The Hedge Fund Journal has been publishing the Tomorrow’s Titans report on rising star hedge fund managers since 2010 (last year’s report can be found here). It has been an annual report since 2020, and since 2021 has run a mix of short and extended profiles. Most of the managers featured in this year’s report have launched a strategy – and their own firm – during the past five years. All the names are new, save for macro and credit manager Alberto Gallo, who has featured before when at Algebris, and who has now launched his own firm Andromeda with Aditya Aney.

Managers featured range in age from their 20s to their 60s, and it is not a list of first-time launches; some managers featured are onto their second, third or fourth launch.

Download

Tomorrow’s Titans 2023 [PDF]

Strategy mix

Thirty-three of the fifty managers featured are running discretionary strategies; thirteen are running systematic strategies; the two single strategy managers are explicitly hybrid, and two multi-strategy/multi-manager platforms are also effectively hybrid.

The largest group of managers run discretionary equity long/short strategies with a geographic or sector focus. Orlog and Jungle Gene are globally focused; High Ground is Europe-oriented; Wellfield trades energy, and Gersemi trades shipping. Some have both a geographic and sector bent, such as Millingtonia’s digital dominated strategy in India. There are five discretionary managers investing in credit.

There are three CTA strategies, three event driven and three equity market neutral. Two trade discretionary macro, one systematic macro, one is a volatility arbitrageur and Cellyant trades a rather unique strategy in securities financing arbitrage.

There are four pure cryptocurrency managers trading a variety of long/short and/or market neutral strategies using proprietary technology, and one multi-strategy platform, The Quarry, which allocates to crypto strategies and other relative value strategies.

There are three commodity traders: one systematic strategy trading a range of commodities, one fundamental systematic trader focused on energy, and a third trading carbon.

Managers featured in this year’s report range in age from their 20s to their 60s.

Hamlin Lovell, Contributing Editor, The Hedge Fund Journal

Many managers are using AI and machine learning for part of their process and there are several dedicated AI and machine learning strategies, such as those run by Castle Ridge Asset Management, Kvasir Technologies and Ancova Capital Management.

Some managers are activist: Metrica in Singapore has recently been so in South Korea, and Nippon Active Value Fund is dedicated to activism in Japan. In the US, Brian Finn of Findell Capital Management has written an open letter, and Jonathan Lefebvre of Aleena Capital engages with companies on matters including ESG.

ESG

Many managers incorporate ESG into their investment process, the operation of their management company, and the selection of their service providers.

Some managers marketing in Europe are also making disclosures under the EU Sustainable Finance Disclosure Regime: Osmosis equity market neutral does so under SFDR Article 8, and Carbon Cap’s The World Carbon Fund makes disclosures under SFDR Article 9.

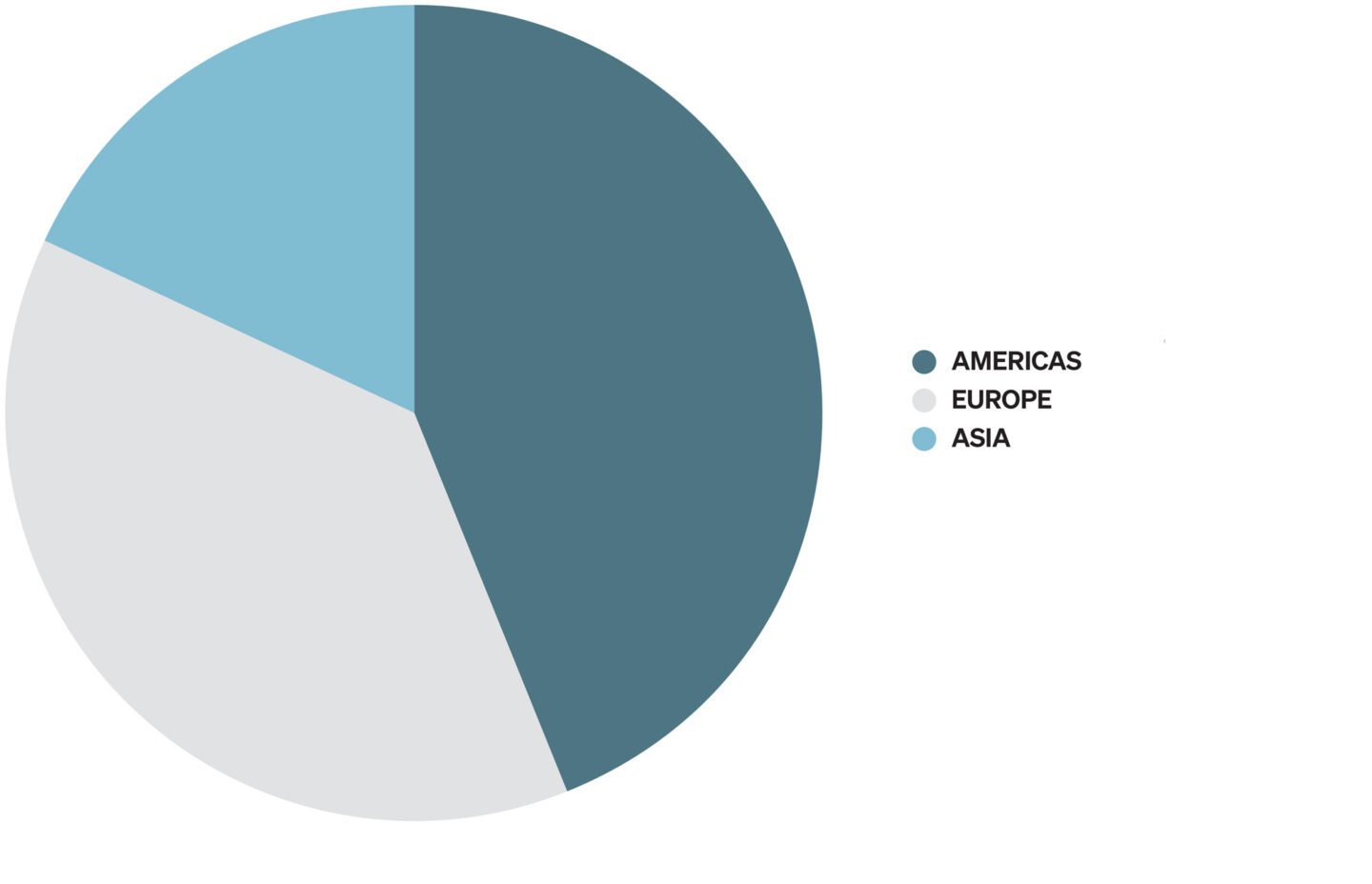

Locations

Twenty two managers are located in the Americas: nineteen in the US, two in Canada and one, Fourth Sail, in Brazil. Within the US, outside the tristate area of New York, New Jersey and Connecticut, there are managers in Boston, Chicago and Wyoming, as well as in the growing hedge fund hubs of Texas and Florida.

Nineteen of the managers are based in Europe. There are ten in the UK of which eight are in London, one in Cornwall and one in Cambridge. There are two in Germany, two in Luxembourg, one in Switzerland, one in Spain, and one in each of Denmark, Sweden and Norway.

Nine managers are based in Asia, including Shanghai, Hong Kong, Singapore and Tokyo as well as one in India. Unusually, there are no managers based in Australasia in this year’s report, though we do feature expat Australians: Orlog’s John Qiu and Carl Radford and Mike Rothlin, who are launching a macro strategy in Hong Kong. For the first time, we feature a manager based in Abu Dhabi, which is building a growing hedge funds presence.

Location: Geographical breakdown of 2023 Titans

Assets and maturity

Managers running more than USD 1 billion include Arini, Fourth Sail and Mane Global; those running more than USD 500 million include DCM Systematic and Pantechnicon. But this is not a ranking of the largest launches of recent years, for a couple of reasons. Some managers do not want media coverage and so do not feature at all in this report. Plus, we have set out to provide a broader coverage of emerging managers, where optimal capacity can vary by strategy; so for example Nordic equities specialist Protean has set a capacity limit of USD 200 million for its long/short strategy, while Daniel McNamara’s Polpo Capital will cap its CMBS long/short strategy at USD 150 million. Assets are not always listed in profiles. Some managers could be open to seed or acceleration capital deals while others do not need them.

Seeders are not always publicly disclosed, but we can highlight a few. Some funds are effectively lift outs or spin outs from former firms; Mane Global continues to run money for Moore Capital, while Jack Land’s Axebrook has spun out of York Capital. Scandinavia’s largest hedge fund manager, Brummer & Partners of Sweden, regularly seeds new funds such as Pantechnicon. In Canada, seeders include Canadian pension funds and Quebec Emerging Managers’ Program. The Norwegian oil fund, Norges Bank Investment Management, is allocating to specialist “boutique” hedge fund managers globally, such as UK equity long/short manager, Kernow Asset Management. There are also seasoned seeders such as Stable Asset Management.

Previous firms

Most managers have previously worked for other hedge funds including giants such as Brevan Howard, BlueCrest, Bridgewater, Citadel (and affiliates), Millennium, Moore Capital, TCI and York Capital. The remaining managers hail from smaller and medium sized firms such as emerging markets specialist Prince Street and Asia-Pacific specialist Indus Capital.

Some managers came from a proprietary trading background, at banks such as China’s Bank of Communications, Deutsche Bank, Natixis, Societe Generale, Credit Suisse, and Goldman Sachs. Meanwhile the option traders at Patronus Capital Management were previously market makers for Optiver. One co-founder – of Castle Ridge – formerly worked for a giant Canadian pension fund. Two managers, Derek Brown of Dardanelles Capital, and Misha Sanwal of Millingtonia, previously worked in private equity, in addition to hedge funds. Daniya Lukmanova of Infinite Edge is distinguished by her prior role in academic biomedical research.

33

Thirty-three of the fifty managers featured are running discretionary strategies.

Platforms and service providers

Most managers have founded their own firms, but we also feature developing strategies sitting on established platforms, these include strategies managed by Osmosis Investment Management, Crossborder Capital and First Private Investment Management in Europe, as well as Dalton (and affiliate Rising Sun) and Wolver Hill Asset Management in Asia. There are also newer platforms catering for emerging managers, these include Eschler Capital Management in the UK and Eva Maria Kullmann’s Ancova Capital Management in Cayman.

Some managers are working with bulge bracket prime brokers and service providers. Others, often the smaller and newer ones, are working with firms such as Interactive Brokers, Apex Fund Services or NAV Consulting.

Vehicles

Most managers are running Cayman, Luxembourg or Ireland funds, but there are some exceptions. A distinctive trend following CTA, Bowmoor Capital, is setting up a Guernsey structure; Bob Elliott’s Unlimited runs a US-listed ETF; and Nippon Asset Value Fund is an LSE-listed closed end fund investment trust. UCITS funds are run by firms including Seahawk, First Private Investment Management, and Osmosis Investment Management. Some managers currently only run managed accounts and/or sit on managed account platforms such as Galaxy Plus.

The number of launches and asset raising achieved in any one year will fluctuate, and the climate might have become more challenging for some start-ups. That said we continue to see a steady stream of distinctive and often innovative strategies, which are often generating exceptional returns. We are also monitoring pre-launch managers for future reports and encourage readers to reach out alerting us to new launches.

Archive

Tomorrow’s Titans – 2023 Edition

Tomorrow’s Titans – 2022 Edition

Tomorrow’s Titans – 2021 Edition

Tomorrow’s Titans – 2019 Edition

Tomorrow’s Titans – 2016 Edition

Tomorrow’s Titans – 2014 Edition

Tomorrow’s Titans – 2012 Edition

Tomorrow’s Titans – 2010 Edition

Tomorrow’s Titans – 2022 Edition

Tomorrow’s Titans – 2021 Edition

Tomorrow’s Titans – 2019 Edition

Tomorrow’s Titans – 2016 Edition

Tomorrow’s Titans – 2014 Edition

Tomorrow’s Titans – 2012 Edition

Tomorrow’s Titans – 2010 Edition

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical