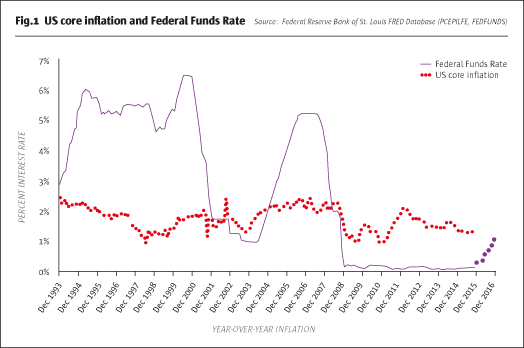

The Federal Reserve (Fed), guided by Chair Janet Yellen, is likely to follow a very different path with a much less aggressive approach for future rate hikes than the Fed under Alan Greenspan. During the last two tightening episodes under Greenspan, the Fed quickly raised the target federal funds rate to above 5%, even though core inflation was around 2%. The Yellen-led Fed will probably be much more cautious. There appears to be no end-point target rate, even if members of the Federal Open Market Committee (FOMC) have views about the long-run possibilities. It is not even clear if the Fed wants to take the effective federal funds rate above the core rate of inflation over the next two years.

What is clear is that only after inflation data shows incremental increases will this Fed even consider additional rate hikes. Thus, all attempts at establishing historical parallels, in terms of the impact of rate-hike cycles on the economy, should be taken with a grain of salt. This Fed is truly being much more cautious than we have seen before and this is likely to be the most dovish rate-rise cycle ever.

Inflation likely to remain below 2%

The Fed prefers to monitor the inflation rate as measured by personal consumption expenditures. This is not the headline consumer price index, but they do track each other. The Yellen-Fed also seems to be placing more or less equal weight on the general inflation trend, which includes food and energy, as well as core inflation, sans the two volatile components. Currently, general inflation is hovering just above zero while the core rate is between 1% and 2% (see Fig.1). We expect the general rate of inflation to rise and the core rate to fall slightly during 2016, so the two inflation measures may converge around 1.5% by end-2016.

We note that the big drop in wholesale energy prices was in Q4/2014 and retail refined product prices fell in Q1/2015, so the year-over-year comparison with these sharply lower prices will diminish through the year, but 2015 did end with retail gasoline prices at very low levels.

More important than the short-term inflation outlook is that, fundamentally, longer-term prospects for both general and core inflation are quite subdued. The tremendous competition in global trade is keeping a lid on inflation. Retiring baby boomers are spending less per capita than they did in their peak earning years and are starting to save more (about time). Banks are constrained by capital ratio regulations and their own risk management processes, and so are highly unlikely to go on a lending binge and expand consumer credit aggressively.

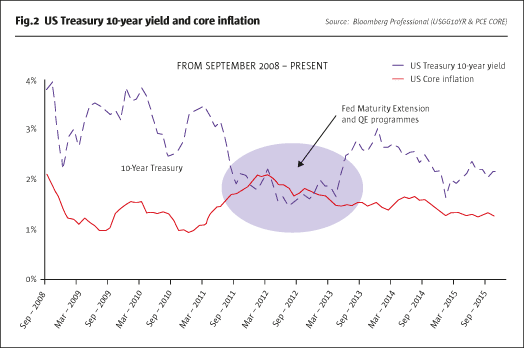

Essentially, the Fed is now quite powerless to push inflation higher without the complicity of a very expansionary fiscal policy. Through Quantitative Easing (QE), the Fed can buy all the outstanding government debt it wants and yet the impact on total spending will be next to nothing if the US government chooses not to increase its spending (i.e., adopt an expansionary fiscal policy). Zero rates matter very little, too. Pushing the federal funds rate to 0% and getting the 10-year Treasury below 2% with QE did not impact government, business, or consumer spending in any material way. The US economy’s natural growth rate is probably between 2% and 2.5% and that is what we have been getting very consistently since 2010. By the same token, small rises in rates and no QE will not matter either. The difference for business and consumer borrowing (and spending) when interest rates range from 0% to 1%, or even 2%, is next to nothing. Amid heightened financial regulation and sophisticated interest rate risk management, the US economy isactually quite insensitive to rate changes, at least in the 1% to 2% range. Sharply higher rates, say back to 5%, certainly would be a negative for the economy, but that is not on the cards.

We are now in an era of low inflation that is likely to last until there is a credit boom – either due to a shift toward an aggressively expansionary fiscal policy or a desire by businesses and consumers to spend more and save less, leading to more lending. Neither scenario is likely over the next several years.

Then there is the 2016 US real GDP outlook. Our analysis suggests the first quarter of 2016 could post exceptionally weak results due to flooding in the Mississippi River valley and the lagged drag of sluggish global growth on the US economy.

The year as a whole does not look very good either; perhaps 1.25% to 1.75% real GDP growth for all of 2016 compared to 2015. Basically, one of the biggest drags on the economy, noted briefly above, is that baby boomers are retiring, and the over-65 crowd does not pack the consumption punch per capita that working-age adults do. In short, the baby boomer generation brought above-average growth in the 1980s and 1990s as they hit their peak earnings years, and now as they retire, the payback to the economy will be sub-standard growth. This view is not well appreciated, and if it turns out to be correct, a data-driven Fed, already prone to being quite cautious, may delay the next rate move for a very long time. In terms of the yield curve, the additional implication is that despite the Fed abandoning zero rates, the 10-Year Treasury bond yield might rally on subdued inflation and disappointing real GDP performance.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 110

A Cautious Fed and Future Rate Hikes

Expect an inflation-based and data-driven approach

BLU PUTNAM, CHIEF ECONOMIST AND MANAGING DIRECTOR, CME GROUP

Originally published in the December 2015 | January 2016 issue