Against the odds, Amplitude has tripled assets to $1.8 billion from $600 million over the past few years, when many CTAs experienced outflows and some even shut down. The asset surge is partly due to Amplitude’s diversifying return profile and very careful filtering of its investor base, post-crisis. But Amplitude’s genesis as one of the first short-term CTAs in Europe would also have seemed highly improbable back in September 2004 when they opened a London office; self-deprecatingly, Amplitude CEO Karsten Schroeder says he would not have seeded himself! Aged 26, Schroeder had grown up in the former East Germany, spent two years as a McKinsey management consultant, had no hedge fund career history, no personal capital, and limited real money experience trading futures and options. His unique selling point was only really some “back-tested” or historical hypothetical performance, something that most seeders and allocators are sceptical of – since it is unheard of to see a bad back-test and very few such “pro forma” track records live up to expectations when they go live.

What Schroeder and co-founders – military service contemporary, Peter Voss (now COO), and school friend, Steffen Bendel (now CTO) – did have was a real passion for their shared hobby building trading models since 1997, a conviction that they were doing something different, and considerable expertise in applying computer programming and optimization techniques to the granular “tick data” that Deutsche Boerse had just started releasing in 2002. These qualities proved enough to pique the interest of former Deutsche Bank banker, Dr Shamil Chandaria, who had a deep enough financial and mathematical knowledge to grasp the potential of Amplitude’s nascent systems. Chandaria provided seed capital of $5 million for the Amplitude Dynamic programme in June 2005, in return for a stake in the management company, most of which has now been bought back by Amplitude, so the firm today is almost wholly owned by its active principals. Although Chandaria acted as a helpful mentor, the first two years were tough – not because the models needed modifying (as they did later on) but because Schroeder had to play the numbers game and have hundreds of gruelling meetings, flying economy class, to secure just a few extra investors who helped take assets up to around $40 million by 2006.

Pinpointing the right investors

Asset inflows suddenly exploded in 2007 in response to performance of 47% that year, but much of this turned out to be “hot money”, which disappeared as investors used Amplitude as an ATM during and after the crisis. Private banks and funds of funds withdrew at least $200 million.This experience was formative in shaping what Schroeder terms Amplitude’s “super-selective” investor criteria, which appear to be the polar opposite of the current fashion for attracting retail investors with “liquid alternatives” offerings, UCITS, ’40 Act funds and so on. Amplitude’s minimum for a managed account is $20 million with the average now $150 million, but money alone is not enough – the right cultural fit is also demanded from investors.

In broad terms, clients have become larger, more institutional and more sophisticated, but Amplitude also seeks to partner with those who really understand the technicality, complexity and return profile. Ex Credit Suisse and Morgan Stanley, investor relations chief Heiko Zuehlke explains that his client base has realistic expectations about when the strategy is likely to make and lose money – and they also understand why this is, although surprisingly this is not because virtually all of Amplitude’s assets are in managed accounts offering total transparency. Given the complexity of the models, a much deeper dialogue is required to really understand what is driving returns. Amplitude visits clients at least three times a year, while they visit Amplitude in Zug at least once a year, obtaining detailed attribution by market and model. Simulations show how the latest models would have performed versus previous versions, and also justify why Amplitude is not changing some aspects of models.

Most CTAs tend to do better under periods of heightened volatility, and Amplitude is no exception, but investors understand that volatility in itself is not sufficient – autocorrelation is also needed for the models to perform. All of this openness seems a refreshing antidote to the perception of CTAs as opaque “black boxes”, and although Amplitude seems to be overseen by at least four regulators (SEC, NFA, CFTC and FCA) the real driver here has simply been investor demands for transparency. “We have to be honest and humble to get satisfied investors,” says Schroeder.

Amplitude is a signatory of the HFSB (Hedge Fund Standards Board) which recommends a whole raft of disclosures, on operational and governance as well as portfolio matters. Zuehlke was hired in 2009 partly to professionalize investor communications, and he takes pride in listing the elite investor base as including large Middle Eastern, Scandinavian, UK, Swiss and Canadian clients. Some clients have been invested for seven years now, and it is not unusual for them to spend months on strategy calls digging into the strategy before they pull the trigger.

Downside protection

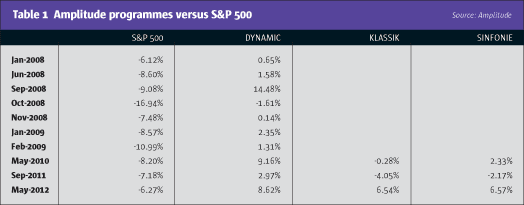

These institutionalinvestors are often seeking out downside insurance for the classic 60% equities/40% bonds asset mix that dominates their portfolios, and Amplitude has provided this on occasions including late 2008, summer 2011, and more recently October 2014. “We can never offer a 100% guarantee of downside protection, but if you look at the two programmes together, there has never been a case where they failed to offer downside protection,” states Schroeder – and all but one of Amplitude’s investors is exposed to both of the programmes. Zuehlke has calculated that if the 24 instances when the S&P 500 lost over 5% per month in the past 14 years are compounded, the cumulative loss is 180%, and Amplitude’s latest upgraded programmes would have made up more than two-thirds of this. Part of this period is shown in Fig.1 for the historical track record. This desired return profile remains Amplitude’s guiding star, and Schroeder says, “We do not have to try and be all things to all people,” partly because Amplitude enjoys the luxury of a hyper-concentrated investor base.

The downside protection return objective has several implications for Amplitude’s research process and IR. Firstly, Amplitude acknowledges a trade-off between Sharpe ratios and downside protection – and has no intention of sacrificing the latter on the altar of the former. Sophisticated institutions appreciate the way in which Amplitude smooths their overall returns, rather than obsessing over its standalone Sharpe ratio. Amplitude is quite explicit about rejecting model changes that might impair their downside protection qualities, even if Sharpes were boosted. ”Any style drift is very dangerous,” says Zuehlke, and although Amplitude seems to have attracted sticky money, Schroeder has no doubt that investors would swiftly exit in response to style drift.

Providing downside protection for client portfolios does not mean that Amplitude itself will switch off in response to its own drawdowns. Risk management systems will scale overall exposures and individual position sizes in response to volatility, but not losses. This is because Schroeder, controversially, thinks that cutting overall exposure in response to drawdowns is counter-productive. Individual positions and models do have stop losses, but he contends that stop losses at the fund level lock in losses, and will often result in missing out on the drawdown recovery. Schroeder thinks it is a false comfort for funds to suggest that drawdowns will not exceed some fixed multiple of volatility – because under adverse market conditions, drawdowns can easily be more than 1.5x standard deviations. And as today’s position is independent of tomorrow’s, Amplitude aims to stay invested and exposed.

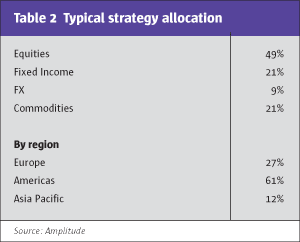

Amplitude also argues that equity downside protection logically needs to be based, prima facie, on tactically going short of equity markets, as historical patterns of correlation between equities and other asset classes might not persist. Zuehlke points out that bonds in Asia and Europe are so close to absolute price ceilings that further appreciation potential is limited. Similarly, he argues that commodity prices have already fallen so far that shorting commodities will not necessarily be helpful during any equity correction in the way that it was in 2008. Hence around half of Amplitude’s book, on a risk-adjusted basis, is in the equity markets (see Table 2).

Amplitude trades currencies, commodities and bonds as well as equities. Dynamic, which hard closed in 2008, trades 39 markets with average holding periods of 1.5 days, and Klassik, which launched in 2009, trades 73 markets, with average holding periods of eight days. These relatively short holding periods limit the investment universe to the most liquid markets, because transactions costs, including slippage, are critical for shorter-term traders. Both programmes are automatically generating signals and orders 24 hours a day, five days a week, but Amplitude has never had any aspiration to enter into the “arms race” of high-frequency trading, and has no need for co-located servers, or fibre optic cables to reduce latency by microseconds or milliseconds; the shortest holding period is typically one or two hours. Nor would Amplitude find it useful to have many more brokers than its current four (Newedge, Deutsche, UBS and Goldman Sachs) as FX is the only OTC (over the counter) market traded, with everything else exchange-traded and all execution electronic. Execution research is nevetheless a key research focus for Amplitude, and one that has earned its keep: even as assets have grown, slippage costs have been cut by 80% since 2008. Slippage costs are around the same level as in 2006, while assets are about 10 times as high.

Relentless organic innovation

Yet nobody should think that the long-term consistency of slippage costs means markets have not changed since 2006. To get some sense of the pace of change, Amplitude admits that their 2006 suite of models, applied to today’s financial markets, would actually lose money! As well, the first year and a half was not easy for the Klassik programme, which required substantial upgrades before it began performing. Very simple models worked back in 2004 and 2005, whereas now the advances in computer power allow for the design of strategies undreamt of 10 years ago. Says Schroeder, “Model degradation is much more serious in shorter-term trading than it is in the medium or long-term space.” To be more precise, Amplitude estimates that the “half life” of a component is typically two years. “This does not mean that models are subject to wholesale changes, but rather that their components are honed and refined so that half of the programme would have seen some amendment or improvement after two years,” says Zuehlke. It seems that the 15-strong research and IT team are all “running to stand still” when it comes to their research.

Schroeder asserts that the research is all “green field”, so nothing published “off the shelf” in any book or academic article is of any use. So for instance, while Amplitude aims to profit from momentum, traditional trend indicators are not useful. The opportunity to get involved in independent, ground-breaking, proprietary research is one factor attracting scientists and programmers to Amplitude. “Our researchers can be visible and can pursue their own ideas, which might not be possible in giant companies containing hundreds of people,” says Schroeder. Links with academia are maintained, with some researchers doing non-financial presentations, such as at the Maths Olympics in Germany. There are four programmers, and 11 scientists, and their backgrounds are both financial and non-financial, with Bendel having designed computer games. Competitive compensation schemes help to lure academics and researchers to Amplitude, but they have to prove themselves over an extended period – Amplitude’s contracts contain quite long probationary periods, because it takes the firm a long time to get comfortable with research staff. Spending millions more on technology would not add value because the people are the key asset, Zuehlke stresses.

“The models have become very complex, very highly parameterized, and use multiple factors,” says Schroeder. For Amplitude, “A model is a collection of different approaches, ideas and concepts,” and just as a chef earns Michelin stars for recipes rather than raw ingredients, so Amplitude find that the way in which the elements are combined and optimized really makes them special.

Another one of Amplitude’s robustness tests is that component upgrades need to be universal to all models and markets traded, to reduce the risk of “overfitting” – or finding relationships that might only work in isolated cases. Amplitude also tests models and components both “in sample” and “out of sample” to guard against systems that might only work for isolated periods. The teams explore tens of thousands of possibilities before homing in on those that are presented to bi-weekly committees that ultimately approve model upgrades on a consensual basis, following a rigorous series of testing, validation and sign-off procedures.

Notwithstanding the quantum of change, there have been plenty of constants. Amplitude has not scaled down volatility in response to asset growth, so margin to equity has stayed steady. The time frames traded have also been consistent for the 10 years, and this is of great importance to some allocators, as the time horizon of signals is a key differentiator in terms of return patterns. As well as diversifying traditional long-only portfolios, the shorter-term CTA space is sought after by allocators with portfolios of CTAs and quant funds, because shorter-term CTAs are not just lowly correlated with medium and longer-term ones, but also much less correlated to one another than are quant funds trading longer time frames. Consequently, some fund pickers even build a fund from a basket of short-term CTAs. Precisely how Amplitude is different from other short-term CTAs is a question that Schroeder says only investors can answer, because they have far greater transparency than Amplitude over all of these systems. Amplitude suggests that possible peers could include CFM Discus, Crabel, QIM and Kaiser, but correlations amongst all of these are relatively low. Amplitude has been lowly correlated to a range of well known CTAs.

CTA turnaround and future research

Yet short-term CTAs are not entirely a breed apart from long-term ones, as the two types do share some experiences. Many of them have been frustrated by the intervention associated with Quantitative Easing, as central bank activity has disrupted the natural rhythms of market trends. “QE taking place in a counter-trend manner is not helpful,” says Schroeder, and he also takes a swipe at compatriot East German, Angela Merkel, complaining that her “salami slicing” tactics for dealing with the European sovereign debt crisis have cost CTAs a lot of money.

Here Schroeder is pleased to see the Federal Reserve curtailing its QE purchases, excited that the Eurozone is moving in the opposite direction, and thinks that 2014 is a turnaround year for the whole CTA industry, where he has many good friends. “It is difficult for investors to go for strategies that have not performed for several years. Now that performance is picking up it will be much easier for investors to make recommendations to their committees,” he opines. Being in Zug means Amplitude is close to “the major financial hub of Zurich, which fits in well with the travel schedules of existing and potential clients,” says Schroeder.

Some CTAs have come under pressure to cut fees, partly due to their unexciting post-crisis performance, and also due to the perception that some types of more scalable CTA strategies can be replicated more cheaply through index products. Amplitude is open-minded about charging lower management fees in return for higher performance fees, as they are not asset gatherers, but does not expect general pressure on fees in its capacity-constrained, shorter-term space. Dynamic has been closed since 2009. Sinfonie, which combines a 30% weight in Dynamic with 70% in Klassik is likely to hard close soon, which will leave only Klassik open, with capacity of $3-5 billion.

Further strategy launches should not be ruled out. Historically Amplitude has focused entirely on technical and systematic data, but now avenues for future research include fundamental data, with machine-readable packages being explored. Machine learning and pattern recognition are also being investigated, and Zuehlke thinks this is all a bit off the beaten track. Whatever model upgrades are made, Schroeder expects to remain 100% systematic. In another 10 years from now we cannot fathom what will be driving Amplitude’s models and returns, but we would wager that some of the inputs could be completely different to those used today.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical