The Hedge Fund Journal first highlighted Aspect Systematic Global Macro (ASGM) in our 2017 feature celebrating the 20th anniversary of Aspect Capital, which runs $7.6 billion and belongs to The Hedge Fund Journal’s Europe 50 ranking. Now it is opportune to revisit the evolving strategy and take stock of new developments. ASGM has grown assets to $150 million, including a recently launched UCITS. ASGM is performing well, up 8.4% (net of fees) in the first half of 2018, and is demonstrating its differentiated return profile.

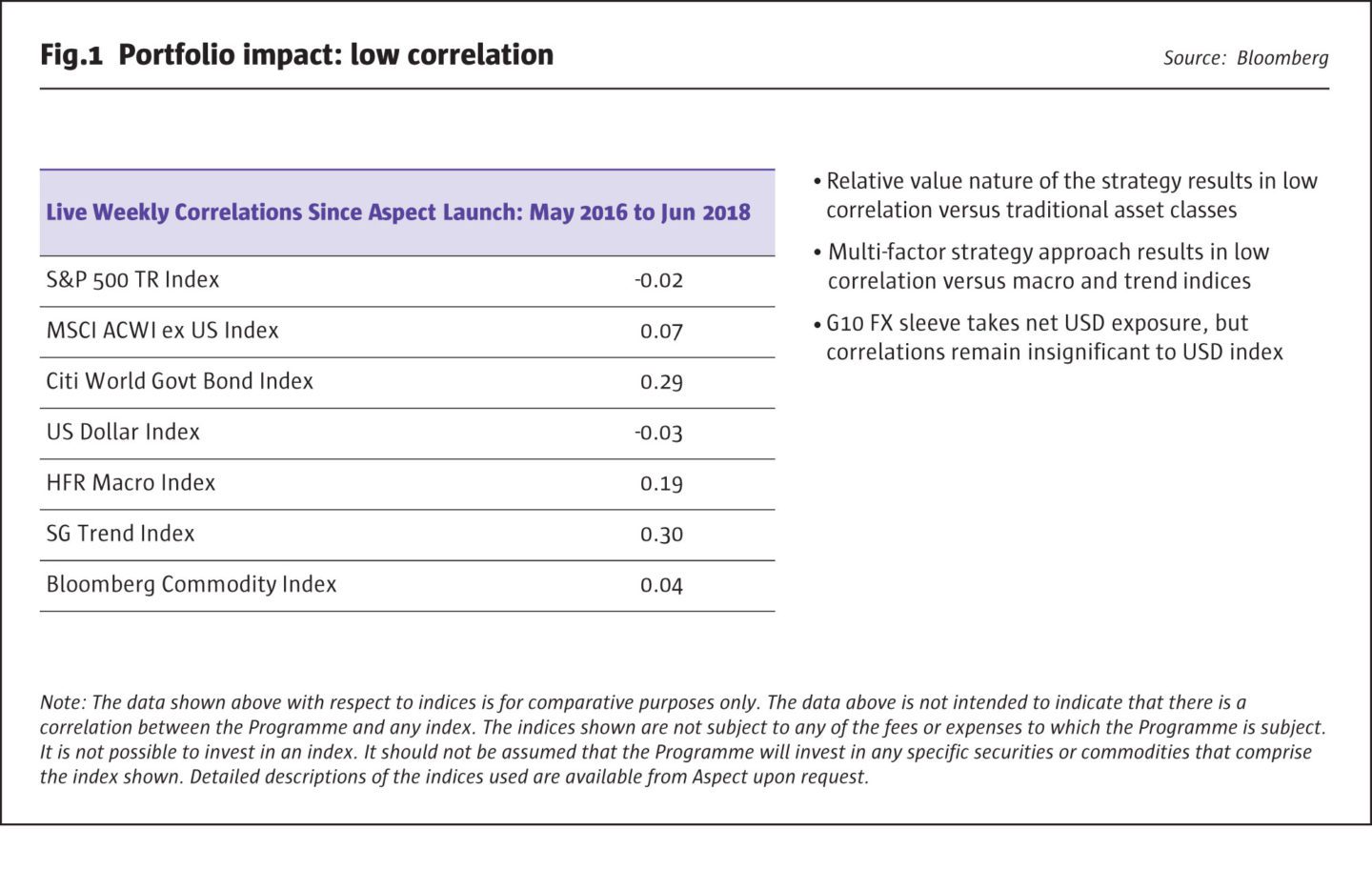

ASGM was always intended to be very lowly correlated to traditional trend-following CTAs. Over 90% of ASGM signals are based on non-price or macro fundamental data, whereas traditional trend followers use price or technical data – and trade commodities, which ASGM does not. ASGM is also un-correlated to other systematic macro managers that use fundamental data, judging by the SG Macro Trading Index (Quantitative). ASGM has as well shown no meaningful correlation to discretionary macro managers and does not have the hard-wired long currency carry trade bias that has caused losses for some strategies in 2018.

ASGM also aims to avoid correlation to conventional asset classes, such as bonds and equities, and the strategy, including the managers’ previous track record at Auriel dating back to 2004, has delivered minimal equity and bond correlations, says co-portfolio manager, Anoosh Lachin. ASGM has had a 0.3 correlation to bonds since Aspect hired the Auriel team and re-launched it in May 2016, partly because its relative value trades have tended to have long exposure to the US and European bonds that dominate bond indices.

(L-R): Asif Noor, Portfolio Manager; Anoosh Lachin, Portfolio Manager.

Over the past year, five inter-related ASGM developments have been: broadening the investment universe; adding and deleting models; accelerating trading speeds; proving the value of factor timing in risk-off regimes; and increasing use of alternative data. The latter is emphasised not only because it is fashionable, but also as Aspect’s approach is rather distinctive.

Investment universe and models

ASGM still has 13 macro themes and has introduced a 20% risk weighting in equity indices (in US, Canada, UK, Europe, Hong Kong, Japan, Korea and Australia) as an asset class. “Equities provided diversification, as they have near zero correlation to the existing asset classes of fixed income, currencies and emerging currencies,” explains co-PM, Anoosh Lachin.

The composition and expansion of ASGM’s investment universe is partly constrained by market liquidity and transaction cost considerations. Sovereign bond futures (with the largest risk weighting of 42%) are traded, on a mainly relative value basis, in eight countries: US, Canada, Japan, Australia, UK, Germany, France and Italy. But the two-year versus 10-year yield curve slope is only pursued in three of these countries, Australia, Germany and the US, where Aspect finds enough liquidity at both maturities. Similarly, only the US VIX future, which has an average risk weighting of 5%, is liquid enough. “It is ten times more liquid than the European VSTOXX, which is itself more liquid than the VDAX,” says co-PM, Asif Noor.

ASGM is by no means restricted to futures however. Currency forwards, which have a risk weighting of 33%, are traded in G10 countries, and seven emerging markets: Brazil, Mexico, Hungary, Poland, Turkey, Korea, and South Africa.

The addition of other over the counter (OTC) markets – interest rate swaps – to ASGM remains a long-term goal, mainly to access emerging markets interest rates that lack liquid (or any) futures markets. This has been delayed because fixed transaction costs result in a minimum trade ticket size that is too high for ASGM’s current level of assets. Some of Aspect’s larger programmes, such as the $4 billion Aspect Diversified, are trading rate swaps, and Aspect Alternative Markets trades many more OTC markets.

Adding and deleting models

Three new models are now trading equity index futures, at higher speeds than ASGM’s fixed income models. Currencies have seen some switches of models. In G10 currencies, a traditional macro indicator has been replaced by one more based on alternative datasets. In EM FX, a slower-moving, price-based model has been dropped, and a faster-moving, option-based model, has been added.

Accelerating trading speeds

The faster equity and currency models are one reason for shorter holding periods. Another is that new and alternative datasets, such as survey data and macro data, are working more swiftly. Trades are now placed twice a day, up from once a day. For instance, equity trades are initiated before Asian markets open, and the second batch of trades are placed during the European trading day. Aspect has a trading desk available, 24 hours a day.

The general trend of increasing the tempo of trading pre-dates these new models and data inputs however. Trading speeds have been steadily rising since the programme started in 2004; the average holding period has dropped by just over a day per year, from 45 to approximately 25 days.

Timing factors and dodging risk-off phases

ASGM normally has exposure to all asset classes and markets (bar the implied volatility calendar spreads, where exposure is more opportunistic) but is timing factor exposures. “Factor timing is mainly done for risk management reasons, and applies more to the slower models. The longer holding period models, which have lower information coefficients and worse hit rates, may not spot a world economic meltdown,” explains Noor.

ASGM have been factor timing for about ten years at Auriel, including in 2008. It takes three forms. “Regime conditioning, intra-model, is present in most models, to determine if the market regime is conducive to a particular asset class or country, based on external factors such as interest rates, inflation, sovereign risk or volatility,” says Noor. For instance, in 2018, a sovereign risk indicator helped to remove exposure to the Turkish Lira ahead of a sharp drop.

“Two other types of risk filters switch off individual models, or groups of models, depending on risk appetite. This is more about chopping off the left tail of the distribution,” he adds. They aim to avoid currency carry trade corrections. The risk filters throw up false alarms about 70-80% of the time, but transaction costs in currencies are so small that the models are able to rapidly re-enter markets, usually within a few days.

“When the risk filters get it right, such as in February 2018, then they really pay off by avoiding losses. Their alpha-adding capability is around 25%,” says Noor.

When the risk filters get it right, such as in February 2018, then they really pay off by avoiding losses. Their alpha-adding capability is around 25%.

Asif Noor, Portfolio Manager

Alternative data

ASGM’s multi-factor approach, including valuation, sentiment and technical models – which vary by asset class – can use traditional or alternative data, or both.

Currently, approximately 80% of Aspect’s data is traditional and 20% alternative, but going forward, the share of alternative data is likely to grow as it makes up over half of future research projects. Less than half of the items on ASGM’s mid-2018 research agenda involve traditional data which include equity valuation models, more work on timing factors and expanding the fixed income investment universe to include swaps, as aforementioned.

The rest of the research projects involve what Aspect terms alternative data: macro-survey based indicators for EM FX; bank liquidity indicators; utilisation of NLP algorithms across various spectrums to build sentiment indicators across the asset classes.

Aspect began investigating alternative data 18 months ago. Aspect’s 80 strong research and development team includes a data team of data scouts, including some PhD students, who look for interesting datasets to discuss within alternative data groups. This is a centrally managed cross-departmental effort to triage alternative data for multiple teams and avoid duplication of effort. The group includes Aspect’s short-term trading strategy, the Aspect Tactical Opportunities Programme (ATOP), run by Dr Constantin Filitti. But Aspect’s medium term, price-based trend following strategies, are not expected to participate and nor is Aspect’s alternative markets strategy, which also uses traditional trend following models to trade alternative markets.

UCITS structuring

The UCITS, launched in June 2018, is currently the only fund structure for ASGM. As far as the investment strategy is concerned, the UCITS provides full access to the models and markets traded by ASGM. So UCITS investment restrictions do not cause any “tracking error” issues.

UCITS cost issues should be a source of only very marginal performance divergence, partly because costs are capped. “The ongoing charges for the Aspect Systematic Global Macro fund are capped at 1.30% per annum (including the annual management fee of 1%) for the first year or until the fund’s AUM reaches $100m, if earlier. Aspect caps total expense ratios when new funds are small, for the benefit of investors, track records, and growth,” says Christopher Reeve, Director of Investment Solutions.

At current assets of $12 million, the UCITS has an expense ratio perhaps 10-20 basis points higher than an offshore fund would have, though this will fall as assets grow.

Rather than using a third party UCITS platform, Aspect has its own platform. The ASGM UCITS structuring cost is slightly lower than on Aspect’s other UCITS sub-fund, Diversified Trends, which launched in December 2010 because a smaller proportion of the book requires structuring. This is not due to leverage: both are “sophisticated” UCITS with VaR limits, rather than the leverage limits applying to a “simple” UCITS. “It is the UCITS issuer limits that require structuring for ASGM. Specifically, the UCITS rule specifying a 35% cap on exposure to any one issuer (unless it is diversified over six or more underlying issues) would constrain ASGM model exposures to markets such as ten-year government bond futures, which are treated as one issue. Hence, a certificate issued by an SPV is used to obtain exposure to some fixed income futures markets. Morgan Stanley acts as a liquidity provider for the certificates,” explains Reeve.

Hypothesis-driven research

Alternative data is new but does not change the philosophical basis of Aspect’s research process. “We remain very much hypothesis-driven, rather than machine-driven, which rules out unsupervised learning. Transparency is key, but hypotheses can be very eclectic and are not restricted to academic journals, newspapers and so on,” says Noor.

Discretionary judgement – rather than algorithms – also helps to determine which models are used. “Adding or deleting models is the most qualitative decision that Aspect is likely to make, based on their properties, and correlations to other models. We may reject models with a good back-test if they do not have broad based application,” he adds.

Alternative data is proving a fruitful research avenue. “The team are excited about the potential to use alternative data in macro strategies, including in slower-moving strategies such as carry, trend and value. Alternative macro data indicators, including data releases and revisions, are having a quite significant impact on performance, for both alpha and correlation,” says Lachin. Aspect expects alternative data models to generate several percentage points of alpha per year, and more as time goes by.

But alternative data is not a silver bullet solution by any means. Just as our interview in late 2017 pointed out how Aspect does not expect its alternative markets to generate stronger trends than traditional markets over time, Aspect does not envisage alternative data being a more productive or predictive raw material for research than traditional data. However, there is a wider breath of orthogonal datasets to investigate which may lead to better quality uncorrelated alpha models. “The hit rate for both is that about one in twelve research prototype models turn out to be successful. Alternative data is not more informative, and hypotheses do not always work. There may even be more risk of over-fitting and noise clouding out signals,” observes Noor.

Alternative data also exhibits a similar “alpha decay” trajectory to traditional data. Noor draws an analogy from equity futures models. “20 years ago, one of the first models we used was earnings yield in equity futures or PE ratios. This was very easy and simple, and it worked well at the start. We then moved to weekly data, then sector-adjusted data, then forward-looking earnings yields. To stay ahead of the curve, we have to keep evolving and researching models. The same applies to alternative data and this is consistent with everything else we do”.

8.4%

ASGM is up 8.4% (net of fees) in the first half of 2018

Data vendors

Buzzwords and techniques such as artificial intelligence, machine learning, deep learning/neural networks, cognitive computing, natural language processing (NLP), Big Data, and unstructured data, are all potentially used by Aspect’s data vendors. Aspect is increasingly tending to rent space in the cloud for its research data needs, but not yet for live trading.

Nonetheless, most data vendors provide long histories of trial data for testing, and Aspect spends much energy testing datasets, before deciding whether to buy them. ASGM also needs long enough data histories to test the data. Costs of data are rising – for both traditional and alternative types, as exchanges, index providers, and licenses cash in on the growing appetite for data.

As a relative value macro strategy, ASGM has special data needs that differ from those of strategies trading single corporate securities. “ASGM needs data to be cross-region, which can rule out US-centric data. Any data such as on credit card or bank account transactions would need to be aggregated up to the macro level to be useful,” points out Lachin.

Aspect expect their competitive edge to come through how they interpret and combine the data, rather than from sourcing unique data. It is very unlikely that Aspect would bind a data supplier to exclusivity. In fact, being offered data on an exclusive basis might even be a red flag. “We would be cautious and sceptical of data that is so good, its value is intrinsic rather than being based on any skill applied to it,” says Noor. Additionally, Aspect would fear that extraordinarily predictive data is more susceptible to decay. They would as well be suspicious that secret data might be of potentially dubious legality.

Dynamic currency hedging

Currency is a risk factor that global investors cannot avoid and can contribute a significant proportion of volatility risk for global equity portfolios – yet it is often neglected. Aspect are of the opinion that the extremes of ignoring currency risk, or hedging 100% of currency risk, are sub-optimal, as are fixed hedge ratios such as hedging 50% of currency risk, which can also consume substantial cashflows. Aspect has confidence in the predictive power of their models and find that their dynamic currency hedging strategies may not add any incremental volatility risk to a portfolio. Noor and Lachin have been running currency overlays for about 15 years since their Auriel days.

Aspect’s currency overlay strategy – managing around $1.8 billion in dynamic currency hedging – is a customised carve out of ASGM. It uses the same alpha models as the G10 and EM currency part of ASGM but is constrained by the client’s currency exposures and hedge ratio tolerances in addition to the objective of outperforming clients’ customised benchmarks, risk tolerances and so on. The objective is to both hedge and mitigate some currency exposures and add alpha through the currency markets. Aspect and clients work out what the FX exposures are, and how to tailor a bespoke solution that can include a mix of passive hedging and active currency management that is intended to be negatively correlated to the client’s benchmark, thus reducing overall portfolio risk.

Investor attitudes to it vary by region based partly on perceptions of how local currencies will perform in a risk off climate. “For instance, US investors pay more attention to currency risk partly because the US dollar has historically appreciated during risk aversion phases. In contrast, Australian investors are more likely to leave foreign currency risk unhedged, as the Australian dollar has historically depreciated during risk off periods,” says Reeve.

This diversification objective has nearly always been attained, as ASGM has generally been positive when stock-markets were negative. As with ASGM, the currency overlay strategy is based on multiple factors, with minimal momentum exposure, and so it is very lowly correlated to traditional, trend following CTAs. For instance, since 2016, ASGM has traded sterling from the long and short sides. The strategy was short of the pound, going into the Brexit vote, and later went long.

Fees for dynamic currency hedging can be little more than on passive currency hedging mandates, which Aspect also offer as part of a solution. The smallest ticket size is partly a function of the volatility target and is probably around $200 million. Aspect is developing a good dialogue with investment consultants about the offering.

KYV: Legal Issues for Alternative Data

In addition to KYC (Know Your Customer), hedge fund managers now need to do KYV (Know Your Vendor) when buying data. “The three main legal issues in alternative data are privacy, copyright and insider trading laws,” says Aspect General Counsel, Jonathan Greenwold.

Privacy

“On privacy, Aspect would in particular want comfort that vendors have sourced data in compliance with GDPR, where subjects need to have provided explicit consent for use of the data – even if it is anonymised. For instance, Cambridge Analytica’s use of Facebook data would not be compliant in a post-GDPR world unless the users had given their explicit consent to how their data was to be used, even on an anonymised basis.” he says. “In the US, data and privacy rules vary by states and sectors,” he adds.

Anonymising data is necessary but not sufficient. As a minimum, “data needs to have been anonymised, and received without any PII (Personally Identifiable Information) or other information which could be reverse engineered to identify individuals,” explains Greenwold.

“There is more likely to be a privacy issue with web-scraping than with financial forecasts that have been published for general consumption. But web-scraping is also nuanced – if no personal data is used, it is more likely to be consistent with what customers have consented to,” he adds.

Copyright

“Sentiment data based on public officials’ speeches and other public comments is more likely to be compliant, whereas that derived from blogs and articles might run into copyright issues,” he goes on. “Copyright issues need to be dealt with by ensuring that either the data is copyright-free, or that providers have given their consent to use it,” Greenwold says.

Insider trading

“Insider trading laws differ between the US and UK. In the US, insider trading is only a crime if data has been misappropriated, and not if there is consent. In the UK and Europe, the rules are more stringent, so it does not matter if the data has been misappropriated or not,” Greenwold explains.

An example of the US approach arose in a recent case concerning credit card data. “Employees of Capital One were using credit card data to predict stock price moves. The court did not accept their argument that the data was not material enough to predict share price moves, and moreover, the data was being used without the consent of the bank or the credit card users,” Greenwold points out.

Aspect’s audit trail process for data depends on where it lies on a risk matrix. “We would evaluate a data set’s risk profile in light of the number and type of potential concerns opposite each of copyright, privacy and insider dealing. Data higher up the risk matrix would be less likely to be used and, if used, would be subject to a more extensive audit trail that is refreshed more often,” says Greenwold.

Liability

Though data vendors may try to disclaim liability (as well as responsibility for provenance and accuracy!) in their data supply agreements, Greenwold is of the opinion that both suppliers and buyers of data could be liable for misuse of inside information, regardless of the contractual terms. “For example, a vendor who has not obtained appropriate consent could run into GDPR issues with the individuals supplying the data regardless of whether the vendor has disclaimed liability opposite the purchasers of the data.”

But the bottom line is that “if your principal concern with a data set is how liability for misuse is going to be shared between you as buyer and your vendor, then it is probably a data set you don’t want”, he says.

Evolving regulations

Regulation is nascent or non-existent in some areas of alternative data. In some cases, new data interacts with old regulations, not written with alternative data in mind such as the case above on how to evaluate if credit card data is material, as it takes time for regulations to catch up. In this situation, Greenwold would resort to a common-sense smell test of asking if the data provides a legitimate edge. Where data is sold exclusively, or is very expensive, or both, that is another red flag.

“Satellites and drones are an area without much regulation yet. For some US states, drones would need to be visible for data they collect to be compliant,” he illustrates.

Greenwold has not yet been in any situation where he has had to exercise a veto over the use of data, partly because the data scouts are already filtering out a lot, based on their concerns.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical