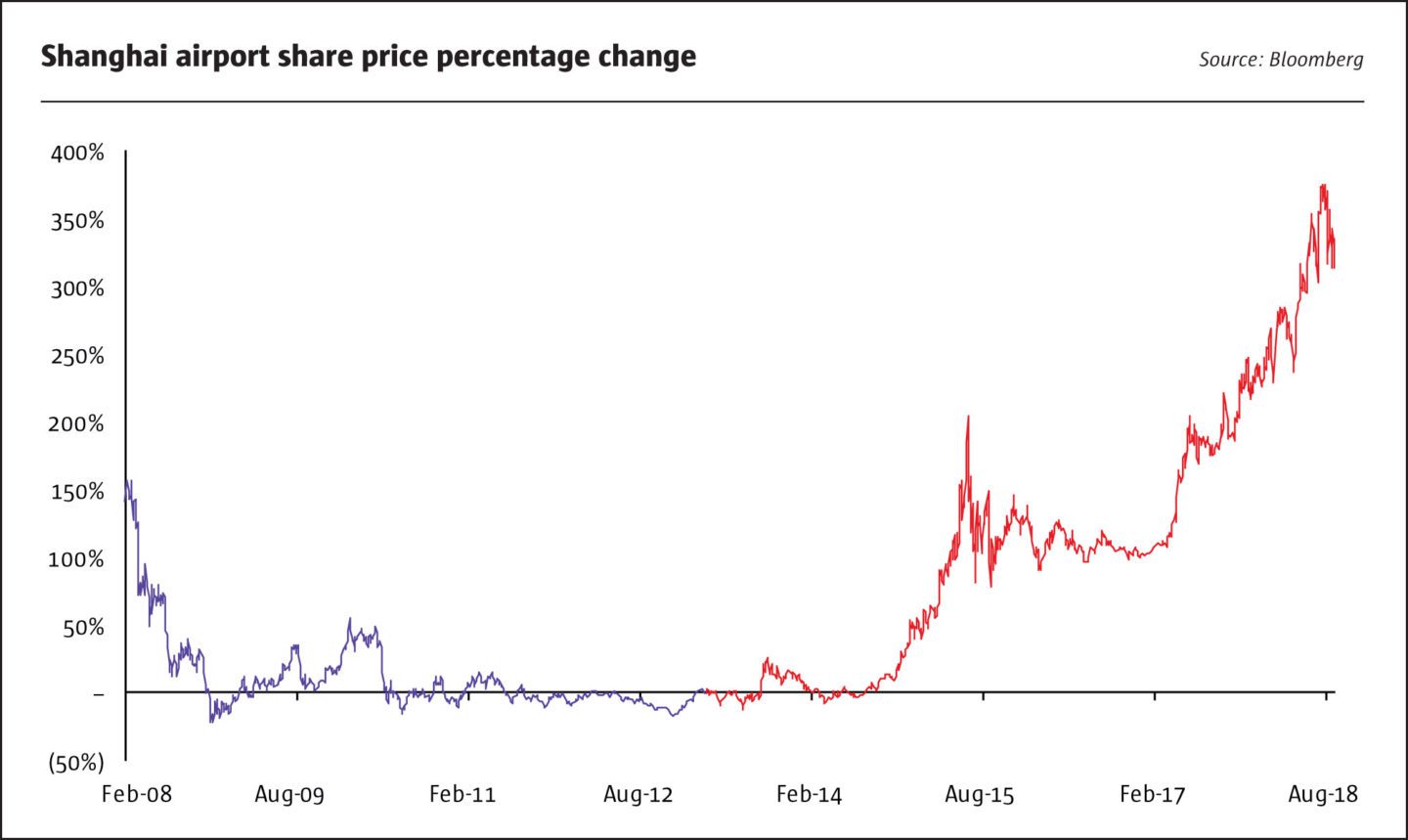

For instance, Shanghai Airport saw its share price crash 75% between 2007 and 2009, while its valuation also plummeted from 31 times to 7 times EV/EBITDA. At his prior firm, Hsiung bought near the lows and advocated this idea at the JP Morgan Alternative Investment Summit in 2013.

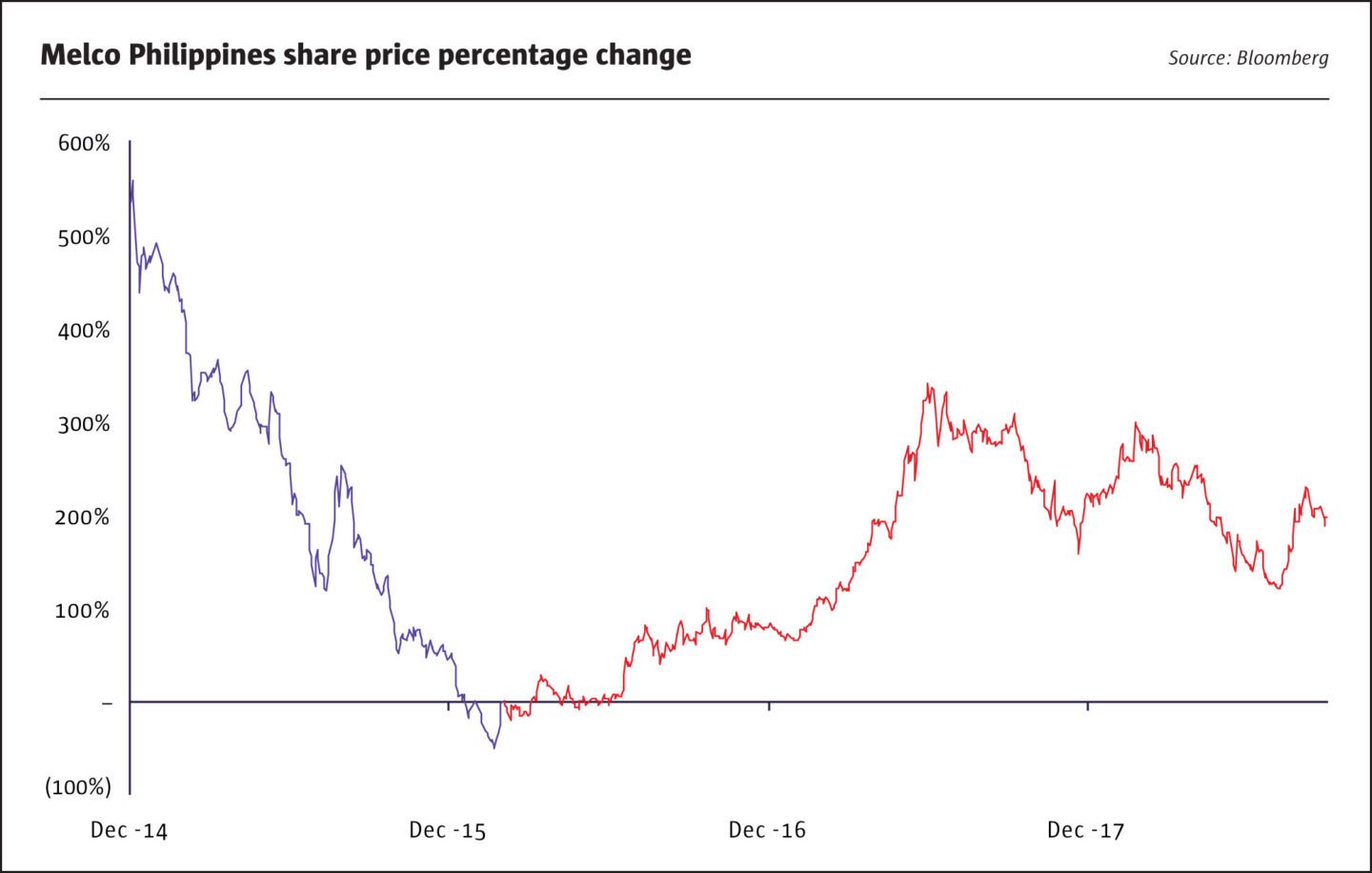

Casinos operator Melco Resorts and Entertainment (Philippines) Corporation fell even further by 92%, to the point where its valuation was a fraction of the construction cost of its complex of 1,800 slot machines, 400 gaming tables and 900 hotel rooms, plus a Nobu restaurant and hotel. Hsiung returned to the JP Morgan Alternative Investment Summit in 2016 to advocate this idea, which from the trough multiplied nine-fold and recently culminated in a take-private bid.

For a contrarian value investor like Acion, volatility is an opportunity to embrace not shun. The fact that key equity markets in Asia have had three to four times as many 20% drawdowns during the past 20 years as US markets increases the likelihood of buying stocks and bonds at bargain valuations.

The investment philosophy at Acion is inspired by behavioural finance Nobel prize winner Daniel Kahneman and legendary value investor Seth Klarman. This means a focus on processes that drive good decision making and underwriting for margin of safety.

Acion identify three necessary criteria for investments. First, a value gap meaning a significant deviation from intrinsic value. Second, a variant insight versus common knowledge, based on better information or analysis. Third, an anticipated catalyst that drives convergence between the views of Acion and the market.

The team was shaped by its members’ careers in private equity. “The amount of detail we go into in our due diligence process, is orders of magnitude different from most asset managers who invest in public markets,” says Hsiung.

Their culture is based on five qualities. Teamwork, which pools resources and insights into better decisions. Process, as structure and rigour lead to better decisions. Introspection, as self-awareness and humility allow improvement. Integrity, as honesty and fairness are the bedrock of any successful organization. Alignment, as the fair division of risk and reward over is the only path to earn trust.

Case study: Chinese payments

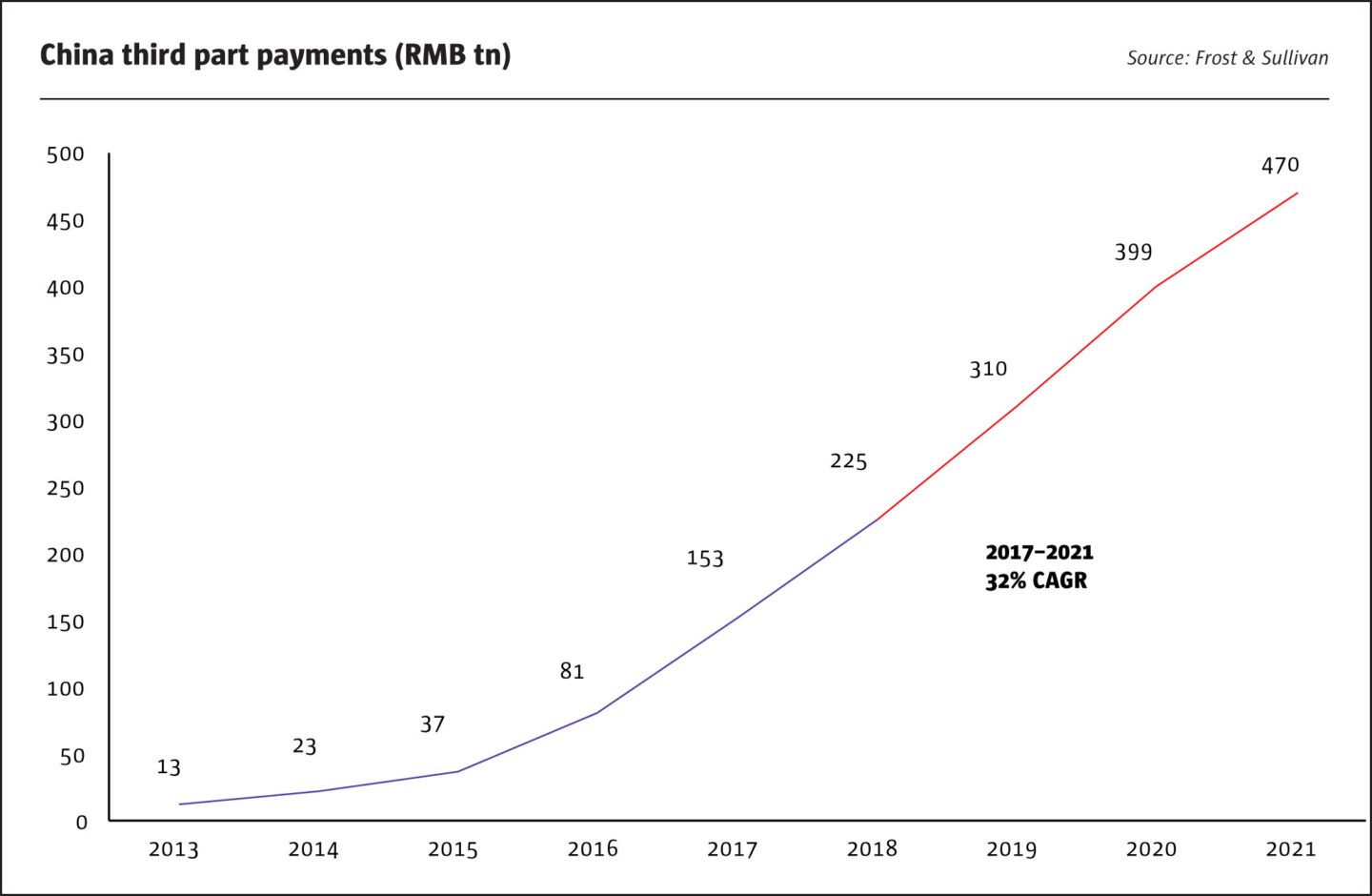

Payment processing, which facilitates non-cash transactions between consumers, merchants, clearing houses and banks, is an industry where “moats” – or barriers to entry – are increasing due to data security, network stability and ancillary service demands. It is also an industry that has seen explosive growth in China and could continue to grow by 30% per year, according to forecasts from Frost & Sullivan.

Acion argues that processing fees are more likely to rise than fall, as Chinese monetisation rates are already between one seventh and one half of the US. If processing fees were to rise, operational leverage could expand profits multifold. Even without margin expansion, Acion forecasts that payment processor Huifu will increase net profit by more than 50% per year between 2017 and 2019.

Huifu Payment was founded in 2006. Pre-IPO investors included Bain Capital, which invested over USD 150 million in 2015 at HKD 5.36 per share. An IPO took place at HKD 7.50 per share in June 2018, but by August the shares had more than halved to well below what Bain Capital paid 3 years ago.

Acion contends that Huifu is badly misunderstood. It was the first payment processor to list in China, has very little sell side research coverage and is grouped by investors into the Chinese fintech industry. That perception helped to explain the poor share price performance, as Chinese fintech is primarily associated with P2P (peer-to-peer) lenders that are facing regulatory scrutiny over unscrupulous practices, asset-liability mismatches and usurious rates of interest.

Acion sets out three scenarios for Huifu stock. The pessimistic case, which assumes Huifu ceases to be a going concern, would only entail 3% share price downside, based on RMB 4 billion worth of cash, properties and payment licenses to approximate liquidation value.

The base case, implying share price appreciation of between 100% and 250%, includes valuation multiple expansion to a 2019 multiple of 21 times P/E or 15 times EV/EBITDA based on comparable stocks such as First Data and Global Payments.

The most optimistic scenario would see Huifu re-rated to a valuation on par with Dutch-listed Adyen, which has traded on a P/E ratio as high as 100 and an EV/EBITDA multiple as high as 77. That could imply share price appreciation of between 968% and 1,578%. Peers such as Square, Wirecard and GMO Payment also trade at lofty ratios.

Feng Hsiung

Feng is Founder and Chief Investment Officer of Acion Partners Ltd. in Hong Kong. He founded the firm with a strategic partnership with KKR in September 2014 and is responsible for the firm’s overall business strategy. From February 2007 until April 2014 Feng was a Partner and Portfolio Manager at York Capital in New York and Hong Kong. He launched an Asia-dedicated hedge fund (York Asian Opportunities fund) which grew to over USD 600m of assets under management. In February 2008 he was appointed CEO of York Capital Management Asia (HK). Prior to joining York Feng was a Portfolio Manager at Citadel Investment Group from April 2004 until Oct 2006. From August 1999 until August 2004 Feng worked as an analyst at Goldman Sachs New York. He started his career at McKinsey Consulting in New York in October 1997. Feng holds a Bachelor of Arts in Government, Dartmouth College, Hanover, New Hampshire, USA.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical