Algert Global CEO and CIO, Dr Peter Algert, founded the firm in 2002, and counts himself very lucky to have been close to the genesis of quantitative equity investing namely the University of California, Berkeley and BARRA, where he studied and worked in the 1980s. “We can honestly claim that this is where quant equity started. Berkeley Professor, Barr Rosenberg, started the eponymous BARRA (Barr Rosenberg Associates); John Andrew McQuown, the M in KMV, launched first the index fund at Wells Fargo in the 1970s, which became Barclays Global Investors (BGI) and later joining Dimensional Fund Advisors; Richard Grinold moved from academia to become global head of research at BGI and Peter Muller, who had studied at Princeton, set up PDT (Process Driven Trading) after a spell at MSCI BARRA. Many staff at Algert are connected to that pool of DNA,” says Algert.

Philosophy

Common foundations underlie the investment philosophies of all these quantitative equity managers. “We believe that markets are not entirely efficient, but are hard to beat, and it is best to do so with a strong and complementary set of teammates. Our philosophy and culture encourages rigorous, disciplined research, grounded in strategies that make sense economically and to fundamental investors. We take sensible investment ideas from traditional long/short equity funds and use systematic expertise to apply the insights to a huge universe of stocks, which we believe would be impractical for a traditional discretionary approach” says Algert.

Dr Peter Algert, CEO and CIO, Algert Global

Algert believes there are mis-pricings in equity markets due to well documented behavioural and cognitive biases that often prevent investors from rationally processing information. In some cases, they are slow to adapt to news, in other instances these biases lead to over-reaction (e.g., overconfidence bias, representativeness heuristic). Often, investors are misled by how data is framed by companies.

As well as insights built around behavioural finance, Algert draws on internal research and academic work in accounting and traditional finance to focus their risk taking on mis-pricings that will be corrected during their holding period.

“We carry out continuous R&D subject to our time-invariant philosophy, and within the framework of our three pillars: return forecasting, risk management and managing implementation and transaction costs,” explains Algert.

Algert believes their returns are differentiated from other quantitative managers by maintaining a wider investment universe of single stocks; use of proprietary factors, implementation skill, analytical techniques, and longer average trade horizons.

We believe that markets are not entirely efficient, but are hard to beat, and it is best to do so with a strong and complementary set of teammates.

Dr Peter Algert, CEO and CIO, Algert Global

Portfolio construction and investment universe

Translating this investment philosophy into portfolios, Algert Global seeks to be meticulous in creating diversified portfolios that deliberately deploy risk in specific regions, market capitalisation ranges and to their proprietary factors.

Having started trading US equity market neutral in 2003, Algert has steadily expanded its geographic breadth and market depth to add US micro-caps, Europe and Japan in 2005; Asia ex-Japan in 2006; Canada in 2008; and Latin America in 2012, with broader emerging Europe plus EMEA added more recently. Algert’s global investment universe now consists of approximately 12,000 stocks with a subset being deployed depending on investment objective.

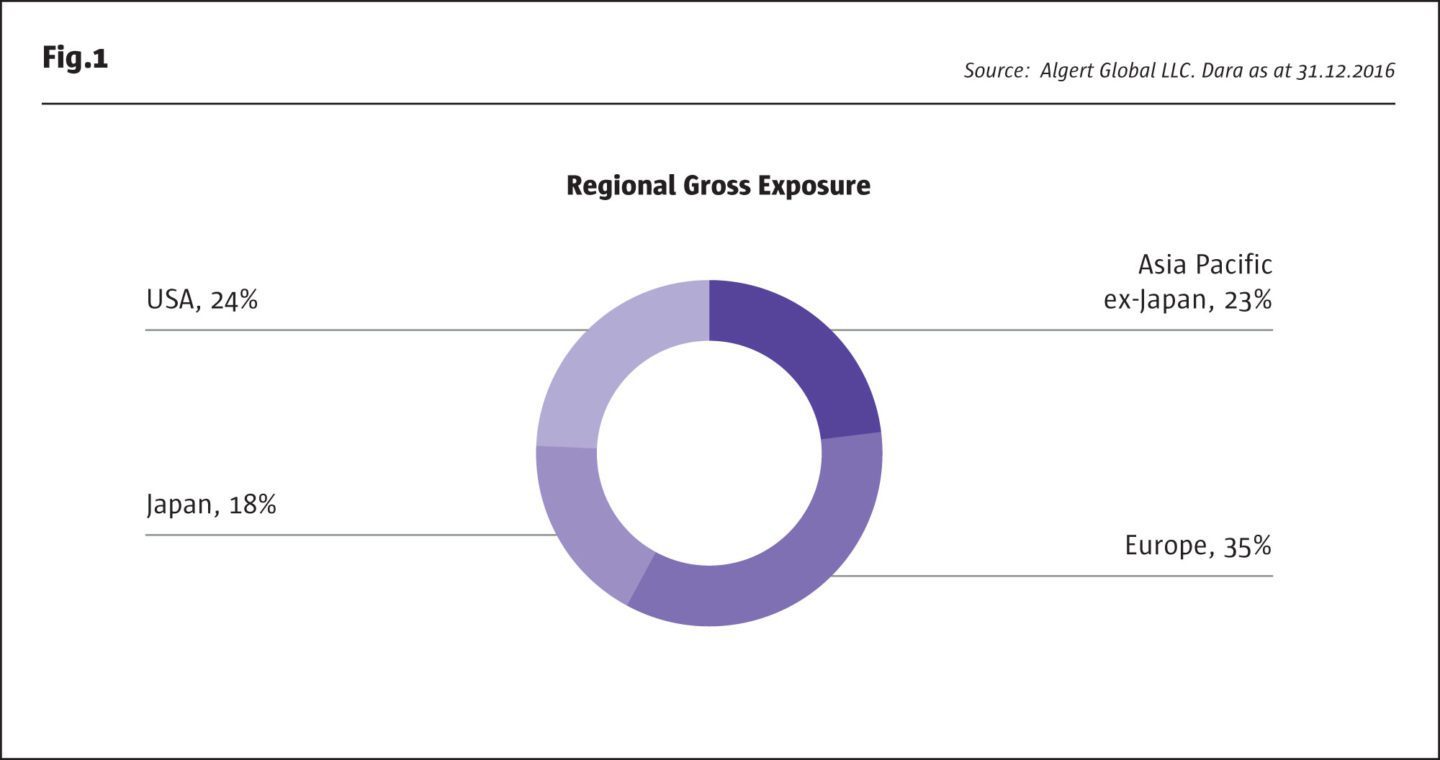

The investment committee sets strategic targets for country, region and sector exposures, which for hedge fund strategies might deviate from exposures simply implied by market capitalization weights. For example, Algert caps US exposure at 40%, and has more Asian exposure (Algert’s Deputy CIO, Ryan LaFond, had been head of Asia Pacific and Emerging Markets quantitative research at BlackRock between 2008 and 2016) and mid-cap exposure than many managers, with some small caps and microcaps in certain strategies.

Algert’s lens is not only wide-angle but is also more granular in having more pixels. Some equity market neutral managers use country, region or sector index products, particularly on the short side, sometimes because their assets are too big to allow for meaningful position sizes in single securities. These derivatives form part of Algert’s toolbox but are rarely used as most exposure is in single stocks as Algert feel the derivatives can be too blunt of a tool in many cases.

Broad based alpha attribution

Algert Global has been managing Equity Market Neutral strategies since 2003, first as a US-only strategy with 2005 marking the launch of its flagship global market neutral fund. While the equity market neutral strategies initially were only managed in offshore funds, Algert has since expanded into sub-advising US 40’Act (2015) and UCITS (2016).

Common to all absolute return strategies is correlation with equity beta near the target of zero, hence returns are all alpha. Algert is notable for relatively well balanced and broad-based performance attribution. “Longer term gross alpha (before financing costs) has been evenly split between the long and short books (shorts have lost money in absolute terms but have underperformed equity markets and the long book). All geographic sleeves have made a positive contribution, as have the three-key thematic alpha models: contrarian value, trend catalyst, and quality,” says Head of Investment Strategy, Jan Bratteberg.

Proprietary factors and avoiding over-crowding

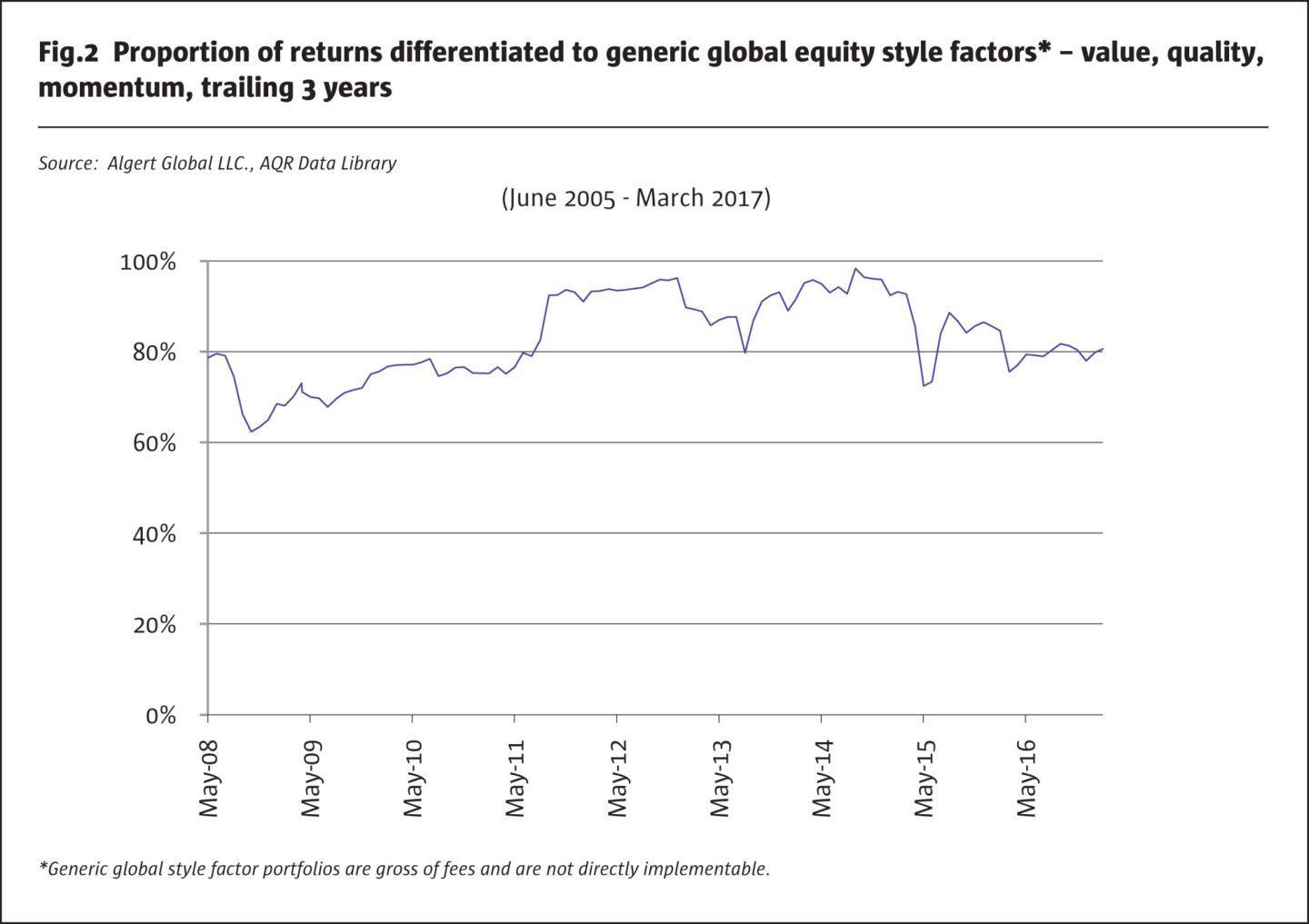

Algert designs its factors and models to be orthogonal to known risk premia such as value and momentum, as the most valuable return streams are not correlated to generic risk premia that can be accessed at low cost. The only explicit portfolio inputs are proprietary factors, and BARRA is used to measure generic factor exposures. For instance, Algert’s trend catalyst model does have some degree of overlap with the generic BARRA momentum model. But on average over time approximately 20% of Algert’s return profile can be explained by generic factors, as shown in Fig.2.

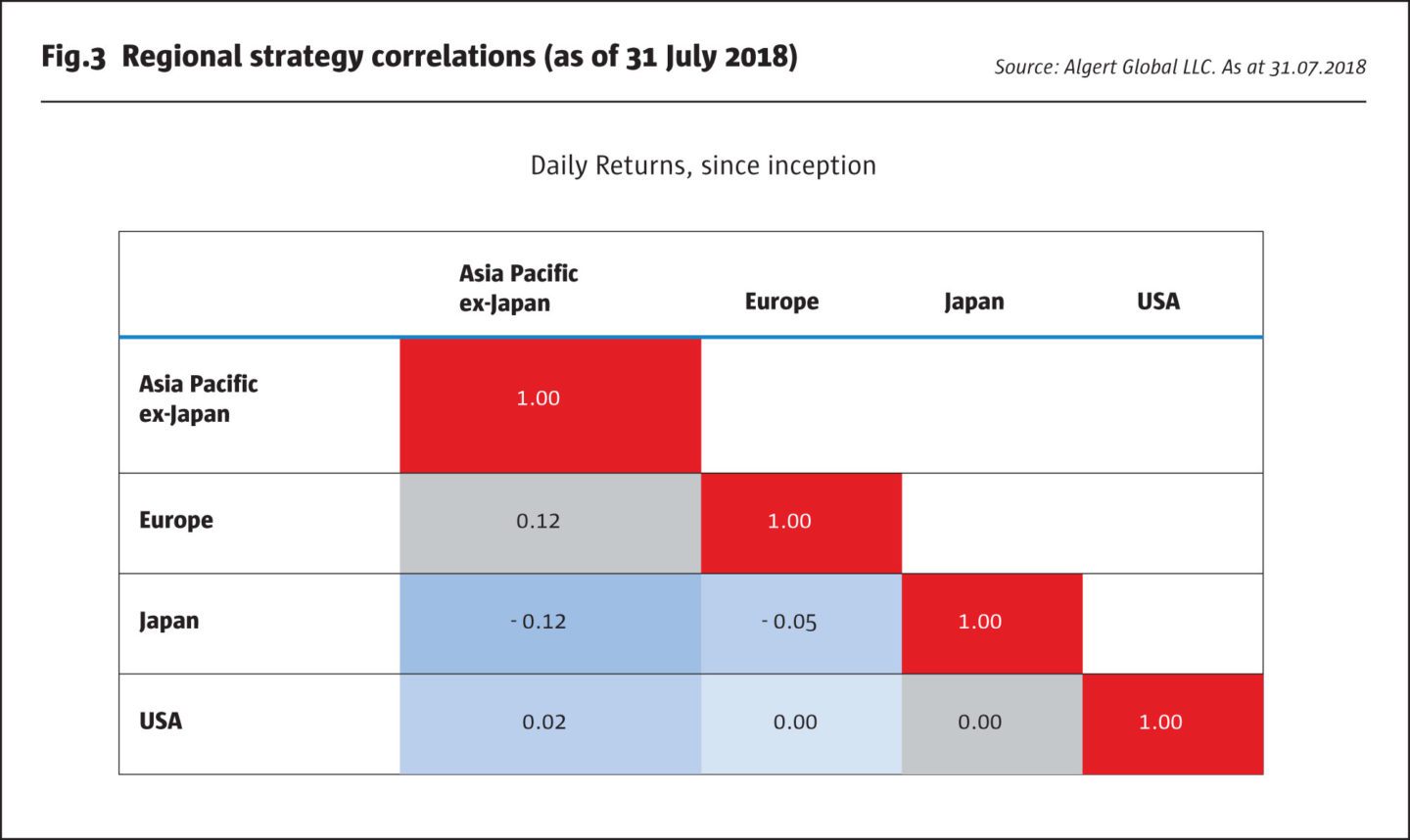

Algert’s individual factors have low, and sometimes no, overlap with generic ones. For example, the European version of Algert’s value factor does not select any stocks that come up in a traditional value screen and Algert has no exposure to traditional momentum in Japan. Of course, this independent approach does not always enhance absolute performance. Algert observes that basic momentum in Japan had its best performance in 30 years in 2017! Whereas some managers use the same factor models across geographies and sectors, one hallmark of the Algert process is tailoring factors to regions, industries and sometimes stock specific characteristics. Whereas generic factors show correlation between regions, correlations between Algert’s four broad regional buckets are near zero, as shown in Fig.3.

“It is more realistic to describe us as tilting, rather than timing, factors” says Algert. Algert’s timing of its own factors has made a marginal contribution, adding modestly to gross returns. Algert does not make wholesale shifts between factors, but rather has sometimes tilted towards or against them, such as increasing momentum by 10-15% at times, based on a factor timing model. “We think factor timing is very hard and prone to data mining as cycles are so long. We have only seen maybe three cycles in 30 years of data. We do timing with a small t, in the tails and at the margins – and most of the time we do not do any timing,” explains Algert. In the early years some discretion was exercised over style weights, for example to boost the value weighting in 2009, but now style weighting decisions have been systematised.

As well as having marginal and patchy overlap with generic factors, Algert takes care to avoid over-crowding at the individual position level. Crowded positions – measured by other hedge funds’ and active mangers disclosed holdings and correlations – are penalised in the process, making the hurdle for taking long or short positions much higher. As most crowded positions are in large or mega caps, Algert’s high mid-cap weighting helps. “Our average holding period of about 9 months combined with our conservative limits on AUM capacity, means that we can often avoid investing in the most liquid and largest names which tends to also be the most crowded,” explains Algert.

Evolving data and models

“Models have to be sensible, and implementation is virtually 100% systematic, but is not a black box. We have to know why models are generating signals and relate positions and trades to plausibly explainable factors,” says Algert.

Accounting data is a classic source in which the team are expert. Deputy CIO, Ryan La Fond, is a PhD of accounting and has taught it at MIT, while Peter Algert learnt accounting at Berkeley. Algert has devoted much effort to accounting, cash-flow and valuation data and the strategies have a heavy fundamental foundation. For instance, longs tend to be profitable, cash-generative and reasonably valued (though not deep value).

Over the past several years, Algert has widened the net to pick up data on cross-asset indicators, sentiment, options markets, flows (e.g., short volumes), smart money indicators (e.g., security lending) and data sources such as Social Media, and product prices. Algert also finds financial regulation creates a lot of interesting data even if it also creates extra work in running any business.

Some stocks’ return forecasts now contain as many as 30-40 factors, and Algert believe that non-linear blends thereof are more powerful than linear blends. “We put factors together in a structured, non-linear way, using modern data science tools. We are cautious about over-fitting data and do the combinations in a very parsimonious manner with only one variable. Fundamentals combined with investor recognition is a simple example of how combining two relatively uncorrelated forecasts likely gives a better forecast,” says Algert.

40

Some stocks’ return forecasts now contain as many as 30-40 factors, and Algert believe that non-linear blends thereof are more powerful than linear blends.

NLP (Natural Language Processing)

Having started researching Natural Language Processing (NLP) in 2011, Algert began applying it to trading in 2012. “In 2011, very little was available in the public domain, but open source software and protocols now help a firm of our size. NLP now makes up 25-30% of the risk budget, which differentiates us, according to some investment consultants,” says Algert.

Though Algert is using open source techniques, the details of its NLP analysis are proprietary. “NLP is a fascinating, multi-disciplinary, area, combining linguistics, computer science and psychology. Over the last couple of years, we have hired four experienced researchers and built proprietary, not cookie-cutter, analytics. The standard online dictionaries and academic working papers have not been helpful, so we have built and refined our own dictionaries to rank documents by importance, parsing words and sentences, considering negation. We pick up the tone, nuances and sentiment of documents, and how this changes over time, to reveal if companies are being defensive or very guarded,” says Algert. NLP and text-mining is applied to over 3,000 company conference calls each quarter in the US, conditioned in the context of fundamental data. In the US market, these insights have generated positive alpha over a multi-year period. The NLP project has gone global too. “We have steadily added non-English languages, such as Japanese,” adds Algert.

Long only small caps

Algert has two long only strategies approaching ten-year histories, which have top decile track records for periods ending June 2018, according to the eVestment Alliance database. The US Small-Cap (benchmarked against the Russell 2000) is ranked 5 out of 183 managers on a 5 year period and 17 out of 148 mangers since its inception in November 2008. The International (i.e. non-US) Small-Cap (benchmarked against the MSCI EAFE Small-Cap), is ranked 8 out of 71 managers over 5 years and 10 out of 53 managers since its inception in February 2010. While the International strategy is soft closed, the US strategies still has capacity available.

“The long only strategies are not a watered-down version of the hedge fund’s long book. They have an “active share” of 95% and use the same return forecasts as the hedge fund strategies, but have different benchmarks and objective functions, ,” says Algert. Thus, the names in Algert’s long only strategies do not perfectly overlap with the relevant geographic long books of the hedge fund strategy.

Computing power and quant talent

Quality rather than quantity of data defines Algert’s process. “We are not doing what Google would call big data – say a petabyte a week – but still use substantial amounts of data. Similarly, we are not doing high frequency trading or intraday optimisation, but still need a decent amount of computing power. The Python ecosystem is used with virtual servers and a cutting-edge storage array, with some Cloud overflow,” says Algert.

An efficient and user-friendly computing infrastructure is also essential to attract staff. The battle for quant talent is arguably more intense in technology epicentre, San Francisco, than anywhere else in the world. Algert has a close-knit team of 11 staff in investment, research and trading, seven of whom overlapped for multiple years at BGI/Blackrock. Algert has never had a voluntary departure from the investment team – bar Ryan LaFond, who was hired back in 2016 – and the firm believes there are many attractions of working at Algert. The flexible, high performance computing environment is one.

“Work/life balance is another: people have families, society needs replenishment and that needs to be balanced with our fiduciary duty. We do not encourage people to spend their whole life in the office. We allow for remote working as the Bay area commute can be tough. Bicycles can be parked in the office. We like really smart and experienced people who can get work done efficiently. Culturally, staff are respectful of each other,” says Algert.

“Algert seeks to align the results for clients to the results for the firm. The firm is wholly owned by employees. Ten of the 23 staff have equity in the company, and the other 13 participate in revenue-sharing so that everyone feels like they are part owners,” adds Bratteberg.

Models have to be sensible, and implementation is virtually 100% systematic, but is not a black box. We have to know why models are generating signals.

Dr Peter Algert, CEO and CIO, Algert Global

Discretionary intervention

Economic sensibility, scientific rigour and subjectivity are key aspects of the research process at Algert Global. However, when the research is completed and approved by the Investment Committee, Peter Algert is a strong believer in “invest it like you test it”. “Overreaction to short term events is a typical behavioural flaw we try to avoid so we make the hurdle for changes to our process and model quite high” says Algert. There are however a few situations where the investment team might intervene. These might include breaking news around litigation, significant analyst earnings revisions and corporate actions. Focusing on the latter, 80% of rules for dealing with takeovers are codified. “Corporate actions or takeovers might invalidate Algert’s models, but different approaches apply to different types of mergers. The main rule is to remove targets of cash takeovers; while stock-for-stock deals are hedged by shorting the acquirer’s stock; rumoured takeovers are sometimes ignored, and sometimes lead to exiting a position. Overall, takeovers have made a positive contribution,” says Algert.

Capacity and product range

The small and mid-cap exposure in Algert’s Global’s absolute return funds would limit capacity for managers who want to run tens of billions but is not a real constraint given Algert’s capacity intentions. Still, it is somewhat surprising that Algert runs only $2.5 billion after 15 years of attractive and differentiated alpha generation. Peter Algert is quite candid about some of the reasons. It took some time for Algert to get up to speed with the multi-year cycle of dialogue and RFP routines needed to secure the imprimatur of the investment consultants who are important for US public funds: today Algert boasts over $1 billion of assets from public funds. And culturally, Algert reckons that the extrovert and optimistic qualities needed to raise assets are the diametric opposite of those – such as humility and caution – required to manage money. Algert run one ESG strategy in a managed account, based on a specific list of excluded stocks for a client. Algert might be reluctant to take on an ESG mandate if the screens were too restrictive however, as the manager fears this could cause some decay in returns.

Daily liquidity strategy

Algert’s track record for the daily liquidity global equity market neutral strategy, which the recently launched UCITS fund, AQC – Algert Global Equity Market Neutral Fund, is based on, has just past three years with one brief gap in between vehicle closures and openings. Net returns between July 2015 and July 2018 have been around 10%, well ahead of the HFRX Equity Market Neutral index.

Algert’s liquid investment universe criteria of minimum $3 billion market capitalisation, and minimum average daily volumes of $5 million, exclude about 50% of stocks that can be traded by the offshore strategies. This translates into less exposure to small-cap names and names typically found in Emerging Markets where liquidity can be lighter. The UCITS typically has 225 stocks on each side. Algert’s research suggests that the smaller investment universe might have historically reduced the Sharpe ratio by 20% or so, but thus far the liquid strategy has actually outperformed because large caps and mid-caps happen to have generated more alpha over the periods since it was launched.

Execution and costs

Algert believes it is distinguished by average holding periods of between 6-12 months, which are multiples longer than many quantitative funds and certainly much longer than statistical arbitrage approaches. This is partly due to Algert’s belief that longer-term signals are more stable and less susceptible to decay, than are shorter term signals. “Our perspective is that accounting, valuation and our NLP insights matter more over longer horizons,” says Algert.

In addition, Algert does not expect to have a competitive edge over shorter periods. “Over seconds, minutes, hours or days, it is harder to compete with giants who have bigger infrastructure. We cannot compete on latency and cannot compete with those quantitative managers that basically have their own stock exchange,” says Algert. Nonetheless, Algert still spends time and attention on execution, meeting brokers to discuss algorithms, which are used to place about 98% of its order flow. Peter Algert’s PhD thesis was in market microstructure, and the firm continues to study it fastidiously to improve implementation of its strategy.

Looking forward, Algert will continue to expand its investment universe, gather data from new sources, and develop its novel analytical techniques, in the quest for its unique streams of alpha. “While our investment philosophy remains constant, we have historically seen about 10-15% turnover in our models per annum, and we would expect about the same on a go-forward basis; markets evolve and we must evolve with it,” ends Peter Algert.

The best of both worlds: Aquila Group’s AIFM and UCITS platform

Aquila Capital, which was founded in 2001, has dedicated staff responsible for areas including risk management, legal and compliance, administration, client relationships, investor relations, investment operations, trade execution and risk management. Drilling down into the detail of these areas reveals how much work and expertise is required. Legal and compliance involves prospectuses, contracts and contract management. Product administration entails various regulatory reporting deadlines and shadow NAV calculations. Trading administration includes capital calls, complaints and other administration. Investment compliance and operations may involve pre-trade compliance, eligibility criteria, regulatory strategy, order management, trade reconciliations, broker set up, EMIR trade reporting and clearing. Sales operations provides data to providers and platforms and helps with NDA and KYC routines. Risk management includes oversight, reporting, consulting, customised risk and portfolio reviews. Investor relations includes marketing, RFPs, DDQs, competitor analysis and client reporting.

Aquila’s client advisory network is global. Corporate communications promote managers through international PR, marketing and graphic design.

Aquila Capital is versatile enough to accommodate a variety of fund structures, including AIFs and UCITS. Aquila Capital has operations mainly at its Hamburg headquarters and legal structures in Luxembourg (Alceda Fund Management). Aquila Capital are strong advocates of Luxembourg as a domicile and Aquila Capital’s Manfred Schraepler, who has worked in Luxembourg in previous jobs, contributed an article to The Hedge Fund Journal in December 2016, entitled ‘Luxembourg – The Better Compromise. The case for the Grand Duchy’.

A taste of Aquila Group’s UCITS selection criteria

Aquila Capital believes that UCITS is an attractive distribution route for many managers wishing to diversify their investor base. UCITS is particularly appealing for US managers who may find that other distribution avenues, such as the AIFMD passport, national private placement regimes (NPPRs), and reverse solicitation, can be more onerous. UCITS can be distributed via the UCITS passport and/or NPPRs, which Aquila Capital are experienced at obtaining from national regulators. But Aquila Capital is not seeking to persuade every manager to set up a UCITS. “We want to ensure an easy fit into UCITS without sacrificing performance and have developed a quantitative and qualitative scoring model that includes other criteria,” explains Schraepler. A pattern of stable, through-the-cycle returns, based on a theoretically and empirically plausible, transparent and repeatable, process, is sought. The total expense ratio or ongoing charge ratio of the fund should also be acceptable. Operational due diligence (ODD) hurdles also need to be surmounted. ODD is carried out by an independent, external consultant, looking at issues including operations, legal matters, accounts, business stability, business recovery, and strong service providers.

This year Aquila has strengthened its UCITS alternative offering, with the launch of an equity market neutral fund (AQC1 SICAV – Algert Global Equity Market Neutral), and a CTA (AC – Adaptive Trends) on its Alceda platform.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical