Multi-strategy hedge fund managers have in recent years attracted a disproportionate share of net asset inflows and investment talent. Acadian’s heritage and origins as a quantitative equity manager, and its culture, differentiate it from those dedicated multi-strat platforms. They do however share the common goal of giving investors a convenient way to access multiple hedge fund strategies in one vehicle, combining returns streams with low correlation to one another to deliver a more consistent return profile.

Acadian Multi-Strategy is designed to be the firm’s solution for investors seeking absolute returns, since it targets the highest return per unit of risk, over a full cycle, selecting the most relevant ideas from Acadian’s growing repertoire of macro, arbitrage, market neutral, equity long short and commodity strategies, which account for USD 3.5 billion of Acadian’s USD 103.7 billion of assets under management as of December 2023. Acadian Multi-Strategy was seeded in 2020 with internal proprietary capital and significant personal investments from the teams managing it.

(L-R): Ioannis Baltopoulos, SVP, Portfolio Manager, Equity Alternative Strategies, Michael Gleason, SVP, Director of Equity Alternative Strategies, Heidi Chen, SVP, Portfolio Manager, Equity Alternative Strategies, Acadian

The strategy incorporates a standard hedge fund fee structure, which has two benefits. First, with respect to performance fees, it offers potential for netting across the component strategies. Second, the fixed management fee percentage avoids the blurriness associated with pass-through fee models.

Acadian Multi-Strategy can be accessed through Cayman or Delaware accounts. Acadian Multi-Strategy uses a curated blend of factors and signals to build a growing suite of unique strategies, which can be capacity constrained; some are currently exclusive to the program while others are available on a standalone basis. Several of the strategies revolve around securities financing, where Acadian’s expertise and competitive edge also feeds into overall portfolio structuring efficiencies for the vehicle.

Defining idiosyncratic alpha and return targets

The objective is to generate strong and positively skewed risk-adjusted returns, with limited drawdowns, a focus on capital preservation, no equity beta and no unintended style and factor bets. Acadian attempts to maximise the idiosyncratic, or stock/security/instrument specific contribution to returns, and limit exposure to what they view as known systematic themes, such as country, sector and size. Acadian also views equity market risk and alpha drivers through prisms that differ from traditional factor and style analysis.

We are transparent to a fault, and the culture empowers us to challenge not only each other, but also the data.

Michael Gleason, SVP, Director of Equity Alternative Strategies

“We have our own alpha model grouped into themes. A big proportion of our returns are idiosyncratic,” says Michael Gleason, SVP, Director of Equity Alternative Strategies. In common with many quantitative asset managers, valuation factors are relevant for the equity strategies, but two of the newest ones – Deep Learning Alpha and Greater China Long Short – have less value exposure.

Acadian Multi-Strategy aims for a gross Sharpe of one or above, which is higher than the targets for some of the individual strategies, in part because some degree of diversification benefit is expected amongst its growing range of seven strategies. The first four strategies already have shown average pairwise correlations near zero since inception.

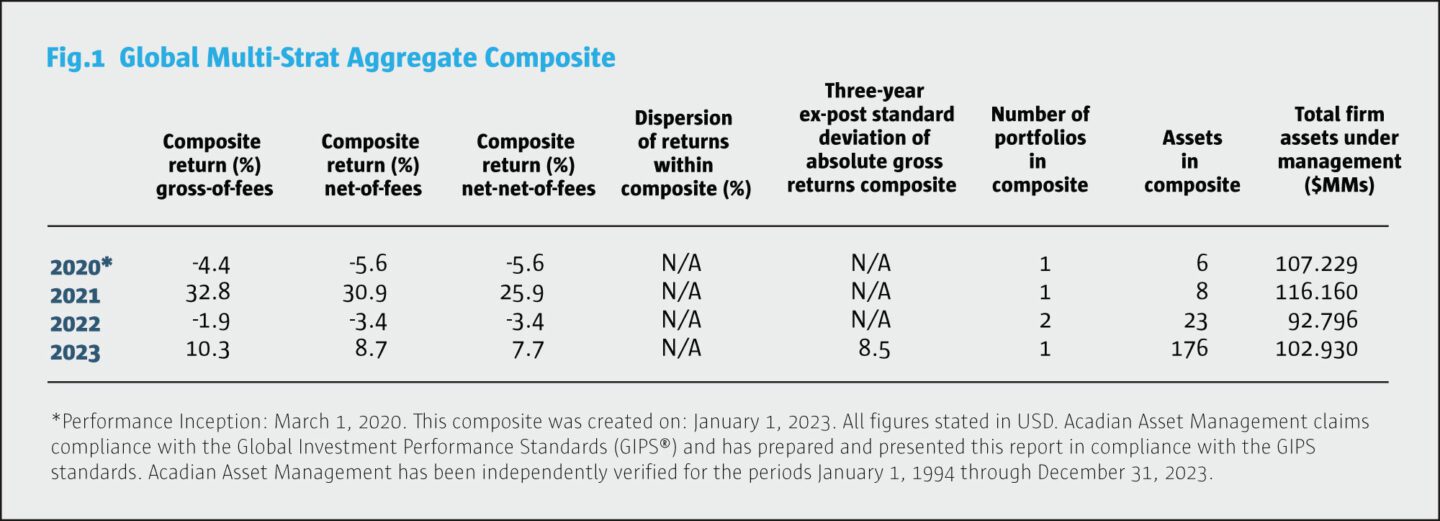

The return profile has been lowly correlated to hedge funds and has sometimes even been convex relative to hedge fund indices such as HFRX RV Multi-Strategy. The hit rate has scored nearly 60% positive weeks, and the win: loss ratio shows a huge positive skew with average up weeks making 0.4% and average down weeks losing 0.1% (see Fig.1).

Early performance in 2020 was partly hampered by a suboptimal fund of funds structure, which we explore later in this article. Acadian Multi-Strategy’s strongest calendar year so far was 2021, a vintage banner year for the firm and the Equity Alternative Strategies Team. “The long/short strategy had its best year mainly due to stock selection, while market neutral made its best return since inception in 2005, thanks to proprietary factors that generated an idiosyncratic return profile. And the arbitrage strategy also performed well with convex payoffs relative to the equity market and hedge fund indices,” says Gleason. On a rolling 3-year basis as of the end of 2023, Acadian Multi-Strategy has outperformed the MSCI ACWI index with less than half the volatility. Realized beta over the same period has been modest at just 0.19. 2024 is off to a good start, with January returns meeting expectations.

Longer term, Acadian has equity track records dating back to 1988 (the firm was founded in 1986). “The longest running strategies have targeted alpha of 2% for tracking error of 4%, and generally achieved or surpassed it; the very longest track record in market neutral goes back 18 years and has delivered an impressive Sharpe ratio despite some costs of stock borrow and leverage,” says Gleason.

Cyclicality of alpha

The return goals apply over a full business cycle, and there can be time-varying periods of underperformance. Times of stress, including parts of 2020, can increase correlations and reduce diversification benefits between the strategies. Some strategies can stay out of favour for long periods and Acadian realistically acknowledge that certain models may turn out to be subject to some degree of “overfitting” and/or anyway see alpha decay. Acadian recognize some factors and signals that worked 30 years ago may not work now.

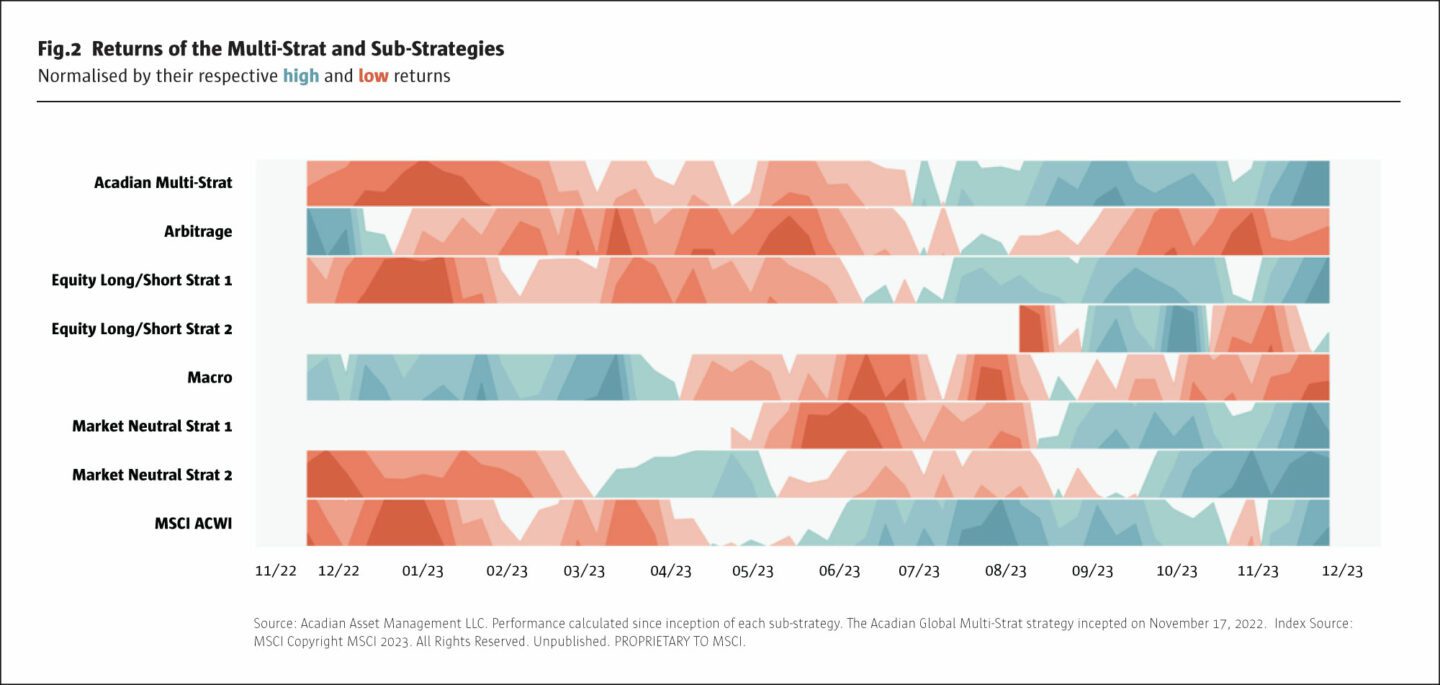

The cyclicality of returns is illustrated graphically in a horizon diagram (see Fig. 2). The layered rows represent each strategy’s normalized cumulative return. The intensity of the colour shading represents larger gains or losses.

2007 epiphany

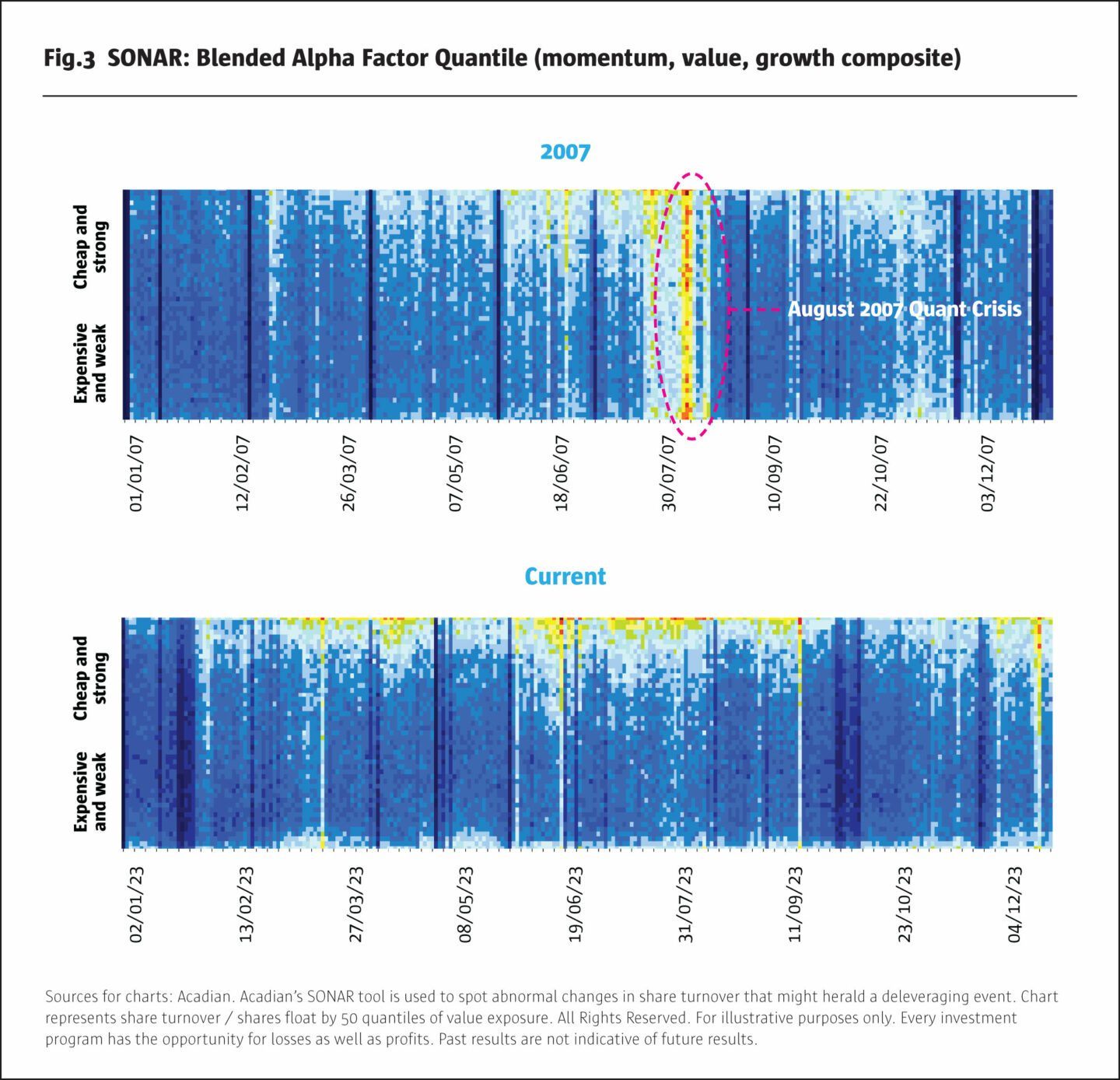

The infamous August 2007 “quant equity crisis” – which is a case study for CAIA students – witnessed extremely challenging conditions for many equity quant strategies. At that time, Acadian had equity alternatives assets of around USD 3.5 billion, Michael Gleason was living and working for another firm in London, and he views it as an event that somewhat separated sheep from goats: “The response to the week of Monday August 6th 2007 bifurcates managers between those that responded rapidly, and those who did not.” This experience informed and inspired the development of diagnostics, such as a SONAR real time tool to decompose volumes into quantiles and shockwaves. “SONAR was built and calibrated in 2007 in response to the systematic deleveraging of quantitative strategies. The heterogeneity of systematic strategies disappeared quickly and seemingly without warning, causing many to reassess both the crowdedness of systematic strategies and the material flaws in assumptions around risk and liquidity,” says Gleason.

“We still see echoes of 2007 occasionally. While Acadian’s strategies today are far more nuanced and diversified than any approach from 2007, we still use SONAR to monitor market microstructure and to look for potential deleveraging events. We are well prepared for such episodes, in terms of forecasting, output and risk engines,” says Gleason.

However, the 2021 “meme stock” craze, which spawned the 2023 movie “Dumb Money” and saw GameStop, AMC and Express share prices multiply more than fivefold in January 2021, was not in fact an example of widespread quant fund deleveraging. A February 2021 note entitled Quick Take: Don’t Blame the Quants this Time, found that Acadian’s “market sonar” showed no signs of systematic deleveraging of quant portfolios.

Academic influences and data digestion

As is typical for a quant manager, Acadian believe that markets are not random, and behavioural inefficiencies can be systematically identified and traded.

“Human behavioural biases create inefficiencies that can be exploited to generate alpha. Incomplete information can create anomalies, and even when investors have complete information, they may not process it correctly, which can lead other participants to over and under react,” points out Gleason.

Acadian’s process is at the intersection of academia and practitioners. There are strong relationships with academics externally, and some academics on the staff, all of whom work together to unearth new anomalies. “We review many academic papers and carefully try to replicate their results, but also try to verify and rely on our own real world, real life, observations in areas such as counterparties and shorting bans. We collect and curate vast amounts of data, to process and extract signals, using statistics and machine learning techniques,” says Gleason. Firm-wide, Acadian ingest 450 million daily observations in 150 global markets, adding up to 55 terabytes of data and over 40,000 tradeable equity assets. “The data is the raw information, but it needs to be manipulated in the right ways. It takes a lot of resources to collect, curate and process it,” stresses Gleason.

Intellectually diverse global team

Unlike some other quant firms, there is no prohibition on hiring those who have studied orthodox finance in MBAs, CFAs or economics, and there are also graduates of maths, statistics and other scientific disciplines. “We have oriented ourselves around a common systematic investment process. It’s a symphony conducted by a collection of individuals with a diversity of thought, background and experience,” says Gleason.

Team longevity, incentives, culture and transparency

Acadian reports turnover on the investment team has been on par with industry standards and typical rates of attrition and highlights that its systematic process, deep bench strength (100-strong), and ability to attract and retain investment talent minimizes the impact of any individual departure. These attributes are further reinforced by a strong continuity framework at the firm level.

The firm is not contractually obliged to pay portfolio managers carry on the performance of specific strategies, though they do participate in overall firm economics. Beyond a competitive base package, most senior investment professionals have an ownership interest in the company as limited partners in the Acadian Key Employee Limited Partnership. “There are no ‘pods’ to define any team and strategy-specific remuneration, and overall there are no classic siloes, besides some practical day to day separation,” says Gleason.

A stimulating office also helps to retain staff. “It is an exciting and fun place to work. We like to see each other and generate osmosis from working closely together in the same office,” says Gleason. This healthy and constructive dialogue is enabled by a transparent culture. “We are transparent to a fault, and the culture empowers us to challenge not only each other, but also the data,” he adds.

Funneling ideas into Equity Alternatives and Acadian Multi-Strategy

As the manager of the seven-strong Equity Alts team, Gleason is responsible for day-to-day management of Acadian Multi-Strategy, and several of its underlying strategies. He sits on the nine-strong senior investment leadership team, which reports to CIO, Brendan Bradley. SVPs and Portfolio Managers, Heidi Chen and Ioannis Baltopoulos, both work on architecture, engineering, research and management across the entire suite of alternative strategies, products and processes. All three of them sit on the Investment Policy Committee, which is chaired by Bradley, who leads and empowers direct reports to manage functional areas and work well together, strategically directs the Investment Division, and approves substantive decisions related to the investment process.

The Acadian process changes through evolution rather than revolution, as over 100 people review, evolve, hone, refine and fine tune models to extract alpha signals and factors from public markets in an uncorrelated pattern, also heeding sustainable investing considerations. “Where we believe it’s material to risk-adjusted returns, ESG is infused throughout the process,” says Chen, citing examples of corporate governance and management behaviour.

Acadian Multi-Strategy also draws on ideas from a seasoned 16-person equity research team, a dedicated macro and multi asset team of seven and a dedicated systematic credit team of six. “We have considerable breadth in terms of teams, diversity and styles,” says Gleason.

1988

Acadian has equity track records dating back to 1988 (the firm itself was founded in 1986).

Acadian Multi-Strategy roster

Acadian Multi-Strategy blends equity long/short and equity market neutral strategies developed since 2005, with multi-asset systematic macro strategies traded since 2015, some distinctive arbitrage strategies, as well as some newer strategies. Time horizons for investment signals can range from days to months.

Equity market neutral

The equity market neutral sleeve is a risk-controlled strategy that utilizes Acadian’s alpha forecast, which trades 500 to 1,000 stocks inside tight country, sector, beta and dollar neutral constraints as well as being broadly size and factor neutral. Some Acadian factors do have limited overlap with well-known factors such as value and momentum, but they try to minimize exposure to generic factors.

While the flagship equity market neutral strategy that has an 18-year tenure also uses some machine learning insights, a second equity market neutral strategy, added in 2023, is mainly built using deep learning signals. Both strategies have now been systematically incorporated into the market neutral bench.

Arbitrage

Arbitrage uses elements of Acadian Alpha to generate short signals and employs efficient securities financing techniques, with 2000 positions exploiting regulatory arbitrage. The arbitrage is around funding, securities financing and borrow rates, which have been impacted by regulations such as Volcker and Basel rules. “Acadian has a proprietary database of nearly 20 years of indicative borrow rates. We have a rich history of partnership with the sell side based on trust and collaboration and we work with multiple counterparties. The strategy, which we started in 2018, sits at the intersection of Acadian’s alpha forecast and the securities financing market” says Gleason.

Securities financing is normally a means to the end of alpha generation, but it can become the direct source of alpha for Acadian’s second arbitrage strategy, added in October 2023: Delta Neutral Arbitrage that is designed to capture funding spreads across multiple global markets.

Equity long/short

Launched in 2020, Acadian GP Equity (Global Private Equity), pinpoints a very specific sub-sector within asset management: private equity alpha extraction in public markets. “We argue that long duration private equity capital benefits from financial and operational leverage, but suffers from the J curve, drawdowns and concentration risk,” says Gleason.

Attempts to replicate private equity have followed different approaches over the years. “Leveraging small cap value tends to result in very large drawdowns. We prefer to use liquid markets to focus on the GP, or PE manager, economics by owning publicly listed private equity and private equity-like firms,” explains Gleason.

The strategy is unusual in Acadian Multi-Strategy in being net long (average beta 0.3) with exposure to 75 to 100 stocks, and its short book hedging follows an intricate and precise process. “We use Acadian analytics and tools to find firms that are private equity-like or are similar, based on drilling into their underlying exposures. We then use ETF hedges on the short side and the hedging is quite complex to decompose underlying investments from general partners. We use multiple sources,” says Gleason. The Global Private Equity strategy has generated a substantial return premium versus a variety of benchmarks including indices of listed private equity managers.

The second equity long/short strategy is Greater China Equity Long/Short, a market Acadian has been active in offshore investing for decades. Its counterparty relationships raise barriers to entry and the signals are tailored to very specific liquidity, retail investor oriented and sentiment driven alpha models that differ slightly from those in the rest of the strategy. “There are fewer participants in this space, which increases the barriers and acts as a moat. The strategy is still beta neutral and is expected to be accretive to the overall multi-strat,” says Gleason.

Macro

Systematic macro seeks to exploit inefficiencies across and within five major asset classes – equities, bonds, FX, commodities and volatility. It uses a broad set of return signals, which incorporate fundamental, macro-economic and price-based data to form directional and cross-sectional views.

We have oriented ourselves around a common systematic investment process. It’s a symphony conducted by a collection of individuals with a diversity of thought, background and experience.

Michael Gleason, SVP, Director of Equity Alternative Strategies

Strategy addition criteria

Other strategies may be added after they pass demanding hurdles: “All new strategies must be naturally accretive to Acadian Multi-Strategy in terms of an increase in returns, a reduction in risk or both. Each new strategy generally needs to be lowly correlated to the others. They are categorised in a spider chart of families … their trading cadence, holding period and factor exposures have been engineered to complement the existing book of business,” explains Gleason.

Equity beta is only one of many dimensions used to build the portfolio. Forecast equity betas are zero for most of the strategies, but portfolio construction has some expectations about strategies’ equity market sensitivities: for instance, arbitrage and Global Private Equity could lose in negative markets, when equity market neutral and macro should profit, and this has been borne out since inception.

Strategies do not necessarily need to be scalable. To stay lowly correlated to other hedge funds, Acadian finds niche and exotic strategies outside the mainstream, some of which can have limited capacity. Acadian Multi-Strategy had assets of USD 176 million as of December 2023, and has an initial capacity target of USD 1 billion to allow for some unknowns. “While some of the sub-strategies are more scalable, the plan is to soft close at USD 1 billion and re-assess, including for new strategies in active development,” says Gleason.

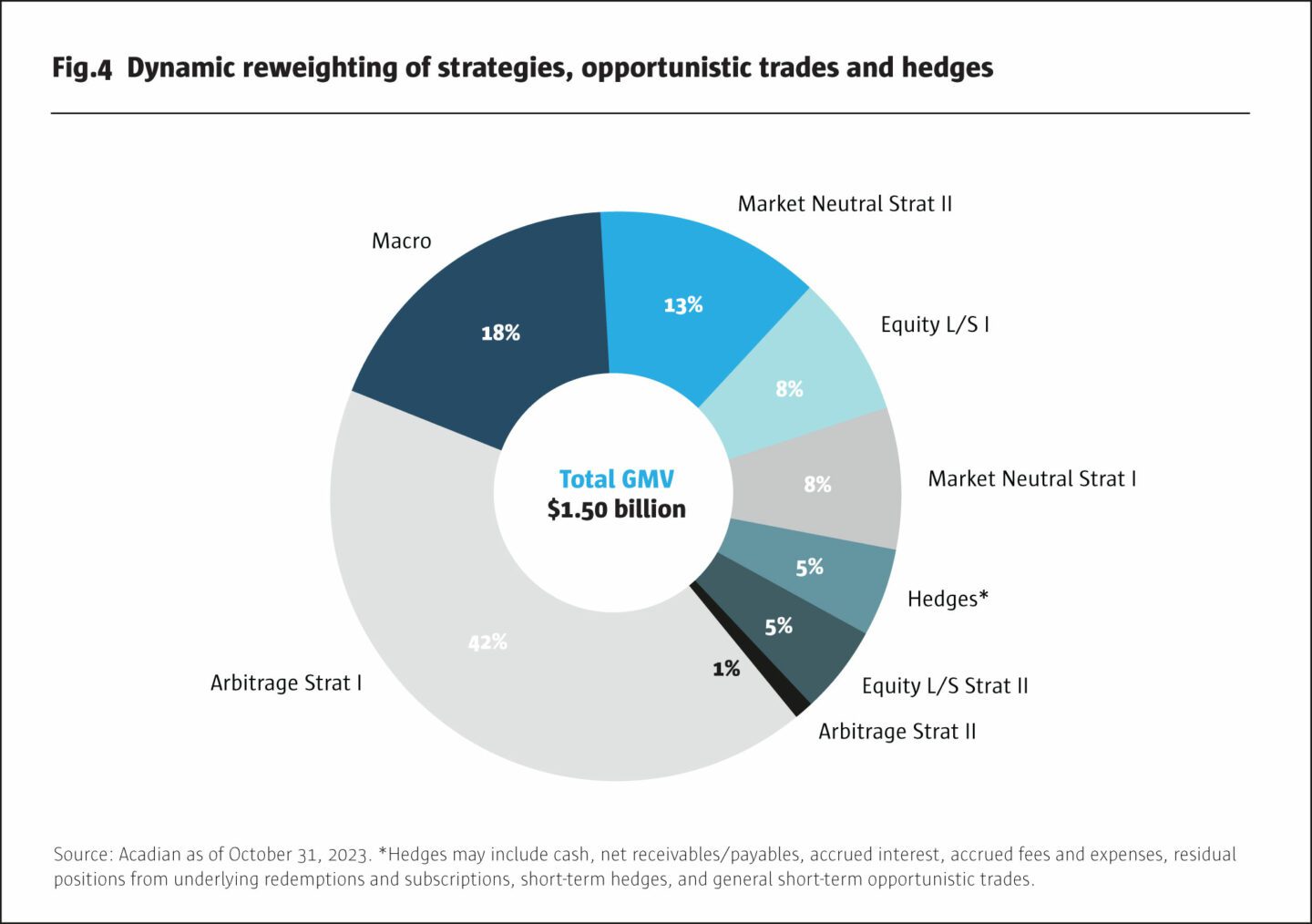

Dynamic reweighting of strategies, opportunistic trades and hedges

Risk allocations amongst the strategies are not expected to be equal for a variety of reasons. They are determined by a systematic process, based on alpha drivers and time horizons. “We consider alpha payoffs, drawdowns and how they blend together. This informs how risk is deployed between the sleeves,” says Baltopoulos.

There are several steps and layers. “Centralized risk management considers buying power and cashflows. Sleeves operate almost independently and rebalance almost as if the multi-strategy was external. We also have real time sight of proposed trades, and aggregate risk to control them, based on individual positions,” says Baltopoulos.

Meanwhile, hedging trades are placed directly by the central book, which is managed as a separate, essential sleeve for the overall multi-strat. This sleeve contains a variety of instruments including ETPs, FX and equities.

Volatility, leverage, smart structuring and security financing

Acadian Multi-Strategy expects to employ leverage i.e. gross exposure between 6 and 10 times, though a volatility range rather than gross exposure is targeted. “We try to control volatility in a tight range, and we rely on multiple risk models including proprietary formulations. If volatility picks up, we will take appropriate action to keep it within the stated range. This does not involve a knee jerk reaction, but the process naturally de-levers,” says Baltopoulos.

The strategy was initially run on a fund of funds model, which was suboptimal because it could not hedge, apply vehicle level leverage or make use of cash and margining efficiencies. This also meant that different strategies operated at different levels of leverage.

In November of 2022, Acadian Multi-Strategy was launched in a comingled structure, which is more cash efficient and has cross margining and financing benefits. “We work closely with multiple counterparties, and all trades are via derivatives to maximise cash efficiency and our use of leverage,” says Gleason.

The whole book of 4,000 to 5,000 single name positions is on swap, as are the futures and ETFs across the book. “The market became cautious of synthetic prime brokerage post the GFC, but there are many reasons to like the model. It is relatively easy to move balances across our counterparties,” points out Gleason.

Lessons learnt from single strategies benefit the whole Acadian Multi-Strategy product. “We have uncovered multiple ways to use securities financing transactions in the investment process,” says Chen. “In many cases, we receive advantageous financing costs to establish positions, because our contrarian process makes us long of less popular and short of more popular names, based on alpha forecasts. This is the reverse of the typical hedge fund buying favourite longs and shorting indices. Understanding the needs of counterparties helps us carefully manage our debit/credit spreads,” she explains.

Acadian Multi-Strategy is distinctive both in terms of bottom-up signal generation and strategy design, and top-down portfolio construction, structuring, financing and management techniques. Its approach and return profile are very different from and could be very complementary to the giant multi-strategy ‘pod’ platforms.

***

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader’s financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 (“AFSL”). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority (‘the FCA’) and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical