The founders of ABR Dynamic Funds, LLC started their careers as options market makers in the early 2000s, both swiftly becoming specialists on the AMEX. Founder and CEO, Taylor Lukof – who had wanted to be an options trader from age 18 – was at the time the youngest AMEX member, while working for TANSTAAFL Research & Trading, LLC. Co-Founder, MIT Physics graduate David Skordal worked for Susquehanna International Group. They traded ETF and single name options, ETF arbitrage, inverse and levered ETFs, all on a quantitative basis, for a mix of market making and proprietary trading. That experience provided the foundation for ABR’s strategy focused on big picture market-level volatility in US equities.

The founders started developing the algorithms that power the systematic strategy in 2010, using proprietary and friends and family capital. They then launched ABR Dynamic Funds in 2015 to make the strategies available to other investors and were the first firm selected to work with Wilshire Associates’ new index business. The strategy is designed to be transparent in being systematic and very closely tracking Wilshire indices that publish daily NAVs on Bloomberg. The derivatives traded are level 1, mark-to-market, and the portfolio contains less than ten line items, all with readily obtainable market values. The investible products – liquid alternative mutual funds and UCITS V funds – have tracked the indices very closely even as firm assets have grown from $10 million to $925 million. There are currently three ‘40 Act US mutual funds and three Irish-domiciled UCITS funds.

We are systematic to remove emotion, and our strategy works because others fall prey to emotions.

Taylor Lukof, Founder and CEO, ABR Dynamic Funds

ABR aims to deliver crisis alpha with participation in bull markets over time. The firm’s 75/25 Volatility Strategy (“ABR 75/25”), which consists of two separate ABR strategies blended together in the stated proportion, has met both objectives most of the time and had its best ever quarter in Q1 2020. Its Sharpe ratio has been above one, and its Sortino ratio around two (2006 to October 2021 including pre-inception results) because the return profile has been asymmetric; the Sortino penalizes downside volatility not just any volatility. The strategy’s best month produced returns that were twice as high as the S&P 500 and its worst month was only half as bad as the worst month for the equity index. The strategy can of course lose money, including during periods showing unusual patterns of market behaviour, such as calendar year 2018.

Dynamic correlation

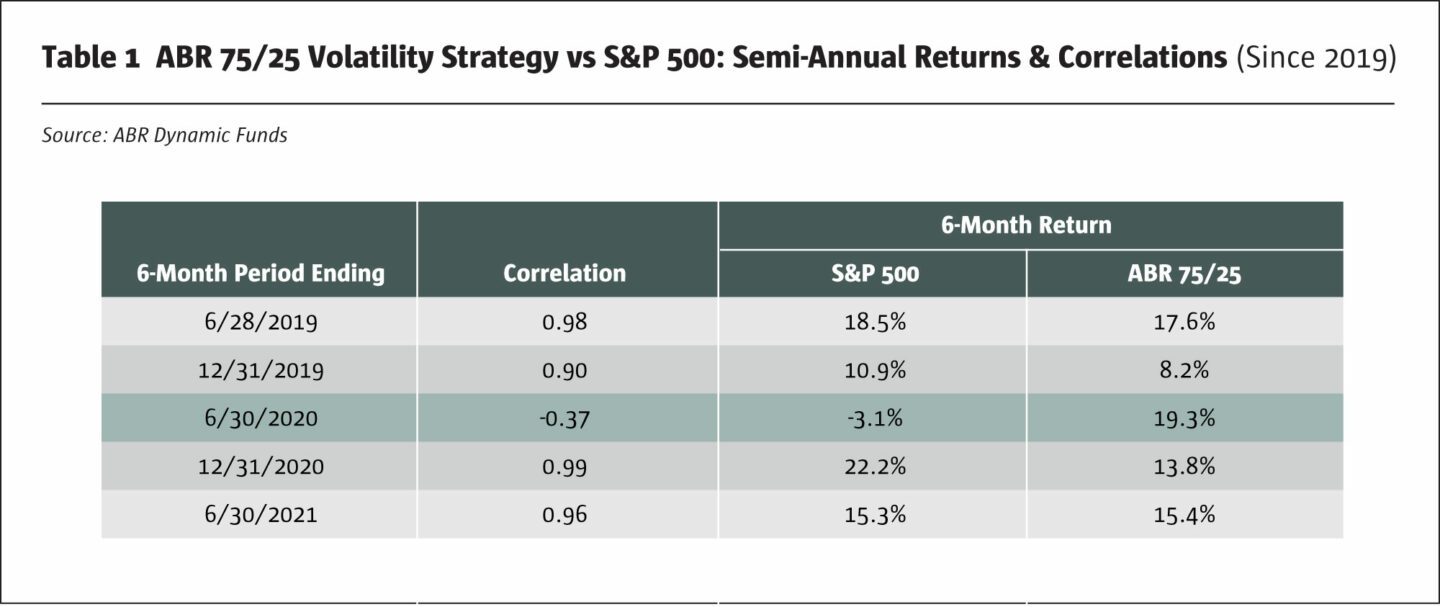

Though the strategy has profited during equity market crises, it is not a tail risk strategy per se, and its correlation to the S&P 500 is dynamic and variable: sometimes positive and sometimes negative. So far, the ABR 75/25 has averaged a high correlation when the S&P 500 was up and a low correlation when it was down. For instance, it made 22% in March 2020, and has also made 15% in the first half of 2021. The rolling correlation to the S&P 500 has ranged from about +0.9 to -0.5. ABR 75/25 also has a dynamic and variable correlation to the VIX (volatility) index, partly because equity markets are inversely correlated with volatility most of the time, but also because the strategy can be net long or net short volatility.

Two transparent strategies

ABR 75/25 is comprised of two strategies – the firm’s proprietary long and its own short volatility strategy. They are distinctive strategies and not inverses of one another (though for execution purposes, long and short VIX exposures are netted off in the funds that combine the two). ABR started offering its long and short volatility strategies as standalone products, allowing investors to blend them, and later launched single pooled investment vehicles for combining them, with the goal of improving risk and return. The ABR 75/25 fund allocates 75% to the ABR Long Volatility Strategy (the ticker for the index used in this strategy is ABRVXX – The ABR Dynamic Blend Equity and Volatility Index) and 25% to the ABR Short Volatility Strategy (the ticker for the index used in this strategy is ABRXIV – The ABR Enhanced Short Volatility Index).

Indices show dynamic correlation

The performance of these strategies is very different from the simple buy and hold approach to being long or short of volatility. The short volatility strategy has, remarkably, profited in both 2019 and in 2020. Both the long and the short strategies profited in the first half of 2021, which may also sound counter-intuitive, but these strategies are deceptively simple. It seems conceptually straightforward, but the devil is in the detail that has been honed and refined over years of research and trading.

90%

ABR research suggests that static long volatility incurs average daily decay of 0.11% in VIX futures, which will quickly compound up to a loss of over 90% as seen in naïve long volatility strategies

Bleed versus blow up risk

The challenge of volatility trading is balancing bleed against blow up risk. “A static long bias will often result in managers slowly bleeding away returns, because it is expensive to keep paying any kind of insurance – you suffer decay. And a substantial and static short exposure may blow up at some stage, as the XIV ETP did,” says Lukof. ABR research suggests that static long volatility incurs average daily decay of 0.11% in VIX futures, which will quickly compound up to a loss of over 90% as seen in naïve long volatility strategies. Meanwhile a naïve short volatility strategy is likely to see a drawdown of at least 90% at some stage.

ABR addresses these challenges from several angles. It hedges volatility exposures with other asset classes; opportunistically follows trends in volatility; varies its degree of net long and net short volatility exposures; avoids leverage and controls short volatility sizing, and occasionally briefly moves into cash, all based on the systematic models.

Momentum and behavioural biases

ABR’s primary driver of volatility positioning is a proprietary momentum signal, which buys rising and sells falling volatility, within a tight risk framework to manage position sizing and risk. The core signal is based on behavioural finance biases. “We are systematic to remove emotion, and our strategy works because others fall prey to emotions,” says Lukof. Volatility markets are a persistent source of inefficiency due to behavioural biases, such as recency bias. “Humans tend to buy high and sell low, based on a herd mentality that has evolved over millions of years. In 2020, equities sold-off by 35%. Then in Q2 2021, with the S&P 500 100% above the lows, there have been record inflows,” says Lukof.

A central tenet of the strategy is that volatility is autocorrelated at extremes when the emotions of euphoria and panic make volatility trends overshoot in both directions. “Mean reversion strategies can be popular in volatility, and vol does always eventually mean revert after making extreme highs or lows, but this strategy may not have worked well over the past decade. You could have gone out of business. We do the opposite of what people normally do,” says Lukof. ABR avoids mean reversion partly because future peaks in the VIX might be much higher than historical ones. The highest VIX on record was seen in March 2020, at around 83. “The perception that the VIX is capped around 80, based on the last two crises, is wrong. Its precursor, the CBOE S&P 100 Volatility Index, nearly doubled that in 1987. 80 is not a theoretical or historical upper bound,” says Skordal.

Variable volatility exposure

ABR is usually net short volatility, on an unleveraged basis, and the short volatility exposure is kept in a controlled range. However, the strategy can flip to net long VIX futures in a matter of days or weeks because volatility trends can be quite fast moving. “Of course, the strategy will sometimes go net long on volatility on false alarms, which happened in January, May and August 2019, though this was still a strong year, with [our 75/25] strategy up 27%,” says Lukof.

Lukof admits that 2020 was a relatively easy year for a trend following volatility strategy. “We moved to a long stance when the VIX was about 30 and rode it up to 80”. What distinguished ABR from many funds was that it profited in both April and March 2020, as the model adapted to the decline in volatility. The strategy also profited around the US Presidential election in November 2020, which saw the largest ever drop in VIX futures in a month, by 35%.

Variable fund volatility

Variable strategy exposure to volatility also implies that ABR 75/25 needs some latitude to vary its own volatility. The short volatility index’s standard deviation is 36%, the long volatility index’s standard deviation is 16%, and ABR 75/25 has had a standard deviation of around 16%, thanks to a low correlation between the two. But the strategy’s standard deviation fluctuates around these levels because the strategy is not volatility-controlled. “It needs the headroom to deliver outsized convexity wins and payoffs when conditions are right for the strategy,” says Lukof.

Sizing and risk management

Sizing is essential for risk controls. For instance, ABR’s short volatility index averaged only 20% net short exposure to volatility in 2017 and made 36% in that year (gross of fees), which was approximately 20% of the 180% return delivered by the infamous XIV ETF. In 2018 XIV blew up while the short volatility index had a substantial drawdown that was subsequently recovered. The ABR 75/25 strategy was flat on the day in February 2018 when XIV blew up.

Stress testing

The firm’s managers are seasoned enough to know that they cannot expect to make money every month or every year. “The best quarterbacks fail on 35% of their pass attempts but are still good at what they do based on their hit rate,” says Skordal. In 2018 the strategy lost 13% over the calendar year after being wrong footed by rapid reversals in the VIX, which meant it got whipsawed following the trend in both directions. 2018 saw no real crisis but three small corrections in February, October and December, which led to brief spikes in volatility that rapidly reversed. Additionally, the ratios between VIX and equity moves were out of kilter with historical norms which upset the diversification within the strategy. The 2018 loss can also be seen in the context of what was a rather strange year when virtually all asset classes lost money.

One potentially more adverse scenario could be an equity market crash and spike in the VIX that was not preceded by any uptick in the VIX: then ABR 75/25 could have long equity and net short VIX exposure. Historically such scenarios of crashes coming out of the blue are very rare, according to Lukof. The strategy is backtested to 2006, when clean VIX futures data became available, but the portfolio managers have also reached back further to think about historical events. “Volatility was trending higher before the flash crash of 2010; before September 11th, 2001 (albeit a coincidence in this case), and before October 1987. There have been surprises such as the 2014 plane crash in Ukraine, when the market dropped 4%,” says Lukof.

Nonetheless, hypothetically, a sudden tripling or quadrupling of the VIX when ABR 75/25 was net short volatility could clearly be an adverse scenario. One risk mitigant is that short VIX exposure is sized relatively small when the VIX is low.

The best quarterbacks fail on 35% of their pass attempts but are still good at what they do based on their hit rate.

David Skordal, Co-Founder, ABR Dynamic Funds

Liquidity, execution and transaction costs

Liquidity is paramount for the strategy, as it operates inside daily dealing liquid alternatives fund structures. The funds have a “clean” NAV with no sales charges and no bid/offer spread or swing pricing. On average the daily rebalance is only about 2% of the book, which also helps to reduce costs. There were certainly liquidity air pockets and bottlenecks in many areas of the financial markets in March 2020, but VIX futures saw larger volumes and liquidity over this period. Whereas some volatility strategies use OTC (over the counter) instruments such as variance swaps, the derivatives that ABR uses are all exchange traded – i.e., S&P equity index futures and VIX futures. The strategies also employ cash, and Treasury bonds, which are highly liquid as well. The VIX futures are used to replicate volatility indices rather than buying an index product from another provider.

It nonetheless takes some effort to minimize tracking error versus the indices: “The simplest execution approach of accepting VWAP (volume weighted average price) prices would allow for higher assets to be managed but actually result in a performance lag of one or two percent a year, so we trade in a window closer to the market close,” says Lukof. Capacity is estimated at between 5 and 10 billion USD, with VIX futures the main constraint.

Global distribution via liquid alternatives funds

ABR chose to wrap the strategy in liquid alternative funds to maximise the potential market and ensure transparency and governance. After doing due diligence on platforms, Forum Funds was selected to house the ‘40 Act mutual fund, while DMS and Montlake – which are now part of Waystone – were selected to organize and oversee the UCITS funds. Early investors in the UCITS included family offices and regional banks in Switzerland.

The distribution strategy is intended to be as inclusive as possible, offering retail investors access via RIAs, though ABR is growing its share of institutional assets and has had conversations with leading institutional and pension fund investment consultants.

Currently most US assets come from some of the largest and most sophisticated RIAs (Registered Investment Advisors). “They have the intensity of interest to truly learn what the strategy is doing, through a lengthy due diligence process, to understand the unique properties of dynamic correlation,” says Lukof. ABR has also been approved by some leading turnkey asset management programs (TAMPs) in the US, which can cater to other investor groups.

Most assets are currently raised in the US, but the UCITS is expected to grow the share of assets from Europe, South America and Asia. Key markets in Europe include the UK, Spain, Italy, Switzerland and Austria, where Lukof has reconnected with a contact he made at university. His old professor, from an M&A internship while he was on an exchange program in Austria, now runs a firm that is involved with introducing the fund to sophisticated prospective investors. In Asia, the funds are made available by one of the largest three Japanese banks, through an arrangement with one of Softbank’s investee firms. ABR could be open to separately managed accounts but would probably want to see assets of at least USD 100 million per account.

ABR does not believe that the strategy would be a good fit for an ETF. “Simple equity or fixed income beta works in ETFs, which generally rebalance with market-on-close orders. ETFs also may use a monthly rebalancing approach, which contrasts with our dynamic approach. Our strategy does not work with a redemption in kind mechanism. Additionally, the futures that we trade are more tax efficient within our strategies for US investors than some other types of portfolio holdings,” says Lukof.

Other indices

ABR has thus far commercialized the two strategies that make up the ABR 75/25 strategy but has developed other indices that could be used as the basis for investment products. Four other indices are licensed by Wilshire Associates, which include multi-asset class strategies covering commodities, fixed income, equities and volatility. ABR controls the intellectual property and the timing of any commercialization. “We are cautious about rolling out new products and are not inclined to jump on the bandwagon of fashionable strategies such as thematic ETF launches,” says Lukof.

As 2021 moves to a close, ABR believes that the ABR 75/25 strategy is well-suited to market conditions. They are of the opinion that historically richly valued equity markets strengthen the case for having some opportunistic, potentially long volatility exposure.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical