BlueBay’s “DNA lies in its hedge fund heritage” was repeated throughout the day when The Hedge Fund Journal visited the London headquarters of Europe 50 manager BlueBay and interviewed its hedge fund team. Founded in 2001, the firm was one of Europe’s first specialist credit asset managers. Actively managed, long-only strategies run alongside its hedge funds, with a hedge fund-style toolkit applied to long-only products from inception (the firm was among the first to gain approval to use credit default swaps in its UCITS funds). This means the firm can offer, for each sub-asset class of credit, products along the management style continuum, from active long-only (benchmark-aware) to total return and hedge funds – something which other firms are perhaps only now trying to emulate.

BlueBay’s success is remarkable, with AUM nearing $60 billion in 14 years. Nevertheless, growth has always been measured. “We are not asset gatherers,” says CEO Alex Khein. “We don’t launch new products unless there is a natural fit with our skillset and specialisation and there is a clear client need.”

As a next-generation fixed income manager, BlueBay’s active management and absolute return ethos percolates across the business, with investment teams blending skillsets to exploit all factors of return within its fixed income asset classes, a trait inherent since the beginning. “Our hedge fund mentality is evinced by an absolute return mind-set and strong focus on capital preservation,” says Khein.

Institutional stability

The BlueBay platform gives its managers the ability to maintain a strict focus on running their strategies. “This approach enables our absolute return strategies to draw upon significant resources and benefit from the cross-fertilisation of ideas, yet remain small, nimble and focused to operate in all market conditions,” observes alternatives strategy director, Ameneh Ziai.

Portfolio manager Rodrigo da Fonseca, who manages the Emerging Market Opportunity strategies alongside co-CIO, David Dowsett, explains how a collaborative approach applies to their investment decisions: “We can draw on a very diverse opportunity set, both on the long and short side and utilise the broader EM team’s expert analysis to action focused views”, although Dowsett and da Fonseca are the ultimate decision-makers.

Three out of the four desks run active long-only strategies alongside their alternative strategies. BlueBay’s scale and market presence gives the hedge fund strategies access to issuers and policy-makers, as well as strong counterparty relationships that may be unavailable to some smaller firms, which are reportedly experiencing deteriorating terms of business from some counterparties. “The emerging market corporate universe did not exist as a standalone asset class before 2000, and there are very few dedicated players as it is expensive to build a team, but we have the luxury of drawing upon our large pool of EM experts,” says Polina Kurdyavko, manager of the Emerging Market Corporate Alpha strategy. She also runs $4.5 billion of EM corporate debt on the long-only side, which “gives us an enhanced ability to access EM credit, given our presence and reputation in the market.”

“The access to credit expertise and markets is not the only benefit of being part of a broader organisation,” argues Ziai, who also highlights that “the support of the wider infrastructure is an integral advantage for our hedge fund strategies. We have firmly established systems, such as risk management, legal and compliance that are all essential, yet expensive, requirements for running a viable fund”.

A proactive risk monitoring process is strictly embedded within BlueBay’s framework. The risk function is “completely independent, but has strong interaction with portfolio managers,” says head of investment risk, Jean-Philippe Blua. He believes close dialogue with the PMs should mean they are pre-emptively made aware of potential risks in their portfolio and therefore ensure these risks (market, liquidity & counterparty) are more appropriately managed.

Tools of the trade

As hedge funds have at their disposal a wide menu of instruments for expressing views, including Non-Deliverable Forwards, Total Return Swaps, Interest Rates Swaps (IRSs), Credit Default Swaps (CDS) and Credit-Linked Notes, as well as cash bonds, portfolio managers are able to pinpoint the precise view they wish to express. This might be an interest rate view without currency risk (via IRS), or a credit spread view without interest rate risk (via CDS), or indeed any combination of positive or negative views on currency, interest rate and credit risk. Cayman, Luxembourg SIF and Delaware vehicles are examples of fund structures that afford sufficient flexibility to pursue the hedge fund strategies.

The alternative strategies do have the freedom to employ leverage, and in theory the EM Corporate Alpha strategy, for instance, could reach 400% net long, but in practice it has not exceeded 150%. “Levered carry is a recipe for disaster,” says Kurdyavko.

The alternative strategies do have the freedom to employ leverage, and in theory the EM Corporate Alpha strategy, for instance, could reach 400% net long, but in practice it has not exceeded 150%. “Levered carry is a recipe for disaster,” says Kurdyavko.

BlueBay has always been innovative in its product development and has been investing in emerging market corporate debt since 2002. In keeping with this theme, in 2007 Kurdyavko saw early-mover advantage in launching a dedicated Emerging Market Corporate Alpha strategy focused on the asset class to capitalise on dispersion and volatility.

EM corporate debt is, at circa $1.7 trillion, an enormous market, bigger than US high-yield and nearly half the size of US investment-grade, yet ironically Kurdyavko believes the asset class is not on the radar of many managers, and remains largely underinvested.

Kurdyavko co-manages the strategy with portfolio manager, Anthony Kettle. Their focus is to generate alpha across all points of the credit cycle by identifying inefficiencies and mispricings via multiple sources across six books. The short book was their best play in 2014, and that contributed to over half the strategy’s return. Kurdyavko finds that the risk/reward profile of shorting cash credit is very asymmetric, as “the average cash price of a bond is 99 cents on the dollar, but the average recovery is only 20 cents.” Short book themes have included Chinese real estate, Indonesian coal, oil producers, and oil services names in China and Mexico.

Liquidity is important for both longs and shorts, but can be more critical for shorts. Many hedge fund managers find that their short investment universe tends to define a smaller universe than their long books, often because the pool of borrowable securities, or those with CDS markets, is much smaller than the total asset class. An acid test of a hedge fund manager is arguably whether they can consistently generate positive returns from shorts.

Advantage from crisis

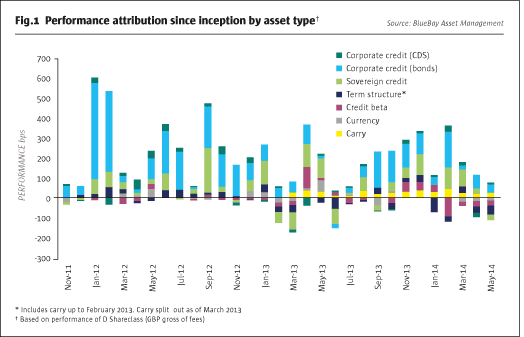

Kurdyavko’s highest-conviction shorts in 2014 were Ukrainian banks, which she viewed as “insolvent in the first place”. The National Bank of Ukraine bestowed a gift upon short sellers by asking the banks not to repay US dollar liabilities, and short positions saw prices crash from the 90s to the 40s; ballooning credit spreads are shown in Fig.1. This is far from the first time Kurdyavko has been on the winning side of an EM banking crisis. Her biggest trade in 2008-2009 was shorting Kazakh banks. In both Ukraine and Kazakhstan, depositors were protected and made whole, which in effect pushes bondholders further down the waterfall, making the short more attractive. Even so, with a 10% coupon on the Ukrainian debt, the timing mattered due to an expensive cost of carry.

The team is also starting to find opportunities on the long side. Some 10% of the universe trades below 80 cents on the dollar, and this is the highest proportion in 10 years. “Distressed names trading around 40-50 cents will either return to par or go through restructuring,” predicts Kurdyavko. She has experience of the EM debt work-out process, which in 80% of cases involves restructurings out of court to put companies on a more sustainable footing. One important consideration that BlueBay makes in these situations is whether interests of creditors are aligned with those of shareholders.

A flexible approach to EM sovereign debt

Dowsett and da Fonseca run two sovereign-focused emerging market alternative strategies. The Emerging Market Opportunity strategy was their first foray using an unconstrained approach to the asset class, where they could showcase their best ideas. Thereafter they launched a second, Cayman vehicle which facilities even greater flexibility.

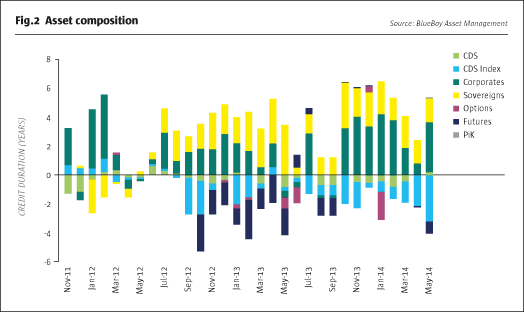

This flexibility has become particularly important in EM where interest rates have decoupled from currencies (see Fig.2) because the two markets now have different drivers.

“Historically, when EM countries had a dearth of currency reserves, they were forced to raise rates in response to currency sell-offs,” explains Dowsett. “Now that many EM countries have abundant forex reserves they have the latitude to pursue a more traditional developed market policy response and cut interest rates in response to slower growth and weaker currencies.” So rallying hard currency debt can go hand in hand with weakening emerging currencies – and BlueBay’s absolute return strategies could profit from both moves.

Dowsett believes EM currencies could overshoot on the downside, and expects this to happen when the Federal Reserve starts hiking rates. When that happens is debated within the firm. Dowsett sees rates moving off a zero bound this year, but he will not call the trough in EM currencies until he sees exports picking up or other key trends.

Cautious yet constructive

The EM team’s central investment view in early 2015 was simply that sovereign hard currency debt was the best asset class to own in a world of strong US dollars and weak economic growth where investors are searching for yield. The EM Opportunity strategies are primarily invested in investment-grade sovereigns to reflect this cautious outlook, emphasising the lower-beta, less volatile part of the investment universe. BlueBay is constructive on EM sovereign debt partly due to a favourable supply/demand balance, and foresees contracting supply as new issuance falls short of maturities, leading to small net redemptions by sovereign issuers. “This is a strong anchor for the asset class,” asserts Dowsett, though he is still selective about which sovereigns to own.

Another core theme earlier this year was that ECB action was helping Eastern European sovereign bond yields to converge towards those in Western Europe. “Given how low interest rates are, the 230 basis point pick-up on Croatian debt was significant,” illustrates Dowsett. The long-only funds might express this view by owning cash bonds of Croatia, Latvia or Slovenia, which include some interest rate duration risk, whereas the hedge funds could use a total return swap or credit default swap to isolate the country-specific credit spread and strip out the interest rate risk.

Dowsett and da Fonseca’s strategies have been net short at times, including in 2008, and BlueBay’s EM team has a long history of dodging sovereign default bullets, having exited Argentina, Russia and Ecuador many months – or in some cases years – before they defaulted. BlueBay has been short the Ukrainian hryvnia currency but, in a clear illustration of why hedge funds should not be too big, liquidity criteria did not permit them to put the trade on in large size. BlueBay has also been short Russian and Ukrainian sovereign debt and that of other oil producers including Iraq, and Trinidad and Tobago.

Credit dispersion, asymmetry and volatility

While the oil price crash hurt EM countries, it has helped fundamental traders such as Geraud Charpin and his Credit Alpha Long Short strategy, as it throws into sharp relief the difference between firms that can make a profit at an oil price of 20 dollars and those that will still be losing money at 80 dollars. “The oil sector has been a particularly ripe source of ideas because it went from one extreme to the other,” says Charpin. Oil made up such a high proportion of US high-yield that benchmark-conscious investors were all crowded into the space, leading to short trades where Charpin drew on the bench of corporate expertise within BlueBay.

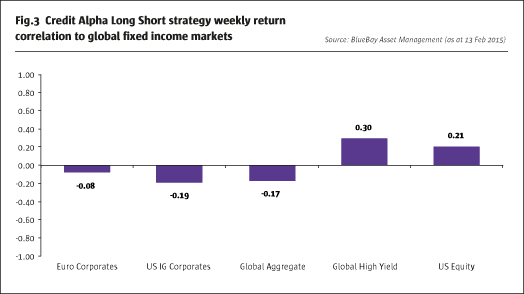

Charpin’s strategy does not rely on carry, and is uncorrelated with global fixed income markets, as shown in Fig.3. Instead, Charpin looks for price movement, seeking to exploit credit dispersion, asymmetry and volatility in the market. Charpin draws on the resourcing of the wider team, so he can have a broader set of investment ideas. They use bottom-up, fundamental analysis to identify directional and relative value opportunities across the universe. “I also need to be flexible in trading so I easily can move in and out of positions,” adds Charpin.

Momentum and shorter-term trades are utilised to enhance performance, with an emphasis on capital preservation and remaining liquid. “A focus on price movement rather than yield/carry, and access to an unconstrained set of instruments, helps me ensure the strategy is well positioned to deliver returns throughout the credit cycle, without an embedded directional bias,” explains Charpin.

A diverse opportunity set

Charpin’s mandate is broad enough to cross over into the emerging markets universe, although his trades can be structured differently to those in the EM strategies. In his European canvas, Charpin has been playing the QE trade from many angles, buying non-core sovereigns, bank hybrids and subordinated bank debt. After flat performance in 2014, everything is working in 2015, with profits coming from corporate credit, sovereign debt (including in Central and Eastern Europe) bank paper, rates and currencies. “The market is starting to look at value and we have been on the right side of spread compression,” he says. “Individual stories are working as the market focuses on recovery stories,” such as a bank where Charpin briefly owned the tier 2 debt. However, just before the bank got in trouble he switched into the senior paper. The situation escalated and the subordinated debt became worthless. He has kept hold of the senior paper to participate in the recovery story.

Yet sometimes Charpin is happy to take a more technical view. “We have owned bank capital, mostly because regulatory changes are creating plenty of supply for a new asset class with a new and growing investor base – as tier 1 paper offered great value relative to negative Bund yields.” As the asset class matures Charpin envisages more differentiated price action, but correlations have been so high he has been happy to make the beta bet. However, these positions have been a tactical and temporary stance without any structural long bias: as Fig.3 highlights, Charpin’s strategy has had no meaningful correlation to conventional asset classes, and comparably low correlations are seen in the EM and event driven strategies.

Going forward Charpin has an abundance of ideas. Just as Kurdyavko is seeing more value in EM corporates, Charpin is getting more constructive on US high-yield, which has underperformed European credit due to energy exposure and fears of rate rises. The corporate landscape is changing as growth shifts from EM to developed markets, and Charpin sees no sign of the M&A boom abating. Further out Charpin is, like all of the other managers, looking for greater dispersion. He is “longing for the removal of macro overhang, which should give way to more differentiation.”

Capturing mispricing in leveraged finance

Anthony Robertson’s Event Driven Credit strategy (as profiled in The Hedge Fund Journal in January 2015), seeks to capitalise on the temporary mispricing of risk by investing in a combination of opportunistic and stressed situations, as well as select restructuring/distressed opportunities with a clear path to exit. “The sell-down of non-core and problem loans by European banks accelerated during the second half of 2014, adding to an already ripe opportunity set for situational credit investing,” says Robertson. Prospective investments in the strategy are sourced through the large proprietary network established by the team, in conjunction with robust, independent risk oversight.

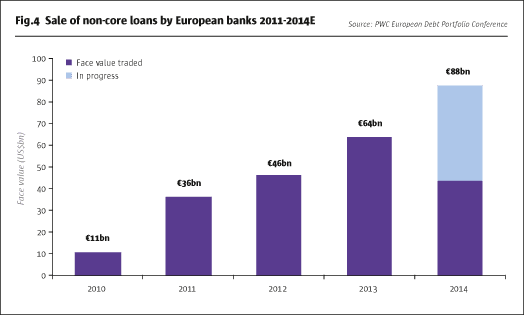

Growing differentiation in the credit world allowed his strategy to start fulfilling its real potential in 2014, which was the toughest year since 2011 for many traditional credit investors, but the best year so far for his strategy, which was the top-performing fixed income long/short credit fund for the 12 months to March 2015, according to the Barclayhedge rankings. In 2015 The Hedge Fund Journal profiled how BlueBay had decided to re-open the strategy to external capital. Already Robertson is delighted by subsequent interest in the strategy and his team are busy analysing new issues, restructurings, refinancings, bond and loan auctions and bank sales of loan books. Although banks have already divested hundreds of billions of loans they have at least another trillion to get rid of, according to a PwC report, and the volume of sales has been ramping up for several years now (see Fig.4). Robertson sees a runway of opportunity stretching out for three to six years, and asserts that “there will be a wholesale shake-out in credit markets that will lead to the next distressed cycle.”

Robertson, like Charpin, also found opportunities in the energy sector were helpful for the short book, which started bearing fruit in 2014. Robertson points out how heavy issuance is growing the weight of senior claims, and increasing the implicit leverage of the junior debt, rendering recovery rates on the subordinated paper much lower. “Unsecured debt with limited covenant protection is a very precarious trade to be long in,” he warns, but the deteriorating quality is ideal for short sellers. Although Robertson has steadily increased his short book to 19% of the strategy as of April, he and his team are still finding more and better opportunities on the long side.

In contrast to his peers, Robertson tends to avoid emerging markets as he feels more comfortable withthe legal process in many developed markets.

Where next?

Where is BlueBay’s alternatives business heading? “BlueBay has no overall firm-level target for assets, as the focus is more on achieving performance and thoughtful capacity management,” explains Khein. There is also no pressure to provide comprehensive coverage of all fixed income asset classes and strategies, although “these are areas of potential sub-asset class extensions in future years.” Asset-backed securities, including non-agency mortgages, real estate debt, structured credit, and infrastructure debt are not invested in at present. “We do not push product launches, but rather focus on what we believe is relevant to our clients in the current and anticipated market climate,” he underscores. This is echoed by Robertson, who says, “We are not looking to develop products just for the sake of raising assets, as this does not marry with our skillset.”

Risk and diminishing reward

Khein acknowledges that the whole asset management industry is under fee pressure, partly due to the general underperformance of active managers in recent years. He believes a “2 and 20 model only works for a select group of managers who can bring consistent, multi-year absolute returns”.

However, at the same time Khein argues that fees must match capacity constraints and business running costs, and that “the alignment with client interests is a key consideration.” Robertson agrees that fees may come down and in future may need to be aligned with either business running costs and/or with clients. He also believes investors may ask for slightly lower management fees and request hurdle rates for performance fees as interest rates rise.

Liquidity is another common concern. BlueBay views illiquidity risk across all credit markets, as “a growing and industry-wide risk,” according to Khein. Head of investment risk, Jean-Philippe Blua told us, “Liquidity risk is my biggest worry”. He admits that it can be hard to gauge liquidity, so they use a mix of quantitative and qualitative measures. Khein thinks an unintended consequence of the re-regulation of banks is that asset managers, instead of brokers, now act as the concertinas absorbing the ebb and flow of liquidity. BlueBay is responding in many ways: sometimes holding more cash, using more liquid derivatives to obtain beta exposure, fund structures such as swing pricing, and asking the risk team to watch markets like hawks.

Next-generation ideology

While the Fed is likely to begin hiking rates later in the year, Japan and Europe remain in QE mode, and BlueBay believes we are likely to remain in a low-yielding environment for some time to come. This situation is beneficial to next-generation fixed income specialists like BlueBay, who can offer investors an alternative suite of investment products not dependent on absolute yield levels, in a risk-controlled manner and with a focus on capital preservation.

The entrepreneurial spirit upon which the firm was founded remains intact; BlueBay is able to implement strategies they believe in, at a time they think is optimal in terms of both the market and their client base. However, in an environment of increasing regulation, fixed costs for infrastructure can prove significant for standalone strategies. “With the support of BlueBay’s deep resources our hedge fund strategies offer clients products that are small and flexible enough to remain nimble, yet underpinned by a robust institutional platform,” concludes Ziai.

The firm remains vigilant in maintaining the philosophy of its founders; its hedge fund mind-set and an absolute return approach underpin its product spectrum. BlueBay has also retained its culture. Growth is disciplined, and they have not lost sight of what they have achieved. That bears testimony to the founders’ foresight, and we expect the firm to continue showing prescience in its ongoing corporate and product development.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical